India Cold Chain Pharmaceutical Logistics Market Size, Share, Trends and Forecast by Product, Service, and Region, 2025-2033

India Cold Chain Pharmaceutical Logistics Market Overview:

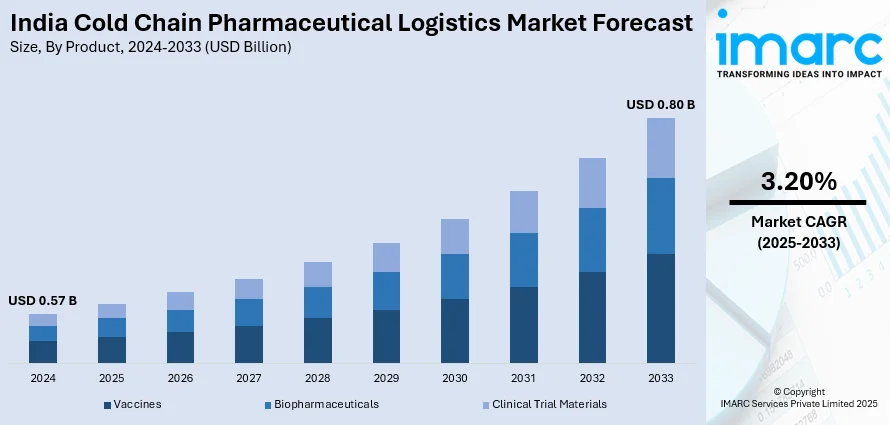

The India cold chain pharmaceutical logistics market size reached USD 0.57 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.80 Billion by 2033, exhibiting a growth rate (CAGR) of 3.20% during 2025-2033. The India cold chain pharmaceutical logistics market share is expanding, driven by the rising adoption of biosimilars, gene therapies, and specialty drugs, creating the need for precise temperature control solutions, along with the ongoing execution of government initiatives that promote digital healthcare and telemedicine, encouraging investments in modern cold chain logistics infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.57 Billion |

| Market Forecast in 2033 | USD 0.80 Billion |

| Market Growth Rate (2025-2033) | 3.20% |

India Cold Chain Pharmaceutical Logistics Market Trends:

Increasing pharmaceutical exports

Rising pharmaceutical exports are impelling the India cold chain pharmaceutical logistics market growth. India is one of the largest producers and exporters of generic medicines, vaccines, and biologics, with a high demand from international markets. According to the data published on the official website of the Ministry of Commerce and Industry, the Indian exports of drugs and pharmaceuticals rose by 7.22%, reaching USD 2.39 Billion in September 2023 to USD 2.57 Billion by September 2024. Many of these pharmaceutical items are temperature-sensitive and require strict cold chain management to maintain their efficacy during transit. Export regulations from developed and developing countries mandate compliance with worldwide quality standards, encouraging Indian pharmaceutical companies to invest in advanced cold chain pharmaceutical logistics. The expansion of biosimilars, gene therapies, and specialty drugs further drives the demand for precise temperature control solutions. Logistics providers are responding by developing modern cold storage facilities, refrigerated transportation, and real-time monitoring systems to ensure product safety. Additionally, government initiatives and incentives to boost pharmaceutical exports are attracting investments in cold chain infrastructure.

To get more information on this market, Request Sample

Rise in home healthcare and online pharmacies

An increase in home healthcare and online pharmacies is offering a favorable India cold chain pharmaceuticals logistics market outlook. In December 2024, Flipkart, the e-commerce firm, was set to introduce a fast medicine delivery service named ‘Flipkart Minutes,’ with the goal of completing orders in just 10 minutes in India. Flipkart Minutes functioned in Bengaluru, Delhi-NCR, and Mumbai, intending to grow into 8-10 key cities, such as Hyderabad, Chennai, Kolkata, and Pune. With more people ordering medicines, vaccines, and other critical drugs online, logistics providers must ensure these temperature-sensitive products reach customers safely and efficiently. Many medicines, including insulin, biologics, and certain antibiotics, require strict temperature control during transit to maintain their effectiveness. Cold chain logistics providers are expanding their fleet of refrigerated vehicles and last-mile delivery solutions for catering to the high demand. Home healthcare services, which involve delivering medical supplies and diagnostic kits directly to patients, also require reliable cold storage and transport solutions. The rise in chronic diseases and an aging population further creates the need for timely and safe medicine deliveries. Additionally, government initiatives promoting digital healthcare and telemedicine are encouraging investments in advanced cold chain logistics infrastructure. Companies are utilizing the Internet of Things (IoT)-based temperature monitoring and real-time tracking systems to enhance supply chain efficiency.

India Cold Chain Pharmaceutical Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product and service.

Product Insights:

- Vaccines

- Biopharmaceuticals

- Clinical Trial Materials

The report has provided a detailed breakup and analysis of the market based on the products. This includes vaccines, biopharmaceuticals, and clinical trial materials.

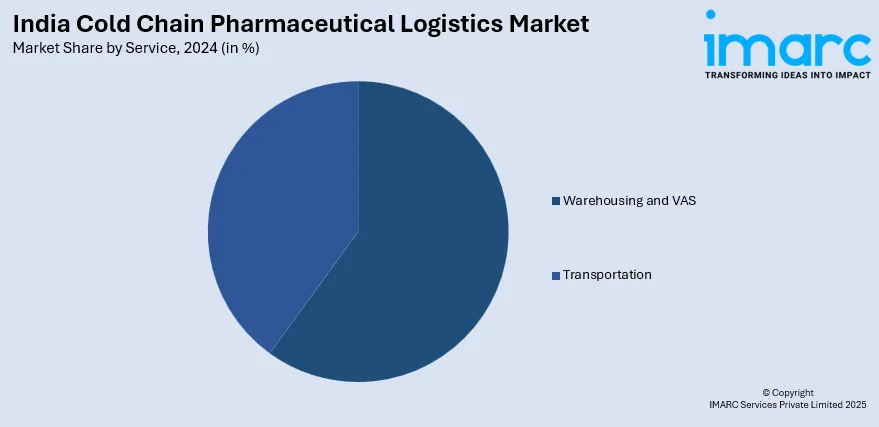

Service Insights:

- Warehousing and VAS

- Transportation

A detailed breakup and analysis of the market based on the services have also been provided in the report. This includes warehousing and VAS and transportation.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cold Chain Pharmaceutical Logistics Market News:

- In October 2024, UPS, a well-known supply chain firm, unveiled its dedicated healthcare-oriented cross-docking center in Hyderabad, India. Aimed at prioritizing the needs of Indian pharmaceutical clients, this pharma-grade facility featured international freight forwarding capabilities. The organization boasted a workforce of over 10,000 specialists in healthcare logistics, operating across 216 locations with a combined area of 17 Million square feet (10 Million dedicated to cold chain) of cGMP and GDP-conforming allocation area for healthcare, catering to more than 200 countries and territories. The plant could accommodate or organize 15 pallets at +15°C to +25°C, 7 pallets at +2 to +8°C, and 50 pallets in unregulated environmental conditions.

- In February 2024, FedEx Express, a division of FedEx Corp., launched its 'FedEx Life Science Center' in Mumbai, India. The enhanced capability aimed to fulfill and assist the clinical trial storage and logistics needs of healthcare clients both in the Indian market and those exporting to India from across the globe. This service offered extra choices, such as dry-ice refilling, gel-pack swapping, and refrigerated storage.

India Cold Chain Pharmaceutical Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Vaccines, Biopharmaceuticals, Clinical Trial Materials |

| Services Covered | Warehousing and VAS, Transportation |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India cold chain pharmaceutical logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the India cold chain pharmaceutical logistics market on the basis of product?

- What is the breakup of the India cold chain pharmaceutical logistics market on the basis of service?

- What are the various stages in the value chain of the India cold chain pharmaceutical logistics market?

- What are the key driving factors and challenges in the India cold chain pharmaceutical logistics market?

- What is the structure of the India cold chain pharmaceutical logistics market and who are the key players?

- What is the degree of competition in the India cold chain pharmaceutical logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cold chain pharmaceutical logistics market from2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cold chain pharmaceutical logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cold chain pharmaceutical logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)