India Coffee Shops/Cafes Market Size, Share, Trends and Forecast by Ownership, Services, Product Offering, and Region, 2026-2034

India Coffee Shops/Cafes Market Overview:

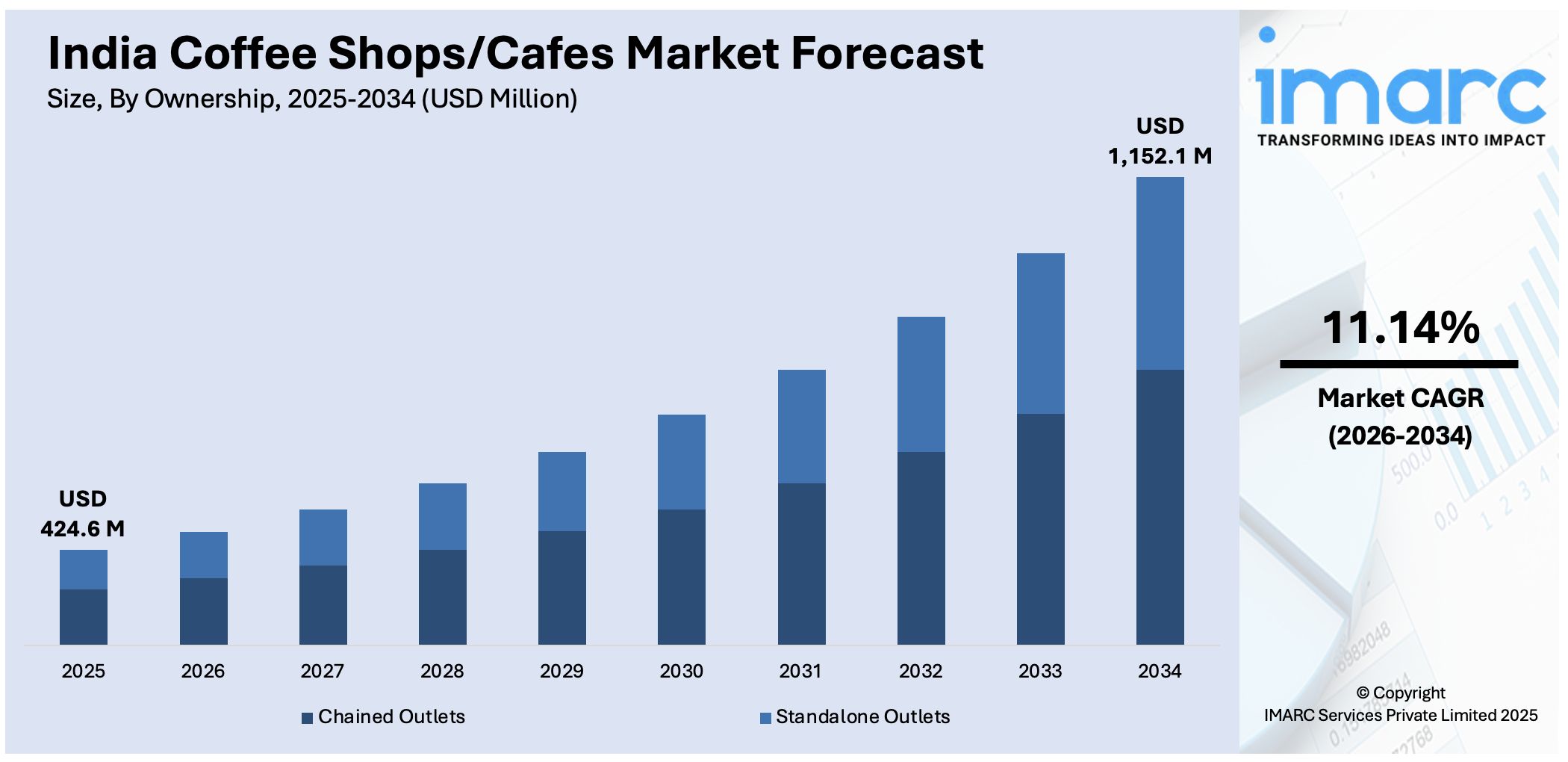

The India coffee shops/cafes market size reached USD 424.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,152.1 Million by 2034, exhibiting a growth rate (CAGR) of 11.14% during 2026-2034. The market is driven by rising urbanization, increasing disposable incomes, and growing café culture among millennials. The influence of global coffee chains, expanding premium coffee preferences, and demand for social and co-working spaces further boost growth. Additionally, digital ordering, quick service formats, and specialty coffee trends fuel the India coffee shops/cafes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 424.6 Million |

| Market Forecast in 2034 | USD 1,152.1 Million |

| Market Growth Rate (2026-2034) | 11.14% |

India Coffee Shops/Cafes Market Trends:

Rapid Urbanization and Changing Consumer Lifestyles

With increasing urbanization and a fast-paced lifestyle, coffee shops have become popular social and relaxation hubs. Young professionals together with students and entrepreneurs prefer to use cafes for work activities and meetings as well as relaxed social interaction. Additionally, as more people embrace on-the-go dining habits, demand for quick-service coffee shops and takeaway options has surged, further boosting India coffee shops/cafes market growth in metro cities and emerging urban centers. For instance, in January 2025, Coffee Island, the biggest food service chain in Greece, launched its inaugural outlet in India located in Gurugram. Collaborating with Vita Nova, they intend to grow to 20 locations by March 2026 and reach 250 locations by 2029. The brand provides personalized coffee experiences, catering to the expanding coffee culture in India, and intends to extend its reach in the UK, Canada, and France. Such developments indicate rising foreign investment and growing confidence in India's café market potential.

To get more information on this market Request Sample

Increasing Disposable Income and Premium Coffee Consumption

Rising disposable incomes, particularly among the middle class and millennials, have fueled the demand for premium coffee experiences. Consumers are now willing to spend on specialty coffee blends, artisanal brews, and premium café ambiance. The popularity of international coffee chains like Costa Coffee, Tim Hortons, and Starbucks, along with homegrown brands such as Third Wave Coffee and Blue Tokai, reflects this trend. Higher affordability has also encouraged consumers to explore gourmet coffee offerings, driving the growth of specialty and high-end coffee shops across India which is creating a positive India coffee shops/cafes market outlook. For instance, in March 2025, the Coffee Bean & Tea Leaf announced its plans to open 25 cafes in India, following its recent launch in GK1, South Delhi. Its master franchisee aims for 250 locations by 2029. The brand's marketing campaign features humorous slogans, enhancing customer engagement and promoting the growing interest in specialty coffee among consumers.

India Coffee Shops/Cafes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on ownership, services, and product offering.

Ownership Insights:

- Chained Outlets

- Standalone Outlets

The report has provided a detailed breakup and analysis of the market based on the ownership. This includes chained outlets and standalone outlets.

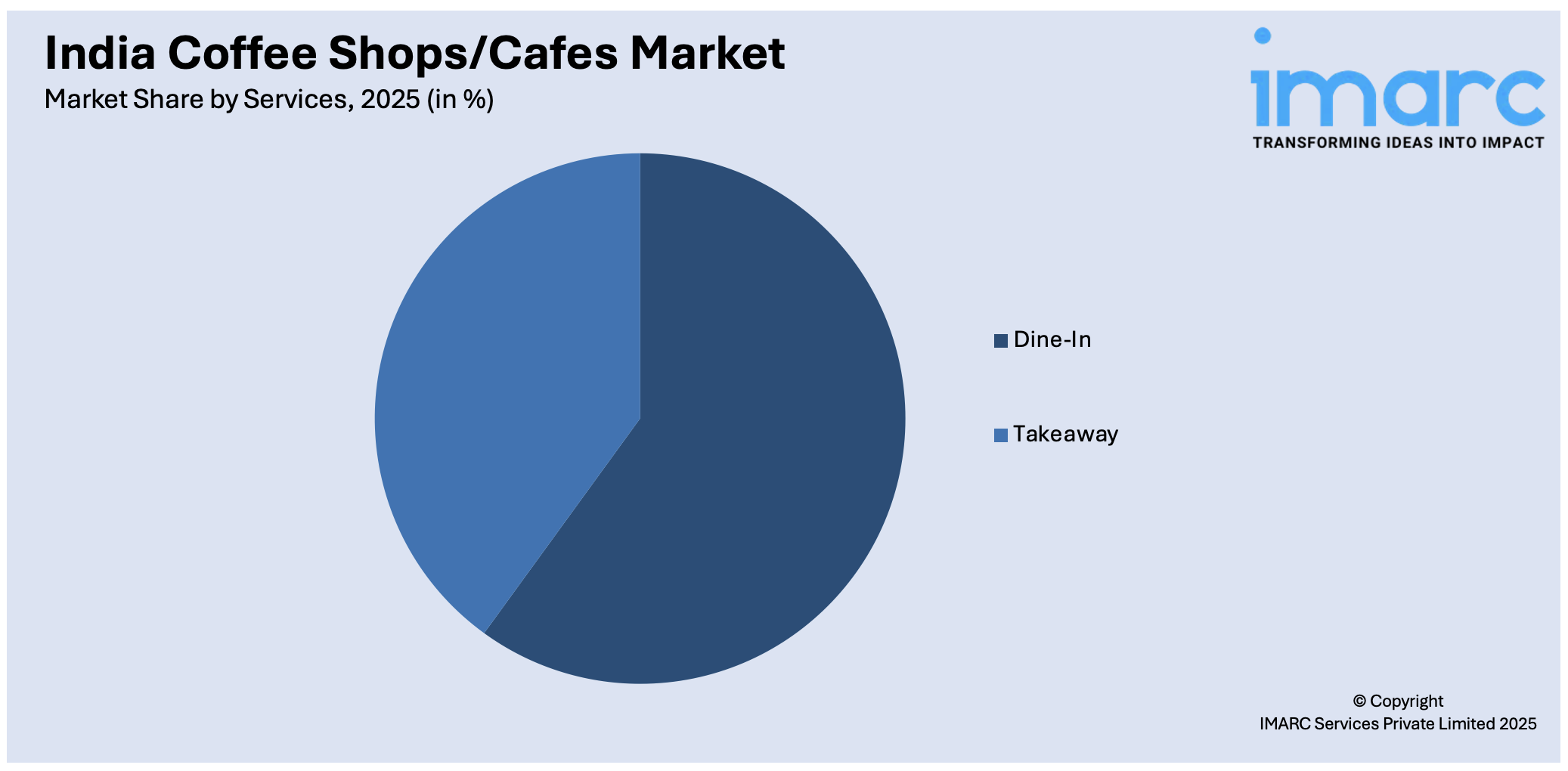

Services Insights:

Access the comprehensive market breakdown Request Sample

- Dine-In

- Takeaway

A detailed breakup and analysis of the market based on the services have also been provided in the report. This includes dine-in and takeaway.

Product Offering Insights:

- Coffee

- Tea

- Snacks

- Others

A detailed breakup and analysis of the market based on the product offering have also been provided in the report. This includes coffee, tea, snacks, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Coffee Shops/Cafes Market News:

- In March 2025, Nespresso, a subsidiary of Nestle, launched its inaugural boutique store in India at the Select Citywalk Mall located in Delhi's Saket. Nespresso and Nestle India have established a distribution partnership with Thakral Innovations. It will serve as the official distribution partner and will encompass the complete variety of Nespresso coffee products in B2B channels.

- In April 2024, Union Artisan Coffee launched in India with its first café located in Worldmark, Aerocity, New Delhi. Led by Village Food Concepts as the master franchise, this pivotal launch signifies an important advancement for the brand as it expands its presence in the dynamic Indian market.

India Coffee Shops/Cafes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Ownerships Covered | Chained Outlets, Standalone Outlets |

| Services Covered | Dine-In, Takeaway |

| Product Offerings Covered | Coffee, Tea, Snacks, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India coffee shops/cafes market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India coffee shops/cafes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India coffee shops/cafes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The coffee shops/cafes market in India was valued at USD 424.6 Million in 2025.

The India coffee shops/cafes market is projected to exhibit a CAGR of 11.14% during 2026-2034, reaching a value of USD 1,152.1 Million by 2034.

The India coffee shops/cafes market is driven by changing consumer lifestyles, rapid urbanization, inflating disposable incomes, and a growing preference for socializing outside the home. Youth-centric culture, exposure to global café trends, and digital engagement further drives the demand. Expansion in tier II and III cities and evolving tastes also contribute to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)