India Cloud Computing Market Size, Share, Trends and Forecast by Service, Workload, Deployment Mode, Organization Size, Vertical, and Region, 2026-2034

India Cloud Computing Market Summary:

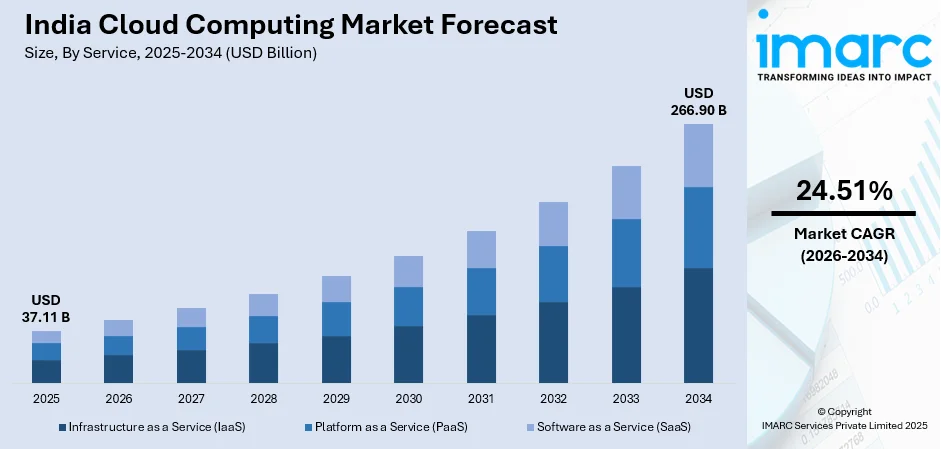

The India cloud computing market size was valued at USD 37.11 Billion in 2025 and is projected to reach USD 266.90 Billion by 2034, growing at a compound annual growth rate of 24.51% from 2026-2034.

Cloud computing market in India has been experiencing outstanding growth due to the rising digital transformation momentum within businesses, the development of cloud adoption initiatives by the governing bodies, and advancements in data centers. The advent of artificial intelligence, big data analytics, and cloud computing has initiated the transformation of business processes, and the need for optimization and scalability has encouraged businesses to opt for cloud computing solutions.

Key Takeaways and Insights:

-

By Service: Infrastructure as a Service (IaaS) dominates the market with a share of 38.1% in 2025, driven by enterprises seeking scalable computing resources without heavy capital investments. IaaS enables organizations to efficiently manage workloads, supporting digital transformation through flexible data storage, disaster recovery solutions, and responsive computing environments across diverse industries.

- By Workload: Data storage and backup leads the market with a share of 25.08% in 2025, reflecting the exponential growth of enterprise data volumes and increasing regulatory requirements for data retention and protection. Organizations prioritize cloud-based storage solutions for their scalability, cost-effectiveness, and robust disaster recovery capabilities ensuring business continuity.

- By Deployment Mode: Public dominates the market with a share of 52.05% in 2025, owing to its scalability, cost-effectiveness, and ease of deployment. Sectors including e-commerce, media, technology startups, and digital-first enterprises rely heavily on public cloud platforms offering pay-per-use models and advanced service integrations.

- By Organization Size: Large enterprises lead the market with a share of 62.07% in 2025, leveraging cloud technologies to improve efficiency, scalability, and innovation across sectors including IT, finance, manufacturing, and telecommunications. Large organizations utilize cloud platforms for mission-critical workloads, advanced analytics, and enterprise-wide digital transformation initiatives.

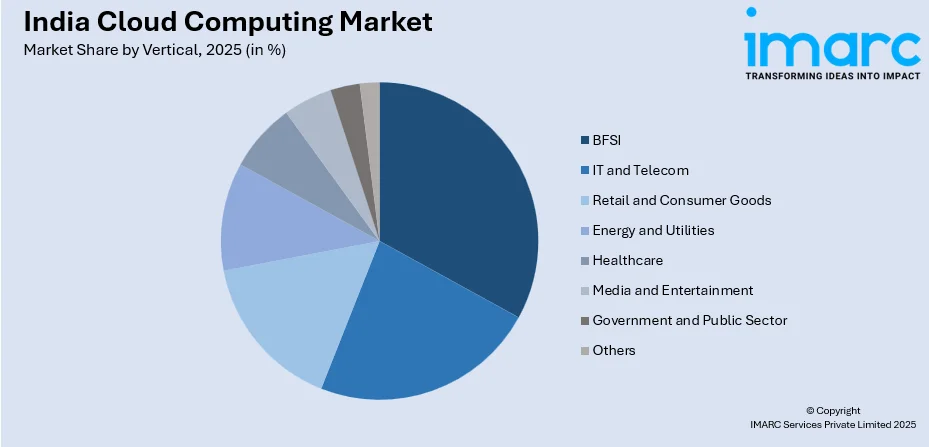

- By Vertical: BFSI dominates the market with a share of 24.03% in 2025, driven by digital banking transformation, regulatory compliance requirements, real-time analytics needs, and fraud detection capabilities. Financial institutions increasingly adopt cloud solutions for secure data storage, customer experience enhancement, and operational agility.

- By Region: North India leads the market with a share of 29% in 2025, benefiting from the concentration of government institutions, corporate headquarters, major IT hubs in Delhi-NCR, and substantial infrastructure investments. The region's robust digital ecosystem and enterprise density support strong cloud adoption.

- Key Players: The India cloud computing market features intense competition among global hyperscalers and domestic service providers. Market participants differentiate through infrastructure investments, AI and analytics capabilities, industry-specific solutions, security offerings, and comprehensive service portfolios spanning infrastructure, platform, and software services.

To get more information on this market Request Sample

The India cloud computing industry is experiencing rapid growth as enterprises and government organizations adopt digital‑first strategies. With the country’s cloud data center capacity at around 1,280 MW and expected to grow four to five times by 2030, expansion is fueled by public and private digitalization initiatives. Supportive policies, including cloud‑first mandates and data localization requirements, are driving domestic infrastructure investments. Hyperscale data centers are rising in major cities, while edge computing extends services to tier‑two locations. AI, machine learning, and advanced analytics integrated with cloud platforms create new business value. Hybrid and multi‑cloud strategies are increasingly adopted to balance security and scalability, and a thriving startup ecosystem further accelerates cloud adoption, positioning India as a key global cloud market.

India Cloud Computing Market Trends:

AI and Machine Learning Integration with Cloud Platforms

The convergence of AI and cloud computing is transforming India’s enterprise technology landscape. Cloud platforms now provide integrated AI and machine learning tools, including data lakes, model training pipelines, and governance frameworks. In November 2025, Deloitte India and AWS launched India’s first AWS Agentic AI Lab to boost cloud and AI adoption in financial services, public sector, and manufacturing. Healthcare providers use AI‑ready platforms for imaging and clinical support, while manufacturers adopt IoT‑enabled cloud solutions for predictive maintenance, enabling faster innovation and outcome-focused operations.

Sovereign Cloud and Data Localization Initiatives

Data sovereignty requirements are driving major investments in India’s domestic cloud infrastructure and sovereign cloud solutions. Regulations mandating local data storage for sensitive sectors like financial services and healthcare are creating demand for certified sovereign clouds that combine elasticity with jurisdictional control. In September 2025, SAP launched its SAP Sovereign Cloud in India to secure critical data and comply with the National Information Security Policy & Guidelines, enabling innovation while maintaining control. Government initiatives further promote cloud adoption for public services, enhancing the cloud ecosystem and addressing data protection and national security.

Hyperscale Data Center Expansion and Edge Computing

Massive investments in data center infrastructure are transforming India’s cloud capabilities. Hyperscale facilities are being established across major cities, while edge computing nodes in tier‑two cities bring compute closer to users. In 2025, Reliance Industries and partners announced an $11 billion investment to develop 1 GW of AI‑native data center capacity in Visakhapatnam, highlighting strong corporate commitments. This expansion reduces latency, enhances service availability, and supports low‑latency use cases like industrial automation and real‑time analytics. Improved fiber connectivity and power reliability further strengthen cloud service delivery nationwide.

Market Outlook 2026-2034:

The Indian cloud computing market is set for outstanding growth during the forecast period, with accelerating digital transformations, adoption of artificial intelligence, and heavy investments in infrastructure by global and local vendors. The digital transformations happening in the BFSI sector and the start of healthcare and manufacturing sector digitalizations offer huge growth potential for cloud computing in the country. Smaller and mid-sized businesses have been adopting cloud computing for their competitive edge applications, and large businesses have been moving their critical workloads to hybrid infrastructure environments. The market generated a revenue of USD 37.11 Billion in 2025 and is projected to reach a revenue of USD 266.90 Billion by 2034, growing at a compound annual growth rate of 24.51% from 2026-2034.

India Cloud Computing Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Service |

Infrastructure as a Service (IaaS) |

38.1% |

|

Workloads |

Data Storage and Backup |

25.08% |

|

Deployment Modes |

Public |

52.05% |

|

Organization Sizes |

Large Enterprise |

62.07% |

|

Verticals |

BFSI |

24.03% |

|

Region |

North India |

29% |

Service Insights:

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

The Infrastructure as a Service (IaaS) dominates with a market share of 38.1% of the total India cloud computing market in 2025.

IaaS retains its lead in the market as more companies look for nimble and elastic computing resources that can be delivered quickly or at a low up-front cost. This paradigm allows companies to efficiently manage various workloads and at the same time facilitate the digital transformation process, cloud deployment models, and enhanced security mechanisms. The Indian market uses the benefits of scalability and the pay-as-you-use business model associated with the IaaS paradigm for storing data, disaster recovery, data analytics, and testing.

The segment benefits from expanding data center infrastructure across major metropolitan areas and improving connectivity, which enables more reliable and low-latency service delivery. Global cloud providers continue to add cloud regions in India as part of their efforts toward lower latency and higher overall availability of their services. Enterprises-from startups to large corporations-have harnessed IaaS as the core enabler in their cloud strategies for seamless workload migration, modernization of applications, and scalable multi-cloud deployments across industry verticals.

Workload Insights:

- Application Development and Testing

- Analytics and Reporting

- Data Storage and Backup

- Integration and Orchestration

- Resource Management

- Others

The data storage and backup leads with a share of 25.08% of the total India cloud computing market in 2025.

Data storage and backup workloads lead as organizations manage rapidly growing data volumes requiring secure, scalable, and cost‑effective solutions. Cloud storage offers elastic scalability, geographic redundancy, and simplified disaster recovery compared with on‑premise systems. In December 2025, Western Digital highlighted that India’s data center capacity, attracting nearly $70 billion in investments, sustains strong demand for high‑capacity HDDs, showing persistent core storage needs alongside cloud and flash adoption. Regulatory mandates for data retention and protection across BFSI, healthcare, and government sectors further drive cloud storage uptake.

The segment is further supported by the latest storage technology adoption, lower costs with increasing GBs, and the development of data management platforms. Businesses have been using cloud storage for their data centers, archives, and backup processes for primary data storage purposes. The addition of intelligence data management capabilities, auto tiering, and compliance further adds value for the businesses and companies that handle various data sets on hybrid and multi-cloud storage environments.

Deployment Mode Insights:

- Public

- Private

- Hybrid

The public dominates with a market share of 52.05% of the total India cloud computing market in 2025.

Public cloud continues to lead India’s cloud market due to its scalability, cost‑effectiveness, and ease of deployment. Sectors like e‑commerce, media, edtech, and digital‑first startups rely on public cloud services for pay‑per‑use models, global infrastructure, and advanced integrations. Reflecting this dominance, AWS announced a $7 billion investment to expand its data center footprint in Telangana over 14 years, reinforcing its leadership. Public cloud democratizes enterprise‑grade computing, enabling organizations of all sizes to compete effectively and access advanced technology without heavy upfront infrastructure costs.

Public cloud adoption continues to accelerate as platforms enhance security certifications, compliance capabilities, and industry-specific offerings suited for regulated sectors. Integration of AI and machine learning services with advanced analytics and developer tools establishes complete ecosystems to support innovation, operational efficiency, and fast application deployment across industries. The emergent cases of hybrid architectures for enterprises that require data sovereignty or special security controls should not distract from the fact that the public cloud remains the correct starting point for cloud journeys and foundational digital transformation initiatives.

Organization Size Insights:

- Large Enterprise

- Small and Medium Enterprise

The large enterprises lead with a share of 62.07% of the total India cloud computing market in 2025.

The large enterprise sector accounts for the largest market share, with the widespread use of cloud technology in their efforts to optimize their business processes, as well as innovate. The large enterprise uses the cloud infrastructure in their critical business operations, as well as their resource planning, customer relationship, and business analytics services. This is because the complexity of their business operations translates to high cloud usage. The need to provide secure, robust, as well as fully available cloud services emerges as a result of this high complexity in the business operations of the large enterprise sector.

Large organizations are increasingly turning towards multi-cloud and hybrid models in a bid to fully leverage cloud resource deployment, prevent lock-in situations, and ensure compliance with varied regulations. This move enhances resilience and agility. The spending on cloud modernization, application refactoring, and digital transformation programs among large organizations fuels the overall market expansion. Small and medium enterprises are the quickest-growing market sector due to the ease of access, scalability, and economics of cloud technology, which facilitates the digital transformation process and competitive positioning.

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- BFSI

- IT and Telecom

- Retail and Consumer Goods

- Energy and Utilities

- Healthcare

- Media and Entertainment

- Government and Public Sector

- Others

The BFSI dominates with a market share of 24.03% of the total India cloud computing market in 2025.

The BFSI sector commands the largest vertical share driven by digital banking transformation, regulatory compliance requirements, and the need for real-time analytics and fraud detection capabilities. Financial institutions increasingly migrate to cloud platforms for secure data storage, customer experience enhancement, operational agility, and cost optimization. Data localization mandates requiring financial data storage within India have spurred investments in domestic cloud infrastructure.

Banks, insurance, and financial services organizations use cloud technology for their core banking transformation, digital payments, risk solutioning, and customer applications. The combination of AI and Machine Learning capabilities can improve their abilities in lending risk scoring, money laundering detection, and personal financial services. Compliance management solutions for financial services can be offered via cloud-based regulatory technologies.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 29% share of the total India cloud computing market in 2025.

North India maintains market leadership supported by the concentration of government institutions, corporate headquarters, and major IT hubs across the Delhi National Capital Region. The region hosts significant data center investments and benefits from robust digital infrastructure supporting enterprise cloud adoption. Government departments and public sector organizations in the national capital region drive substantial cloud consumption as e-governance initiatives expand.

The region benefits from established telecommunications infrastructure, skilled technology workforce, and proximity to decision-making centers for major enterprises. Delhi-NCR's emergence as a significant data center hub attracts global and domestic cloud providers establishing points of presence. Corporate headquarters of major conglomerates and multinational subsidiaries contribute to concentrated cloud demand while the startup ecosystem adds dynamism to the regional market.

Market Dynamics:

Growth Drivers:

Why is the India Cloud Computing Market Growing?

Accelerating Digital Transformation Across Enterprises

Indian enterprises are rapidly embracing digital transformation, reshaping business models, customer engagement, and operations. Cloud computing underpins this shift, offering scalable infrastructure, advanced analytics, and modern application platforms. A 2024 EY survey found that 90 % of Indian businesses believe cloud adoption is driving AI integration and accelerating innovation across functions. Organizations are moving from legacy on‑premise systems to cloud‑native architectures, recognizing digital agility as a competitive necessity. By democratizing advanced technologies, cloud platforms enable businesses of all sizes to compete effectively, while investments in digital capabilities continue to enhance efficiency, customer experience, and revenue growth.

Government Initiatives and Policy Support

Government initiatives such as Digital India, Startup India, and Make in India are fostering strong conditions for cloud adoption across public and private sectors. Cloud‑first mandates drive the migration of citizen services and public systems to platforms like the “GI Cloud – MeghRaj,” providing scalable, pay‑per‑use services for e‑governance. Data localization policies and sectoral regulations promote domestic cloud investment while ensuring data sovereignty. Cloud-enabled platforms like DigiLocker modernize service delivery, and policies supporting digital literacy, technology adoption, and infrastructure development create a robust ecosystem for sustained growth in India’s cloud market.

Expanding Data Center Infrastructure and Connectivity

Massive investments in data center infrastructure by global and domestic operators are transforming India’s cloud capabilities. Hyperscale facilities in major cities support enterprise cloud services, while edge computing extends reach to tier‑two locations. In December 2025, Microsoft announced a $17.5 billion investment to expand cloud and AI infrastructure in India, including data centers, skilling programs, and sovereign cloud solutions. Enhanced fiber connectivity, power availability, and submarine cable access improve reliability and reduce latency, supporting use cases from real‑time analytics to industrial automation, lowering adoption barriers and enabling competitive, high-quality cloud services.

Market Restraints:

What Challenges the India Cloud Computing Market is Facing?

Data Privacy and Security Concerns

Data privacy and cybersecurity concerns continue to hinder cloud adoption, especially for organizations managing sensitive information. Strict regulatory requirements add compliance challenges that some enterprises struggle to meet. Additionally, security incidents and breach reports increase caution, making organizations wary of migrating critical workloads and sensitive data to the cloud, slowing overall adoption despite the technology’s potential benefits.

Legacy System Integration Complexities

Cloud migration in the case of firms with substantial legacy infrastructure in their technology is a challenging task. It can include mainframes from the past few decades, unique interfaces, as well as largely customized business applications. They cannot be migrated to the cloud easily. They need advanced modernization, which involves rewriting code, managing data flows, as well as training employees on a containerized infrastructure, along with designing an integration solution.

Skilled Workforce Shortage

There is a lack of professionals in the field of certified cloud architects, site reliability engineers, and cloud security experts that is still not meeting the evolving demands within the market, resulting in stiff competition for these specific professionals. There is a resulting impact on cloud implementation-speed, thereby acting as a drag factor for digital transformation. It has also led organizations to focus on developing these competencies in-house for cloud optimization, management, and adhering to cloud security requirements for seamless cloud implementation.

Competitive Landscape:

The India cloud computing market features intense competition among global hyperscalers and domestic service providers. Major international cloud platforms have established significant presence through multiple data center regions, extensive partner ecosystems, and comprehensive service portfolios. Domestic providers compete through localized offerings, sector-specific solutions, and competitive pricing. Indian IT services companies leverage cloud partnerships to deliver managed services and transformation consulting. Competition intensifies as providers expand AI and machine learning capabilities, enhance security offerings, and develop industry-specific solutions. The competitive environment drives continuous innovation, service enhancement, and pricing optimization benefiting cloud consumers across market segments.

Recent Developments:

- In February 2025, Grant Thornton Bharat announced it had entered into a strategic partnership with Yotta Data Services to speed up enterprise adoption of cloud computing, Artificial Intelligence (AI), and Generative AI (GenAI) to drive innovation, growth, and competitiveness. Yotta Data Services is a full‑service digital transformation provider offering GPU infrastructure, cloud solutions, colocation, and managed IT services.

India Cloud Computing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS) |

| Workloads Covered | Application Development and Testing, Analytics and Reporting, Data Storage and Backup, Integration and Orchestration, Resource Management, Others |

| Deployment Modes Covered | Public, Private, Hybrid |

| Organization Sizes Covered | Large Enterprise, Small and Medium Enterprise |

| Verticals Covered | BFSI, IT and Telecom, Retail and Consumer Goods, Energy and Utilities, Healthcare, Media and Entertainment, Government and Public Sector, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India cloud computing market size was valued at USD 37.11 Billion in 2025.

The India cloud computing market is expected to grow at a compound annual growth rate of 24.51% from 2026-2034 to reach USD 266.90 Billion by 2034.

Infrastructure as a Service (IaaS) dominated the India cloud computing market with a share of 38.1%, driven by enterprises seeking scalable computing resources without heavy capital investments for digital transformation initiatives.

Key factors driving the India cloud computing market include accelerating digital transformation across enterprises, government initiatives such as Digital India and cloud-first policies, expanding data center infrastructure investments, AI and big data adoption, cost efficiency requirements, and demand for hybrid cloud solutions.

Major challenges include data privacy and security concerns particularly for sensitive sectors, legacy system integration complexities requiring substantial modernization investments, skilled workforce shortages in cloud architecture and management, regulatory compliance costs, and vendor lock-in considerations affecting multi-cloud strategies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)