India Collaborative Robot Market Size, Share, Trends and Forecast by Component, Payload, Application, End Use Industry, and Region, 2025-2033

Market Overview:

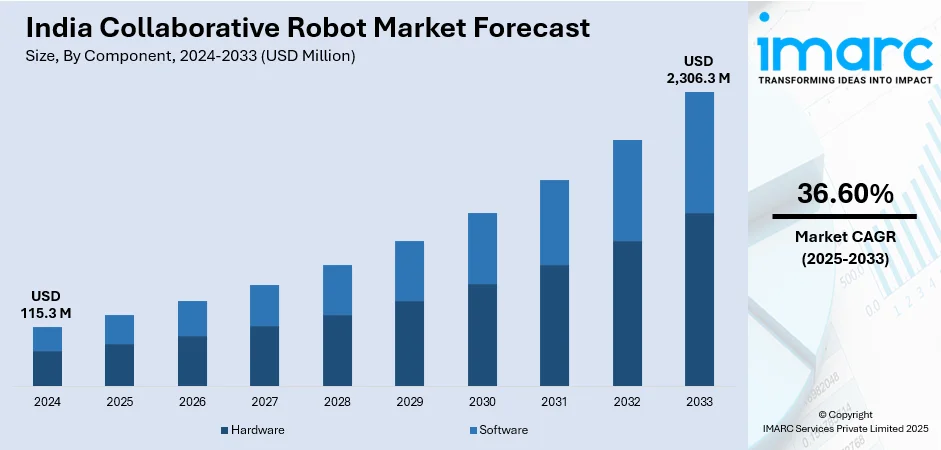

India collaborative robot market size reached USD 115.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,306.3 Million by 2033, exhibiting a growth rate (CAGR) of 36.60% during 2025-2033. The ongoing advancements in robotics, artificial intelligence, and sensor technologies, which contribute to the continuous improvement of collaborative robots, are driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 115.3 Million |

| Market Forecast in 2033 | USD 2,306.3 Million |

| Market Growth Rate (2025-2033) | 36.60% |

A collaborative robot, or cobot, is a type of robotic system designed to work alongside and interact safely with humans in a shared workspace. Unlike traditional industrial robots that typically operate in isolation behind safety barriers, cobots are equipped with sensors and advanced programming to ensure they can collaborate with human workers without posing a risk of injury. These robots are designed to assist humans in various tasks, enhancing efficiency and productivity in industries such as manufacturing, healthcare, and logistics. Cobots are often equipped with features like force and tactile sensing, vision systems, and flexible programming interfaces, allowing for easy reprogramming and adaptation to changing tasks. The emphasis on safety and ease of use distinguishes collaborative robots from their conventional counterparts, making them valuable tools for improving human-robot collaboration in diverse work environments.

To get more information on this market, Request Sample

India Collaborative Robot Market Trends:

The collaborative robot market in India is experiencing robust growth due to several key drivers, which, when interconnected, underscore the transformative potential of this technology. Firstly, the escalating demand for automation across industries has propelled the adoption of collaborative robots as versatile and adaptable solutions. As organizations strive for increased efficiency and productivity, these robots offer a collaborative approach, working seamlessly alongside human operators. Moreover, the advancement of artificial intelligence and machine learning technologies has empowered collaborative robots with enhanced capabilities, enabling them to learn and adapt to dynamic work environments. This, in turn, contributes to improved operational flexibility and responsiveness, critical factors in today's fast-paced business landscape. Additionally, the growing emphasis on workplace safety has emerged as a compelling force driving the collaborative robot market. With their ability to operate safely in proximity to humans, these robots mitigate risks, reduce accidents, and enhance overall workplace safety standards. Furthermore, the rise of Industry 4.0 and the Internet of Things (IoT) has catalyzed the integration of collaborative robots into interconnected smart manufacturing systems. This connectivity facilitates real-time data exchange, fostering a more agile and responsive production ecosystem. In conclusion, the collaborative robot market's upward trajectory is a result of the interconnected forces of automation demand, technological advancements, safety imperatives, and the evolution toward intelligent, connected manufacturing processes.

India Collaborative Robot Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, payload, application, and end use industry.

Component Insights:

- Hardware

- Software

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware and software.

Payload Insights:

- Upto 5 Kg

- 5-10 Kg

- Above 10 Kg

A detailed breakup and analysis of the market based on the payload have also been provided in the report. This includes upto 5 kg, 5-10 kg, and above 10 kg.

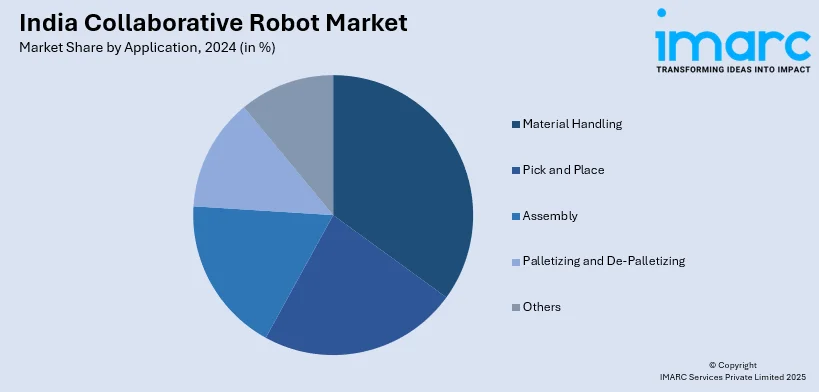

Application Insights:

- Material Handling

- Pick and Place

- Assembly

- Palletizing and De-Palletizing

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes material handling, pick and place, assembly, palletizing and de-palletizing, and others.

End Use Industry Insights:

- Automotive

- Electronics

- Manufacturing

- Food and Beverage

- Chemicals and Pharmaceutical

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, electronics, manufacturing, food and beverage, chemicals and pharmaceutical, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Collaborative Robot Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software |

| Payloads Covered | Upto 5 Kg, 5-10 Kg, Above 10 Kg |

| Applications Covered | Material Handling, Pick and Place, Assembly, Palletizing and De-Palletizing, Others |

| End Use Industries Covered | Automotive, Electronics, Manufacturing, Food and Beverage, Chemicals and Pharmaceutical, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India collaborative robot market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India collaborative robot market?

- What is the breakup of the India collaborative robot market on the basis of component?

- What is the breakup of the India collaborative robot market on the basis of payload?

- What is the breakup of the India collaborative robot market on the basis of application?

- What is the breakup of the India collaborative robot market on the basis of end use industry?

- What are the various stages in the value chain of the India collaborative robot market?

- What are the key driving factors and challenges in the India collaborative robot?

- What is the structure of the India collaborative robot market and who are the key players?

- What is the degree of competition in the India collaborative robot market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India collaborative robot market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India collaborative robot market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India collaborative robot industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)