India Centrifugal Pumps Market Size, Share, Trends and Forecast by Type, Stage, Flow Type, Capacity, End-User, and Region, 2026-2034

India Centrifugal Pumps Market Overview:

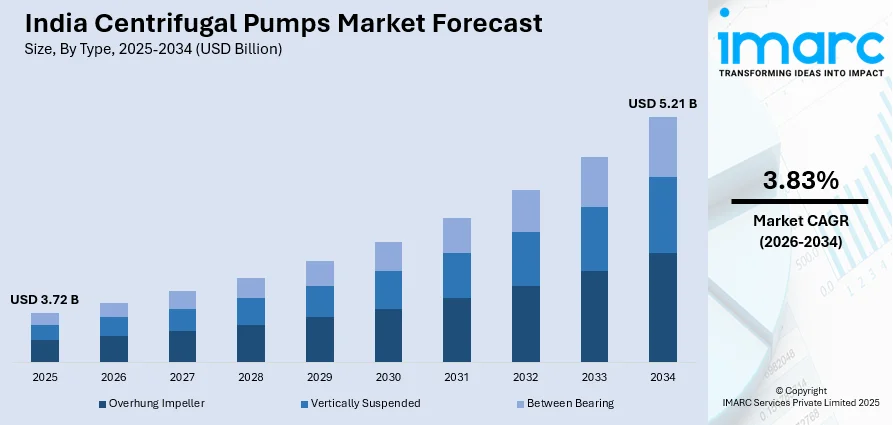

The India centrifugal pumps market size reached USD 3.72 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 5.21 Billion by 2034, exhibiting a growth rate (CAGR) of 3.83% during 2026-2034. India’s centrifugal pumps market is growing due to expanding pump testing infrastructure and rising demand for energy-efficient solutions. Industries are adopting advanced pumps for improved efficiency, while government initiatives support sustainable practices. Increased investments in innovation and localized manufacturing are driving market expansion across key industrial sectors.

Key Takeaways:

- The India centrifugal pumps market was valued at USD 3.72 billion in 2025.

- It is projected to reach USD 5.21 billion by 2034, representing a compound annual growth rate (CAGR) of about 3.83% between 2026–2034.

- Major growth drivers include increasing investments in water and wastewater treatment projects, rapid industrialization, expanding agricultural irrigation activities, and rising demand from the oil and gas, power generation, and construction sectors across India.

- Segmentation Highlights:

- Type: Overhung Impeller, Vertically Suspended, Between Bearing.

- Stage: Single Stage Pump, Two Stage Pump, Multi-Stage Pump.

- Flow Type: Axial Flow Pumps, Radial Flow Pumps, Mixed Flow Pumps.

- Capacity: Small Capacity, Medium Capacity, High Capacity.

- End-User: Chemicals, Oil and Gas, Power Generation, Construction, Pharmaceuticals, Food and Beverages, Metals and Mining, Water and Wastewater, Others.

- Regional Insights: The report covers major zones within India: North India, South India, East India and West India — signalling growth opportunities across geographies.

To get more information on this market, Request Sample

India Centrifugal Pumps Market Trends:

Expansion of Pump Testing Infrastructure

India’s centrifugal pumps market is witnessing significant advancements with the expansion of testing infrastructure. As industries demand high-performance and efficient pumping systems, robust testing facilities have become essential for ensuring product reliability, durability, and compliance with international standards. The ability to locally test complex pump systems enhances manufacturing efficiency and reduces dependence on external testing centers, fostering innovation and accelerating product development. In March 2024, ITT Inc. announced a USD 11 Million investment to enhance pump testing capabilities, including its Vadodara, India facility. This investment strengthens India’s centrifugal pumps market by enabling large-scale testing for chemical, energy, and mining applications. With increased power capacity for pump, motor, and control system testing, manufacturers can now conduct more advanced performance evaluations, ensuring high operational efficiency and reliability in demanding industrial environments. The expansion of testing infrastructure is driving industrial growth by allowing pump manufacturers to refine designs, improve quality control, and optimize efficiency. As India’s industries increasingly adopt centrifugal pumps for critical applications, localized testing capabilities reduce lead times, enhance customer confidence, and support market competitiveness. With continuous investments in advanced testing infrastructure, the centrifugal pumps market in India is poised for further innovation and long-term growth.

Rising Demand for Energy-Efficient Pumps

India’s centrifugal pumps market is evolving with an increasing focus on energy-efficient solutions. Industries such as agriculture, water treatment, and manufacturing are prioritizing pumps that reduce energy consumption while maintaining high performance. This shift is driven by rising electricity costs, sustainability goals, and government regulations promoting energy efficiency. Manufacturers are now developing advanced pump technologies, incorporating variable frequency drives (VFDs) and high-efficiency motors to optimize energy usage. The demand for energy-efficient centrifugal pumps is further supported by government initiatives encouraging sustainable industrial practices. With stricter environmental policies and the need for cost-effective operations, industries are transitioning towards pumps that offer lower operational costs and reduced carbon emissions. This has led to increased R&D investments by pump manufacturers to create innovative designs that enhance fluid dynamics and minimize power wastage. Additionally, industrial and municipal water management projects are adopting smart pumping systems that adjust flow rates based on real-time requirements. These advancements not only enhance efficiency but also extend pump lifespan and reduce maintenance costs. As energy efficiency becomes a key factor in purchasing decisions, the centrifugal pumps market in India is experiencing significant growth, positioning itself as a crucial segment in the country’s industrial and infrastructure development.

India Centrifugal Pumps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, stage, flow type, capacity, and end-user.

Type Insights:

- Overhung Impeller

- Vertically Suspended

- Between Bearing

The report has provided a detailed breakup and analysis of the market based on the type. This includes overhung impeller, vertically suspended, and between bearing.

Stage Insights:

- Single Stage Pump

- Two Stage Pump

- Multi-Stage Pump

The report has provided a detailed breakup and analysis of the market based on the stage. This includes single stage pump, two stage pump, and multi-stage pump.

Flow Type Insights:

- Axial Flow Pumps

- Radial Flow Pumps

- Mixed Flow Pumps

The report has provided a detailed breakup and analysis of the market based on the flow type. This includes axial flow pumps, radial flow pumps, and mixed flow pumps.

Capacity Insights:

- Small Capacity

- Medium Capacity

- High Capacity

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes small capacity, medium capacity, and high capacity.

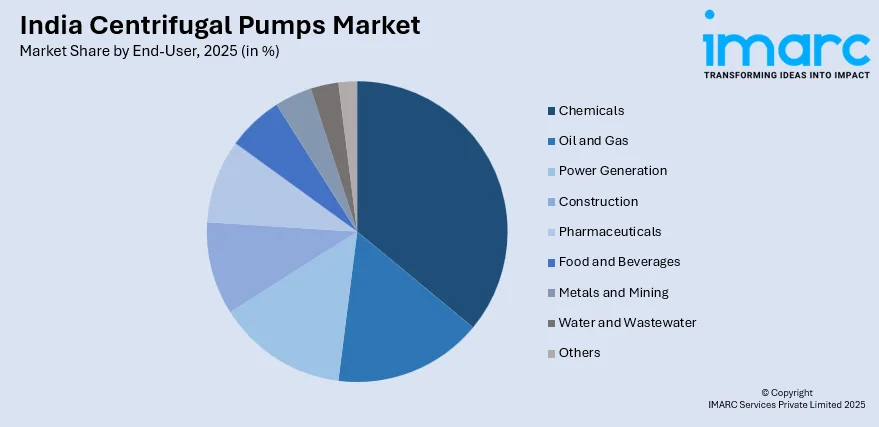

End-User Insights:

- Chemicals

- Oil and Gas

- Power Generation

- Construction

- Pharmaceuticals

- Food and Beverages

- Metals and Mining

- Water and Wastewater

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes chemicals, oil and gas, power generation, construction, pharmaceuticals, food and beverages, metals and mining, water and wastewater, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Centrifugal Pumps Market News:

- December 2024: Roto Energy Systems Ltd. secured global and domestic orders for 400 Roto Rudra Solar Submersible Pumping Systems. This strengthens India’s centrifugal pumps market by advancing renewable energy solutions, supporting sustainable water management, and enhancing efficiency in agriculture, irrigation, and drinking water applications.

- December 2024: Latteys Industries Limited secured major orders for solar submersible pumps under the PM-KUSUM scheme, totaling INR 37.525 Crore. This strengthens India’s centrifugal pumps market by expanding renewable energy-driven water solutions, enhancing agricultural efficiency, and supporting sustainable irrigation and government-backed green energy initiatives.

India Centrifugal Pumps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Overhung Impeller, Vertically Suspended, Between Bearing |

| Stages Covered | Single Stage Pump, Two Stage Pump, Multi-Stage Pump |

| Flow Types Covered | Axial Flow Pumps, Radial Flow Pumps, Mixed Flow Pumps |

| Capacities Covered | Small Capacity, Medium Capacity, High Capacity |

| End-Users Covered | Chemicals, Oil and Gas, Power Generation, Construction, Pharmaceuticals, Food and Beverages, Metals and Mining, Water and Wastewater, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India centrifugal pumps market performed so far and how will it perform in the coming years?

- What is the breakup of the India centrifugal pumps market on the basis of type?

- What is the breakup of the India centrifugal pumps market on the basis of stage?

- What is the breakup of the India centrifugal pumps market on the basis of flow type?

- What is the breakup of the India centrifugal pumps market on the basis of capacity?

- What is the breakup of the India centrifugal pumps market on the basis of end-user?

- What are the various stages in the value chain of the India centrifugal pumps market?

- What are the key driving factors and challenges in the India centrifugal pumps market?

- What is the structure of the India centrifugal pumps market and who are the key players?

- What is the degree of competition in the India centrifugal pumps market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India centrifugal pumps market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India centrifugal pumps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India centrifugal pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)