India Citric Acid Market Size, Share, Trends and Forecast by Application, Form, and Region, 2025-2033

Market Overview:

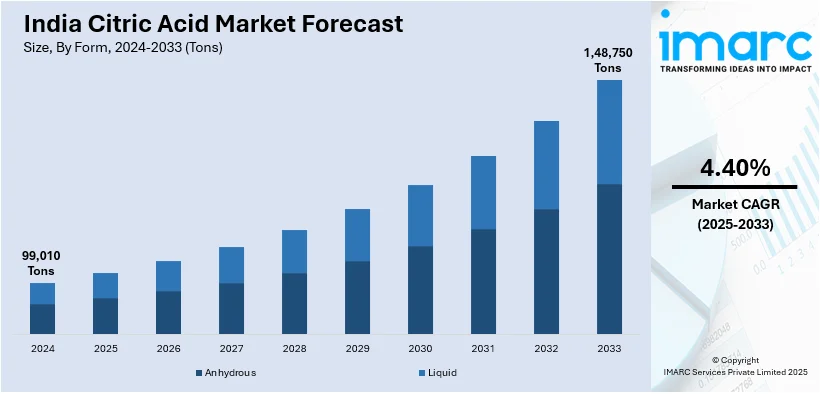

The India citric acid market size reached 99,010 Tons in 2024. The market is projected to reach 1,48,750 Tons by 2033, exhibiting a growth rate (CAGR) of 4.40% during 2025-2033. The market growth is attributed to the expanding food and beverage industry, rising demand for RTD beverages and processed foods, pharmaceutical and cosmetic applications, and increasing consumer preference for natural ingredients.

Market Insights:

- Based on region, West and Central India accounts for the largest share of the citric acid market in 2024.

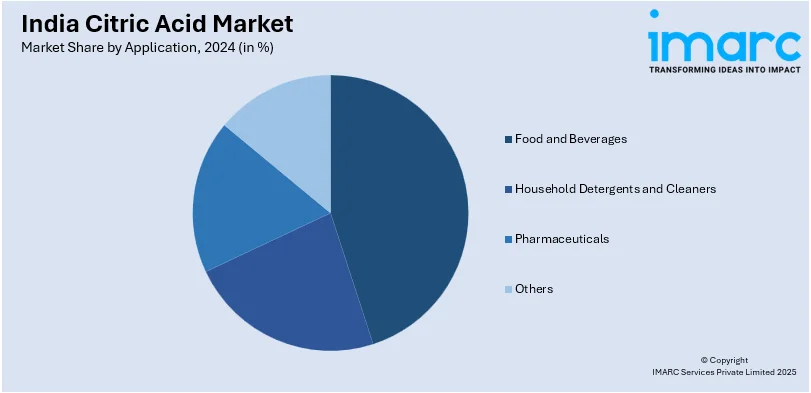

- Based on application, food and beverages represent the largest segment in 2024.

- Based on form, anhydrous citric acid dominates the market in 2024.

Market Size & Forecast:

- 2024 Market Size: 99,010 Tons

- 2033 Projected Market Size: 1,48,750 Tons

- CAGR (2025–2033): 4.40%

- Largest Region in 2024: West and Central India

Citric acid is a mild organic acid naturally found in citrus fruits such as lemon, lime, orange, and pomelo. It can also be produced synthetically through fermentation by Aspergillus Niger fungus. Citric acid offers numerous health benefits, such as detoxification, enhanced energy, and support for digestion and kidney function. As a result, it is widely employed in the food and beverage (F&B) sector as an additive, preservative, flavor enhancer, and coloring agent. Besides this, it is also preferred over phosphates in detergent manufacturing for its environmentally friendly water system formulation.

To get more information on this market, Request Sample

The market for citric acid in India is mainly driven by the bolstering growth of the F&B industry. Besides this, the increased demand for ready-to-drink (RTD) beverages and processed foods due to rising disposable incomes, urbanization, and busy lifestyles is creating a positive outlook for market expansion. Moreover, citric acid's role in enhancing metabolism and nutrient absorption in medicines and health supplements is fueling the market growth. In addition to this, the largescale product employment in cosmetics and personal care items, such as facial masks, to promote skin tone, brightening, oiliness reduction, and dead skin cell regeneration is aiding in market expansion. Furthermore, the shift towards organic and natural products driven by the rise in awareness of the adverse impact of synthetic chemicals is expanding the applications of citric acid in detergents, coatings, adhesives, plastics, pharmaceuticals, clinical nutrition, and pet food, contributing to the market's growth trajectory.

India Citric Acid Market Trends/Drivers:

Expanding F&B industry

As per the India citric acid market analysis, the F&B industry in India has been experiencing remarkable growth due to various factors, such as changing consumer preferences, increasing disposable incomes, urbanization, and a shift towards convenience-oriented lifestyles. As people become busier, there's a rising inclination towards packaged and processed foods that offer quick and easy consumption options. Citric acid, known for its versatile applications in the food sector, is extensively employed for providing taste enhancement, preservation, and texture improvement to a wide range of products. In addition to this, its sour taste and pH regulation properties are utilized in numerous food products such as beverages, confectionery, jams, and dairy products. As a result, the growth of the F&B industry, accompanied by the need for quality and shelf-life extension, has led to a substantial citric acid demand in India.

Rising demand for RTD beverages and processed foods

The increasing demand for RTD beverages and processed foods, influenced by the fast-paced urban lifestyle and the need for on-the-go consumption options, represents one of the main factors impelling the market growth. With rapid urbanization and changing work dynamics, consumers are seeking convenient and easily accessible food and beverage choices. Citric acid's presence in these products helps maintain the desired flavor, color, and shelf life. Besides this, it acts as a natural preservative, ensuring that RTD beverages and processed foods remain safe and visually appealing for an extended period. Furthermore, citric acid's sour taste contributes to the overall taste profile of these products, making them more attractive to consumers. This trend is presenting lucrative opportunities for the expansion of the India citric acid market share.

Price Dynamics, Source Innovation, and Process Differentiation

Raw material costs, especially for substrates like sugar, molasses, and corn, continue to influence citric acid pricing in India. Feedstock availability fluctuates with monsoon variability and global commodity prices, affecting fermentation economics. Import dependency for certain starches and glucose types adds further cost volatility. Most domestic production is fermentation-based using Aspergillus niger, while natural citrus extraction remains commercially unviable due to low yields. Manufacturers are exploring high-purity output through strain optimization and enhanced downstream filtration to meet rising pharma and food-grade demand. Differentiation between conventional and high-purity grades is becoming more relevant, not just in pricing but in end-use applications and regulatory compliance. Fermentation process refinements and microbial R&D are helping reduce batch variation and improve overall yield efficiency.

Circular Practices and Supply-Side Fragility

India citric acid market price trends are highly influenced by the industry's shift toward sustainability and circular economy practices. Citric acid producers in India are beginning to implement waste valorization strategies by converting spent fermentation biomass into animal feed, biogas, or compost. Some are piloting use of agri-waste like fruit peels or sugarcane residues as supplementary feedstocks, supporting sustainability goals and mitigating input costs. These moves align with broader interest in circular economy models across the food processing sector. On the supply side, market concentration remains a concern. A few large players dominate capacity, while many small and mid-sized units rely on imports or toll production. This leaves the supply chain exposed to input shocks, logistics delays, and global price swings, particularly from China, which remains a key supplier of both raw materials and finished citric acid. Quality inconsistency from smaller producers also raises challenges in regulated end-user segments, all of which further affects the India Citric Acid Market growth.

India Citric Acid Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India citric acid market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on application and form.

Breakup by Application:

- Food and Beverages

- Household Detergents and Cleaners

- Pharmaceuticals

- Others

Food and beverages represent the most popular application

The report has provided a detailed breakup and analysis of the market based on the application. This includes food and beverages, household detergents and cleaners, pharmaceuticals, and others. According to the report, food and beverages represented the largest segment.

The increased use of citric acid in food and beverage applications as a natural acidulant to enhance the flavor profile of various products and contribute to pH regulation, ensuring consistent taste and texture, is creating a positive outlook for market growth. Moreover, its compatibility with a range of ingredients and the ability to act as a chelating agent makes it an essential component in food and beverage formulations. Furthermore, the demand for clean labels and natural ingredients is encouraging manufacturers to turn to citric acid as a versatile alternative to synthetic additives, thereby strengthening the market growth. In addition to this, its reputation as a safe and recognizable ingredient aligns with the rising consumer interest in healthier and more transparent food options. As a result, citric acid is extensively employed to help meet the changing demands of both consumers and manufacturers within the dynamic landscape of the food and beverage industry.

Breakup by Form:

- Anhydrous

- Liquid

Anhydrous dominates the market

The report has provided a detailed breakup and analysis of the market based on the form. This includes anhydrous and liquid. According to the report, anhydrous represented the largest segment.

The escalating demand for anhydrous citric acid can be attributed to its unique properties that cater to the specific requirements of diverse industries. In the pharmaceutical sector, anhydrous citric acid's role in improving solubility and enhancing drug stability has led to its increased utilization in formulation development, aiding in market expansion. Concurrent with this, the absence of water molecules in anhydrous citric acid contributes to extended shelf life and enhanced stability in various applications, creating a favorable market outlook. Furthermore, industries such as cosmetics and personal care are incorporating anhydrous citric acid due to its effectiveness in adjusting pH levels and acting as a gentle exfoliant, promoting skin health, thereby bolstering the market growth. As the focus on product quality, efficacy, and sustainability intensifies across industries, anhydrous citric acid's versatile attributes align with these demands, driving its demand as a preferred ingredient in various formulations.

Breakup by Region:

- North India

- West and Central India

- South India

- East India

West and Central India exhibits a clear dominance, accounting for the largest India citric acid market growth

The report has also provided a comprehensive analysis of all the major regional markets, which include North, West and Central, South, and East India. According to the report, West and Central India represented the largest segment.

West and Central India are leading the India citric acid market due to several factors. The presence of a robust industrial base, particularly in states like Maharashtra and Gujarat, facilitates the production and consumption of citric acid, commonly used in food, pharmaceuticals, and cleaning products. The region's favorable government policies and well-established infrastructure support the growth of industries that utilize citric acid. Moreover, the high population density in these areas leads to increased consumer demand for processed foods and beverages, where citric acid is a key ingredient. The strategic location of these regions also enables easy access to both domestic and international markets, fostering trade opportunities.

Competitive Landscape:

The competitive landscape of the Indian citric acid market is distinguished by the existence of several key players and a blend of domestic and international manufacturers. Established multinational companies bring technological expertise and extensive distribution networks, allowing them to maintain substantial market shares. Simultaneously, domestic players leverage their understanding of local preferences and cost-effective production capabilities. The market exhibits intense rivalry driven by factors including product quality, pricing strategies, and innovation. Companies strive to differentiate themselves by offering a diverse portfolio of citric acid grades tailored to varying applications, from food and beverages to pharmaceuticals and personal care. As sustainability gains prominence, environmentally conscious practices and clean-label offerings are becoming pivotal in shaping competitive strategies and fostering consumer trust.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Latest news and Developments:

- July 2025: Chemrich Global expanded its international chemical operations by uniting U.S. and Indian facilities, with a focus on AI-integrated quality control and custom manufacturing for sectors including food, pharma, and cleaning. Citric acid (FCC grade) remains a top product, with Chemrich India (Mumbai, Gujarat) specializing in bulk-scale production and Chemrich USA (New Jersey, New York) offering regulatory-grade packaging and fast B2B fulfillment.

India Citric Acid Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | '000 Metric Tons |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Food And Beverages, Household Detergents and Cleaners, Pharmaceuticals, Others |

| Forms Covered | Anhydrous, Liquid |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India citric acid market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India citric acid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India citric acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The citric acid market in India reached a volume of 99,010 Tons in 2024.

The India citric acid market is projected to exhibit a CAGR of 4.40% during 2025-2033, reaching a volume of 1,48,750 Tons by 2033.

The market is driven by increasing requirements from the food and beverage industry, heightened awareness of health and nutritional benefits, and the expanding integration of vegetable oils in pharmaceutical formulations and cosmetic products. Citric acid’s role as a preservative, acidity regulator, and flavor enhancer boosts consumption. Additionally, industrial applications in cleaning agents and eco-friendly products contribute to sustained market growth.

Food and beverages dominate the India citric acid application, majorly propelled by the rising demand for packaged and processed foods, increased use as a flavoring and preserving agent, and growing consumer preference for clean-label and natural additives. Expanding beverage production and health-focused product innovations further support this segment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)