India Clinical Trials Market Size, Share, Trends and Forecast by Phase, Study Design, Indication, Service Type, Sponsor, and Region, 2025-2033

India Clinical Trials Market Overview:

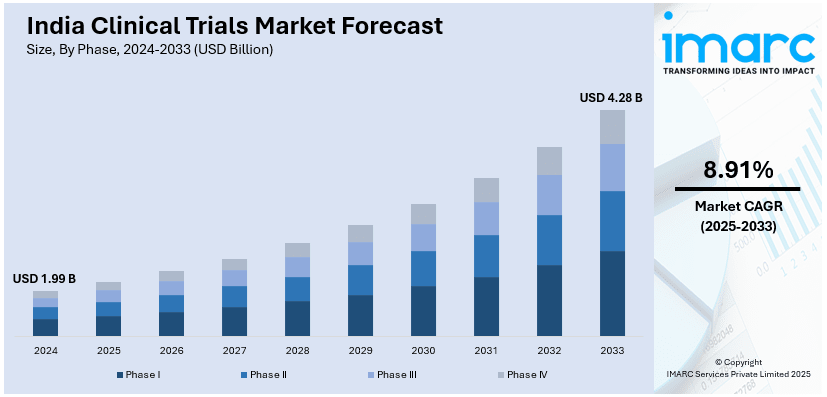

The India clinical trials market size reached USD 1.99 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.28 Billion by 2033, exhibiting a growth rate (CAGR) of 8.91% during 2025-2033. The market is significantly expanding due to a large, diverse patient pool, cost-effective operations, and regulatory reforms enabling faster approvals. Increasing demand for oncology and rare disease studies, adoption of decentralized trials, and advancements in digital health technologies further augment the India clinical trials market share. Supportive government policies and rising research and development (R&D) investments also enhance market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.99 Billion |

| Market Forecast in 2033 | USD 4.28 Billion |

| Market Growth Rate (2025-2033) | 8.91% |

India Clinical Trials Market Trends:

Increasing Adoption of Decentralized Clinical Trials (DCTs) in India

The shift toward decentralized clinical trials (DCTs), driven by technological advancements and regulatory support is facilitating the India clinical trials market growth. DCTs leverage digital tools such as telemedicine, wearable devices, and electronic consent to conduct trials remotely, reducing patient burden and improving participation rates. The COVID-19 pandemic further accelerated this trend, as traditional site-based trials faced disruptions. Regulatory bodies have introduced guidelines to facilitate DCTs, encouraging sponsors to adopt hybrid trial models. Additionally, India’s growing smartphone penetration and improving digital infrastructure make it an ideal market for remote monitoring and virtual trials. Pharma companies and CROs are increasingly partnering with local tech firms to implement AI-driven data analytics and IoT-enabled devices for real-time patient tracking. On 25th September 2024, Amazon Web Services (AWS) India entered into a partnership with the National Health Authority (NHA), the Government e-Marketplace (GeM), and the Public Sector Bank Alliance (PSBA) to enhance digital infrastructure in the country. This partnership is about building scalable solutions that will specifically augment the digital framework for healthcare. The initiative is aligning with the growing clinical trial industry in India and allows for more efficient and technology-oriented healthcare services. This trend is expected to enhance trial efficiency, reduce costs, and accelerate drug development timelines, positioning India as a preferred destination for innovative clinical research.

To get more information on this market, Request Sample

Rising Demand for Oncology and Rare Disease Clinical Trials

India’s clinical trials market is experiencing a rise in demand for oncology and rare disease studies, driven by increasing disease prevalence and government initiatives. Cancer cases in India are projected to rise significantly, creating a pressing need for innovative therapies. India reported 1.4 Million new cancer cases in 2023, underscoring the continuing public health challenge posed by this disease. In budget 2025-26, the government proposes more Day Care Cancer Centers (nearly 200) to upgrade cancer care. Also, research projects such as NexCAR19 and the National Cancer Grid and initiatives including Ayushman Bharat have made it easier to conduct clinical trials and broadens access to novel cancer treatments throughout the country. Global pharmaceutical companies are expanding their oncology trials in India due to its large, diverse patient pool and cost-effective trial execution. Additionally, the government’s National Rare Disease Policy aims to enhance research and drug development for rare conditions, attracting international sponsors. The availability of specialized hospitals, skilled investigators, and genetic research centers is creating a positive India clinical trials market outlook. Moreover, regulatory reforms, such as faster approvals and waivers for local trials in certain cases, are encouraging more sponsors to conduct studies in India. As a result, the country is emerging as a key hub for cutting-edge research in oncology and rare diseases, fostering collaborations between global pharma firms and Indian CROs.

India Clinical Trials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on phase, study design, indication, service type, and sponsor.

Phase Insights:

- Phase I

- Phase II

- Phase III

- Phase IV

The report has provided a detailed breakup and analysis of the market based on the phase. This includes Phase I, Phase II, Phase III, and Phase IV.

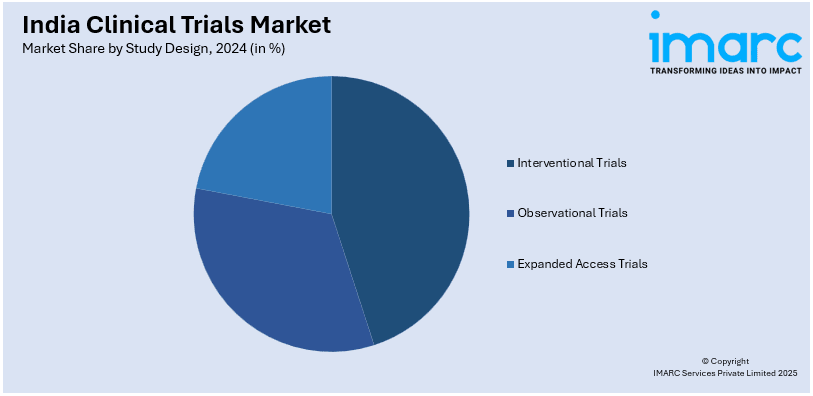

Study Design Insights:

- Interventional Trials

- Observational Trials

- Expanded Access Trials

A detailed breakup and analysis of the market based on the study design have also been provided in the report. This includes interventional trials, observational trials, and expanded access trials.

Indication Insights:

- Autoimmune/Inflammation

- Rheumatoid Arthritis

- Multiple Sclerosis

- Osteoarthritis

- Irritable Bowel Syndrome (IBS)

- Others

- Pain Management

- Chronic Pain

- Acute Pain

- Oncology

- Blood Cancer

- Solid Tumors

- Others

- CNS Conditions

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle Regeneration

- Others

- Diabetes

- Obesity

- Cardiovascular

- Others

The report has provided a detailed breakup and analysis of the market based on the indication. This includes autoimmune/inflammation (rheumatoid arthritis, multiple sclerosis, osteoarthritis, irritable bowel syndrome (IBS), and others), pain management (chronic pain and acute pain), oncology (blood cancer, solid tumors, and others), CNS conditions (epilepsy, Parkinson’s disease (PD), Huntington’s disease, stroke, traumatic brain injury (TBI), amyotrophic lateral sclerosis (ALS), muscle regeneration, and others), diabetes, obesity, cardiovascular, and others.

Service Type Insights:

- Protocol Designing

- Site Identification

- Patient Recruitment

- Laboratory Services

- Bioanalytical Testing Services

- Clinical Trial Data Management Services

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes protocol designing, site identification, patient recruitment, laboratory services, bioanalytical testing services, clinical trial data management services, and others.

Sponsor Insights:

- Pharmaceutical & Biopharmaceutical Companies

- Medical Device Companies

- Others

The report has provided a detailed breakup and analysis of the market based on the sponsor. This includes pharmaceutical & biopharmaceutical companies, medical device companies, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Clinical Trials Market News:

- March 24, 2025: The Postgraduate Institute of Medical Education and Research (PGI) announced starting clinical trials for CAR T-cell therapy for multiple myeloma and plans to recruit 10 to 12 patients from across India. These trials aim to improve access to this cutting-edge therapy, already used for leukemia and lymphoma, in the country. The expected decrease from INR 45 crore (approximately USD 5.4 Million) to INR 30 Lakh (approximately USD 36,000) could have a substantial impact on the growing trend of clinical trials and the field of cancer treatment in India.

- September 14, 2024: The Indian Council of Medical Research (ICMR) signed MoAs to undertake first-in-human clinical trials for 4 new and innovative therapies comprising a small molecule for the treatment of multiple myeloma and a Zika vaccine. Working with leading industry players such as Aurigene Oncology and ImmunoACT highlights India's growing reach in the world of global clinical trials. The initiatives demonstrate India's commitment to offering affordable, state-of-the-art therapies through clinical trials.

India Clinical Trials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Phases Covered | Phase I, Phase II, Phase III, Phase IV |

| Study Designs Covered | Interventional Trials, Observational Trials, Expanded Access Trials |

| Indications Covered |

|

| Service Types Covered | Protocol Designing, Site Identification, Patient Recruitment, Laboratory Services, Bioanalytical Testing Services, Clinical Trial Data Management Services, Others |

| Sponsors Covered | Pharmaceutical & Biopharmaceutical Companies, Medical Device Companies, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India clinical trials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India clinical trials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India clinical trials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The clinical trials market in India was valued at USD 1.99 Billion in 2024.

Regulatory reforms and efforts to streamline approval processes are enhancing efficiency and transparency in trial approvals. Additionally, expanding healthcare infrastructure and rising expertise among medical professionals are supporting complex and large-scale studies. Moreover, the growing prevalence of chronic and lifestyle diseases is driving the demand for novel therapies, leading to more clinical research.

The India clinical trials market is projected to exhibit a CAGR of 8.91% during 2025-2033, reaching a value of USD 4.28 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)