India Cigarette Lighter Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, and Region, 2026-2034

India Cigarette Lighter Market Summary:

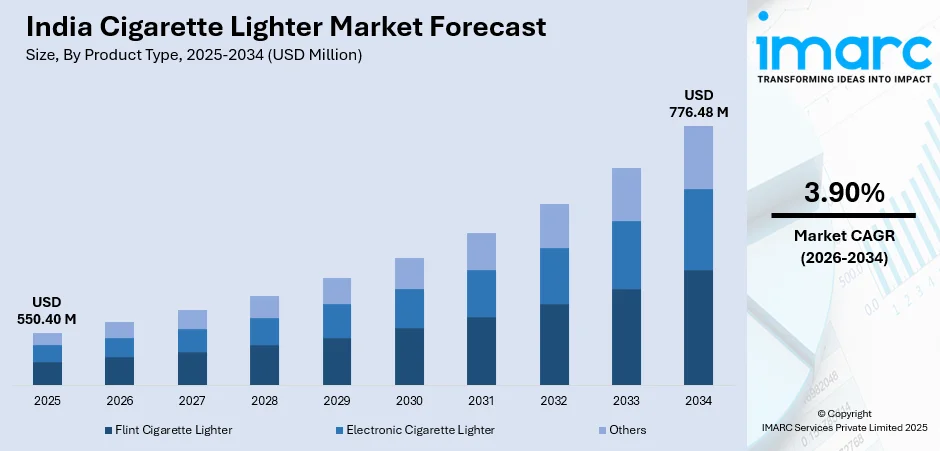

The India cigarette lighter market size was valued at USD 550.40 Million in 2025 and is projected to reach USD 776.48 Million by 2034, growing at a compound annual growth rate of 3.90% from 2026-2034.

The India cigarette lighter market is witnessing substantial expansion, driven by increasing urbanization, rising disposable incomes, and the growing preferences for convenient ignition solutions over traditional matchboxes. The shift towards portable and reliable flame-producing devices continues to strengthen market adoption across diverse consumer segments, supporting sustained demand for cigarette lighters throughout the country. Additionally, expanding retail availability through convenience stores is improving product accessibility, further accelerating market penetration across urban and semi-urban regions.

Key Takeaways and Insights:

- By Product Type: Flint cigarette lighter dominates the market with a share of 52% in 2025, owing to its reliability, affordability, and widespread consumer preference for traditional ignition mechanisms. The simple mechanical design and consistent performance continue to drive market acceptance across urban and rural areas.

- By Material Type: Plastic leads the market with a share of 60% in 2025. This dominance is driven by cost-effectiveness, lightweight properties, and versatile design options that appeal to price-sensitive consumers seeking convenient and disposable ignition solutions.

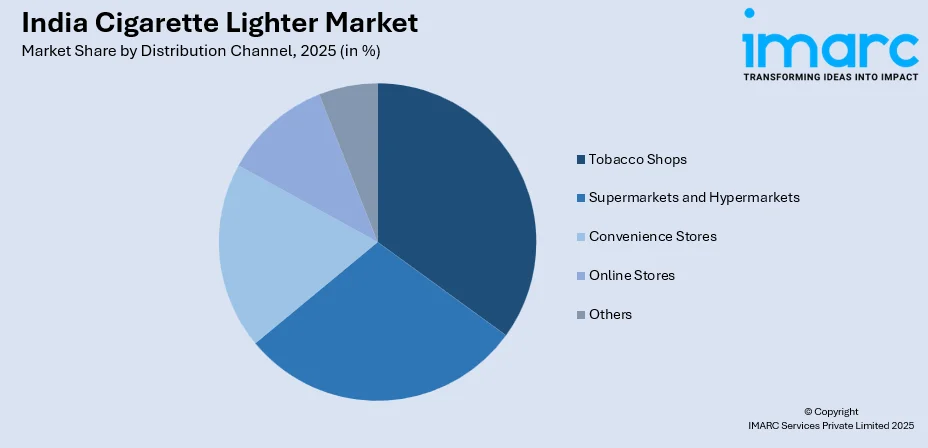

- By Distribution Channel: Tobacco shops comprise the largest segment with a market share of 35% in 2025, reflecting the strong integration of cigarette lighters with tobacco product retailing and the consumer preference for purchasing ignition tools alongside smoking materials.

- By Region: North India represents the largest region with 28% share in 2025, driven by the high population density in Delhi-NCR metropolitan areas, robust retail infrastructure, and elevated disposable incomes, enabling consistent consumer demand.

- Key Players: Key players drive the India cigarette lighter market by expanding product portfolios, enhancing safety features, and strengthening nationwide distribution networks. Their investments in design innovations, affordability strategies, and partnerships with retail channels boost brand awareness, accelerate consumer adoption, and ensure consistent product availability across diverse market segments.

To get more information on this market Request Sample

The India cigarette lighter market is advancing, as manufacturers continuously introduce innovative product variants, ranging from traditional flint lighters to battery-powered electronic lighters that ignite at the push of a button. In 2024, the total count of smokers in India was about 100.2 Million people, reflecting a rise from 80,481,112 in 2020. This represents a substantial consumer base driving consistent demand for ignition products. The market expansion is further supported by the rising popularity of pocket lighters as fashion accessories and gifting items, particularly among younger demographics seeking stylish and personalized designs. Technological advancements, incorporating features, such as digital displays, adjustable flame power, and enhanced safety mechanisms, are attracting tech-savvy consumers and expanding product applications beyond traditional smoking purposes. The increasing penetration of organized retail channels, including supermarkets and hypermarkets, alongside the rapid growth of e-commerce platforms, is broadening product accessibility across urban and semi-urban areas.

India Cigarette Lighter Market Trends:

Rising Adoption of Electronic and Rechargeable Lighters

The India cigarette lighter market is witnessing a significant shift towards electronic and universal serial bus (USB)-rechargeable lighters, as consumers increasingly seek sustainable and eco-friendly alternatives. These flameless devices utilize plasma arc technology, offering windproof performance and eliminating the need for butane refills. The growing environmental consciousness among urban consumers, combined with convenience features, such as light-emitting diode (LED) battery indicators and fast charging capabilities, is accelerating the adoption of rechargeable lighters across metropolitan areas and expanding the market growth trajectory.

Premiumization and Fashion-Forward Lighter Designs

Consumer preferences are evolving beyond functionality towards lighters that serve as lifestyle accessories and collectible items. Manufacturers are introducing premium windproof lighters with customized engravings, limited-edition designs, and distinctive artistic finishes that appeal to collectors and fashion-conscious consumers. The positioning of pocket lighters as gifting products, particularly during festive seasons, is driving demand for aesthetically appealing variants. This premiumization trend is enabling brands to command higher price points while attracting affluent consumers seeking distinctive personal accessories.

Government Support for Indigenous Manufacturing

The regulatory landscape is increasingly favoring domestic production capabilities, as the government implements import restrictions and quality standards to support indigenous manufacturing. The mandatory Bureau of Indian Standards certification requirements for flame-producing lighters are enhancing product safety while protecting domestic manufacturers from substandard imports. These policy measures are encouraging investments in local production facilities, strengthening supply chain resilience, and creating employment opportunities within the cigarette lighter manufacturing sector across the country.

Market Outlook 2026-2034:

The India cigarette lighter market demonstrates promising growth prospects, driven by demographic advantages, increasing consumer spending power, and expanding retail infrastructure. The market generated a revenue of USD 550.40 Million in 2025 and is projected to reach a revenue of USD 776.48 Million by 2034, growing at a compound annual growth rate of 3.90% from 2026-2034. Rising urbanization rates, increasing penetration of modern retail formats, and growing consumer preference for convenient ignition solutions over traditional matchboxes are strengthening market fundamentals. The expansion of e-commerce channels is broadening product accessibility, while manufacturer investments in product innovation, safety features, and design diversification are attracting diverse consumer segments.

India Cigarette Lighter Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Flint Cigarette Lighter |

52% |

|

Material Type |

Plastic |

60% |

|

Distribution Channel |

Tobacco Shops |

35% |

|

Region |

North India |

28% |

Product Type Insights:

- Flint Cigarette Lighter

- Electronic Cigarette Lighter

- Others

Flint cigarette lighter dominates with a market share of 52% of the total India cigarette lighter market in 2025.

Flint cigarette lighter maintains its dominant market position due to its proven reliability, mechanical simplicity, and consistent performance across diverse environmental conditions. It appeals to a broad consumer base seeking dependable flame production without battery requirements or electronic components, making it particularly popular in rural and semi-urban areas where simplicity and durability are prioritized over advanced features. Its ability to function effectively without dependence on electricity or charging infrastructure further strengthens its appeal in everyday use.

The affordability of flint lighters enables widespread accessibility across all income segments, supporting their leading market position. The tactile satisfaction of the flint wheel mechanism, combined with the nostalgic appeal of traditional lighter designs, continues to attract consumers who value classic functionality. Manufacturers are introducing flint lighters in diverse colors, patterns, and decorative finishes to appeal to fashion-conscious consumers while maintaining the core mechanical reliability that defines this product category across the India cigarette lighter market.

Material Type Insights:

- Metal

- Plastic

- Others

Plastic leads with a share of 60% of the total India cigarette lighter market in 2025.

Plastic dominates the material segment owing to its exceptional cost-effectiveness, lightweight properties, and versatile design capabilities that enable mass production at competitive price points. Manufactured using polycarbonate or polypropylene materials, plastic cigarette lighters offer affordable ignition solutions that appeal to price-sensitive consumers across urban and rural markets, enabling broad market penetration across all demographic segments. Their low transportation and storage costs further support widespread distribution through both organized and unorganized retail channels.

The ease of manufacturing plastic lighters in vibrant colors and diverse design patterns enhances their appeal among younger consumers seeking personalized accessories. The disposable nature of plastic lighters aligns with consumer preferences for convenience and hassle-free replacement without maintenance requirements. Advancements in plastic manufacturing technologies have improved product durability and safety features while maintaining affordability, strengthening the competitive positioning of plastic lighters within the India cigarette lighter market.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Tobacco Shops

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Tobacco shops exhibit a clear dominance with a 35% share of the total India cigarette lighter market in 2025.

Tobacco shops maintain their leading distribution position due to the natural product synergy between cigarette lighters and smoking materials, enabling convenient one-stop purchasing experiences for consumers. The extensive network of kirana stores and paan shops across urban and rural areas ensures widespread product availability, supporting consistent consumer access to cigarette lighters throughout the country. Low price points and quick transactions further suit the fast-moving retail environment of these outlets.

The impulse purchase nature of cigarette lighters at tobacco retail points drives sales volumes, as consumers frequently purchase lighters alongside their regular tobacco products. The trusted relationship between consumers and local tobacco retailers enhances brand loyalty and repeat purchases. Tobacco shops benefit from their strategic locations in high-traffic areas, ensuring maximum consumer visibility and accessibility for cigarette lighter products within the market. This channel also allows easy introduction of new designs and variants directly at the point of sale.

Regional Insights:

- North India

- West and Central India

- East India

- South India

North India represents the leading region with a 28% share of the total India cigarette lighter market in 2025.

North India dominates the regional market due to its substantial population concentration, advanced retail infrastructure, and elevated consumer spending power across Delhi-NCR and surrounding urban centers. The high urbanization rates and dense retail networks in states, including Delhi, Uttar Pradesh, Haryana, and Punjab, support robust product distribution and consistent consumer demand for cigarette lighters. In 2025, the population of the Delhi metro area reached 34,666,000, reflecting a 2.54% rise from 2024.

The region benefits from well-developed transportation corridors and logistics infrastructure that enable efficient product distribution across urban and semi-urban markets. Rising disposable incomes among the expanding middle-class population in North India strengthen purchasing power for both value-oriented and premium lighter products. The concentration of modern retail formats, including shopping malls and hypermarkets, alongside traditional tobacco shops and kirana stores, provides diverse distribution channels supporting sustained market growth throughout North India.

Market Dynamics:

Growth Drivers:

Why is the India Cigarette Lighter Market Growing?

Expanding Smoker Population and Shifting Consumer Preferences

The India cigarette lighter market is experiencing sustained growth, driven by the expanding population of cigarette smokers and the gradual shift in consumer preferences from traditional matchboxes towards portable and convenient ignition solutions. The increasing urbanization across metropolitan areas is exposing consumers to modern lifestyle products, including premium and electronic cigarette lighters that offer enhanced functionality and design aesthetics. Rising disposable incomes, particularly among the growing middle-class population, are enabling consumers to invest in higher-quality ignition products beyond basic disposable options. India's per capita disposable income was expected to hit INR 2.14 Lakh in 2023-24. The cultural acceptance of smoking in various social settings continues to support baseline demand for cigarette lighters across diverse demographic segments. Younger consumers are increasingly viewing lighters as fashion accessories and personal statement items, driving demand for stylish and customized variants. The convenience factor of pocket lighters, offering reliable flame production without the hassle of matchbox storage and disposal, appeals to consumers seeking practical everyday solutions.

Expanding Retail Infrastructure and Distribution Networks

The growth in organized retailing formats and distribution networks is greatly enhancing product reach in India. The spread of supermarkets, hypermarkets, and convenience stores in cities and semi-urban regions is providing additional touch points for consumer interaction, apart from exclusive tobacco product retailing outlets. The presence of kirana stores, along with other retailers, ensures full coverage in both large cities and smaller towns, thus ensuring countrywide product availability. E-commerce is emerging as a new distribution model, especially for highly techno-conscious city buyers, who are increasingly getting accustomed to online shopping methods. As per IMARC Group, the India e-commerce market size was valued at USD 129.72 Billion in 2025. The key retail chain companies are providing a dedicated shelf for high-end and electronic models of cigarette lighters, thus greatly enhancing their visibility for impulse buying purposes. The inclusion of cigarette lighters in point-of-sale (POS) stands at checkout counters increases their consumer visibility for incremental sales. The collaboration between key manufacturers and retail companies is improving distribution networks while also ensuring regular filling of products within highly popular retail outlets.

Product Innovation and Technological Advancements

Continuous product innovations and technological advancements are creating new growth opportunities within the India cigarette lighter market by expanding product applications and attracting new consumer segments. Manufacturers are introducing electronic cigarette lighters, featuring USB charging capabilities, plasma arc technology, and windproof designs that appeal to environmentally conscious consumers seeking sustainable alternatives to disposable options. The integration of safety features, including child-resistant mechanisms, automatic shut-off functions, and overheat protection, is addressing consumer concerns while meeting regulatory requirements. Advanced design capabilities enable manufacturers to produce lighters in diverse shapes, colors, and materials that appeal to different consumer preferences and lifestyle orientations. The development of multi-purpose lighters suitable for outdoor activities, kitchen applications, and emergency preparedness is broadening the addressable market beyond traditional smoking use cases. Premium brands are incorporating innovative features such as LED flashlights, built-in bottle openers, and decorative elements that enhance product value propositions. These technological improvements are commanding higher price points while differentiating manufacturers in an increasingly competitive marketplace.

Market Restraints:

Regulatory Pressures and Anti-Smoking Campaigns

The India cigarette lighter market faces significant restraints from increasing government regulatory measures and public health campaigns aimed at reducing tobacco consumption. The implementation of graphic health warnings on tobacco products, public smoking bans, and aggressive taxation policies is discouraging smoking initiation while encouraging cessation among existing smokers. Health awareness initiatives targeting young populations are influencing attitudes towards smoking, potentially constraining future demand growth for cigarette lighters.

Competition from Alternative Ignition Sources

The market encounters competitive pressure from traditional matchbox manufacturers and alternative ignition solutions that continue to serve significant consumer segments, particularly in rural and price-sensitive markets. The deeply entrenched matchbox industry benefits from established distribution networks and cultural preferences in certain regions. Additionally, the ultra-low cost of matchboxes and their familiarity among older consumers limit the pace of lighter adoption in these segments, intensifying competitive pressure on the market.

Quality Concerns and Counterfeit Products

The proliferation of substandard and counterfeit cigarette lighters poses challenges for legitimate manufacturers and creates consumer safety concerns that can damage overall market perception. Low-quality imports failing to meet safety standards risk product failures and potential hazards that undermine consumer confidence. The difficulty in distinguishing authentic branded products from counterfeits complicates consumer purchasing decisions and erodes brand value for established manufacturers operating in the market.

Competitive Landscape:

The India cigarette lighter market exhibits a competitive landscape, characterized by the presence of both international brands and domestic manufacturers competing across multiple product segments and price points. Market participants are focusing on product differentiation through design innovations, safety feature integration, and brand building to strengthen competitive positioning. Companies are expanding distribution partnerships with organized retail chains and e-commerce platforms to enhance market reach and consumer accessibility. Strategic investments in manufacturing capabilities are enabling players to optimize production costs while maintaining quality standards. Marketing initiatives leveraging social media engagement and influencer partnerships are attracting younger consumer demographics.

India Cigarette Lighter Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

|

Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Flint cigarette lighter, Electronic cigarette lighter, Others |

| Material Types Covered | Metal, Plastic, Others |

| Distribution Channels Covered | Tobacco shops, Supermarkets and hypermarkets, Convenience stores, Online Stores, Others |

| Regions Covered | North India, West and Central India, South India,East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India cigarette lighter market size was valued at USD 550.40 Million in 2025.

The India cigarette lighter market is expected to grow at a compound annual growth rate of 3.90% from 2026-2034 to reach USD 776.48 Million by 2034.

Flint cigarette lighter dominated the market with a share of 52%, driven by its proven reliability, mechanical simplicity, and affordability that appeals to a broad consumer base across urban and rural markets.

Key factors driving the India cigarette lighter market include expanding smoker population, rising urbanization, increasing disposable incomes, expanding retail infrastructure, product innovations, and the growing consumer preferences for convenient ignition solutions.

Major challenges include regulatory pressures from anti-smoking campaigns, competition from traditional matchbox manufacturers, quality concerns regarding counterfeit products, import restrictions affecting supply chains, and evolving consumer health awareness impacting tobacco-related product demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)