India Circuit Protection Devices Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Circuit Protection Devices Market Overview:

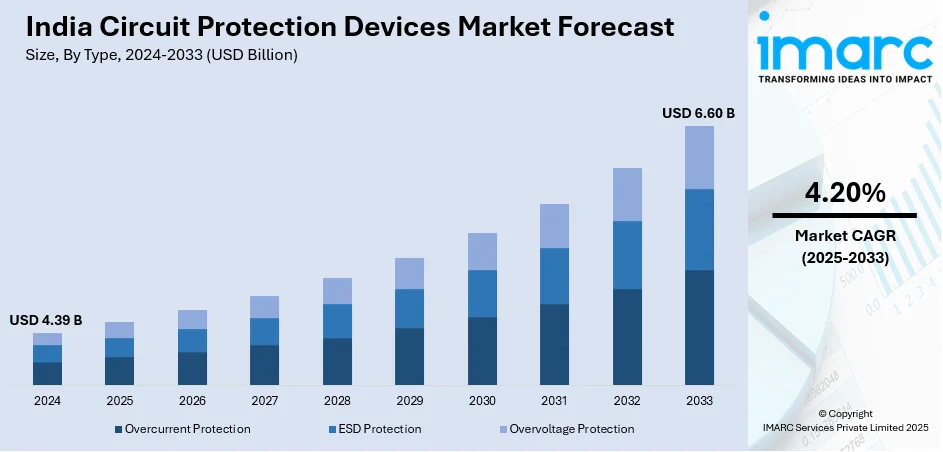

The India circuit protection devices market size reached USD 4.39 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.60 Billion by 2033, exhibiting a growth rate (CAGR) of 4.20% during 2025-2033. The market for circuit protection devices in India is growing, driven by improvements in electronic protection technology and a growing need for energy-efficient safety solutions. Moreover, improved electrical safety, less downtime, and dependable power management across industries are being fueled by growing industrial automation, the use of renewable energy, and digital monitoring systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.39 Billion |

| Market Forecast in 2033 | USD 6.60 Billion |

| Market Growth Rate (2025-2033) | 4.20% |

India Circuit Protection Devices Market Trends:

Advancements in Electronic Circuit Protection

The demand for advanced circuit protection devices is driven by the increasing complexity of electrical networks in the commercial, residential, and industrial sectors. Electronic protection solutions are taking the place of conventional mechanical components in power infrastructure as they get more advanced, guaranteeing improved safety, more efficiency, and quicker reaction times. Moreover, these developments meet the growing need for dependable electrical systems by reducing downtime and enhancing operational performance. In March 2024, Siemens introduced the SENTRON ECPD, an advanced electronic circuit protection device with ultra-fast switching technology. This innovation strengthens India’s circuit protection devices market by enhancing electrical safety, reducing maintenance costs, and improving efficiency in residential, commercial, and industrial power systems. The move to electronic circuit protection is revolutionizing the sector by combining automatic fault detection, digital monitoring, and self-healing capabilities. Also, these technologies lessen equipment damage and increase system longevity by drastically lowering short-circuit energy. The need for these devices, which guarantee reliable and secure power distribution, is growing as smart grids and renewable energy sources are used. Electronic circuit protection is becoming an essential part of contemporary electrical systems as companies and infrastructure projects grow, influencing the direction of power management in India.

To get more information on this market, Request Sample

Growing Demand for Energy-Efficient Safety Solutions

The increasing focus on energy efficiency and sustainability is reshaping the circuit protection devices market. Industries are seeking solutions that not only ensure safety but also contribute to optimized power consumption and reduced operational risks. As the demand for an uninterrupted power supply grows, advanced protection devices are evolving to integrate real-time monitoring, predictive maintenance, and smart energy management features. In October 2024, Schneider Electric introduced the MasterPacT MTZ Active circuit breaker in India, enhancing real-time energy monitoring and safety. This innovation strengthens India’s circuit protection devices market by improving energy efficiency, reducing operational risks, and supporting industries with advanced, reliable, and digitalized power management solutions. Energy-efficient circuit protection solutions are becoming crucial for power-intensive industries as automation and IoT-enabled infrastructure become more widely used. System dependability is increased and unscheduled downtime is decreased by the capacity to track consumption trends and proactively fix issues. These devices are also being adopted by industries more frequently in order to meet sustainability objectives and strict energy restrictions. In addition to enhancing protection, the incorporation of digital elements into circuit breakers facilitates smooth data-driven decision-making, which increases the need for energy-efficient safety solutions in India's expanding commercial and industrial environment.

India Circuit Protection Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Overcurrent Protection

- ESD Protection

- Overvoltage Protection

The report has provided a detailed breakup and analysis of the market based on the type. This includes overcurrent protection, ESD protection, and overvoltage protection.

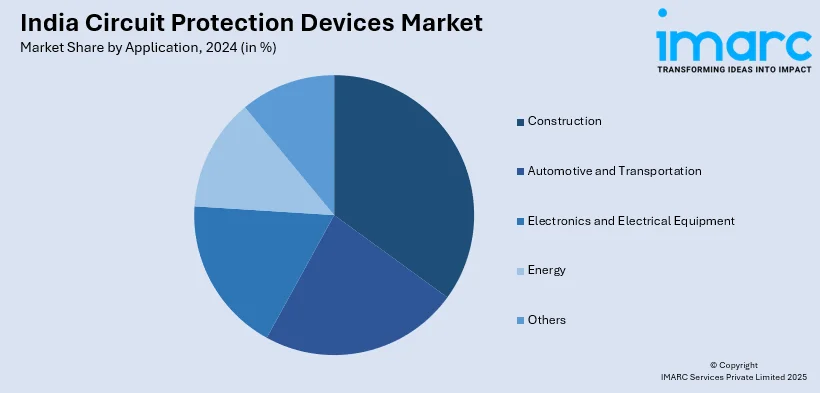

Application Insights:

- Construction

- Automotive and Transportation

- Electronics and Electrical Equipment

- Energy

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes construction, automotive and transportation, electronics and electrical equipment, energy, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Circuit Protection Devices Market News:

- February 2025: Lauritz Knudsen launched innovative circuit protection devices at ELECRAMA 2025, supporting India’s electrical infrastructure growth. This initiative strengthens the India circuit protection devices market by enhancing safety, reliability, and efficiency in power distribution, aligning with the Make-in-India initiative to boost local manufacturing and R&D.

- February 2025: ABB India introduced the LIORA modular switch range at ELECRAMA 2025, featuring integrated Miniature Circuit Breakers (MCBs) for enhanced safety. This development strengthens India’s circuit protection devices market by improving reliability, supporting smart infrastructure, and promoting locally manufactured, BIS-certified electrical solutions for diverse applications.

India Circuit Protection Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Overcurrent Protection, ESD Protection, Overvoltage Protection |

| Applications Covered | Construction, Automotive and Transportation, Electronics and Electrical Equipment, Energy, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India circuit protection devices market performed so far and how will it perform in the coming years?

- What is the breakup of the India circuit protection devices market on the basis of type?

- What is the breakup of the India circuit protection devices market on the basis of application?

- What are the various stages in the value chain of the India circuit protection devices market?

- What are the key driving factors and challenges in the India circuit protection devices market?

- What is the structure of the India circuit protection devices market and who are the key players?

- What is the degree of competition in the India circuit protection devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India circuit protection devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India circuit protection devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India circuit protection devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)