India Chlor Alkali Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

India Chlor Alkali Market Overview:

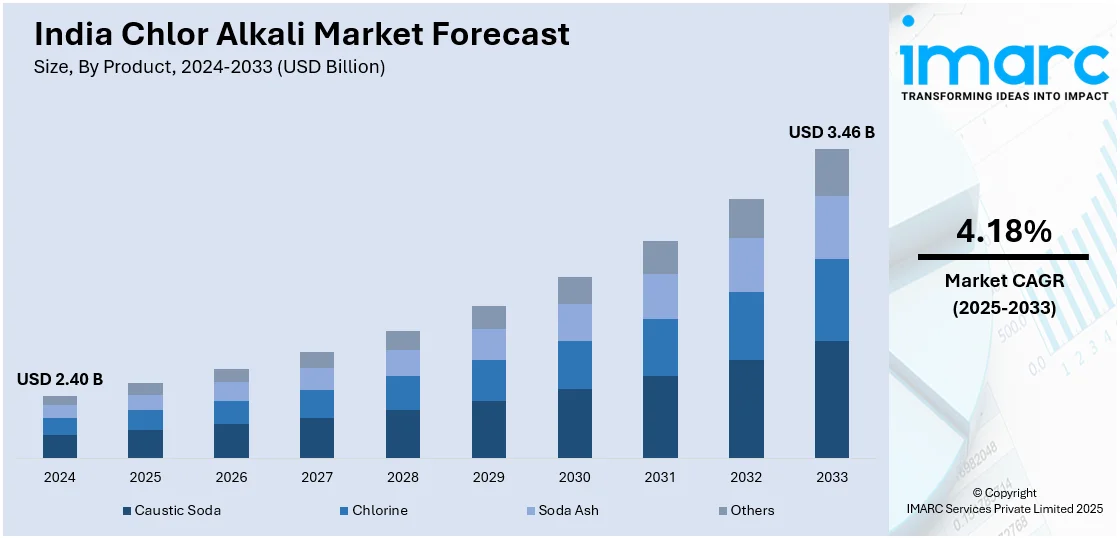

The India chlor alkali market size reached USD 2.40 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.46 Billion by 2033, exhibiting a growth rate (CAGR) of 4.18% during 2025-2033. The market is driven by increasing demand from various industries, such as textiles, chemicals, and water treatment. Furthermore, the expanding number of construction and infrastructure projects is fueling caustic soda consumption and the rising requirement for polyvinyl chloride (PVC) is bolstering chlorine demand. In addition to this, the launch of favorable government initiatives supporting industrial expansion, rising urbanization, and advancements in energy-efficient production technologies are further catalyzing the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.40 Billion |

| Market Forecast in 2033 | USD 3.46 Billion |

| Market Growth Rate 2025-2033 | 4.18% |

India Chlor Alkali Market Trends:

Increasing Demand for Water Treatment Owing To Growing Population

The escalating concerns regarding water pollution and scarcity in India have sharply increased the demand for chlor alkali products, particularly chlorine and caustic soda, which are essential for water purification and wastewater treatment. Various favorable government initiatives, such as the Jal Jeevan Mission, aim to supply clean drinking water to rural households, further driving the utilization of chlorine-based disinfection solutions. The Jal Jeevan Mission, in particular, aims to provide safe and reliable piped water to every rural household by 2024, and as of a 2022 functionality assessment, 86% of households had operational tap connections. Moreover, despite housing 18% of the global population, India possesses only 4% of the world's water resources, making water scarcity a pressing issue and amplifying the reliance on chlorine-based treatment methods. Furthermore, the country's urban population is predicted to grow to 600 million by 2030, which would increase the demand for chlor alkali chemicals, as municipal water treatment infrastructures expand. Water-soluble polymers, such as polyacrylamide, play a crucial role in processes like coagulation and flocculation, effectively removing contaminants and enhancing water quality. As a result, leading businesses, such as Tata Chemicals and Gujarat Alkalies and Chemicals Ltd. (GACL), are responding by increasing their outputs to keep up with the growing product demand.

To get more information on this market, Request Sample

Rapid Growth in PVC and Alumina Production

India is witnessing a significant rise in the demand for chlorine and caustic soda, driven primarily by the expansion of PVC and alumina production. PVC is extensively utilized in construction, agriculture, and infrastructure, especially for pipes, cables, and fittings. With government initiatives such as “Housing for All” and infrastructure modernization, domestic PVC manufacturing is growing, consequently increasing chlorine consumption – an essential raw material in PVC production. Similarly, alumina refining, vital for the aluminum industry, consumes large quantities of caustic soda. India’s alumina production is expanding to meet rising domestic and export demand for aluminum, particularly in sectors like transportation, packaging, and renewable energy. As a result, caustic soda consumption has surged across major alumina-producing states, such as Odisha and Andhra Pradesh. Furthermore, the growing focus on self-reliance and import substitution in both PVC and aluminum sectors is likely to sustain this trend.

India Chlor Alkali Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Caustic Soda

- Chlorine

- Soda Ash

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes caustic soda, chlorine, soda ash, and others.

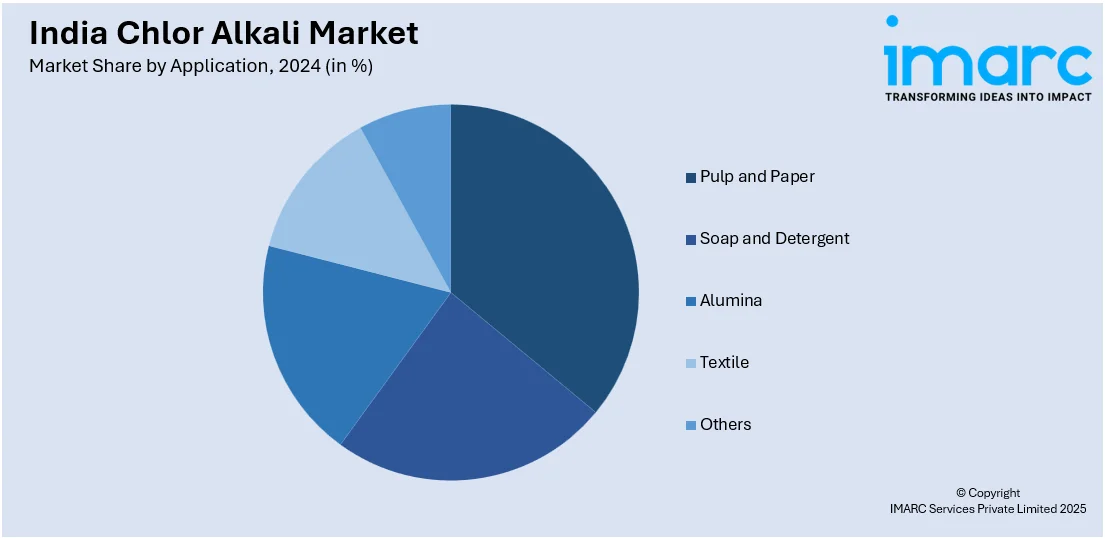

Application Insights:

- Pulp and Paper

- Soap and Detergent

- Alumina

- Textile

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes pulp and paper, soap and detergent, alumina, textile, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Chlor Alkali Market News:

- April 2024: Nuberg EPC launched India's largest chlor-alkali project for Mundra Petrochemical Ltd. (MPL), a subsidiary of Adani Enterprises. Commissioned by MPL, the facility will have a production capacity of 2,200 TPD and operate using a 100% NaOH process. It will manufacture key chemicals, including 50% Caustic Soda, Caustic Flakes, Anhydrous HCl, and Liquid Cl₂, along with various by-products.

- February 2024: INEOS Inovyn introduced its Ultra Low Carbon (ULC) range of chlor-alkali products, including Caustic Soda, Caustic Potash, and Chlorine, which reduce carbon emissions by up to 70% compared to industry norms. The new product line is powered by renewable energy, with initial manufacturing sites in Rafnes, Norway, and Antwerp, Belgium, utilizing wind energy from the North Sea.

India Chlor Alkali Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Caustic Soda, Chlorine, Soda Ash, Others |

| Applications Covered | Pulp and Paper, Soap and Detergent, Alumina, Textile, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India chlor alkali market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India chlor alkali market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India chlor alkali industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The chlor alkali market in India was valued at USD 2.40 Billion in 2024.

The India chlor alkali market is projected to exhibit a CAGR of 4.18% during 2025-2033, reaching a value of USD 3.46 Billion by 2033.

The key factors driving the India chlor alkali market include growing demand from end-use industries such as textiles, paper, chemicals, and water treatment, along with infrastructure development and urbanization. Additionally, increasing use of PVC in construction and rising industrial output are contributing to market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)