India Coconut Water and Fortified Water Market Size, Share, Trends and Forecast by Organized and Unorganized, Pack Type, Pack Size, Distribution Channel, and Region, 2025-2033

Market Overview:

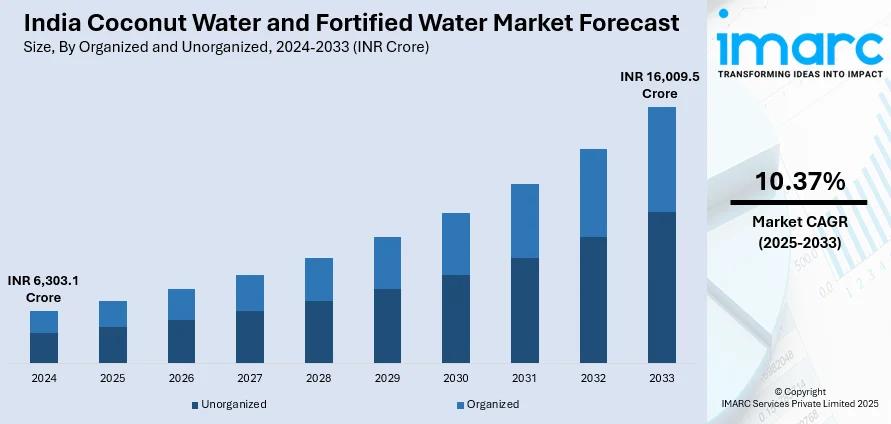

The India coconut water and fortified water market size reached INR 6,303.1 Crore in 2024. Looking forward, IMARC Group expects the market to reach INR 16,009.5 Crore by 2033, exhibiting a growth rate (CAGR) of 10.37% during 2025-2033. The growing prevalence of various chronic disorders, rising demand for packaged and ready-to-drink (RTD) beverages, and increasing popularity of cafe culture represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 6,303.1 Crore |

|

Market Forecast in 2033

|

INR 16,009.5 Crore |

| Market Growth Rate (2025-2033) | 10.37% |

Coconut water is the clear liquid form inside immature coconuts known as Cocos nucifera. It is rich in carbohydrates and electrolytes, such as potassium, sodium, and magnesium, that treat and prevent dehydration. It contains antioxidants that help modify free radicals to reduce oxidative stress in the body. It assists in lowering blood sugar levels and preventing kidney stones by reducing crystal and stone formation. It also offers various benefits, such as boosting energy levels, supporting digestion, improving cognition, reducing joint pain, and managing weight. On the other hand, fortified water is a rich source of protein, amino acids, vitamins, minerals, and bioactive botanicals. It boosts the immune system and mental well-being by supporting emotional calmness and revitalization. It aids in maintaining bone mass and performing several fundamental cellular reactions, such as enzymatic and biological mechanisms. It decreases the impact of low-dietary calcium on bone growth and mineralization to inhibit intact parathyroid hormone (iPTH) secretion and bone resorption. At present, the rising health consciousness among the masses is catalyzing the demand for coconut water and fortified water in India.

To get more information of this market, Request Sample

India Coconut Water and Fortified Water Market Trends:

The increasing prevalence of various chronic disorders, such as diabetes, obesity, kidney stones, digestive disorders, and cancers, represents one of the key factors supporting the growth of the market in India. Besides this, there is a rise in the demand for coconut water and fortified water due to the growing awareness about the benefits of these beverages among the masses. This, along with the increasing participation of individuals in fitness and athletic activities, is propelling the growth of the market in the country. In addition, the wide availability of coconut water and fortified water through online and offline distribution channels is offering lucrative growth opportunities to industry investors. Moreover, the growing demand for packaged and ready-to-drink (RTD) beverages due to the hectic lifestyles of consumers is providing a favorable market outlook in the country. Apart from this, key manufacturers are introducing organic product variants that are free from chemical additives, preservatives, and artificial colors. They are also focusing on various marketing strategies, which is contributing to the growth of the market. Additionally, the rising popularity of cafe culture and the increasing number of quick-service restaurants (QSRs) is bolstering the growth of the market in India.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India coconut water and fortified water market report, along with forecasts at the regional levels from 2025-2033. Our report has categorized the market based on organized and unorganized, pack type, pack size, and distribution channel.

Organized and Unorganized Insights:

- Unorganized

- Organized

The report has provided a detailed breakup and analysis of the India coconut water and fortified water market based on the organized and unorganized. This includes unorganized and organized. According to the report, unorganized represented the largest segment.

Pack Type Insights:

- Bottles

- Tetra

- Others

A detailed breakup and analysis of the India coconut water and fortified water market based on the pack type has also been provided in the report. This includes bottles, tetra, and others. According to the report, bottles accounted for the largest share in the market.

Pack Size Insights:

- 200 ML

- 1000 ML

- 500 ML

- Others

A detailed breakup and analysis of the India coconut water and fortified water market based on the pack size has also been provided in the report. This includes 200 ML, 1000 ML, 500 ML, and others. According to the report, 200 ML accounted for the largest market share.

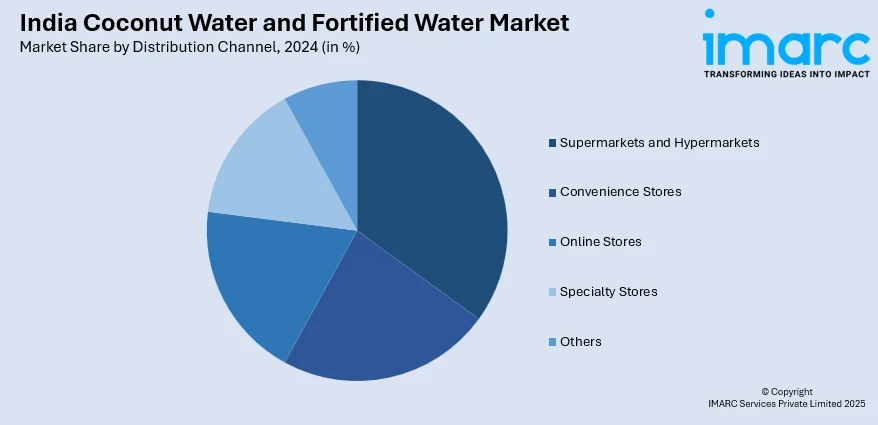

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Specialty Stores

- Others

A detailed breakup and analysis of the India coconut water and fortified water market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online stores, specialty stores, and others. According to the report, supermarkets and hypermarkets accounted for the largest market share.

Regional Insights:

- North India

- Delhi NCR

- Uttar Pradesh

- Haryana

- Rajasthan

- Punjab

- Others

- West and Central India

- Maharashtra

- Gujarat

- Madhya Pradesh

- Others

- East India

- West Bengal

- Bihar

- Orissa

- Jharkhand

- Others

- South India

- Tamil Nadu

- Karnataka

- Andhra Pradesh

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include North India (Delhi NCR, Uttar Pradesh, Haryana, Rajasthan, Punjab, and others); West and Central India (Maharashtra, Gujarat, Madhya Pradesh, and others); East India (West Bengal, Bihar, Orissa, Jharkhand, and others); South India (Tamil Nadu, Karnataka, Andhra Pradesh, and others). According to the report, North India was the largest market for India coconut water and fortified water. Some of the factors driving the North India coconut water and fortified water market included the growing health consciousness among the masses, increasing awareness about the health benefits of these beverages, rising number of cafes and restaurants, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India coconut water. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include Agricoles Naturel Foods, Dabur India Limited, Hector Beverages Pvt. Ltd., Jain Agro Food Products Pvt. Ltd., Madhura Agro Process Pvt. Ltd., Manpasand Beverages Limited, Nature’s First India Pvt. Ltd., Nilgai Foods Pvt. Ltd., Pure Tropic, RAW Pressery, Sakthi Coco Products, Coca-Cola India, FDC Private Limited, G7 Beverages, Hector Beverages Pvt. Ltd., NourishCo Beverages Limited and Pepsico India. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Crore, Million Liters |

| Segment Coverage | Organised and Unorganised, Pack Type, Pack Size, Distribution Channel, Region |

| Region Covered | South India, North India, West and Central India, East India |

| States Covered | Delhi NCR, Uttar Pradesh, Haryana, Rajasthan, Punjab, Maharashtra, Gujrat, Madhya Pradesh, West Bengal, Bihar, Orissa, Jharkhand, Tamil Naidu, Karnataka, Andhra Pradesh |

| Companies Covered | Agricoles Naturel Foods, Dabur India Limited, Hector Beverages Pvt. Ltd., Jain Agro Food Products Pvt. Ltd., Madhura Agro Process Pvt. Ltd., Manpasand Beverages Limited, Nature’s First India Pvt. Ltd., Nilgai Foods Pvt. Ltd., Pure Tropic, RAW Pressery, Sakthi Coco Products, Coca-Cola India, FDC Private Limited, G7 Beverages, Hector Beverages Pvt. Ltd., NourishCo Beverages Limited and Pepsico India. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India coconut water and fortified water market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India coconut water and fortified water market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India coconut water and fortified water industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The coconut water and fortified water market in India was valued at INR 6,303.1 Crore in 2024.

The India coconut water and fortified water market is projected to exhibit a CAGR of 10.37% during 2025-2033, reaching a value of INR 16,009.5 Crore by 2033.

The India coconut water and fortified water market is driven by rising health consciousness, increasing demand for natural and functional beverages, urban lifestyle changes, and growing awareness of hydration and nutrition benefits. Additionally, innovative flavors, easy availability, and marketing by key brands fuel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)