India Cereal Bars Market Size, Share, Trends and Forecast by Product, Distribution Channel and Region, 2025-2033

India Cereal Bars Market Overview:

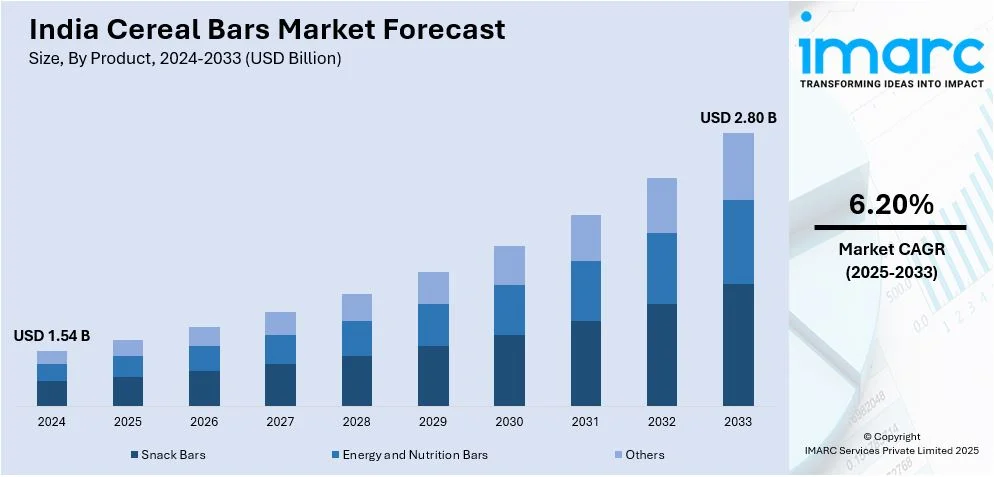

The India cereal bars market size reached USD 1.54 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.80 Billion by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. The market is growing steadily, fueled by increasing consumer interest in convenient and healthy snack foods. Urbanization, hectic lifestyles, and health-conscious eating habits are fueling the popularity of cereal bars among various consumer segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.54 Billion |

| Market Forecast in 2033 | USD 2.80 Billion |

| Market Growth Rate (2025-2033) | 6.20% |

India Cereal Bars Market Trends:

Health and Wellness Trend Boosting Demand

Growing emphasis on health and wellbeing among Indian consumers is fuelling demand for cereal bars. As lifestyles get busy and the concept of nutrition is becoming better known, there's a greater penchant for convenient but healthy food intake. Cereal bars, sometimes positioned as providing energy, protein, and crucial nutrients, are becoming popular with fitness-conscious folks, working professionals, and students alike. Moreover, the trend toward healthier snacking is also being driven by the growth of clean eating, where consumers seek foods that contain natural ingredients, contain no added sugars, and have minimal processing. Low-calorie, high-protein, and functional cereal bars that provide advantages like enhanced digestion, energy levels, and hunger satisfaction are specifically in demand. With this trend on the rise, cereal bars are also becoming a legitimate substitute for traditional snacks, falling in line with the overall movement towards nutrition balance and wellness-based food consumption. For example, in March 2023, Bagrry's India introduced "The Mighty Muesli Bars" in three varieties—Choco Nut Delight, Signature Crunch, and Fruits, Nuts & Seeds—with multi-grains, nuts, fruits, and honey for energy-filled snacking.

To get more information on this market, Request Sample

E-Commerce and Modern Retail Expanding Market Reach

The growth in e-commerce and growth in newer retail channels are also substantially driving the visibility and sales of cereal bars in India. Online platforms allow consumers the comfort of accessing a variety of products, prices comparisons, and consumer reviews. Subscriptions and offers are available on many such platforms, allowing for repeat orders. At the same time, newer retail channels like hypermarkets, supermarkets, and convenience stores are devoting increasingly larger amounts of shelf space to healthy snack food like cereal bars. Such stores encourage sales of such products with in-store promotional display, sampling events, and compelling packaging that triggers impulse purchase. The combination strategy of utilizing both offline and online channels enables cereal bar brands to engage a wider population, including healthy eaters, busy working professionals, and athletes, maximizing market penetration and stimulating growth within this segment.

Innovation in Flavors and Nutrition

As Indian consumers are looking for variety and exclusivity in what they eat, innovation in nutrition and flavors is emerging as an important trend in the cereal bar segment. Increasing demand is there for exotic and new flavors. For instance, in June 2023, Nestlé India introduced two new breakfast cereals, KOKO KRUNCH Millet-Jowar and MUNCH, adding local grains such as jowar to improve variety and innovation in its portfolio. Moreover, customers are also interested in cereal bars with superfoods, seeds, and whole grains as ingredients to make them more nutritionally rich. Furthermore, the clean-label movement is making brands steer clear of artificial ingredients and emphasize natural and minimally processed ingredients. Specialty products such as vegan, gluten-free, and allergen-free cereal bars are becoming popular as they cater to niche groups who have specific requirements. Ongoing development of tastes and nutritional portfolios not only acquires new buyers but also preserves the enthusiasm of current ones, fostering sustained marketplace expansion.

India Cereal Bars Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Snack Bars

- Energy and Nutrition Bars

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes snack bars, energy and nutrition bars, and others.

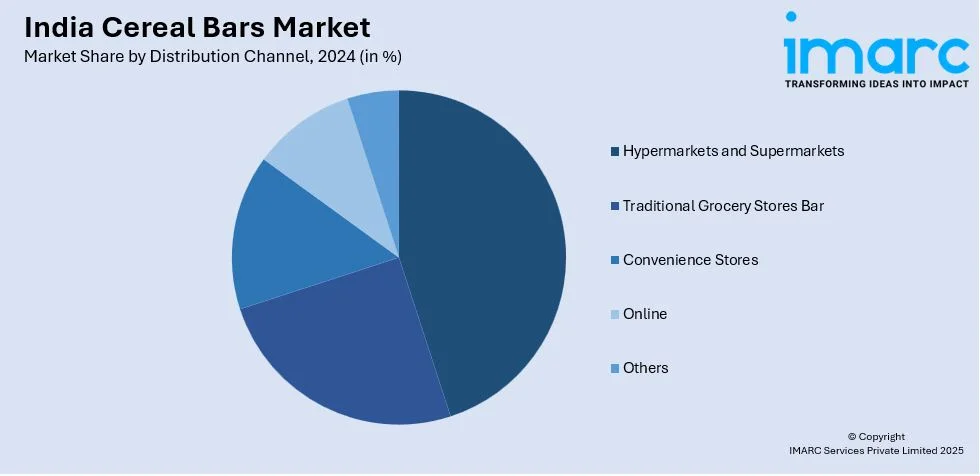

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Traditional Grocery Stores Bar

- Convenience Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, traditional grocery stores, convenience stores, online, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cereal Bars Market News:

- In September 2024, Forever New Protein and Nut Energy Bars, Forever Living Products (India), were launched as a healthy, convenient snack for busy lives. Available in Choco Almond and Cranberry flavors, the bars are preservative-free, protein-rich, containing vitamins, minerals, and prebiotics, and stimulating energy, mood, and gut health.

- In August 2024, ProV Foods of Mumbai widened its market reach in the functional snacking category by introducing ProV Lite "Activated Nuts" and ProV Fusion trail mixes. The new products, such as pre-soaked nuts and combinations like Omega Boost Trail Mix, rode the surging demand for healthy, convenient, and on-the-move snacks.

India Cereal Bars Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Snack Bars, Energy and Nutrition Bars, Others |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Traditional Grocery Stores, Convenience Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cereal bars market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cereal bars market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cereal bars industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India cereal bars market was valued at USD 1.54 Billion in 2024.

The India cereal bars market is projected to exhibit a CAGR of 6.20% during 2025-2033, reaching a value of USD 2.80 Billion by 2033.

Key factors driving the India cereal bars market include growing health consciousness, preference for convenient and nutritious snacks, changing urban lifestyles, and increasing demand for natural and functional foods. Innovation in flavors and ingredients, along with greater availability through modern retail and online platforms, also support market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)