India Coffee Machine Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

India Coffee Machine Market Overview:

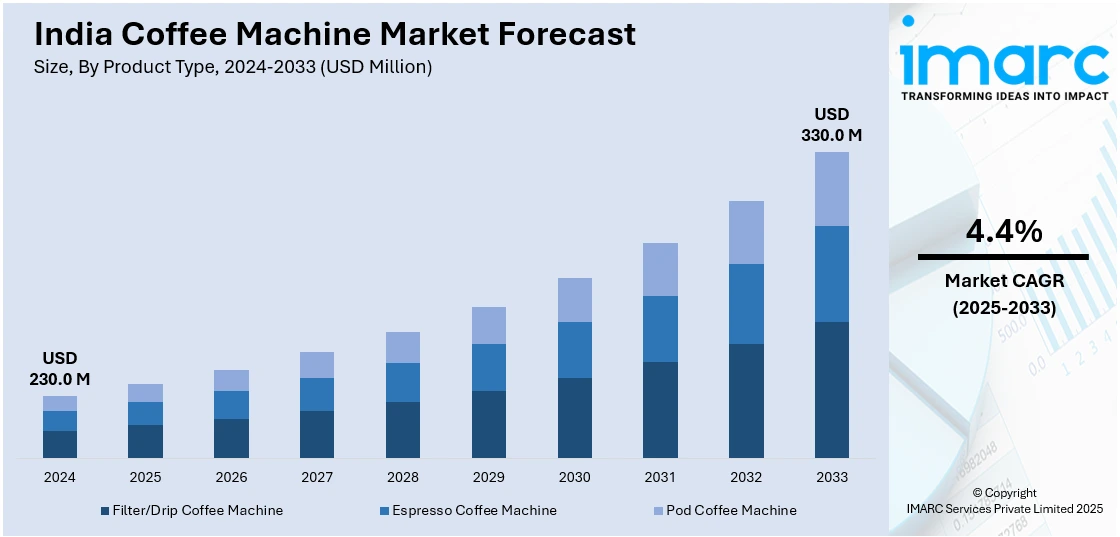

The India coffee machine market size reached USD 230.0 Million in 2024. The market is expected to reach USD 330.0 Million by 2033, growing at a CAGR of 4.4% from 2025-2033. The market is majorly driven by the considerable rise in café culture, increasing disposable income levels of the consumers, and a growing preference for premium coffee at home and workplaces.

Market Insights:

- The regional market breakdown includes North India, South India, East India, and West India.

- On the basis of product type, the market is divided into filter/drip coffee machines, espresso coffee machines, and pod coffee machines.

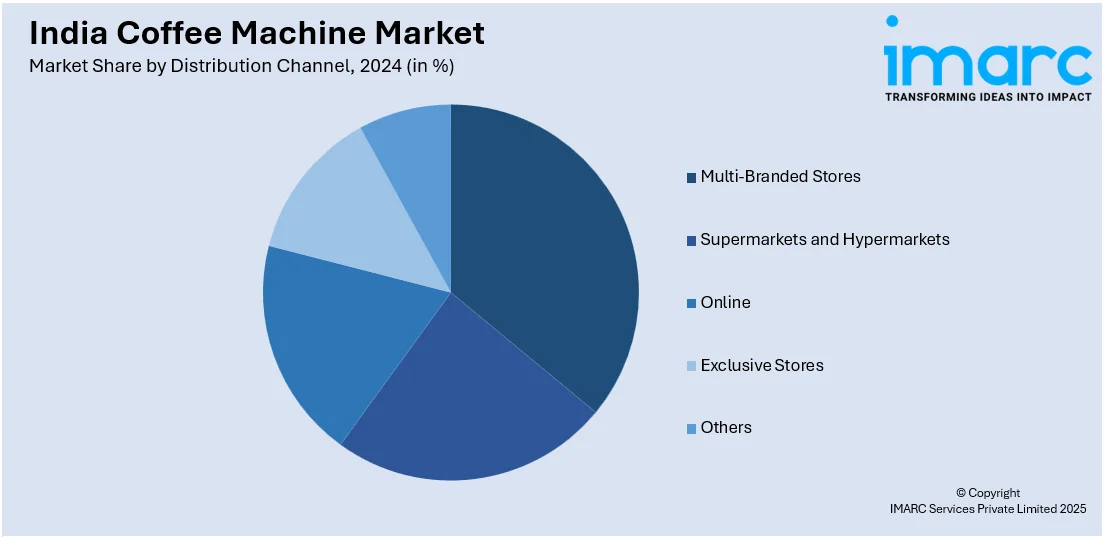

- Distribution channels include multi-branded stores, supermarkets and hypermarkets, online, exclusive stores, and others.

- Based on the end user, the segments include food services, residential areas, offices, and institutional spaces.

Market Size & Forecast:

- 2024 Market Size: USD 230.0 Million

- 2033 Projected Market Size: USD 330.0 Million

- CAGR (2025-2033): 4.4%

India Coffee Machine Market Trends:

Growing Preference for Specialty Coffee Machines

Indian consumers are shifting more towards specialty coffee machines that offer home barista-style coffee. Espresso machine, pod-brew coffee machine, and high-end drip coffee brewer sales are growing with the rise in coffee culture beyond instant coffee. This trend is driven by a growing awareness of artisan brewing methods, growing exposure to global coffee trends, and the growing number of coffee aficionados at home. The simplicity of operating today's coffee machines, including the provision of customized brew strength, temperature, and froth for milk, is appealing to customers seeking in-home café-quality experience. The trend among youth consumers taking to premium coffee on a greater level is causing corporations to look inward at producing machines that harmonize seamlessly with advancements in technology alongside ease of handling. For instance, in December 2024, Nestlé India introduced NESPRESSO with premium coffee and machines for household and commercial use. The brand rolled out to the market via retail boutiques and top e-commerce sites. Moreover, coffee machines with smart controls, pre-programmed brewing cycles, and energy-saving designs are gaining traction in the market, further solidifying the shift towards a premium coffee-drinking culture in India.

To get more information on this market, Request Sample

Expansion of Smart and Connected Coffee Machines

The Indian coffee machine market is experiencing growth in demand for connected and smart appliances. Consumers are increasingly seeking Wi-Fi and Bluetooth-enabled coffee makers that can be controlled through mobile apps to set brewing parameters. For example, in November 2024, Kaapi Machines unveiled the Carimali GLOW coffee machine in New Delhi with digital controls, LED lights, and advanced brewing technology for small cafés, affirming its commitment to India's premium coffee solutions. Furthermore, smart machines provide convenience by allowing users to schedule brews, set temperature and coffee strength, and receive maintenance reminders remotely. The fusion of artificial intelligence and voice capabilities further elevates the user interface, complementing the wider movement of smart home automation. Machines enabled by applications also yield brewing data to the user, so they can further tailor their coffee. The movement is especially increasing in popularity with technology-embracing urban users who are eager for efficiency and personalization in their day-to-day activities. With increasing digital adoption and a rising emphasis on automation, smart coffee machines will be an integral part of Indian homes in the modern era, both improving convenience and personalization in coffee making.

Rising Popularity of Energy-Efficient Coffee Machines

The growing demand for energy-saving coffee makers is fueled by greater consumer sensitivity to sustainability and economic savings. As electricity costs go up and green issues become more pressing, homes and businesses alike are looking for appliances that conserve energy. In response, manufacturers are introducing newer technologies like automatic shut-off, intelligent sensors, and better thermal insulation to increase efficiency. Moreover, governmental policies and environmental labeling schemes like ENERGY STAR certification are promoting the use of energy-efficient appliances. The transition toward sustainable lifestyles and business sustainability in offices and cafes also increases demand. Consequently, energy-efficient coffee makers are a popular option, consistent with global trends toward green consumer products and cost savings on operations.

Emerging Consumer Preferences and Market Dynamics in the India Coffee Machine Market

The emergence of premium and specialty brewing has rapidly transformed the India coffee machine market outlook. As urbanization spreads and young consumers develop a stronger affinity for global coffee cultures, households are increasingly investing in machines that replicate café-style experiences. This evolution is particularly notable among Millennials and Gen Z who, influenced by social media and exposure to international lifestyles, now expect appliances that deliver full customization, ranging from brew strength to milk texture. Enhanced digital interfaces, programmable settings, and sustainability features have likewise entered the spotlight, making high-quality coffee more accessible than ever before.

The rising profile of coffee culture is reflected in the growing adoption of smart, connected devices capable of remote control and maintenance notifications, appealing to India’s burgeoning base of tech enthusiasts and fast-paced professionals. This heightened consumer expectation and convenience-centric approach is driving surges in the India coffee machine market demand. Coffee drinkers are now demanding machines that not only brew a superior cup but also save time and energy, leading manufacturers to integrate intelligent sensors, auto-cleaning routines, and energy-efficient modes. The emphasis on health and wellness has guided market leaders to innovate with low-acid and specialty health-focused brewing options that avoid dietary irritants, capturing a segment of users previously underserved in traditional markets. Simultaneously, both established brands and new entrants are racing to differentiate with features that respond to the unique cultural context of Indian homes, such as equipment designed for local water quality, electrical standards, and usage habits, ensuring widespread adoption. Evidence for these transformative shifts is robust, as summarized in the comprehensive India coffee machine market research report. This report demonstrates how advanced technology integration, consumer health awareness, and design innovation are critically impacting overall market composition, helping shape future competitive strategies. It also points to increased investment in research and development, enhanced customer support infrastructure, and bold marketing campaigns, reflecting the dynamic responses by leading manufacturers as they strive to capture and retain consumer loyalty.

The report further underscores the influence of urban migration, aspirational consumerism, and rising disposable income on market direction, indicating sustained momentum for premiumization and product sophistication. Amid these trends, the expanding coffee machine industry in India has become a showcase for the fusion of technology, lifestyle, and tradition. Industry players are experimenting with localization, whether through partnerships with local coffee brands or adaptations to regional brewing preferences, to enhance market penetration. The competitive environment is also witnessing consolidation, with mergers and acquisitions shaping the lineup of leading brands while creating room for boutique and niche players. Export opportunities are opening as India becomes recognized not just as a consumer but also as a manufacturer of innovative coffee solutions, contributing to employment and skill development. All these forces together are significantly influencing the evolving India coffee machine market share, setting the stage for a uniquely Indian ecosystem within the global coffee appliances landscape. The sector’s ongoing journey reflects an intricate balance between embracing modernity and maintaining cultural context, ensuring that the next phase of market growth will be both inclusive and innovative, catering to a broad spectrum of Indian consumers on their own terms.

Market Growth Drivers and Sales Channel Expansion in India’s Coffee Machine Industry

As the dynamics of modern retail and service continue to reshape consumption habits, the emphasis on growth is unmistakable in the evolving India coffee machine market growth. A core factor contributing to this trajectory is the robust development within India’s HoReCa (Hotel, Restaurant, Café) sector, where rapid urbanization, tourism, and lifestyle changes have brought commercial coffee solutions to the forefront. Businesses are investing in commercial-grade machines capable of handling high volumes and diverse beverage menus, responding to the demand for café-quality coffee across hospitality venues and premium dining chains. The proliferation of stylish boutique cafés in urban centers and the expansion of renowned chains into new markets are further propelling the uptake of sophisticated, durable brewing systems.

Parallel to this, the coffee machine market size in India is being amplified by the popularity of innovative business models such as coffee subscription services. With consumers seeking both convenience and exclusivity, subscriptions deliver fresh, curated coffee beans along with machine recommendations directly to their homes, forging a direct connection between brands and customers. This model not only fosters habitual consumption but also drives awareness and trial of premium coffee machine brands that cater to diverse brewing preferences. Such strategies help expand the footprint of coffee-related products well beyond major metropolitan areas, as subscription services leverage e-commerce to reach a broad and aspirational audience. The significance of the online marketplace cannot be overstated, and its impact is directly felt on the Coffee machine market share in India. The surge in digital retail channels provides consumers with extensive options, price comparisons, video demonstrations, and peer reviews, all critical factors in informed decision-making.

Exclusive product launches and limited-time online deals heighten engagement and assure tech-savvy buyers rapid access to the latest models with minimal friction. This digital-first approach empowers brands to reach consumers nationwide, whether in thriving urban hubs or emerging towns, reinforcing the already dynamic and accessible nature of today’s coffee machine ecosystem. In this context, the growing appetite for premium appliances and tailored experiences is leading to unprecedented coffee machine market demand in India, as consumers demonstrate a willingness to invest in equipment that elevates both everyday routines and special occasions. Brands that excel in personalization, such as those offering programmable brewing cycles and mobile app integrations, are finding particular resonance with urban professionals and young families, many of whom are experiencing specialty brewing for the first time. This focus on customization and discovery is redefining not only the value proposition but also the aspirational appeal of home and commercial coffee machines nationwide. Meanwhile, the continued integration of health-oriented features and eco-friendly designs reflects broader societal priorities, ensuring that growth is paired with sustainability and inclusivity, according to the India coffee machine market analysis. As new segments emerge and technology becomes ever more central to the brewing experience, India’s coffee machine market is poised not only for continued expansion but also for the creation of a uniquely Indian narrative within the global coffee landscape.

India Coffee Machine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Filter/Drip Coffee Machine

- Espresso Coffee Machine

- Pod Coffee Machine

The report has provided a detailed breakup and analysis of the market based on the product type. This includes filter/drip coffee machine, espresso coffee machine, and pod coffee machine.

Distribution Channel Insights:

- Multi-Branded Stores

- Supermarkets and Hypermarkets

- Online

- Exclusive Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes multi-branded stores, supermarkets and hypermarkets, online, exclusive stores, and others.

End User Insights:

- Food Service

- Residential

- Offices

- Institutional

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes food service, residential, offices, institutional, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Coffee Machine Market News:

- In March 2025, Nestlé India launched NESPRESSO, introducing its premium coffee pod machines and boutique concept to India. Nespresso machines, both for home and professional use, are now available in key cities, with the first boutique opening in Delhi and expansion planned for other metros in 2025. Machines and capsules are also being sold via leading e-commerce platforms.

- In February 2025, Swiss brand Franke Coffee Systems entered the Indian market at the AAHAR expo, introducing its full lineup of high-end automatic and espresso coffee machines for hotels, restaurants, and cafes. Franke emphasized its commitment to long-term growth in India, leveraging support from its sister company, Franke Faber India.

- In February 2025, Swiss coffee machine maker Franke Coffee Systems has made its entry into the Indian market at AAHAR 2025 in New Delhi. With cutting-edge automated coffee solutions, the company is looking to fuel India's burgeoning coffee culture with high-end technology, as part of its Asia-Pacific expansion strategy with Franke Faber India.

- In November 2024, Kaapi Machines, India’s leading coffee equipment distributor, unveiled the Carimali GLOW, a durable, affordable espresso machine designed for small to medium-sized coffee businesses. The machine offers advanced features like digital temperature control, electronic pre-infusion, and customizable LED lighting for consistent, high-quality brewing.

- In October 2024, KENT introduced a Coffee Maker and Grinder combo in India for the festive season. The device has a 20 Bar Italian Pump for intense espresso, an in-built steamer for frothing, and 30 grind settings for personalized coffee. This innovation elevates home coffee experiences with advanced brewing convenience.

India Coffee Machine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Filter/Drip Coffee Machine, Espresso Coffee Machine, Pod Coffee Machine |

| Distribution Channels Covered | Multi-Branded Stores, Supermarkets and Hypermarkets, Online, Exclusive Stores, Others |

| End Users Covered | Food Service, Residential, Offices, Institutional, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India coffee machine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India coffee machine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India coffee machine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The coffee machine market in India was valued at USD 230.0 Million in 2024.

The India coffee machine market is projected to exhibit a CAGR of 4.4% during 2025-2033, reaching a value of USD 330.0 Million by 2033.

The key factors driving India’s coffee machine market include rising urban coffee culture, increasing home-brewing post-pandemic, tech-savvy consumers demanding smart connected machines, expanding HoReCa & office use, and online retail growth offering convenience and variety.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)