India Chromatography Instruments Market Size, Share, Trends and Forecast by Type, Consumable and Accessory, End Use Industry, and Region, 2025-2033

India Chromatography Instruments Market Overview:

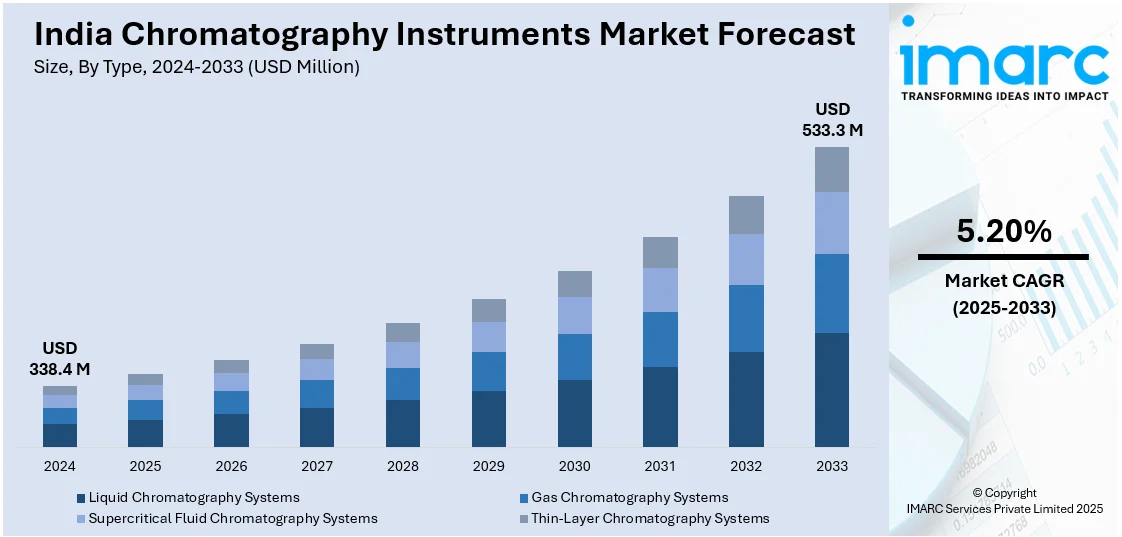

The India chromatography instruments market size reached USD 338.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 533.3 Million by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is growing due to the rising demand in pharmaceuticals, biotechnology, and food safety. Additionally, increasing regulatory compliance and technological advancements in high-performance liquid and gas chromatography systems are enhancing precision, efficiency, and analytical capabilities across research, diagnostics, and industrial applications, thereby significantly impacting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 338.4 Million |

| Market Forecast in 2033 | USD 533.3 Million |

| Market Growth Rate 2025-2033 | 5.20% |

India Chromatography Instruments Market Trends:

Rising Demand for High-Performance Liquid Chromatography (HPLC) in Pharmaceuticals

India’s chromatography instruments market is witnessing strong growth due to the increasing adoption of High-Performance Liquid Chromatography (HPLC) in the pharmaceutical and biotechnology industries. As India remains a global leader in generic drug production and vaccine manufacturing, the need for high-precision analytical techniques is expanding. For instance, as per industry reports, in 2023, India produced approximately four Billion vaccine doses, accounting for 50% of the global supply of eight Billion doses. HPLC finds extensive applications in drug quality control, impurity profiling, and active pharmaceutical ingredient (API) analysis to maintain regulatory compliance with USFDA, EMA, and CDSCO standards. Increasing emphasis on biosimilars, biologics, and complex drug formulations is also enhancing the demand for sophisticated HPLC systems with increased sensitivity and automation capabilities. Moreover, drug makers are spending on next-generation HPLC systems with improved data analytics, which will facilitate more effective drug development and stability testing. The growing regulatory pressure on drug safety and efficacy is compelling research labs and contract research organizations (CROs) to upgrade their analytical instrumentation infrastructure. Furthermore, with increasing pharma exports and quality control measures, the adoption of HPLC is likely to expand, thus becoming one of India's chromatography instruments market drivers.

To get more information on this market, Request Sample

Growing Adoption of Gas Chromatography in Environmental and Food Safety Testing

The increasing focus on environmental monitoring and food safety regulations is driving the adoption of gas chromatography (GC) systems in India. Gas chromatography is widely used for analyzing volatile organic compounds (VOCs), contaminants in air and water, and chemical residues in food products, making it an essential tool in regulatory testing. Moreover, with India’s expanding food processing industry and rising exports, food safety testing requirements are becoming more stringent, leading to increased demand for high-throughput GC instruments with improved accuracy and automation. For instance, according to the IMARC Group, the India food processing market is projected to reach INR 65,244.8 Billion by 2033. Additionally, regulatory bodies such as the Food Safety and Standards Authority of India (FSSAI) and the Central Pollution Control Board (CPCB) are enforcing stricter quality control measures, prompting laboratories to upgrade to sensitive and efficient chromatographic systems. As concerns over industrial emissions, water pollution, and food adulteration rise, gas chromatography is expected to play a crucial role in ensuring compliance and consumer safety.

India Chromatography Instruments Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, consumable and accessory, and end use industry.

Type Insights:

- Liquid Chromatography Systems

- Gas Chromatography Systems

- Supercritical Fluid Chromatography Systems

- Thin-Layer Chromatography Systems

The report has provided a detailed breakup and analysis of the market based on the type. This includes liquid chromatography systems, gas chromatography systems, supercritical fluid chromatography systems, and thin-layer chromatography systems.

Consumable and Accessory Insights:

- Columns

- Column Accessories and Consumables

- Autosamplers

- Autosampler Accessories and Consumables

- Flow Management Accessories and Consumables

- Others

A detailed breakup and analysis of the market based on the consumable and accessory have also been provided in the report. This includes columns, column accessories and consumables, autosamplers, autosampler accessories and consumables, flow management accessories and consumables, and others.

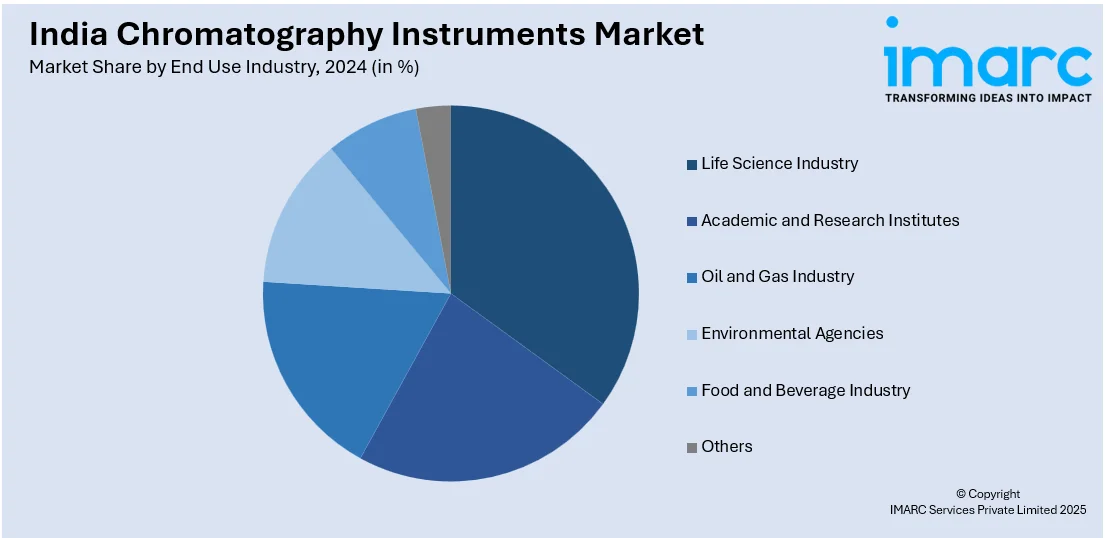

End Use Industry Insights:

- Life Science Industry

- Academic and Research Institutes

- Oil and Gas Industry

- Environmental Agencies

- Food and Beverage Industry

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes life science industry, academic and research institutes, oil and gas industry, environmental agencies, food and beverage industry, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Chromatography Instruments Market News:

- In January 2025, Shimadzu Corporation announced plans to establish Shimadzu Manufacturing India Private Limited (SMI) in Karnataka by 2027 to strengthen operations. SMI will manufacture Liquid Chromatograph (LC), Gas Chromatograph (GC), Ultraviolet-Visible Spectrophotometer (UV-VIS), Liquid Chromatograph-Mass Spectrometer (LC-MS), and Gas Chromatograph-Mass Spectrometer (GC-MS) systems. This expansion aims to enhance the supply chain while supporting India's "Make in India" initiative.

India Chromatography Instruments Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liquid Chromatography Systems, Gas Chromatography Systems, Supercritical Fluid Chromatography Systems, Thin-Layer Chromatography Systems |

| Consumable and Accessories Covered | Columns, Column Accessories and Consumables, Autosamplers, Autosampler Accessories and Consumables, Flow Management Accessories and Consumables, Others |

| End Use Industries Covered | Life Science Industry, Academic and Research Institutes, Oil and Gas Industry, Environmental Agencies, Food and Beverage Industry, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India chromatography instruments market performed so far and how will it perform in the coming years?

- What is the breakup of the India chromatography instruments market on the basis of type?

- What is the breakup of the India chromatography instruments market on the basis of consumable and accessory?

- What is the breakup of the India chromatography instruments market on the basis of end use industry?

- What is the breakup of the India chromatography instruments market on the basis of region?

- What are the various stages in the value chain of the India chromatography instruments market?

- What are the key driving factors and challenges in the India chromatography instruments market?

- What is the structure of the India chromatography instruments market and who are the key players?

- What is the degree of competition in the India chromatography instruments market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India chromatography instruments market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India chromatography instruments market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India chromatography instruments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)