India Cement Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2026-2034

India Cement Market Summary:

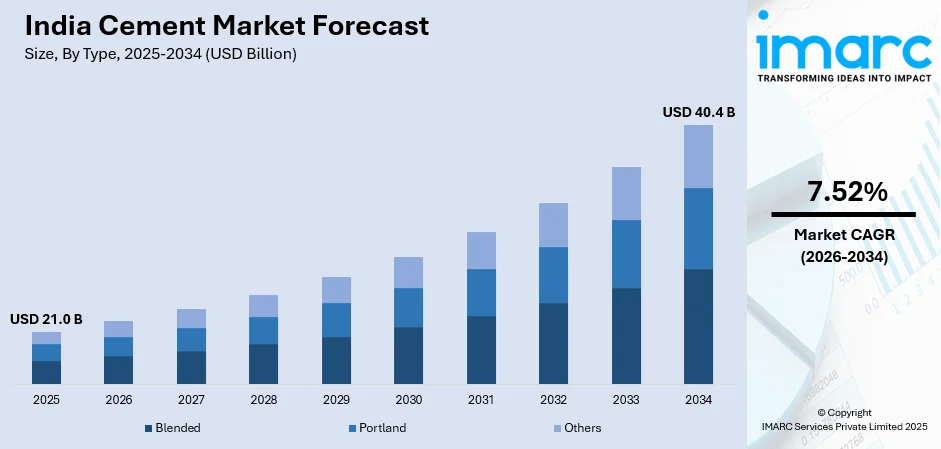

The India cement market size was valued at USD 21.0 Billion in 2025 and is projected to reach USD 40.4 Billion by 2034, growing at a compound annual growth rate of 7.52% from 2026-2034.

The India cement market is experiencing robust expansion driven by accelerated urbanization, ambitious infrastructure development initiatives, and sustained housing demand. Government-backed programs focusing on affordable housing, smart city development, and transportation network modernization are propelling construction activities nationwide. Increasing investments in industrial corridors, renewable energy infrastructure, and commercial real estate are further reinforcing the India cement market share.

Key Takeaways and Insights:

-

By Type: Blended cement dominates the market with a share of 55.08% in 2025, driven by cost-effectiveness, lower carbon emissions, and alignment with sustainability mandates in public procurement and green building certifications.

-

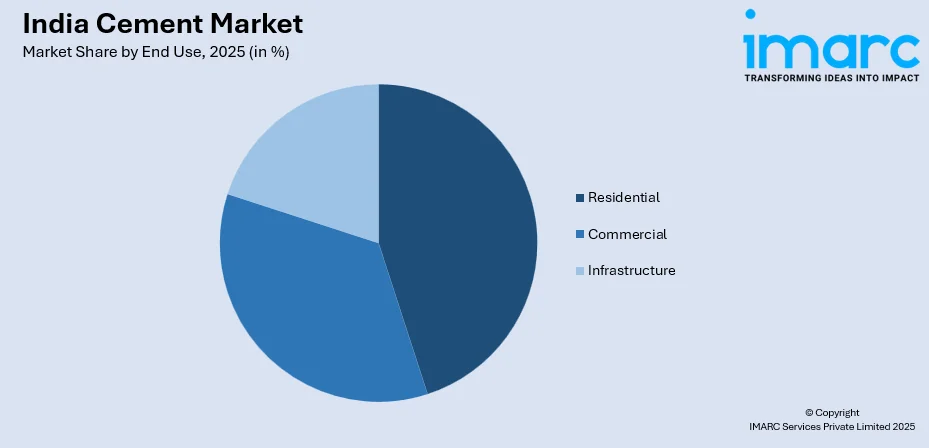

By End Use: Residential segment leads the market with a share of 40.12% in 2025, supported by government affordable housing schemes, rising urbanization, and expanding bank credit towards housing construction activities.

-

By Region: North India represents the largest segment with a market share of 31% in 2025, owing to extensive infrastructure development, highway construction projects, and significant housing demand across major population centers.

-

Key Players: The India cement market exhibits high competitive intensity, with leading manufacturers pursuing aggressive capacity expansion, strategic acquisitions, and sustainability initiatives. Major players are investing in green cement technologies, renewable energy integration, and digital transformation to strengthen market positioning. Some of the major players include Ambuja Cements Limited, Birla Corporation, Dalmia Bharat Group, Deccan Cement Limited, HeidelbergCement India Limited, India Cements Ltd, Jaypee Group, JK Lakshmi Cement Ltd, Shree Cement Limited, The Ramco Cements Limited, UltraTech Cement Ltd., etc.

To get more information on this market Request Sample

The India cement market is advancing as manufacturers embrace sustainable production methods and eco-friendly product innovations. The industry is witnessing a strategic shift toward blended cement varieties, which now constitute most of the production output due to their environmental benefits and cost advantages. In April 2025, Shree Cement added two new grinding units in Etah and Baloda Bazar, boosting its total cement capacity to 62.8 MTPA, demonstrating the industry's commitment to capacity expansion. Leading producers are leveraging India's abundant limestone reserves across multiple states, ensuring a stable raw material base for sustained growth. The sector continues to benefit from favorable government policies, including infrastructure budget allocations, affordable housing initiatives, and regulatory support for green construction materials, collectively positioning India cement market growth on a robust trajectory.

India Cement Market Trends:

Adoption of Green Cement and Sustainable Production Practices

Environmental awareness is transforming India’s cement industry, with manufacturers investing in cleaner production technologies and sustainable materials. The development of Portland limestone cement and fly ash–based blends is accelerating, helping companies reduce carbon emissions while meeting decarbonization goals and growing demand for green procurement solutions. The India green cement market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.8 Billion by 2033, exhibiting a growth rate (CAGR) of 6.11% during 2025-2033, signaling the industry's pivot toward low-carbon solutions and circular economy principles.

Digital Transformation and Industry 4.0 Integration

Cement manufacturers are embracing advanced digital technologies to optimize operations and enhance productivity. Integration of IoT sensors, artificial intelligence, and predictive analytics is enabling real-time process monitoring and improved equipment performance. For instance, in July 2024, AJAX Engineering, a leading manufacturer of concreting equipment, introduced Concrete GPT, an AI-powered digital platform tailored for India’s construction and concreting sector. Designed to support millions of construction professionals, the platform offers access to an extensive, expert-verified knowledge base covering current market trends, technological advancements, and regulatory developments. This further demonstrates how digital platforms are transforming cement manufacturing efficiency.

Expansion of Ready-Mix Concrete Market

The ready-mix concrete segment is gaining substantial traction across India's construction landscape, driven by superior quality, consistency, and project execution efficiency. Urban infrastructure projects, commercial developments, and large-scale housing complexes are increasingly adopting RMC solutions for their reliability and reduced on-site labor requirements. The shift from traditional site-mixed concrete to factory-produced ready-mix formulations is accelerating, supporting enhanced construction quality and faster project completion timelines across the India cement market growth trajectory. For instance, in March 2024, Shree Cement Limited entered the ready-mix concrete segment with the launch of Bangur Concrete, marked by the commissioning of its first greenfield RMC facility located in Hyderabad, with a production capacity of 90 cubic meters per hour. Earlier this month, the company acquired five operational StarCrete LLP plants in Mumbai for Rs 33.5 crore, taking its total RMC capacity to 512 cubic meters per hour.

Market Outlook 2026-2034:

The India cement market outlook remains strongly positive, underpinned by sustained government infrastructure investments, accelerating urbanization, and expanding housing demand. The sector is well-positioned to benefit from the National Infrastructure Pipeline and flagship programs targeting transportation, housing, and smart city development. Industry consolidation and strategic capacity expansions by leading players are strengthening supply capabilities to meet projected demand growth. The market generated a revenue of USD 21.0 Billion in 2025 and is projected to reach a revenue of USD 40.4 Billion by 2034, growing at a compound annual growth rate of 7.52% from 2026-2034.

India Cement Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Blended |

55.08% |

|

End Use |

Residential |

40.12% |

|

Region |

North India |

31% |

Type Insights:

- Blended

- Portland

- Others

Blended cement dominates the market with a share of 55.08% of the total India cement market in 2025.

The blended cement segment has emerged as the preferred choice among construction professionals and developers due to its superior cost-effectiveness and environmental advantages. Indian cement manufacturers have voluntarily embraced reduced carbon emissions by increasing blended cement production, adopting best practices from established markets. Companies are actively replacing clinker with alternative materials such as pozzolana, fly ash, and granulated blast furnace slag, achieving substantial energy savings while supporting industry decarbonization targets.

The widespread availability of industrial by-products from thermal power plants and steel manufacturing facilities ensures a consistent raw material supply for blended cement production across India. Government regulations and green building certification requirements have accelerated adoption, with public procurement policies increasingly favoring environmentally responsible construction materials. The segment's growth aligns with India's commitment to sustainable development, positioning blended cement as a cornerstone of the nation's construction material landscape and supporting long-term India cement market growth.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Infrastructure

The residential segment leads the market with a share of 40.12% of the total India cement market in 2025.

Residential construction remains the primary demand driver for cement consumption in India, supported by population growth, urbanization trends, and rising household incomes. Under the Pradhan Mantri Awas Yojana–Gramin (PMAY-G), the Government has set a target of constructing 3.32 crore rural homes. As of November 19, 2024, approvals have been granted for 3.21 crore houses, with 2.67 crore already completed, leading to substantial improvements in housing quality and living standards for millions of rural households. Urban housing initiatives continue expanding with substantial government investment allocations, further stimulating cement demand across metropolitan and tier-II cities.

Cement's position as an affordable and durable construction material reinforces its essential role in residential building projects across rural and urban areas. Growing bank credit outstanding towards housing construction indicates sustained financial support for homeownership, benefiting cement consumption patterns. The segment's growth is further bolstered by renovation and expansion activities in existing residential structures, alongside new construction projects addressing India's expanding housing requirements and supporting broader India cement market share expansion.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India holds the largest share of 31% of the total India cement market in 2025.

North India's cement market dominance is underpinned by extensive infrastructure development initiatives across major states including Uttar Pradesh, Rajasthan, Punjab, and Haryana. The region benefits from substantial highway construction projects, railway expansion programs, and urban development activities concentrated in the National Capital Region and surrounding areas. For instance, in August 2025, Saifco Cements Pvt. Ltd., a subsidiary of JK Cement Ltd, one of India’s leading cement producers, announced the introduction of the JK Super Cement brand in Kashmir. The launch marks a key step in operationalizing JK Cement’s recent regional acquisition and reflects the company’s strategic focus on strengthening infrastructure development and economic growth across Jammu & Kashmir.

The concentration of affordable housing developments under government schemes has positioned North India as a significant consumption center for bagged cement products. Well-developed transportation networks facilitate efficient cement distribution across the region, supporting both urban construction activities and rural development programs. Leading cement manufacturers continue expanding production capacities in northern states, recognizing the region's strategic importance for capturing market share and meeting sustained demand from residential, commercial, and infrastructure segments.

Market Dynamics:

Growth Drivers:

Why is the India Cement Market Growing?

Government Infrastructure Investment and Policy Support

The Indian government's sustained commitment to infrastructure development serves as a primary catalyst for cement demand expansion. Flagship programs including Bharatmala, PM Gati Shakti, and Vande Bharat corridor initiatives are generating substantial requirements for construction materials across transportation networks. The Union Budget 2025-26 allocated Rs. 11.2 lakh crore (approximately USD 129 billion) for the infrastructure sector, representing a significant commitment to national development priorities. The National Infrastructure Pipeline encompasses several projects spanning roads, bridges, railways, and urban infrastructure, creating long-term visibility for cement consumption patterns and supporting industry capacity planning decisions.

Affordable Housing Programs and Residential Construction Growth

Housing development initiatives are generating consistent demand for cement across urban and rural regions throughout India. The Pradhan Mantri Awas Yojana urban and rural components aim to construct millions of affordable housing units, with the program receiving enhanced budget allocations reflecting government priority. On June 18, 2025, approximately 2.35 lakh new houses were approved under PMAY-Urban 2.0, demonstrating continued momentum in housing program execution. Rising household incomes, expanding bank credit towards housing construction, and growing aspirations for homeownership collectively reinforce residential cement consumption trends across diverse geographic markets.

Urbanization and Smart City Development Initiatives

Rapid urban population growth is driving transformative construction activities across India's cities and emerging urban centers. According to the industry report, 36.87% of India's population now resides in urban areas, representing over millions of individuals, with continued migration expected to accelerate construction requirements. Smart city development programs are modernizing urban infrastructure through investments in transportation systems, public utilities, and sustainable building solutions. The concentration of commercial real estate development, institutional construction, and retail infrastructure in metropolitan areas creates sustained cement demand, while tier-II and tier-III cities are experiencing accelerated construction activities as economic development extends beyond major metropolitan centers.

Market Restraints:

What Challenges the India Cement Market is Facing?

Energy Cost Volatility and Input Price Fluctuations

Cement manufacturing remains energy-intensive, with power and fuel costs comprising a significant portion of production expenses. Price volatility in imported coal, petroleum coke, and grid electricity affects kiln economics, particularly for non-integrated plants lacking captive power generation. Manufacturers are investing in waste heat recovery systems and renewable energy integration to mitigate cost pressures and improve operational resilience.

Environmental Compliance and Regulatory Requirements

Increasing environmental regulations around emissions, groundwater usage, and carbon disclosure are raising compliance costs for cement producers. New standards for particulate emissions and sustainability reporting require capital investments in pollution control equipment and process modifications. Companies must balance regulatory compliance with operational efficiency while pursuing decarbonization objectives aligned with national climate commitments.

Limestone Mining and Land Acquisition Challenges

Difficulty in acquiring new mining leases due to environmental clearances and community concerns is constraining capacity expansion plans in certain regions. Extended approval timelines for limestone extraction rights have delayed several proposed projects, particularly in mineral-rich states. Securing sustainable raw material access remains critical for long-term industry growth while addressing environmental and social responsibility considerations.

Competitive Landscape:

The India cement market exhibits significant consolidation, with leading manufacturers commanding substantial market share through integrated operations and extensive distribution networks. Major players are pursuing aggressive capacity expansion strategies through greenfield projects, brownfield expansions, and strategic acquisitions to strengthen regional presence. Companies are differentiating through product innovation, sustainability initiatives, and digital transformation investments. Green cement portfolios, renewable energy integration, and waste co-processing capabilities are becoming competitive differentiators as environmental considerations gain importance in procurement decisions. Strategic partnerships, technology collaborations, and supply chain optimization efforts are enabling efficient operations and enhanced customer service across diverse market segments.

Some of the key players are:

- Ambuja Cements Limited

- Birla Corporation

- Dalmia Bharat Group

- Deccan Cement Limited

- HeidelbergCement India Limited

- India Cements Ltd

- Jaypee Group

- JK Lakshmi Cement Ltd

- Shree Cement Limited

- The Ramco Cements Limited

- UltraTech Cement Ltd.

Recent Developments:

-

December 2025: Deccan Cements successfully commissioned its 'Line-3' cement plant with commercial production commencing on December 15, 2025, increasing the company's total cement production capacity to 4 million tonnes per annum and strengthening its manufacturing footprint.

-

August 2025: JSW Cement unveiled plans to expand its manufacturing capacity threefold to 60 MTPA in the coming years, backed by a proposed Rs 3,600 crore (around USD 408 million) initial public offering. The expansion will be supported by the JSW Group’s integrated rail, port, and green mobility infrastructure.

India Cement Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD, Million Tons |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Ambuja Cements Limited, Birla Corporation, Dalmia Bharat Group, Deccan Cement Limited, HeidelbergCement India Limited, India Cements Ltd, Jaypee Group, JK Lakshmi Cement Ltd, Shree Cement Limited, The Ramco Cements Limited, UltraTech Cement Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India cement market size was valued at USD 21.0 Billion in 2025.

The India cement market is expected to grow at a compound annual growth rate of 7.52% from 2026-2034 to reach USD 40.4 Billion by 2034.

Blended cement leads the market with a share of 55.08% in 2025, driven by its cost-effectiveness, lower carbon emissions, and alignment with sustainability requirements in construction projects and government procurement standards.

Key factors driving the India cement market include government infrastructure investments, affordable housing programs, rapid urbanization, smart city development initiatives, and growing construction activities in residential, commercial, and industrial sectors.

Major challenges include energy cost volatility, environmental compliance requirements, limestone mining lease acquisition difficulties, logistical inefficiencies, and raw material supply constraints affecting production economics and expansion plans.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)