India Cold Pressed Oil Market Size, Share, Trends and Forecast by Form, Packaging Type, Pack Size, Distribution Channel, and Region, 2026-2034

India Cold Pressed Oil Market Summary:

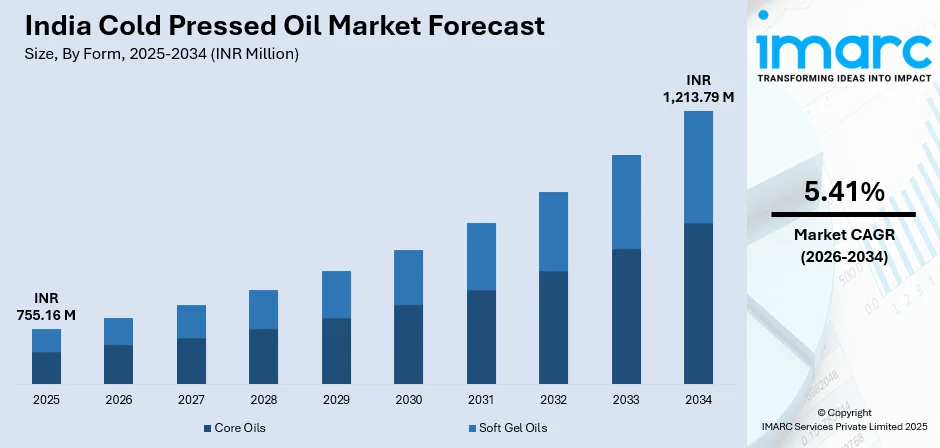

The India cold pressed oil market size was valued at INR 755.16 Million in 2025 and is projected to reach INR 1,213.79 Million by 2034, growing at a compound annual growth rate of 5.41% from 2026-2034.

India's market is experiencing rapid growth as health-conscious consumers are increasingly prioritizing nutrient-dense cooking alternatives over refined varieties. Apart from this, traditional extraction methods preserve essential fatty acids, antioxidants, and natural flavors, positioning these oils as premium wellness products across urban and semi-urban households seeking authentic dietary solutions. The market benefits from growing awareness about chemical-free food processing, Ayurvedic revival movements emphasizing traditional ingredients, and expanding distribution through modern retail channels. Rising disposable incomes enable premium product adoption while government initiatives supporting organic agriculture expand the India cold pressed oil market share.

Key Takeaways and Insights:

- By Form: Core oils dominate the market with a share of 68% in 2025, driven by widespread culinary use of mustard, groundnut, coconut, and sesame oils across regional Indian cuisines and traditional cooking practices.

- By Packaging Type: Bottles lead the market with a share of 51% in 2025, reflecting consumer preference for transparent, tamper-proof containers that enable quality verification and convenient storage in household kitchens.

- By Pack Size: 1 litre represents the largest segment with a market share of 40% in 2025, balancing affordability with practical consumption patterns for average Indian families managing monthly household budgets.

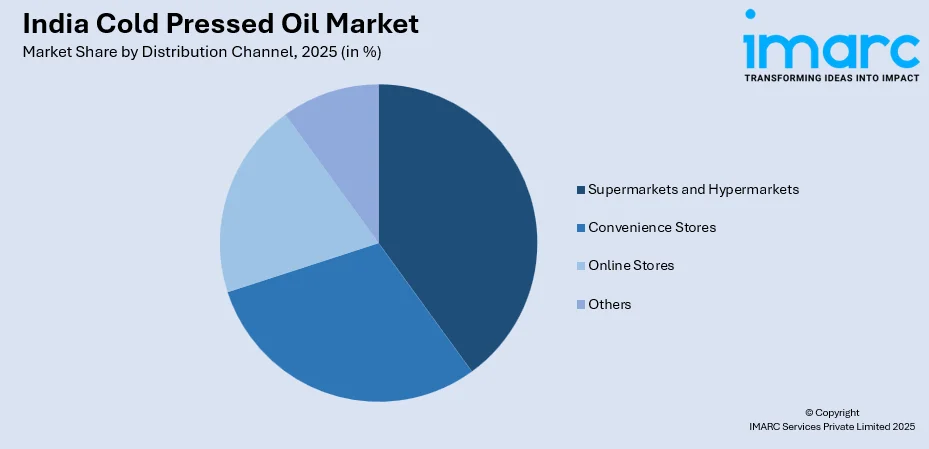

- By Distribution Channel: Supermarkets and hypermarkets account for 35% market share in 2025, benefiting from extensive product assortments, competitive pricing strategies, and growing organized retail penetration in metropolitan areas.

- By Region: North India leads the market with a share of 31% in 2025, propelled by strong cultural affinity for mustard oil in Punjab, Haryana, and Uttar Pradesh, where traditional cooking methods remain deeply embedded in culinary heritage.

- Key Players: The competitive landscape features established FMCG corporations competing alongside regional processors and Ayurvedic brands offering differentiated product portfolios spanning conventional core oils to specialized soft gel variants targeting health-focused consumer segments. Some of the key market players include Adani Wilmar Ltd., Mother Dairy Fruit & Vegetable Pvt. Ltd., Patanjali Ayurved Ltd., Cargill India Pvt. Ltd., Emami Agrotech Ltd., Pansari Group, and Dabur India Ltd.

To get more information on this market Request Sample

The Indian cold pressed oil sector benefits from millennia-old extraction traditions now intersecting with modern wellness movements. Rising disposable incomes enable urban consumers to allocate premium budgets toward products perceived as healthier alternatives to chemically processed oils. Ayurvedic revival movements strengthen cultural associations between traditional oils and holistic health, while social media influencers and nutritionists amplify awareness about retention of heat-sensitive vitamins and bioactive compounds. For instance, Kerala's coconut oil producers leverage regional authenticity in marketing campaigns, positioning cold pressed variants as superior to industrially refined alternatives for both culinary applications and personal care regimens, thereby capturing urban millennials seeking multifunctional natural products. The market's projected growth reflects increasing consumer willingness to pay premium prices for verified quality and nutritional benefits. Moreover, key market players are launching various high-quality products to fulfil the requirements of customers. In 2025, Marico Limited, a key participant in India’s FMCG industry, stepped into the Cold Pressed Oils category with its leading brand, Saffola. This action signifies a tactical broadening of the company’s edible oil range, aiming at consumers looking for cooking oils with assumed health advantages. The updated line features both Single Seed and Dual Seed Cold Pressed Oils. The dual seed variants, Groundnut and Sesame and Groundnut and Safflower, are intended to provide a well-rounded fatty acid profile while preserving the flavor traits associated with seeds. The individual seed choices consist of 100 percent Groundnut, 100 percent Sesame, and 100 percent Mustard oils.

India Cold Pressed Oil Market Trends:

Premiumization Through Heritage Branding

Manufacturers increasingly emphasize regional provenance and ancestral production methods to justify premium pricing strategies. Brands highlight single-origin sourcing from specific agricultural belts, traditional wooden churning techniques, and family recipes passed through generations, creating differentiation in crowded marketplaces. Packaging incorporates vernacular languages, folk art motifs, and storytelling elements that resonate with consumers seeking authentic connections to India's agrarian heritage, transforming commodity oils into artisanal lifestyle products. In 2025, Tata Simply Better, the clean-label cold-pressed oils brand trusted by Indian households launch cold pressed extra virgin olive oil and cold pressed sesame oil. Harvested directly from sun-kissed Spanish olive orchards, this olive oil is produced through cold-pressing, ensuring no heat, no chemicals, and preservation of natural nutrients.

Expansion of Soft Gel Oil Categories

Specialized therapeutic oils packaged in soft gel capsules represent emerging growth frontiers beyond conventional cooking applications. Flaxseed, fenugreek, kalonji, and sesame oils target health-conscious consumers seeking convenient omega-3 supplementation, blood sugar management, and anti-inflammatory benefits without incorporating oils into daily meal preparation. E-commerce platforms facilitate direct-to-consumer (D2C) distribution of these niche variants, bypassing traditional retail channels and enabling brands to educate buyers through detailed nutritional information and usage protocols. In 2025, Vimal Oils announced its plans to enter into the e-commerce section to offer consumers with easy access to various products. In response to the increasing consumer demand for health and wellness, Vimal Oils is preparing to introduce Vimal Wellness, a product range aimed at health-focused customers. The Vimal Wellness collection will include cold-pressed oils, recognized for their purity and various health advantages, along with gourmet oils designed for individuals who appreciate a high-end culinary experience.

Sustainability-Driven Packaging Innovations

Environmental consciousness influences packaging material selection as brands transition toward recyclable glass bottles, biodegradable pouches, and refillable container programs. Companies partner with farmer cooperatives to establish transparent supply chains, showcasing sustainable farming practices and fair-trade certifications on product labels. Some producers introduce deposit-return schemes encouraging bottle reuse, appealing to eco-aware urban demographics while reducing packaging costs and building brand loyalty through participatory sustainability initiatives. In 2025, the Lohit district achieved a significant advancement in health-oriented consumption and agriculture-based entrepreneurship with the launch of a contemporary cold-pressed mustard oil extraction facility today. The project seeks to enhance the worth of local products, create rural employment, and encourage sustainable farming methods in Arunachal Pradesh.

Market Outlook 2026-2034:

The India cold pressed oil market demonstrates robust expansion potential as wellness trends permeate tier-2 and tier-3 cities beyond metropolitan hubs. Organized retail penetration, digital payment adoption, and cold chain infrastructure improvements facilitate nationwide distribution of temperature-sensitive products. The market generated a revenue of INR 755.16 Million in 2025 and is projected to reach a revenue of INR 1,213.79 Million by 2034, growing at a compound annual growth rate of 5.41% from 2026-2034. Government initiatives promoting chemical-free agriculture and FSSAI regulations mandating clear labeling standards strengthen consumer confidence. Moreover, the integration of cold pressed groundnut oil into mid-day meal schemes showcases institutional adoption pathways, potentially normalizing premium oil consumption across socioeconomic segments.

India Cold Pressed Oil Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Form |

Core Oils |

68% |

|

Packaging Type |

Bottles |

51% |

|

Pack Size |

1 Litre |

40% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

35% |

|

Region |

North India |

31% |

Form Insights:

- Core Oils

- Mustard Oil

- Groundnut Oil

- Coconut Oil

- Sesame Oil

- Castor Oil

- Others

- Soft Gel Oils

- Flaxseed Oil

- Fenugreek Oil

- Sesame Oil

- Kalonji Oil

- Others

Core oils dominate with a market share of 68% of the total India cold pressed oil market in 2025.

Core oils maintain commanding market positions through deep integration into regional culinary traditions and daily cooking routines across Indian households. Mustard oil dominates northern states as the preferred medium for tempering spices, preparing pickles, and cooking sarson ka saag, while coconut oil anchors southern kitchens for appam, avial, and Kerala-style fish curries. Groundnut oil serves as versatile cooking fat in western and central regions, valued for high smoke points suitable for deep frying snacks like bhajia and pakora.

These oils transcend mere cooking ingredients, carrying cultural significance in religious ceremonies, massage therapies, and traditional medicine systems. The segment benefits from established agricultural supply chains, with dedicated oilseed cultivation zones ensuring consistent raw material availability. Cold pressed variants command premium positioning over refined alternatives by emphasizing nutrient preservation, authentic flavors, and absence of chemical solvents. Brands leverage regionality as marketing assets, highlighting terroir-specific characteristics such as Rajasthan's robust mustard oil or Tamil Nadu's aromatic gingelly oil.

Packaging Type Insights:

- Bottles

- Cans

- Pouches

- Others

Bottles lead with a share of 51% of the total India cold pressed oil market in 2025.

Glass and PET bottles dominate packaging preferences due to superior product visibility, extended shelf life, and consumer perceptions of hygiene and quality. Transparent containers enable buyers to assess oil clarity, color depth, and sediment presence before purchase, building confidence in product purity. Bottles facilitate convenient pouring mechanisms, resealable caps preventing oxidation, and stackable designs optimizing retail shelf utilization. Premium brands adopt amber or green-tinted glass to protect light-sensitive nutrients, while budget offerings utilize clear PET for cost efficiency.

The format aligns with Indian household storage practices, where kitchens typically feature designated oil dispensers and organized pantry systems. Bottle packaging supports brand differentiation through label designs, embossing techniques, and tamper-evident seals that communicate product integrity. For example, Kerala's coconut oil producers package cold pressed variants in traditional bottle shapes reminiscent of vintage apothecary containers, evoking nostalgia and artisanal craftsmanship. Meanwhile, modern brands incorporate ergonomic handles, portion-control spouts, and QR codes linking to recipe videos, transforming functional packaging into interactive brand touchpoints that enhance consumer engagement and repeat purchases.

Pack Size Insights:

- 1 Litre

- 5 Litres

- 500 mL

- Others

1 litre exhibits a clear dominance with a 40% share of the total India cold pressed oil market in 2025.

One-litre containers strike optimal balance between affordability and consumption patterns for average Indian families, typically lasting two to three weeks based on moderate cooking frequencies. This sizing prevents product degradation from prolonged exposure after opening while remaining accessible to middle-income households managing monthly grocery budgets. Apart from this, the format suits nuclear family structures prevalent in urban areas, where smaller household sizes reduce bulk purchasing incentives common in joint family systems.

Retailers favor one-litre packs for inventory management, as the size generates faster stock turnover and reduces capital tied in slow-moving larger formats. The packaging enables trial purchases for consumers experimenting with premium cold pressed variants before committing to economy packs. For instance, health-conscious buyers in upscale neighborhoods initially purchase single-litre bottles of flaxseed or walnut oil at higher prices to assess flavor profiles and cooking adaptability before graduating to larger volumes. Distribution logistics also benefit, as standardized one-litre units simplify carton packing, transportation calculations, and shelf space allocation across diverse retail formats from neighborhood kirana stores to hypermarket chains.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Convenience Stores

- Supermarkets and Hypermarkets

- Online Stores

- Others

Supermarkets and hypermarkets lead with a share of 35% of the total India cold pressed oil market in 2025.

Modern trade formats provide comprehensive product assortments enabling side-by-side comparison of brands, variants, and price points under controlled environments. Air-conditioned retail spaces protect temperature-sensitive cold pressed oils while dedicated edible oil aisles facilitate category browsing. Organized retailers leverage economies of scale for competitive pricing, periodic promotional schemes offering discounts during festival seasons, and loyalty programs that incentivize bulk purchases of premium oil brands. The market share demonstrates supermarkets' critical role in premium oil distribution and consumer education.

These channels offer experiential advantages including product sampling stations, nutritional information displays, and staff assistance for purchase decisions. Strategic shelf placements at eye level and end-cap promotions enhance brand visibility for cold pressed variants competing against established refined oil brands. For example, metropolitan chains allocate expanded shelf space to organic and health-focused products, positioning cold pressed oils adjacent to quinoa, chia seeds, and other wellness foods to capture health-conscious shoppers. Point-of-sale materials educating consumers about cold pressing benefits, omega ratios, and cooking applications convert browsing into purchases, while integrated supply chains ensure consistent stock availability and freshness maintenance.

Regional Insights:

- North India

- Delhi NCR

- Uttar Pradesh

- Punjab

- Rajasthan

- Haryana

- South India

- Tamil Nadu

- Karnataka

- Kerala

- West & Central India

- Maharashtra

- Gujarat

- Madhya Pradesh

- East India

- West Bengal

- Bihar

- Jharkhand

- Others

North India exhibits a clear dominance with a 31% share of the total India cold pressed oil market in 2025.

Northern states exhibit profound cultural affinity for cold pressed mustard oil, deeply embedded in regional cuisines from Punjabi chole to Bengali fish curry preparations. Traditional winter season consumption patterns, where mustard oil serves dual purposes as cooking medium and body massage oil, sustain year-round demand cycles. States like Uttar Pradesh and Haryana maintain extensive mustard cultivation zones, ensuring localized supply chains that reduce logistics costs and enable freshness premiums. The region's higher per capita incomes in urban centers like Delhi NCR, Chandigarh, and Noida facilitate premium product adoption, while joint family structures in semi-urban areas drive bulk purchasing of five-litre economy packs.

Festive cooking traditions during Diwali, Lohri, and Baisakhi spike demand for authentic cold pressed variants used in preparing traditional sweets and savory dishes. For instance, Punjab's growing health consciousness among affluent farming communities creates dual demand streams, conventional cooking oils for everyday use and specialized therapeutic oils like flaxseed for health supplementation. Retail infrastructure density, including expansive supermarket networks and rapid quick-commerce penetration, ensures widespread product availability across income segments, from premium organic stores in South Delhi to neighborhood shops in the region.

Market Dynamics:

Growth Drivers:

Why is the India Cold Pressed Oil Market Growing?

Rising Health Consciousness and Lifestyle Disease Prevention

Escalating prevalence of diabetes, cardiovascular conditions, and obesity among urban populations drives demand for nutrient-dense cooking alternatives perceived as disease prevention tools. On World Hypertension Day, observed on May 17, 2023, the Government launched the "75/25" initiative designed to offer standardized treatment to 75 million people affected by hypertension and diabetes by December 2025. As of March 5, 2025, a cumulative 42.01 million people have undergone treatment for hypertension, and 25.27 million have received treatment for diabetes, reaching 89.7% of the goal. Cold pressed oils retain antioxidants, vitamins, and essential fatty acids destroyed during refining processes, appealing to consumers seeking functional foods that support wellness goals. Nutritionists and dietitians actively recommend unrefined oils for managing cholesterol levels and reducing inflammation, legitimizing premium pricing through professional endorsements. For example, Mumbai's corporate wellness programs incorporate dietary counseling emphasizing cold pressed groundnut or sesame oil substitution, influencing purchasing decisions among white-collar professionals managing sedentary lifestyles and stress-related health risks.

Expanding Organized Retail and E-commerce Penetration

Modern trade formats and digital marketplaces democratize access to specialty cold pressed oil brands previously confined to niche organic stores or regional markets. Supermarket chains allocate dedicated shelf space for health-focused edible oils, while e-commerce platforms enable direct-to-consumer distribution bypassing traditional wholesale networks. Online channels provide detailed product information, customer reviews, and subscription models ensuring recurring revenue streams for manufacturers. IMARC Group predicts that the India e-commerce market will reach USD 651.10 Billion by 2034.

Government Support for Chemical-Free Agriculture and Food Safety

Policy initiatives promoting organic farming, pesticide-free cultivation, and transparent food labeling strengthen consumer confidence in cold pressed oil quality claims. FSSAI regulations mandating clear indication of extraction methods on packaging enable informed purchasing decisions differentiating cold pressed from chemically processed oils. State agricultural departments provide subsidies for installing wooden ghani units and cold press machinery, lowering entry barriers for small-scale processors and expanding market supply. For example, in 2025, The government announced a new framework for the edible oil sector, enforcing tougher registration and reporting obligations on manufacturers to improve transparency and oversight.

Market Restraints:

What Challenges the India Cold Pressed Oil Market is Facing?

Premium Pricing Limiting Mass Market Penetration

Cold pressed oils command price premiums ranging from forty to seventy percent above refined alternatives, restricting adoption among price-sensitive middle and lower-income segments constituting majority market volumes. Labor-intensive traditional extraction methods, lower yield rates typically 15-25% below industrial refining, and premium raw material sourcing necessitate higher retail prices that clash with Indian consumers' ingrained price consciousness for staple commodities like cooking oils, slowing category expansion beyond affluent urban demographics concentrated in tier-1 cities.

Limited Shelf Life and Storage Challenges

Absence of preservatives and chemical stabilizers reduces shelf life to six to nine months compared to refined oils' extended viability exceeding eighteen months, creating distribution complexities and wastage risks. Retailers hesitate stocking slow-moving premium variants requiring temperature-controlled storage, while consumers in hot climates face rancidity concerns after opening packages. Inadequate cold chain infrastructure in tier-2 and tier-3 cities further constrains market penetration beyond metropolitan areas, limiting the market's geographic expansion potential.

Consumer Awareness Gaps and Authenticity Concerns

Despite growing health consciousness, substantial knowledge deficits persist regarding nutritional distinctions between cold pressed and refined oils, limiting conversion rates among mainstream consumers. Market fragmentation enables adulteration practices where refined oils are mislabeled as cold pressed variants, eroding consumer trust and brand credibility. Absence of stringent authentication standards and inconsistent quality monitoring by regulatory authorities creates credibility challenges that premium genuine manufacturers must overcome through extensive consumer education investments, including the in-store demonstrations and sampling programs deployed by major retailers.

Competitive Landscape:

The India cold pressed oil market exhibits fragmented competitive dynamics with large FMCG conglomerates leveraging extensive distribution networks and brand equity alongside regional specialists emphasizing artisanal production methods and local authenticity. Established players capitalize on diversified product portfolios spanning conventional refined oils and emerging cold pressed categories, utilizing cross-subsidization strategies to penetrate premium segments. Meanwhile, niche organic brands and Ayurvedic companies position cold pressed variants as core offerings, building differentiation through single-origin sourcing, traditional wooden ghani extraction, and wellness-focused marketing narratives. Competitive intensity escalates in urban supermarket channels where shelf space battles and promotional schemes drive margin pressures, while rural and semi-urban markets remain relatively fragmented with local processors serving regional taste preferences and distribution through traditional kirana networks. Some of the companies covered in the report include:

- Adani Wilmar Ltd.

- Mother Dairy Fruit & Vegetable Pvt. Ltd.

- Patanjali Ayurved Ltd.

- Cargill India Pvt. Ltd.

- Emami Agrotech Ltd.

- Pansari Group

- Dabur India Ltd.

India Cold Pressed Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | INR Million |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered |

|

| Packaging Types Covered | Bottles, Cans, Pouches, Others |

| Pack Sizes Covered | 1 Litre, 5 Litres, 500 mL, Others |

| Distribution Channels Covered | Convenience Stores, Supermarkets and Hypermarkets, Online Stores, Others |

| Regions Covered | North India, South India, West & Central India, East India |

| States Covered | Delhi NCR, Uttar Pradesh, Punjab, Rajasthan, Haryana, Tamil Nadu, Karnataka, Kerala, Maharashtra, Gujarat, Madhya Pradesh, West Bengal, Bihar, Jharkhand, Others |

| Companies Covered | Adani Wilmar Ltd., Mother Dairy Fruit & Vegetable Pvt. Ltd., Patanjali Ayurved Ltd., Cargill India Pvt. Ltd., Emami Agrotech Ltd., Pansari Group, Dabur India Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India cold pressed oil market size was valued at INR 755.16 Million in 2025.

The India cold pressed oil market is expected to grow at a compound annual growth rate of 5.41% from 2026-2034 to reach INR 1,213.79 Million by 2034.

Core oils dominated the India cold pressed oil market with a commanding share of 68% in 2025, driven by widespread culinary integration of mustard, groundnut, coconut, and sesame oils across regional Indian cuisines, cultural preferences for traditional flavors, and established agricultural supply chains ensuring consistent availability. These oils command premium prices for refined alternatives, with recent launches demonstrating continued premiumization within this dominant segment.

Key factors driving the India cold pressed oil market include rising health consciousness among urban consumers seeking nutrient-dense cooking alternatives for lifestyle disease prevention, expanding organized retail and e-commerce penetration with supermarkets commanding a major portion of the market share democratizing access to premium specialty oils, and government policy support for chemical-free agriculture and transparent food labeling strengthening quality perceptions.

Major challenges include premium pricing structures with cold pressed oils commanding price premiums limiting mass market penetration among price-sensitive consumer segments, shorter shelf life of six to nine months versus eighteen months for refined oils creating distribution and wastage concerns, consumer awareness gaps regarding nutritional benefits despite growing health consciousness, and authenticity issues from market fragmentation enabling adulteration practices that erode brand credibility. Additionally, lower extraction yields necessitate higher retail prices that clash with Indian consumers' price consciousness for staple commodities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)