India Chloromethane Market Size, Share, Trends and Forecast by Type, Application, End-Use Industry, and Region, 2025-2033

India Chloromethane Market Overview:

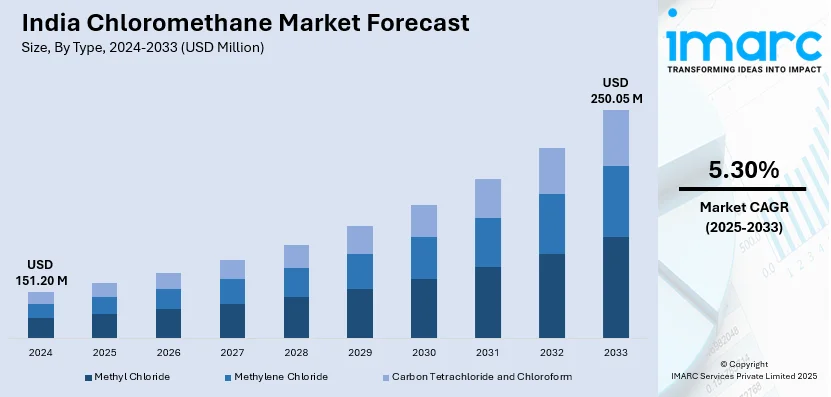

The India chloromethane market size reached USD 151.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 250.05 Million by 2033, exhibiting a growth rate (CAGR) of 5.30% during 2025-2033. The growing demand for herbicides, fungicides, and pesticides owing to the dependence of the country on agriculture, along with the increasing use of chloromethane as an essential raw material in the production of active pharmaceutical ingredients (APIs) and intermediates is bolstering the market growth in India.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 151.20 Million |

| Market Forecast in 2033 | USD 250.05 Million |

| Market Growth Rate 2025-2033 | 5.30% |

India Chloromethane Market Trends:

Increasing Demand in Pharmaceuticals Industry

The pharmaceuticals industry significantly influences the India chloromethane market because it serves as an essential raw material in the production of active pharmaceutical ingredients (APIs) and intermediates. According to the data provided by the Ministry of Chemicals and Fertilizers in 2024, India's pharmaceutical industry for FY 2023-24 was estimated at USD 50 billion, with domestic use accounting for USD 23.5 billion and exports reaching USD 26.5 billion. India’s pharmaceutical sector ranked as the third largest globally by volume and 14th for the value of its production, the industry's swift growth is driving the need for key solvents like chloromethane for drug synthesis and formulation. An increase in chronic illnesses and the rising preference for affordable generic medications are catalyzing the demand for APIs, heightening the necessity for chloromethanes in synthesis and purification. Moreover, strict regulations regarding solvent recovery and eco-friendly manufacturing methods are encouraging pharmaceutical firms to implement innovative chloromethane management and recycling technologies, guaranteeing adherence to environmental standards. As exports increase and local demand grows, India's pharmaceutical industry continues to be a major buyer of chloromethanes, fueling market growth and encouraging producers to enhance capacity and improve processes.

To get more information on this market, Request Sample

Growing Usage in the Agrochemical Sector

The chloromethane market in India is being propelled by the agrochemical sector, as the demand for herbicides, fungicides, and pesticides rises owing to the nation's dependence on agriculture. Chloromethanes act as intermediates in the production of different crop protection chemicals, promoting high productivity and resistance to pests and diseases. The growth of cultivated agricultural land, along with the demand for improved crop production, is leading to higher use of agrochemicals, which in turn affects the demand for chloromethane. As per the data published by the India Brand Equity Foundation (IBEF) in 2024, the Indian agrochemicals industry is projected to grow notably at a compound annual growth rate (CAGR) of 9% from FY25 to FY28, emphasizing the sector’s fast expansion and rising demand for crucial raw materials. Furthermore, government efforts to encourage contemporary farming methods and decrease post-harvest waste are facilitating the adoption of sophisticated agrochemicals, which heightens reliance on chloromethane-based products. The drive for sustainable and environment-friendly options is encouraging investigations into effective chloromethane derivatives that comply with ecological safety regulations. As India maintains its status as a top global exporter of agrochemicals, the local chloromethane sector gains from increasing international trade, bolstering consistent market expansion and enhancing production capacity investments.

India Chloromethane Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, application, and end-use industry.

Type Insights:

- Methyl Chloride

- Methylene Chloride

- Carbon Tetrachloride and Chloroform

The report has provided a detailed breakup and analysis of the market based on the type. This includes methyl chloride, methylene chloride, and carbon tetrachloride and chloroform.

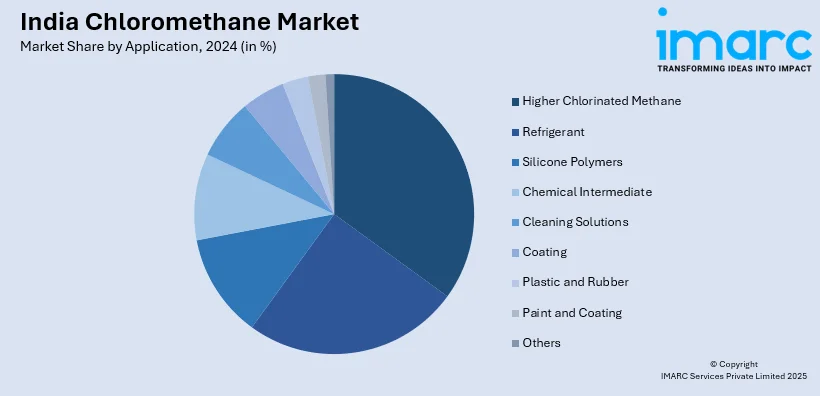

Application Insights:

- Higher Chlorinated Methane

- Refrigerant

- Silicone Polymers

- Chemical Intermediate

- Cleaning Solutions

- Coating

- Plastic and Rubber

- Paint and Coating

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes higher chlorinated methane, refrigerant, silicone polymers, chemical intermediate, cleaning solutions, coating, plastic and rubber, paint and coating, and others.

End-Use Industry Insights:

- Transportation

- Personal Care and Cosmetic

- Building and Construction

- Chemical and Pharmaceutical

- Agriculture Industry

- Textile Industry

- Water Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes transportation, personal care and cosmetic, building and construction, chemical and pharmaceutical, agriculture industry, textile industry, water treatment, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Chloromethane Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Methyl Chloride, Methylene Chloride, Carbon Tetrachloride and Chloroform |

| Applications Covered | Higher Chlorinated Methane, Refrigerant, Silicone Polymers, Chemical Intermediate, Cleaning Solutions, Coating, Plastic and Rubber, Paint and Coating, Others |

| End-Use Industries Covered | Transportation, Personal Care and Cosmetic, Building and Construction, Chemical and Pharmaceutical, Agriculture Industry, Textile Industry, Water Treatment, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India chloromethane market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India chloromethane market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India chloromethane industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India chloromethane market was valued at USD 151.20 Million in 2024.

The India chloromethane market is projected to exhibit a CAGR of 5.30% during 2025-2033, reaching a value of USD 250.05 Million by 2033.

The India chloromethane market is driven by strong demand from pharmaceutical, agrochemical, and silicone sectors that use it in synthesis and production. Expansion in chemical manufacturing, rising infrastructure and electronics development, and an industry shift toward greener, more sustainable production methods further bolster the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)