India Champagne Market Size, Share, Trends and Forecast by Product, Price, Distribution Channel, and Region, 2026-2034

India Champagne Market Size and Share:

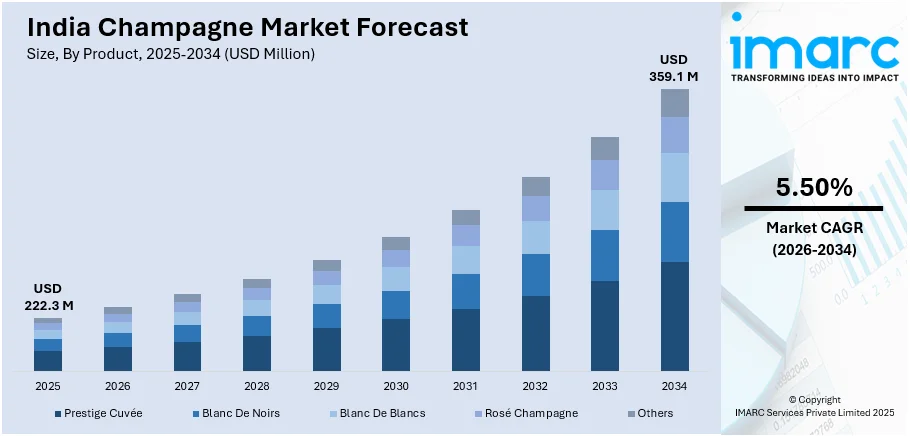

The India champagne market size was valued at USD 222.3 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 359.1 Million by 2034, exhibiting a CAGR of 5.50% from 2026-2034. The India champagne market share is expanding, driven by the rising demand for boutique hotels and vineyard tours that create the need for champagne tastings and events, along with the expansion of e-commerce platforms that offer tailored recommendations based on user preferences to enhance the shopping experience.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 222.3 Million |

|

Market Forecast in 2034

|

USD 359.1 Million |

| Market Growth Rate 2026-2034 | 5.50% |

The increasing trend of premiumization, with consumers seeking luxury experiences, is impelling the market growth. People are willing to pay more for high-quality champagne that reflects sophistication and exclusivity. Premium champagnes, often crafted with exceptional ingredients and aged to perfection, attract those celebrating special occasions or looking to indulge. The rise in disposable incomes also contributes to this shift towards premium products. Brands leverage this high demand by offering limited-edition bottles, personalized packaging, and collaborations with luxury designers. Additionally, high-end restaurants, hotels, and events prominently feature premium champagnes, reinforcing their status as a symbol of prestige. This encourages consumers to opt for more expensive and top-tier offerings.

To get more information on this market Request Sample

The rising shift towards a Western lifestyle and culture is offering a favorable India champagne market outlook. As Indian consumers adopt international trends, champagne becomes a popular choice for celebrations, mirroring its association with luxury and sophistication in Western societies. Rapid urbanization and exposure to big brands introduce people to champagne as a must-have for parties, weddings, and elite gatherings. Millennials and young professionals, influenced by Western culture, prefer champagne over traditional beverages for its modern and aspirational appeal. Additionally, the growing presence of Western-style bars, lounges, and restaurants in India increases champagne's popularity. This cultural shift positions champagne as a status symbol, raising its demand across the country.

India Champagne Market Trends:

Thriving tourism and hospitality sectors

The burgeoning India’s tourism and hospitality sectors are propelling the India champagne market share. As luxury hotels, resorts, and fine-dining restaurants grow, champagne becomes a key offering for guests seeking premium experiences. High-end venues incorporate champagne into their menus, pairing it with gourmet cuisines and using it for celebratory occasions like weddings, anniversaries, and corporate events. Tourist hotspots also feature champagne at cultural festivals and exclusive gatherings, adding to its appeal. Additionally, the rise of boutique hotels and vineyard tours creates the need for champagne tastings and events, enhancing its presence in the lifestyle segment. The hospitality industry also emphasizes curated experiences where champagne plays a central role in luxury offerings. As per IBEF, it is anticipated that international tourist arrivals in India will get to 30.5 Billion by 2028, yielding revenue exceeding USD 59 Billion. With more people visiting India, the demand for champagne is expected to increase.

Rising social media influence

With rising internet penetration across India, social media plays a huge role in supporting the India champagne market growth. As per a recent TRAI report, the average monthly data consumption of a user hit 20.27GB by March 2024, indicating a compound annual growth rate (CAGR) of 54%. The total number of internet users stands at 954.4 million, comprising 556.05 million in urban areas and 398.35 million in rural regions. Moreover, social media platforms remain active with posts highlighting champagne as an emblem of luxury, celebration, and elegance. Champagne is frequently showcased by influencers and celebrities in their content, establishing it as a fashionable option for parties and events. These platforms allow brands to implement targeted advertisements, promotional initiatives, and partnerships that connect with younger and tech-oriented audiences. The visual appeal of social media emphasizes the beauty of champagne bottles and labels, drawing in more people. User-generated content like photos and videos of champagne toasts, builds aspirational value, encouraging others to purchase.

Expansion of e-commerce platforms

As per the India champagne market trends, the expansion of e-commerce platforms is making premium beverages more accessible to consumers nationwide. Internet platforms enable consumers to explore a broad range of champagne brands, evaluate prices, and check reviews, all from the convenience of their own homes. E-commerce platforms also cater to urban and rural areas alike, bridging the gap between champagne producers and customers. Exclusive online deals, festive discounts, and convenient doorstep delivery further increase sales. Additionally, numerous platforms present tailored recommendations based on user preferences, enhancing the shopping experience. Secure payment options and efficient delivery systems make buying champagne online hassle-free. Notably, e-commerce channels also support champagne exports, allowing Indian sellers to tap into international markets and expand their reach, thereby strengthening the market growth. As per the data published on the official website of InvestIndia, India aims to increase e-commerce exports to USD 200-300 billion by the year 2030.

India Champagne Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India champagne market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product, price, and distribution channel.

Analysis by Product:

- Prestige Cuvée

- Blanc De Noirs

- Blanc De Blancs

- Rosé Champagne

- Others

Prestige Cuvée comes under the premium champagne category in India, featuring high-end and limited-edition champagnes. These exclusive products are crafted from the finest grapes and represent the best of the brand's offerings. Prestige Cuvée champagnes are often used for special occasions and celebrations due to their exceptional quality and luxurious appeal. They fulfill the needs of wealthy consumers who value craftsmanship and exclusivity.

Blanc De Noir is made from black grapes, typically Pinot Noir or Pinot Meunier, and offers a rich and full-bodied flavor profile. In India, this segment is popular among champagne enthusiasts who prefer a more intense and robust taste compared to traditional white champagnes. Blanc De Noirs appeals to both novice drinkers and connoisseurs seeking something different.

Blanc De Blancs is a prestigious champagne made solely from white grapes, usually Chardonnay, and is known for its crisp and elegant taste with delicate bubbles. In India, this segment appeals to consumers who appreciate refined and lighter champagnes that emphasize freshness and minerality. Additionally, Blanc De Blancs is often chosen for upscale events, fine dining, and special celebrations.

Rosé Champagne is chosen due to its visually appealing pink color and fruity and floral flavor profile. It is made by blending red and white grape varieties or allowing the skins of black grapes to briefly touch the juice. Rosé Champagne has gained traction in the country, especially among younger consumers and women, as it offers a stylish and refreshing alternative to traditional champagnes. It is frequently chosen for celebrations, weddings, and parties, making it one of the most sought-after champagne varieties.

Analysis by Price:

- Economy

- Mid-Range

- Luxury

The economy segment offers affordable options, making champagne accessible to a broader audience. Brands in this segment spot on providing value for money while preserving a reasonable level of quality. These champagnes are available at supermarkets, hypermarkets, and online stores, targeting entry-level consumers looking to celebrate on a budget.

Mid-range caters to consumers who seek a balance between quality and price. Brands in this category offer premium champagne at more accessible price points compared to luxury options. Mid-range champagnes are popular for special occasions like weddings, parties, and corporate events. Consumers in this segment value both quality and affordability, choosing brands that offer a well-crafted product without the high cost of luxury champagnes.

As per the India champagne market forecast, rosé champagne is chosen due to its visually appealing pink color and fruity and floral flavor profile. It is made by blending red and white grape varieties or allowing the skins of black grapes to briefly touch the juice. Rosé Champagne has gained traction in the country, especially among younger consumers and women, as it offers a stylish and refreshing alternative to traditional champagnes. It is frequently chosen for celebrations, weddings, and parties, making it one of the most sought-after champagne varieties.

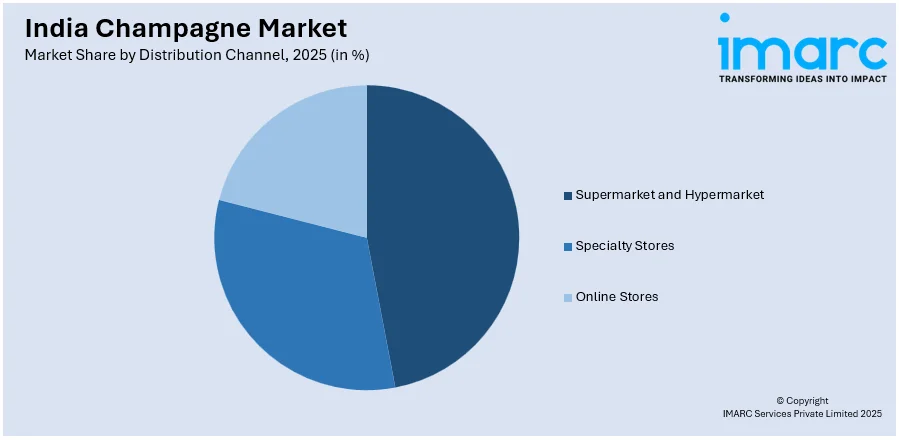

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarket and Hypermarket

- Specialty Stores

- Online Stores

Supermarkets and hypermarkets are preferred since they offer easy access to champagne for a wide range of people. These stores feature both international and domestic champagne brands, providing a variety of price points to cater to different customer segments. As people demand convenience and premium products, supermarkets and hypermarkets are strategically located to make champagne easily available in urban areas. These retail outlets also benefit from heavy foot traffic, making them an essential channel for introducing champagne to new customers and ensuring consistent sales.

Specialty stores concentrate on providing a carefully chosen range of high-quality champagnes for more selective patrons. These shops offer a tailored shopping experience, with expert staff assisting customers in choosing the ideal bottle. They frequently offer a variety of premium and imported champagne labels, targeting the upscale segment of the market. Shoppers who favor unique and premium items look for these stores for their distinct offerings and knowledgeable assistance.

Online stores have become popular due to the expansion of e-commerce platforms. Shoppers can effortlessly explore a vast range of champagne labels, check ratings, and buy products from the ease of their own residences. Digital platforms frequently offer comprehensive details about different champagne types, allowing consumers to make informed choices. By providing dependable shipping choices and special promotions, e-commerce sites are appealing to both new customers and loyal champagne lovers.

Regional Analysis:

- South India

- North India

- West & Central India

- East India

In South India, there is a high India champagne market demand, driven by the region’s affluent population and increasing interest in luxury products. In cities like Bengaluru, Chennai, and Hyderabad, consumers seek premium beverages for celebrations and special occasions. The region's rising disposable income, coupled with a shift in lifestyle and drinking habits, encourages the adoption of champagne. South India’s vibrant social scene, including weddings and corporate events, further increases sales.

East India, including cities like Kolkata and Bhubaneswar, shows a growing preference for champagne. As people, especially in urban areas, get exposure to international trends, they look for new and premium brands. In this area, there is an increase in champagne offerings at luxury hotels, upscale restaurants, and premium retail outlets. Additionally, individuals choose high-quality products for special events and celebrations here.

West and Central India, with cities such as Mumbai, Pune, and Ahmedabad, is among the top areas in India for champagne consumption. As the financial capital, Mumbai serves as a center for luxury items, with a significant demand for champagne, particularly in upscale hotels, clubs, and premium retail stores. The rising trend of upscale dining and lavish events in these regions increases the need for champagne.

In North India, particularly in key cities, such as Delhi, Chandigarh, and Jaipur, there exists a substantial wealthy consumer segment alongside a rise in luxurious living standards. The increasing number of high-net-worth persons in the region generates a requirement for exclusive and imported champagnes. In this area, Champagne is a preferred option for celebrations, weddings, and festive events.

Competitive Landscape:

Key players are working on increasing the popularity of champagne. Major brands offer premium quality products and aim to expand their presence in the country. These corporations invest in marketing and educational campaigns to increase awareness about champagne, targeting younger and affluent consumers looking for luxury experiences. They also team-up with local distributors to improve availability across high-end retail stores and luxury hotels. By hosting exclusive events and promoting champagne in Indian celebrations, these key players attract buyers. They also make efforts to introduce champagne as a trendy drink for special occasions. Additionally, local players launch their brands, catering to specific tastes and preferences.

The report provides a comprehensive analysis of the competitive landscape in the India champagne market with detailed profiles of all major companies.

Latest News and Developments:

- November 2024: Cellar 33, an esteemed export and marketing firm located in Bordeaux, intended to launch its high-quality assortment of champagne, wine, and spirits in India. It includes a range of products, termed 'Champagne Excellence', crafted by 14 leading Champagne makers, highlighting the best selections across the country.

- August 2024: Wine Park introduced orange wines from Radikon, including two orange wines and one red wine, initially available in Maharashtra.

- July 2024: Champagne India Ltd, a Bombay-based company, entered into a partnership agreement with Campagne Technology, France to set up a plant in the Nasik-Pune highway. In this plant, 100 acres of vineyard are being planted with blending stock multiplied from cuttings brought in from the champagne district of France. This collection will contain70 per cent of domestic grape varieties in the blend.

India Champagne Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Prestige Cuvée, Blanc De Noirs, Blanc De Blancs, Rosé Champagne, Others |

| Prices Covered | Economy, Mid-Range, Luxury |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores |

| Regions Covered | South India, East India, West and Central India, North India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India champagne market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India champagne market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India champagne industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India champagne market was worth USD 222.3 Million in 2025.

Looking forward, IMARC Group estimates the market to reach USD 359.1 Million by 2034, exhibiting a CAGR of 5.50% from 2026-2034.

The rising establishment of luxury retail outlets, hotels, and online platforms is making champagne more accessible to a wider audience across the country. Besides this, the increasing exposure to worldwide trends through media, travel, and social events is making champagne more desirable, especially among millennials and Gen Z. Moreover, champagne’s association with weddings, corporate events, and festive occasions continues to support the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)