India Cloud AI Market Size, Share, Trends and Forecast by Type, Technology, Vertical, and Region, 2025-2033

India Cloud AI Market Overview:

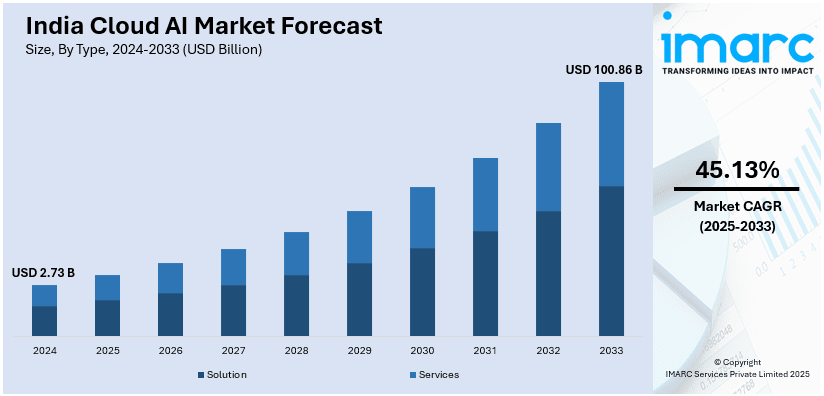

The India cloud AI market size reached USD 2.73 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 100.86 Billion by 2033, exhibiting a growth rate (CAGR) of 45.13% during 2025-2033. The market is driven by rapid digital transformation across industries, increased adoption of AI-as-a-Service (AIaaS), and government initiatives such as Digital India. The growing demand for real-time data processing, edge AI, and hybrid cloud models, coupled with affordable cloud infrastructure and 5G advancements, further augments the India cloud AI market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.73 Billion |

| Market Forecast in 2033 | USD 100.86 Billion |

| Market Growth Rate 2025-2033 | 45.13% |

India Cloud AI Market Trends:

Rapid Adoption of AI-Driven Cloud Solutions Across Industries

The rise in AI solutions adoption across diverse industries, including healthcare, retail, finance, and manufacturing, is favoring the India cloud AI market growth. Businesses are increasingly leveraging AI-powered cloud platforms to enhance operational efficiency, automate processes, and deliver personalized customer experiences. Healthcare providers are increasingly adopting cloud solutions powered by AI for predictive diagnostics and patient data management. Likewise, retail firms are implementing AI solutions to improve demand forecasting and maintain appropriate stock levels. This trend is being driven by the growing availability of low-cost cloud infrastructure, and the arrival of AI-as-a-Service (AIaaS) platforms is pushing it forward. In addition, government initiatives such as Digital India and smart city promotions are creating a conducive environment for cloud-based AI technologies. On 8th January 2025, Microsoft partnered with IndiaAI, a division of Digital India, to boost India's artificial intelligence ecosystem. The collaboration aims to train 500,000 individuals, including students, government officials, and women entrepreneurs, by 2026. The initiative will also establish 'AI Centres of Excellence' and 'AI Productivity Labs' in 20 skill institutes across 10 states, aiming to train 20,000 educators and offer foundational AI courses to 1 lakh students in 200 Industrial Training Institutes (ITIs). As organizations prioritize digital transformation, the demand for scalable, secure, and intelligent cloud solutions is expected to grow exponentially, positioning India as a key player in the global cloud AI market.

To get more information on this market, Request Sample

Increased Focus on Edge AI and Hybrid Cloud Models

The rising emphasis on edge AI and hybrid cloud models is creating a positive India cloud AI market outlook. With the proliferation of IoT devices and the need for real-time data processing, businesses are increasingly adopting edge AI solutions that bring computation closer to data sources. This is particularly relevant for industries including manufacturing, logistics, and telecommunications, where low latency and high-speed decision-making are critical. As digital engagement surges, a 2024 report indicates that 84% of smartphone users in India examine their devices within 15 minutes of rising, dedicating 31% of their waking hours to smartphone usage. The average daily usage has risen from 2 hours in 2010 to 4.9 hours in 2023, with users checking their devices about 80 times per day. This increasing dependence on connected devices is driving demand for AI-powered cloud solutions that optimize performance, reduce latency, and enhance real-time decision-making. Hybrid cloud models that incorporate both public and private cloud infrastructures are also gaining traction for their improved flexibility, data security, and cost-effectiveness. Organizations are adopting hybrid clouds to balance workloads between keeping sensitive information on-premises while leveraging public clouds for AI. Advancements in 5G technology continue to enhance connectivity and facilitate the smooth integration of edge and cloud AI solutions. Consequently, the market is set for significant growth, propelled by the merging of edge computing and hybrid cloud strategies.

India Cloud AI Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, technology, and vertical.

Type Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the type. This includes solution and services.

Technology Insights:

- Deep Learning

- Machine Learning

- Natural Language Processing

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes deep learning, machine learning, natural language processing, and others.

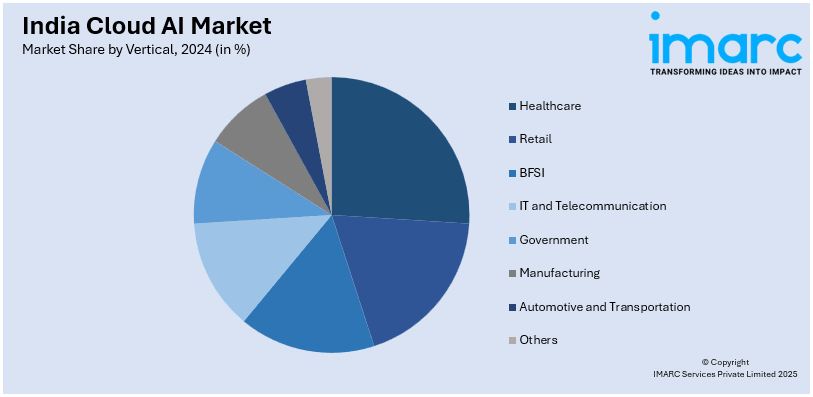

Vertical Insights:

- Healthcare

- Retail

- BFSI

- IT and Telecommunication

- Government

- Manufacturing

- Automotive and Transportation

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes healthcare, retail, BFSI, IT and telecommunication, government, manufacturing, automotive and transportation, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cloud AI Market News:

- January 7, 2025: Microsoft announced investing USD 3 Billion to build India's cloud and AI forte over the next two years, supporting the AI-first vision of the Digital India initiative by setting up new data centers and workforce. Its ADVANTA(I)GE India program aims to educate 10 million individuals by 2030 in AI, focusing on startups, women, and individuals in Tier II and III cities. With SaaSBoomi, Microsoft strengthens the AI and SaaS ecosystem in India through 5,000 startups in India with 2 lakh job opportunities and VC funds of USD 1.5 Billion.

- November 07, 2024: Google Cloud launched initiatives to help early-stage AI startups in India offering up to USD 350,000 in cloud credits as well as technical support and tie-ups with Y Combinator and top accelerators. The 12-week Emerging ISV Partner Springboard and Startup School: GenAI empowers founders with the knowledge required to compete in the AI space, as well as giving founders access to cloud resources and go-to-market strategies. In addition, the Google Cloud and DeliverHealth partnership will revolutionize clinical documentation with the help of cutting-edge AI(NLP) models to further enrich India's growing cloud AI ecosystem.

India Cloud AI Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solution, Services |

| Technologies Covered | Deep Learning, Machine Learning, Natural Language Processing, Others |

| Verticals Covered | Healthcare, Retail, BFSI, IT and Telecommunication, Government, Manufacturing, Automotive and Transportation, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cloud AI market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cloud AI market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cloud AI industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India cloud AI market was valued at USD 2.73 Billion in 2024.

The cloud AI market in India is projected to exhibit a CAGR of 45.13% during 2025-2033, reaching a value of USD 100.86 Billion by 2033.

The cloud AI market in India is driven by rapid digital transformation, increased adoption of cloud services, and government initiatives like Digital India. Growing investments from tech giants, a skilled workforce, and rising demand from sectors such as BFSI, healthcare, and retail also boost growth. Expanding data center infrastructure and advancements in AI technology further support market development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)