India Cigarette Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

India Cigarette Market Summary:

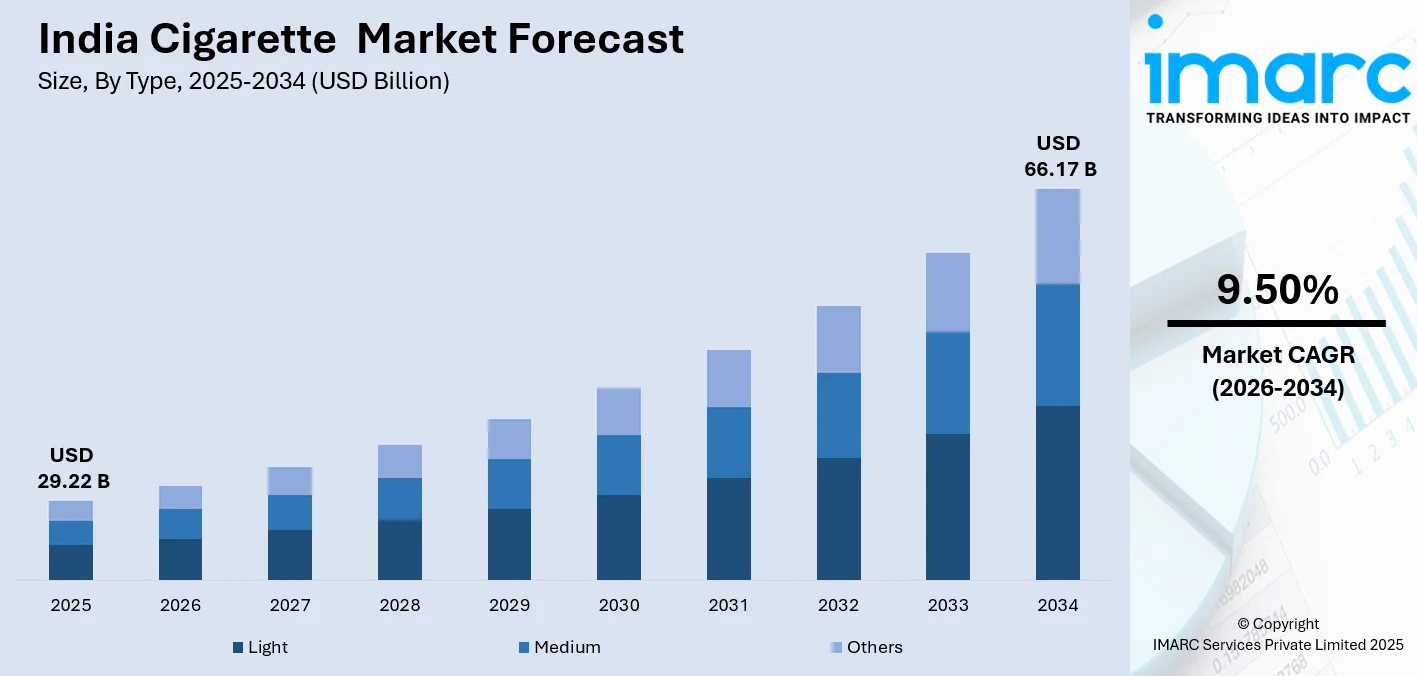

The India cigarette market size was valued at USD 29.22 Billion in 2025 and is projected to reach USD 66.17 Billion by 2034, growing at a compound annual growth rate of 9.50% from 2026-2034.

The Indian cigarette market is experiencing a boost due to increased disposable income, urbanization, and distribution channel expansion. The increased adult population base, demand for high-quality cigarettes and flavors, and high consumer loyalty are some of the factors driving the market. Despite some limitations such as restrictions on advertisements and health warning issues on the packs, innovation in products is increasing the demand for cigarettes. The trend for premium products is on the increase due to high demand for quality tobacco products from high-income groups.

Key Takeaways and Insights:

- By Type: Medium dominate the market with a share of 51% in 2025, driven by their balanced nicotine content that appeals to mainstream consumers seeking a satisfying smoking experience without the intensity of full-strength variants, making them the preferred choice across diverse demographic segments.

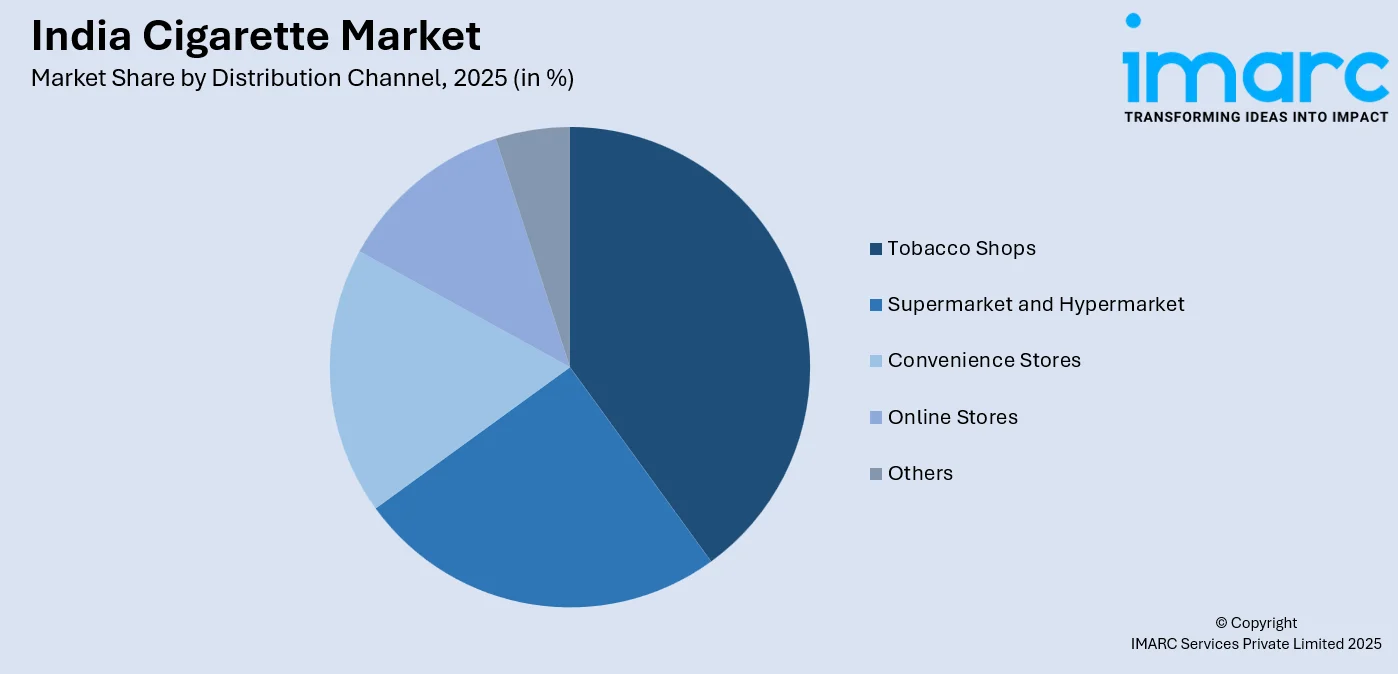

- By Distribution Channel: Tobacco shops lead the market with a share of 40% in 2025, attributed to their specialized product knowledge, extensive neighborhood presence, established customer relationships, and the traditional purchasing habits of Indian consumers who prefer dedicated tobacco retail outlets for their purchases.

- By Region: North India dominate the market with a share of 34% in 2025, supported by the region's large population base, higher urbanization rates in states like Delhi, Punjab, and Uttar Pradesh, greater disposable incomes, and well-developed retail distribution networks facilitating product accessibility.

- Key Players: The India cigarette market is highly competitive, with players focusing on brand differentiation, premium and flavored variants, extensive distribution networks, and product innovation. Strategies emphasize regional penetration, consumer loyalty, and adapting to evolving preferences and lifestyle trends. Some of the key players operating in the market include Elitecon International Limited, Godfrey Phillips India Ltd., Golden Tobacco Limited, ITC Limited, NTC Industries Ltd, and VST Industries Ltd.

To get more information on this market Request Sample

The India cigarette industry is a significant part of the country’s tobacco market, supported by well-established domestic manufacturers and an extensive retail network. Recently, ITC Ltd., the largest cigarette producer in India, experienced a sharp decline in its share value after the government implemented higher excise duties on cigarettes from February 1, 2026, highlighting regulatory pressures on major companies. Cigarettes, made from finely cut tobacco rolled in paper, are available in various sizes, strengths, and flavors to cater to diverse consumer preferences. The industry operates under strict regulations, including advertising restrictions, graphic health warnings, and heavy taxation. Despite these challenges, it remains resilient through strong brands, efficient supply chains, and adaptive marketing strategies. Rising interest in premium products, flavored options, and cultural trends continues to influence consumption across different regions and demographics.

India Cigarette Market Trends:

Growing Premiumization and Product Innovation

The India cigarette market is increasingly moving toward premiumization as consumers with rising disposable incomes seek higher-quality products. Manufacturers are introducing premium variants featuring superior tobacco blends, refined packaging, and enhanced smoking experiences. Innovation also spans diverse flavor profiles, advanced filter technologies, and varied packaging formats, catering to consumers willing to pay more for quality and unique experiences, while emphasizing brand prestige, limited editions, and lifestyle-oriented marketing to attract discerning smokers.

Expansion of Modern Retail Distribution Channels

While traditional tobacco shops continue to dominate, cigarette distribution is gradually shifting toward modern retail formats such as supermarkets, hypermarkets, and convenience stores. ITC has noted accelerated channel changes in 2025, highlighting the growing importance of modern trade, e‑commerce, and quick commerce, and is implementing tailored retail engagement programs to strengthen its presence in premium grocery outlets and digital platforms. These organized channels provide opportunities for greater brand visibility, controlled retail environments, and access to urban consumers with higher purchasing power, complementing traditional outlets to ensure broad market coverage and sustained product availability.

Regional Market Dynamics and Consumption Patterns

The Indian cigarette market shows distinct regional consumption patterns shaped by economic development, cultural influences, and local preferences. Urban areas exhibit higher per capita consumption and a stronger demand for premium brands, whereas semi‑urban and rural regions favor value-oriented products. In June 2025, global tobacco manufacturer KT&G entered India to tap into this diverse consumer base, illustrating how international players adapt strategies to local tastes and distribution networks. Manufacturers are customizing product portfolios and distribution approaches to address regional differences, ensuring effective market penetration across India’s varied geographic and demographic segments.

Market Outlook 2026-2034:

The Indian cigarette market is projected to continue its growth, which is fueled by the rising levels of affluence, urbanization, and shifting consumer behavior. There is a growing demand for premium segments, and the mainstream categories are relatively stable. Brands and portfolios are being developed, and the reach is expanded under the regulatory environments. New developments in reduced-harm offerings are also poised to occur, thanks to effective supply chains and retail collaboration, which ensure widespread reach through both urban and rural settings. The market generated a revenue of USD 29.22 Billion in 2025 and is projected to reach a revenue of USD 66.17 Billion by 2034, growing at a compound annual growth rate of 9.50% from 2026-2034.

India Cigarette Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Medium | 51% |

| Distribution Channel | Tobacco Shops | 40% |

| Region | North India | 34% |

Type Insights:

- Light

- Medium

- Others

The medium dominates with a market share of 51% of the total India cigarette market in 2025.

Medium cigarettes are more or less the mainstream segment catering to the bulk of the smoking population in the country because these offer a well-rounded smoking experience that is sought after by those neither preferring the lighter smoking experience that ‘light’ cigarettes offer or the more robust ‘strong’ ones. This segment has been aided by consumer acceptability in all demographic sections, as well as consumer preference for brands and pricing that is more suited for the mass market. Medium cigarettes meet the nicotine needs of the consumer and offer satisfying flavor, leading to brand affinity that has been developed over the years with the brands in the segment.

The dominance of medium-strength cigarettes demonstrates the consumption patterns of the mass number of smokers in the Indian market, who are accustomed to moderate-strength products that cater to their intake levels on a day-to-day basis. The demand for medium-strength products has led to the creation of an entire range of products from manufacturers to cater to the demands of the consumer who gets to choose from different price options without deviating from the medium-strength variant.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Tobacco Shops

- Supermarket and Hypermarket

- Convenience Stores

- Online Stores

- Others

The tobacco shops lead with a share of 40% of the total India cigarette market in 2025.

Tobacco shops remain the primary distribution channel for cigarettes in India, benefiting from deep neighborhood reach, specialized product knowledge, and strong relationships with regular customers. These outlets offer a wide range of tobacco products, allowing consumers convenient access to preferred brands and variants. In December 2025, Philip Morris India strengthened support for legal distribution networks by collaborating with enforcement agencies and engaging over 3,000 shops across 10 states to curb illicit cigarette trade and protect supply chain integrity. Traditional buying habits, with smokers purchasing cigarettes individually or in small quantities, align closely with the service model of neighborhood retailers.

The reach of cigarette shops, which is extensive across urban, semi-urban, and rural areas of India, ensures that the coverage of the market is complete; this has not yet been achieved by organized retail. The main advantages that the cigarette shops enjoy are low operating expenses, flexible timing, and the ability to build client relationships that guarantee repeat business. To the manufacturers, the cigarette shops offer a trusted distribution option with expertise that cannot be overlooked.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 34% share of the total India cigarette market in 2025.

North India dominates the cigarette industry because of its large population base in key states such as Uttar Pradesh, Delhi, Punjab, Haryana, and Rajasthan. Being an area of relatively higher urbanization, particularly in NCR, it contributes to driving sales of premium and branded cigarette categories. Higher disposable incomes in urban cities along with developed distribution channels guarantee adequate availability of products. Acceptance of cigarette smoking in social groups contributes to enhanced demand for cigarette sales.

The presence of large cities like Delhi in close vicinity fuels demand pockets that eventually attract the emphasis of manufacturers. North India has diverse consumers, ranging from different economic classes, thereby encouraging both premium and economy segments in the cigarette business. North India has been witnessing economic activity, developments in infrastructure, and expansion in the retail sector, which is a positive trend for growth in the market. Brand presence and awareness about popular brands of cigarettes make market development in this region easy.

Market Dynamics:

Growth Drivers:

Why is the India Cigarette Market Growing?

Rising Disposable Incomes and Expanding Middle Class

India’s economic growth is expanding the middle‑class population and increasing disposable incomes, driving higher spending on consumer products, including cigarettes. Rising affluence encourages consumers to move from value‑oriented to premium offerings, boosting market value beyond volume growth. In October 2025, ITC reported 6.7% year‑on‑year revenue growth in its cigarette segment, led by strong performance in differentiated and premium products, reflecting increased demand for higher‑end options. Urban consumers show willingness to pay for perceived quality, while economic development in tier‑two and tier‑three cities expands the market, creating new opportunities for manufacturers nationwide.

Rapid Urbanization and Lifestyle Changes

India’s urbanization is concentrating consumers in cities, boosting cigarette availability, brand exposure, and consumption. Urban lifestyles, social influences, and stress factors contribute to smoking among working populations. In 2025, Godfrey Phillips India saw its stock rise as it expanded the Marlboro brand in southern and other urban markets, highlighting strong demand in city centers. Modern retail infrastructure in cities improves product visibility and accessibility, while migration exposes consumers to branded products and organized outlets. Urban-rural consumption differences also drive premiumization, with city dwellers favoring higher-quality products and supporting market growth.

Extensive Distribution Networks and Product Accessibility

India’s extensive distribution network ensures widespread cigarette availability across the country’s diverse regions. In the Union Budget 2025–26, the government introduced a formal track-and-trace mechanism under the Central Goods and Services Tax Act to combat illicit trade and strengthen regulatory oversight, improving supply chain integrity. Manufacturers maintain robust logistics from metropolitan centers to rural areas, leveraging traditional tobacco shops, general trade outlets, and modern retail formats. Strong trade relationships, efficient inventory management, and reliable distribution support consistent product availability, sustain consumption, and create a competitive advantage for established players while posing barriers for new entrants.

Market Restraints:

What Challenges the India Cigarette Market is Facing?

Stringent Regulatory Environment and Taxation Burden

There is a tight regulation on marketing, advertising, and promotion in the Indian cigarette market, hence limiting brand-building exercises. High taxation, including GST, excise, and cesses, pushes up retail prices, which could have a bearing on consumption. Mandatory graphic health warnings shrink branding space, with evolving rules likely to herald further restrictions or tax increases. Compliance adds to operational complexity and costs as manufacturers will be surrounded by challenges while navigating the regulatory landscape.

Growing Health Awareness and Anti-Smoking Campaigns

Increased awareness of health problems related to tobacco consumption among the general public through the help of government and health activities is leading to a change in consumer behavior. Such education may reduce the recruitment of new smokers and increase quitting among current users. Changes in social attitudes, particularly among the youth and urban segments, combined with restrictions on smoking at workplaces and public places, will continue to make smoking less acceptable and might impact overall market volume.

Competition from Illicit Products and Alternative Tobacco Forms

A significant clandestine market for contraband cigarettes exists in the Indian marketplace due to the relatively lower pricing as opposed to taxing tobacco as in the case of legal products. These contraband and pirated cigarettes drive down the pricing structure in the legal marketplace and do not fall under any governmental regulation or tax system. Further, the conventional forms of tobacco such as bidis, along with “smokeless tobacco products,” compete with each other for consumer spending in the overall tobacco sector.

Competitive Landscape:

The India cigarette market is highly concentrated, with a few established domestic players dominating the market, with strong brand portfolios, wide-reaching distribution networks, and a long market presence. Major players would target premium segments, while the smaller competitors would aim at value propositions and regional segments. The competition is essentially based on brand equity, product quality, pricing, and distribution, per strict advertising and regulatory constraints. Restrictions to foreign investment prevent any international participation. Innovation would, hence, rest on packaging, product quality, and portfolio optimization, underpinned by strong trade relationships and efficient supply chains that keep competitiveness intact in this mature yet evolving market.

Some of the key players include:

- Elitecon International Limited

- Godfrey Phillips India Ltd.

- Golden Tobacco Limited

- ITC Limited

- NTC Industries Ltd

- VST Industries Ltd

Recent Developments:

- In January 2026, the Indian government made changes in the Central Excise (Amendment) Bill, 2025, introducing additional excise duty on cigarettes atop the 40% GST, replacing the earlier cess‑based system. The move is expected to significantly raise retail cigarette prices nationwide.

India Cigarette Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Light, Medium, Others |

| Distribution Channels Covered | Tobacco Shops, Supermarket and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Elitecon International Limited, Godfrey Phillips India Ltd., Golden Tobacco Limited, ITC Limited, NTC Industries Ltd, VST Industries Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India cigarette market size was valued at USD 29.22 Billion in 2025.

The India cigarette market is expected to grow at a compound annual growth rate of 9.50% from 2026-2034 to reach USD 66.17 Billion by 2034.

Medium cigarettes dominated the India cigarette market with a share of 51%, driven by their balanced nicotine content that appeals to mainstream consumers seeking satisfying smoking experiences across diverse demographic segments.

Key factors driving the India cigarette market include rising disposable incomes and expanding middle class, rapid urbanization and lifestyle changes, extensive distribution networks ensuring product accessibility, growing premiumization trends, strong brand loyalty among consumers, and social and cultural influences on smoking behavior.

Major challenges include stringent regulatory environment with comprehensive advertising restrictions, heavy taxation burden increasing retail prices, growing health awareness and anti-smoking campaigns, competition from illicit products and alternative tobacco forms, and evolving regulations that may introduce additional constraints on the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)