India Cloud Kitchen Market Size, Share, Trends and Forecast by Type, Product Type, Nature, and Region, 2026-2034

India Cloud Kitchen Market Size and Share:

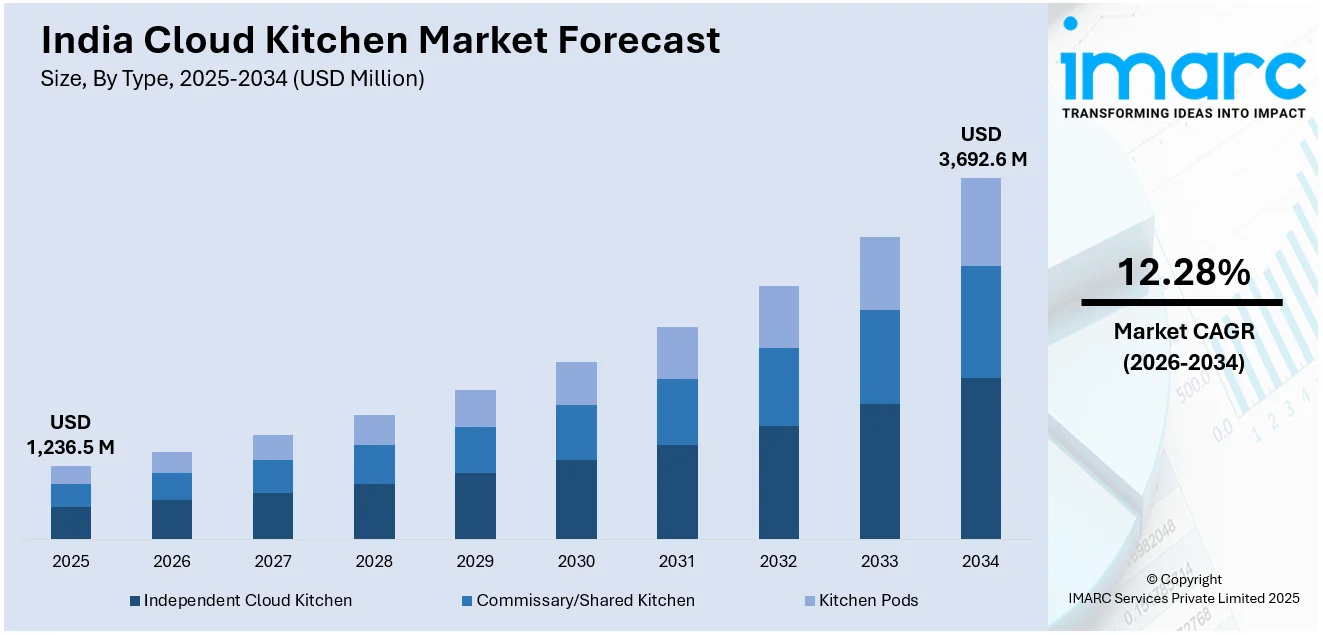

The India cloud kitchen market size was valued at USD 1,236.5 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 3,692.6 Million by 2034, exhibiting a CAGR of 12.28% during 2026-2034. South India currently dominates the market, holding a significant market share of over 35% in 2025. The rapid urbanization, growing demand for online food delivery services, rising consumer preference for convenience, low operational costs compared to traditional restaurants, expanding digital ecosystem, the rise of food delivery platforms, and evolving culinary trends across metropolitan cities are some of the key factors augmenting India cloud kitchen market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,236.5 Million |

|

Market Forecast in 2034

|

USD 3,692.6 Million |

| Market Growth Rate 2026-2034 | 12.28% |

The market in India is experiencing significant growth due to the growing demand for online food delivery services, which is creating a favorable environment for cloud kitchens. Moreover, the rising preference for convenience among consumers, especially in metropolitan areas, is fueling the market expansion. Additionally, cloud kitchens have lower operational costs compared to traditional restaurants, which makes them an attractive business model. According to an industry report, Swiggy, a major food delivery platform in India, saw a 19% rise in average monthly transacting users, reaching 17.1 Million in the second quarter of FY2025, which ended on September 30, 2024. This reflects the growing penetration of mobile apps and food delivery platforms, which is creating a seamless ordering experience and facilitating consumer engagement. In line with this, the ability of cloud kitchens to serve diverse cuisines with greater scalability and flexibility also attracts both consumers and business owners.

To get more information on this market Request Sample

In addition to this, evolving consumer lifestyles, such as busy work schedules and a preference for ready-to-eat meals, are contributing to the India cloud kitchen market growth. According to industry reports, India is a young nation with a population of 377 Million Gen Z individuals. This tech-savvy, younger generation places a high value on convenience, which is driving the shift away from traditional dining experiences. As a result, the demand for cloud kitchens is on the rise, offering flexible, on-demand food services that align with their fast-paced lifestyles. Also, the increasing adoption of cloud kitchen models by existing food brands and entrepreneurs is creating lucrative opportunities for the market. Furthermore, continual advances in food safety, packaging, and delivery technology are enhancing the overall customer experience, thereby supporting the expansion of the market.

India Cloud Kitchen Market Trends

Changing consumer behavior and demand for convenience

Changing consumer behavior, particularly in urban centers, is one of the significant emerging India cloud kitchen market trends. Consumers are increasingly embracing the convenience and contactless nature of dining experiences offered by cloud kitchens. In a fast-paced world, there has been a rise in demand for a diverse array of cuisines and dishes that can be swiftly delivered to one's doorstep. Cloud kitchens, with their agility and focus on delivery, are emerging as a response to this evolving preference. Urban areas, characterized by busy lifestyles and limited time for traditional dining, are accelerating the adoption of cloud kitchen services. According to the World Bank, by 2036, Indian towns and cities will be home to 600 Million people, or 40% of the population, up from 31% in 2011, with urban areas contributing almost 70% to GDP. Customers can now access a broad menu of culinary options from the comfort of their homes, making cloud kitchens an attractive choice. This shift in consumer behavior is reshaping the food industry landscape, emphasizing the significance of adaptability and convenience in meeting the evolving demands of today's diners. As a result, cloud kitchens are experiencing significant traction as a practical solution to cater to these changing preferences and foster a dynamic and thriving market environment.

Rapid digital transformation and online food delivery

The India cloud kitchen market forecast suggests robust market expansion fueled by rapid digital transformation and the growing dominance of online food delivery platforms. For instance, the Digital India initiative, bolstered by a significant investment of approximately INR 14,903 Crore (about USD 1.785 Billion) between 2021 and 2026. The ongoing proliferation of smartphones and internet connectivity enables ordering food online, making it a commonplace practice. This digital shift is leading to an increase in demand for efficient, user-friendly, and reliable food delivery platforms. Cloud kitchens are seamlessly integrating into this digital ecosystem, capitalizing on the convenience offered by online food delivery. They leverage technology, including dedicated mobile apps and websites, to streamline the ordering process and enhance customer experiences. This transformation further improves order accuracy and delivery logistics and expands the reach of cloud kitchens to a broader customer base. Furthermore, digital marketing and data analytics are enabling cloud kitchens to target and engage customers effectively, allowing for menu customization and optimization based on consumer preferences and trends. The synergy between digital transformation and cloud kitchens is creating a symbiotic relationship, with online food delivery platforms propelling the growth of cloud kitchens and vice versa, thereby contributing to the dynamic and evolving food industry landscape in India.

Rising demand for cost efficiency and scalability

Cloud kitchens are notably cost-effective compared to their brick-and-mortar counterparts, primarily due to lower overhead costs, reduced real estate expenses, and optimized labor expenditures. The elimination of dine-in facilities, prime-location rent, and extensive interior decor results in substantial cost savings. This cost-efficiency makes cloud kitchens an appealing option for aspiring food entrepreneurs and established restaurant chains seeking rapid expansion. For instance, Ajay's Cafe is one of the fastest-growing QSR chains in India, serving burgers, cold coffees, and other delectable snacks at over 178 outlets across 44 cities. Without the burden of significant physical infrastructure and its associated costs, they can channel their resources more effectively into menu innovation, marketing, and improving delivery logistics. Apart from this, the scalability of cloud kitchens is another key advantage, as they can quickly adapt to changing market trends, customer preferences, and seasonal demand fluctuations. This flexibility allows food businesses to expand their virtual brands or experiment with new concepts at a lower risk. This, in turn, is creating a positive India cloud kitchen market outlook. As a result, cost-efficiency and scalability are driving the proliferation of cloud kitchens, shaping the future of the food industry in India.

India Cloud Kitchen Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India cloud kitchen market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type, product type, and nature.

Analysis by Type:

- Independent Cloud Kitchen

- Commissary/Shared Kitchen

- Kitchen Pods

Independent cloud kitchen leads the market with around 60.8% of market share in 2025.Independent cloud kitchens cater to niche consumer preferences and drive innovation in food delivery. Unlike aggregator-owned or franchise-based kitchens, independent players bring flexibility in menu experimentation, faster response to local tastes, and personalized branding strategies. They are often run by entrepreneurs or small restaurant operators who leverage lower overhead costs. Many independent cloud kitchens rely heavily on online food delivery platforms for customer acquisition but also increasingly invest in direct-to-consumer channels through websites and social media. Their rise is especially visible in Tier I and II cities, where demand for diverse cuisine and convenience is growing. As digital payments and food delivery logistics improve, independent cloud kitchens are expected to remain key contributors to market diversity and localized offerings in India’s expanding food service ecosystem.

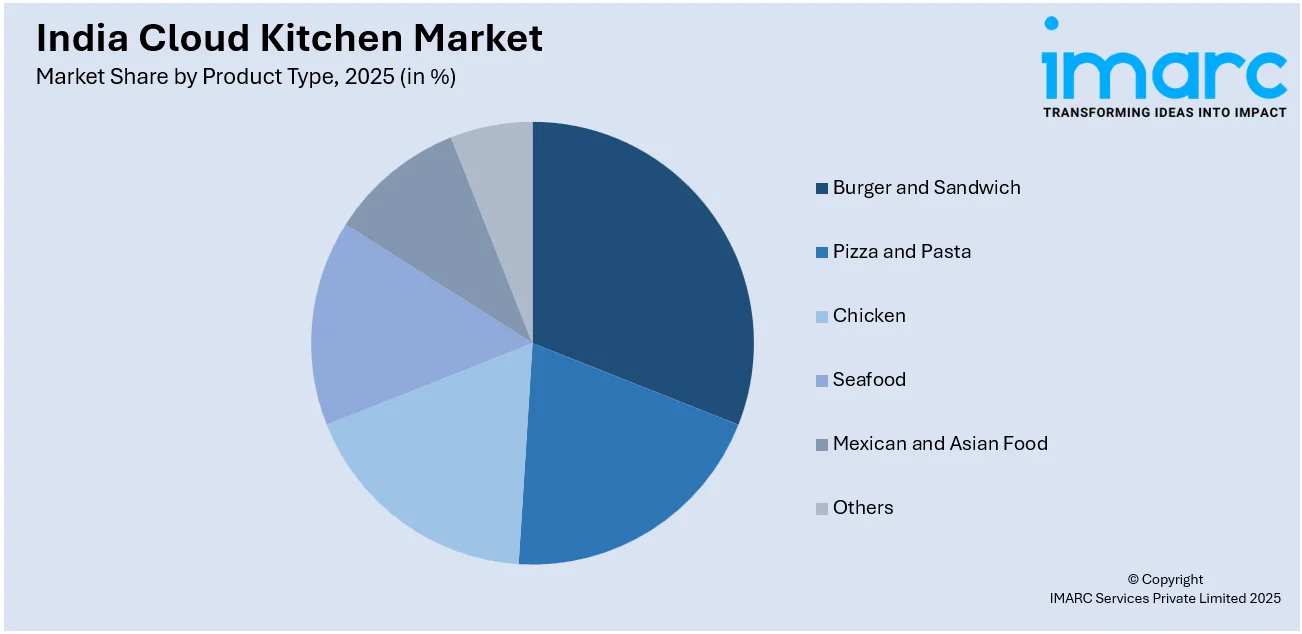

Analysis by Product Type:

Access the comprehensive market breakdown Request Sample

- Burger and Sandwich

- Pizza and Pasta

- Chicken

- Seafood

- Mexican and Asian Food

- Others

Burger and sandwich lead the market with around 35.8% of market share in 2025. The segment is driven by their wide appeal, quick preparation, and suitability for delivery. These products cater to urban consumers seeking convenient, affordable, and globally inspired meals, especially among millennials and Gen Z. Their customizable nature allows cloud kitchens to offer vegetarian, vegan, and protein-rich variations, aligning with shifting dietary preferences. With international fast-food influence and rising demand for handheld meals, burgers, and sandwiches are a go-to category for both independent cloud kitchens and established virtual brands. Their compact packaging and consistent quality make them ideal for maintaining taste and texture during delivery, which enhances customer satisfaction. Additionally, this segment supports high order frequency and volume, helping cloud kitchens achieve better margins and faster inventory turnover. The category’s scalability, combined with creative branding and flavor innovation, reinforces its importance in the market.

Analysis by Nature:

- Franchised

- Standalone

Franchised leads the market in 2025. Franchised cloud kitchens offer structured operations, brand recognition, and consistency in quality across locations. These models appeal to entrepreneurs looking for lower-risk entry into the food delivery space, as they benefit from established menus, centralized procurement, marketing support, and proven business strategies. Franchised brands often scale quickly by replicating successful formats in multiple cities, ensuring faster market penetration and visibility on aggregator platforms. Their presence is especially strong in Tier I and expanding into Tier II cities, where demand for familiar and reliable food options is growing. With centralized control over branding and operations, franchised cloud kitchens maintain customer trust and drive repeat orders. Their ability to leverage data analytics, operational efficiencies, and standardized SOPs makes them a key growth driver in the market.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

In 2025, South India accounted for the largest market share of over 35%, driven by its tech-savvy population, rapid urbanization, and strong food delivery culture. Cities like Bengaluru, Hyderabad, and Chennai serve as key hubs, with a large base of working professionals, students, and digitally engaged consumers fueling consistent demand for online food ordering. The region is home to a mix of traditional and modern culinary preferences, allowing cloud kitchens to experiment with both local delicacies and global cuisines. The strong infrastructure, including reliable internet access, dense delivery networks, and widespread use of food aggregator apps, supports the rapid scaling of virtual kitchen models. Additionally, South India’s early adoption of cloud kitchen formats has encouraged the growth of both independent ventures and franchised brands. Its diverse consumer base and favorable business environment make it one of the most attractive and competitive regions in the market.

Competitive Landscape:

The key players in the market are actively expanding their operations and experimenting with innovative strategies. They are rapidly scaling up their virtual brands to offer a diverse range of cuisines and flavors, leveraging data analytics to understand customer preferences better and optimize their menus. Additionally, these industry leaders are forming strategic partnerships with popular food delivery aggregators to enhance their reach and visibility. Some are also investing in technology, such as artificial intelligence (AI) driven kitchen management systems, to streamline operations and improve efficiency. Furthermore, businesses are focusing on sustainable practices, including eco-friendly packaging and reduced food wastage, aligning with growing consumer concerns about environmental impact. The industry players are also exploring new revenue streams by catering to specific dietary preferences and launching limited-time promotions to keep customers engaged and loyal in this competitive and dynamic market.

The report provides a comprehensive analysis of the competitive landscape in the India cloud kitchen market with detailed profiles of all major companies.

Latest News and Developments:

- February 2025: Big Bowl, a brand under Lenexis Foodworks, launched its 200th cloud kitchen in Attapur, Hyderabad. Operating across 35 cities, the company plans to expand its footprint with 300 additional kitchens by 2027, focusing on Tier II and Tier III markets.

- February 2025: Rebel Foods, a prominent cloud kitchen company, launched “QuickiES”, a new app offering 15-minute food delivery services. The app is positioned to compete with Zomato and Swiggy.

- October 2024: Karigari inaugurated its first cloud kitchen in Noida's Sector 4, marking the brand's 11th outlet. The cloud kitchen will feature Karigari's handpicked dishes, including its signature offerings that blend traditional Indian flavors with modern culinary techniques.

- July 2024: Rebel Foods announced that it would invest INR 200 Crore (around USD 24 Million) to fortify its network of cloud kitchens and brand stores, as well as to extend its EatSure food court style. Within the next two to three years, the business intends to open 100 EatSure food courts.

India Cloud Kitchen Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Independent Cloud Kitchen, Commissary/Shared Kitchen, Kitchen Pods |

| Product Types Covered | Burger and Sandwich, Pizza and Pasta, Chicken, Seafood, Mexican and Asian Food, Others |

| Natures Covered | Franchised, Standalone |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cloud kitchen market from 2020-2034.

- The India cloud kitchen market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cloud kitchen industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cloud kitchen market in India was valued at USD 1,236.5 Million in 2025.

The growth of the India cloud kitchen market is driven by rising demand for online food delivery, growing urbanization, and an increasing number of working professionals preferring quick, convenient meals. Higher smartphone penetration, aggressive digital marketing by food aggregators, and lower operational costs compared to traditional restaurants are also accelerating market growth.

The cloud kitchen market in India is projected to exhibit a CAGR of 12.28% during 2026-2034, reaching a value of USD 3,692.6 Million by 2034.

Independent cloud kitchen holds the largest share in India cloud kitchen due to their flexible operational model, lower setup costs, and ability to cater to diverse food preferences. These kitchens can quickly adapt to changing customer demands without the overhead of dine-in facilities, making them ideal for urban delivery zones.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)