India Commercial Printing Market Size, Share, Trends and Forecast by Technology, Print Type, Application, and Region, 2026-2034

India Commercial Printing Market Size and Share:

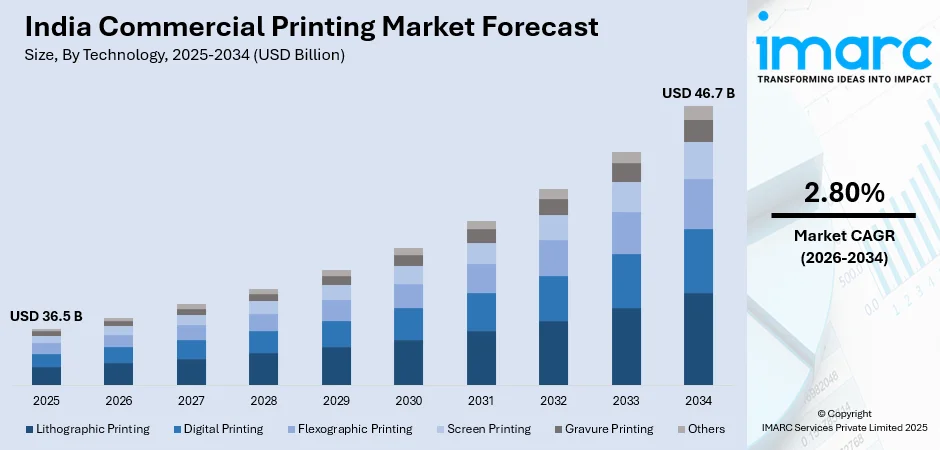

The India commercial printing market size reached USD 36.5 Billion in 2025. The market is expected to reach USD 46.7 Billion by 2034, exhibiting a growth rate (CAGR) of 2.80% during 2026-2034. The market growth is attributed to the development of innovative printing technologies by manufacturers, the use of commercial printing due to its cost-effectiveness and better print quality, the crucial role of commercial printing in the e-commerce industry for production of brochures, pamphlets and leaflets, and the positive impact of the transition to digital technology on India commercial printing market share.

Market Insights:

- On the basis of region, the market has been divided into North India, West and Central India, South India, and East India.

- On the basis of technology, the market has been divided into lithographic printing, digital printing, flexographic printing, screen printing, gravure printing, and others.

- On the basis of print type, the market has been divided into image, painting, pattern, and others.

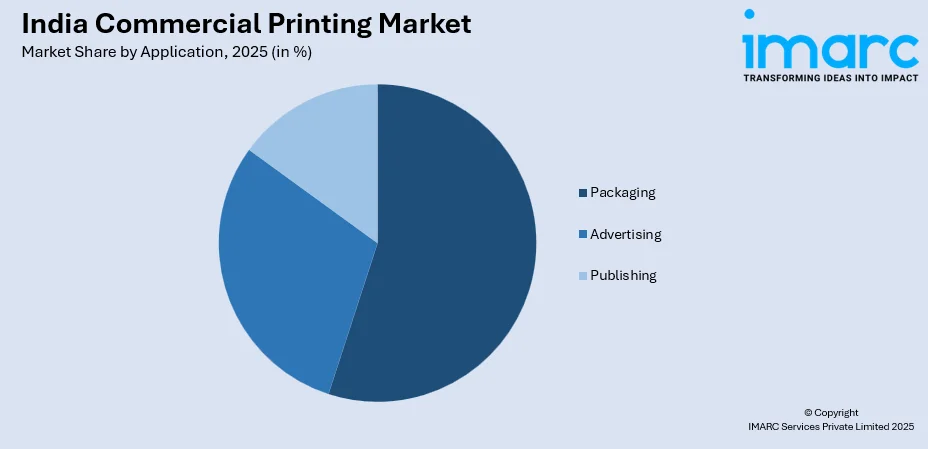

- On the basis of application, the market has been divided into packaging, advertising, and publishing.

Market Size and Forecast:

- 2025 Market Size: USD 36.53 Billion

- 2034 Projected Market Size: USD 46.65 Billion

- CAGR (2026-2034): 2.8%

Commercial printing refers to a collection of services, such as layout designing, binding, composition and press productions, used to transfer the artwork and text onto paper and cards. The commercial printing process utilizes a variety of materials such as flyers, brochures, books, posters, magazines, newsletters, and transactional bills and statements. It plays an essential role in producing large displays, which aids in attracting consumers with attractive designs. Consequently, it is widely used in the packaging, food and beverage, pharmaceuticals, and publishing industries.

To get more information on this market, Request Sample

India represents one of the largest commercial printing markets in the Asia Pacific region. The market is primarily driven by the development of innovative printing technologies by the manufacturers. They have started focusing on introducing engineered products with a reduced carbon footprint, higher energy efficiency, and better resistance to chemicals such as solvents and cleaners. The market is further propelled by the use of commercial printing to its cost-effectiveness and better print quality as compared to smaller printers. Apart from this, commercial printing is also crucial in the e-commerce industry, especially in the production of brochures, pamphlets and leaflets. Moreover, the transition to digital technology has also provided a positive impact on the market growth.

Digital Transformation and Technology Integration:

The India commercial printing market trends reflect a substantial shift toward digital printing technologies, driven by the need for faster turnaround times, customization capabilities, and cost-effective production. Digital printing has emerged as a preferred choice for short-run jobs and variable data printing applications, offering flexibility that traditional offset printing cannot match. This transformation is particularly pronounced in sectors such as packaging, advertising, and publishing, where brands require quick adaptations to market trends and consumer preferences. The integration of automation, artificial intelligence, and cloud-based printing solutions is further enhancing operational efficiency and enabling printers to offer innovative services such as personalized marketing materials and on-demand printing. Advanced digital presses with higher reliability and lower production costs are making digital printing increasingly competitive against conventional methods. The convergence of print and digital media is creating hybrid business models, particularly among regional players who are developing integrated strategies to serve both traditional and digital-first clients. This technological evolution is not only improving print quality and consistency but also enabling commercial printing industry in India players to expand their service offerings beyond basic printing to include value-added services such as design, data management, and logistics support.

Sustainability and Eco-Friendly Printing Solutions:

Environmental consciousness is reshaping the India commercial printing landscape as businesses and consumers increasingly prioritize sustainable practices. The adoption of eco-friendly printing solutions has accelerated significantly, with the industry witnessing substantial growth in the use of recycled paper, vegetable-based inks, and water-based printing solutions. Government policies such as the Plastic Waste Management Rules and initiatives promoting reduced carbon emissions are driving commercial printers to adopt sustainable manufacturing methods. This sustainability trend extends beyond raw materials to encompass energy-efficient printing equipment, waste reduction programs, and circular economy principles. Commercial printers are investing in technologies that minimize environmental impact while maintaining high-quality output, responding to corporate clients who seek sustainable packaging and marketing materials to align with their own environmental commitments. The shift toward sustainability is creating competitive advantages for printers who can demonstrate environmental credentials, as brands increasingly evaluate suppliers based on their sustainability practices. Additionally, the development of biodegradable and compostable printing materials is opening new market opportunities, particularly in the packaging segment where environmental concerns are most pronounced. This green revolution in commercial printing is not merely a response to regulatory requirements but represents a fundamental transformation in how the industry approaches production processes and material selection.

Growth, Opportunities, and Challenges in the India Commercial Printing Market

Growth Drivers:

The India commercial printing market growth is experiencing robust expansion driven by several key factors. The expanding food processing sector, with an expected output of USD 470 Billion by 2025, is significantly boosting demand for packaging printing services. Major corporations such as ITC Limited and Hindustan Unilever are increasing collaborations with commercial printers to enhance product presentation and brand image. The proliferation of small and medium enterprises across India is creating sustained demand for marketing materials, business stationery, and promotional collateral. Technological advancements in printing equipment are enabling commercial printers to offer faster turnaround times, superior quality, and more competitive pricing, attracting clients from diverse industries.

Government Initiatives:

The Indian government's Make in India initiative has been instrumental in promoting domestic production of printing equipment and materials, with policies facilitating over INR 60 billion in investments into the print sector by 2023. The government supports local manufacturers through tax breaks, subsidies, and incentives that promote job creation and reduce dependency on imports. The Digital India initiative is supporting the development of digital infrastructure, providing businesses with tools to adopt advanced digital printing technologies. Foreign Direct Investment policies allowing 100% FDI through automatic route have stimulated foreign investments in the packaging and printing sector, creating opportunities for technology transfer and capacity expansion. Government procurement programs for textbooks and educational materials provide stable demand for book printing services.

Market Opportunities:

Significant opportunities exist in serving the rapidly growing packaging industry, projected to reach USD 130 Billion by 2028. The customization trend in packaging and advertising presents opportunities for printers offering innovative, personalized solutions. The adoption of eco-friendly printing solutions creates market opportunities for businesses offering sustainable alternatives that comply with environmental regulations. Expansion into tier-2 and tier-3 cities provides untapped markets where commercial printing services are underdeveloped. The India commercial printing market analysis reveals that integration of value-added services such as design, data management, and fulfillment can help printers differentiate their offerings and capture higher margins.

Market Challenges:

The India commercial printing market forecast indicates several challenges that could impact growth. High initial investment costs for advanced printing equipment remain a significant barrier for small and medium-sized enterprises, with digital printing unit setup costs exceeding INR 10 million. The transition to digital media is negatively impacting traditional print segments, particularly newspaper and magazine printing, as physical newspaper circulation has declined substantially. Supply chain disruptions for paper and ink materials can affect production schedules and pricing stability. The lack of standardized quality control measures across the fragmented industry creates inconsistency in product quality. Skilled workforce shortages pose challenges as operating advanced printing equipment and mastering specialized techniques require expertise that is currently in short supply.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India commercial printing market report, along with forecasts at the country and regional level from 2026-2034. Our report has categorized the market based on technology, print type and application.

Breakup by Technology:

- Lithographic Printing

- Digital Printing

- Flexographic Printing

- Screen Printing

- Gravure Printing

- Others

Breakup by Print Type:

- Image

- Painting

- Pattern

- Others

Breakup by Application:

- Packaging

- Advertising

- Publishing

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

India Commercial Printing Market News:

- July 2025: Canon India launched the upgraded imagePRESS V1000 with the new Vacuum Paper Feeding Deck at Print Expo Chennai 2025. Designed for high-volume commercial printing, the system ensures stable feeding of thick and coated papers, enhancing productivity, print quality, and operational efficiency.

- February 2025: FUJIFILM India launched its next-generation commercial printing solutions at Printpack India 2025, unveiling the high-speed Revoria Press EC2100S, SC285S/SC285 models, and Apeos 4620 SX/SZ devices. These innovations enhance productivity, image quality, and versatility, strengthening India’s commercial printing capabilities.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Segment Coverage | Technology, Print Type, Application, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India commercial printing market was valued at USD 36.5 Billion in 2025.

We expect the India commercial printing market to exhibit a CAGR of 2.80% during 2026-2034.

The rising adoption of commercial printing across various industries, such as packaging, print media, publishing, etc., to produce flyers, brochures, books, posters, magazines and other such materials, is primarily driving the India commercial printing market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary closure of numerous printing facilities, thereby negatively impacting the Indian market for commercial printing.

Based on the technology, the India commercial printing market can be segmented into lithographic printing, digital printing, flexographic printing, screen printing, gravure printing, and others. Currently, lithographic printing holds the majority of the total market share.

Based on the print type, the India commercial printing market has been divided into image, painting, pattern, and others. Among these, image currently exhibits a clear dominance in the market.

Based on the application, the India commercial printing market can be categorized into packaging, advertising, and publishing. Currently, packaging accounts for the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where West and Central India currently dominates the India commercial printing market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)