India Ceiling Tiles Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

India Ceiling Tiles Market Size and Trends:

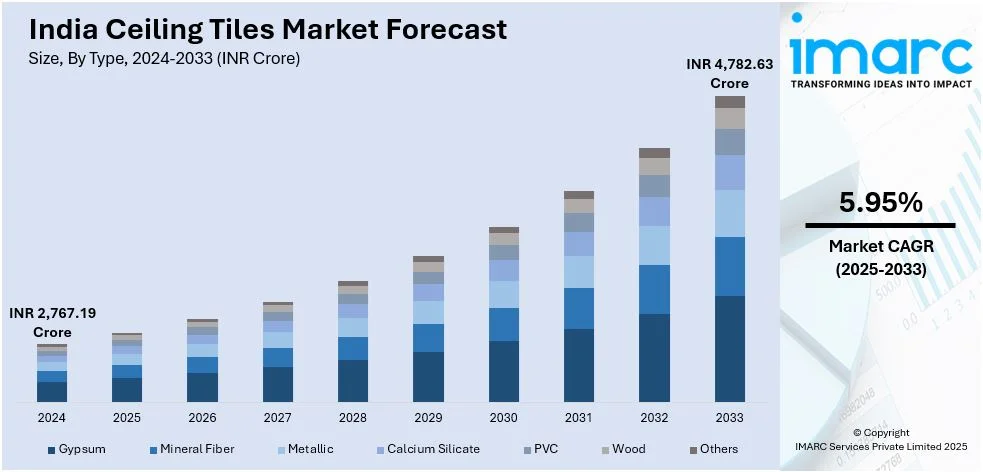

The India ceiling tiles market size was valued at INR 2,767.19 Crore in 2024. Looking forward, IMARC Group estimates the market to reach INR 4,782.63 Crore by 2033, exhibiting a CAGR of 5.95% from 2025-2033. The market is experiencing significant growth driven by urbanization, rising construction activities, and an increasing demand for aesthetically appealing, energy-efficient, and soundproof solutions in residential and commercial spaces. The widespread adoption of ecofriendly materials and innovative designs with a focus on enhancing interior aesthetics and reducing energy costs, are pivotal elements fueling the market expansion. India ceiling tiles market share also plays a significant role in shaping the market dynamics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 2,767.19 Crore |

|

Market Forecast in 2033

|

INR 4,782.63 Crore |

| Market Growth Rate (2025-2033) | 5.95% |

The rapid urbanization and the growth of the construction industry are the main drivers for the India ceiling tiles market. Infrastructure development especially in commercial spaces such as offices, retail outlets and healthcare facilities has increased significantly thereby increasing demand for ceiling tiles. The increasing demand for aesthetically pleasing interiors and improved acoustic solutions in modern buildings also supports the India ceiling tiles market growth. Government initiatives to develop smart cities and affordable housing projects are also acting as major contributors to the increasing adoption of ceiling tiles across the country. India is developing 12 new industrial smart cities under the National Industrial Corridor Development Programme with a ₹28,602 crore investment. Strategically located along the Golden Quadrilateral these cities aim to enhance manufacturing, create employment opportunities, and attract ₹1.52 lakh crore in investment, fostering regional economic growth and sustainability.

To get more information on this market, Request Sample

The other major driver is the increasing consumer inclination toward ecofriendly and sustainable building materials. Ceiling tiles made from recyclable, and energy efficient materials are gaining popularity due to heightened environmental awareness. For instance, in December 2024, Parminder Singh from Punjab introduced ecofriendly tiles from stubble waste providing an innovative solution to the prevalent problem of stubble burning. His startup aims to establish production plants that transform waste into sustainable materials offering farmers a viable alternative while combating air pollution in the Delhi NCR region. Technological advancements such as lightweight and fire-resistant ceiling tiles cater to safety and durability requirements boosting their adoption in residential and commercial buildings. The growing emphasis on energy efficient buildings and demand for modular designs further stimulate the ceiling tiles market in India. These factors are collectively creating a positive India ceiling tiles market outlook.

India Ceiling Tiles Market Trends:

Growing Demand for Eco-Friendly Materials

The demand for ecofriendly materials in the India ceiling tiles market is growing due to increased environmental awareness and the need for sustainable construction practices. For instance, in December 2023, Saint-Gobain Gyproc India launched an innovative range of building products including Habito Standard and Rigiroc gypsum boards, Glasroc X for exterior applications and Metlance metal ceilings. These products aim to enhance architectural design and sustainability addressing India’s evolving construction needs. Consumers and businesses are moving toward ceiling tiles made from recyclable and renewable resources such as agricultural waste to reduce environmental impact. Innovations like tiles derived from stubble waste not only prevent pollution from stubble burning but also promote waste utilization. These ecofriendly tiles are also often provided with additional benefits such as fire resistance, lightweight design and durability which make them an attractive alternative to conventional materials. Government support for green building initiatives further boosts their adoption across residential and commercial projects.

Rapid Urbanization and Infrastructure Development

Rapid urbanization and infrastructure development in India have significantly driven the demand for ceiling tiles with cities expanding and construction activities rising. The government's focus on smart cities and affordable housing projects has created opportunities for modern and functional ceiling solutions. Urban developments such as commercial complexes, residential buildings and public spaces require ceiling tiles for aesthetics, acoustic performance, and insulation. The growing middle-class population and the rising urban migration further fuel the demand for affordable yet fashionable interiors. According to the article published by the India Brand Equity Foundation, India’s middle class is projected to nearly double to 61% by 2047 rising from 31% in 2021 driven by economic reforms and expected growth rates of 6-7%. By 2031, the middle-class section of the population is expected to grow to 715 million, thereby facilitating the demand for consumer goods, housing, and healthcare. With infrastructure projects focusing on energy efficiency and sustainability ceiling tiles are gaining preference to enhance functionality and aesthetic appeal in buildings.

Government Initiatives

Indian government's focus on affordable housing and urban infrastructure development has created large opportunities for the ceiling tiles market. Initiatives such as the "Housing for All" mission aim to provide affordable housing to all citizens in urban and rural areas by 2024 which would intensify the demand for affordable and durable construction materials including ceiling tiles. The "Smart Cities Mission" also focuses on modernizing the urban infrastructure with sustainable building practices. In line with this, in Budget 2024, the government announced Rs 2.2 lakh crore for the Pradhan Mantri Awas Yojana-Urban aimed at building 1 crore affordable homes for poor and middle-class families. The initiative reflects a commitment to urban development with plans for 3 crore homes over five years. These projects require aesthetically appealing, functional, and environmentally friendly materials to enhance living and working spaces. This has encouraged ceiling tile manufacturers to innovate and supply products tailored to the needs of large-scale government-led construction projects.

India Ceiling Tiles Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India ceiling tiles market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type and application.

Analysis by Product Type:

- Gypsum

- Mineral Fiber

- Metallic

- Calcium Silicate

- PVC

- Wood

- Others

Based on the India ceiling tiles market forecast, gypsum ceiling tiles dominate the India ceiling tiles market because of their versatility, durability and cost-effectiveness. Widely preferred for residential and commercial applications gypsum tiles offer excellent acoustic and thermal insulation making them ideal for spaces such as offices, hotels and hospitals. Their ability to provide a smooth and aesthetically pleasing finish has further enhanced their popularity. The gypsum tiles are light in weight, easy to install and fabricated according to the specific requirements of modern interior designs. The material is also inexpensive and fire-resistant making it the preferred choice among builders and contractors working in India.

Analysis by Application:

- Non-Residential Applications

- Private Sector

- Public Sector

- Residential Applications

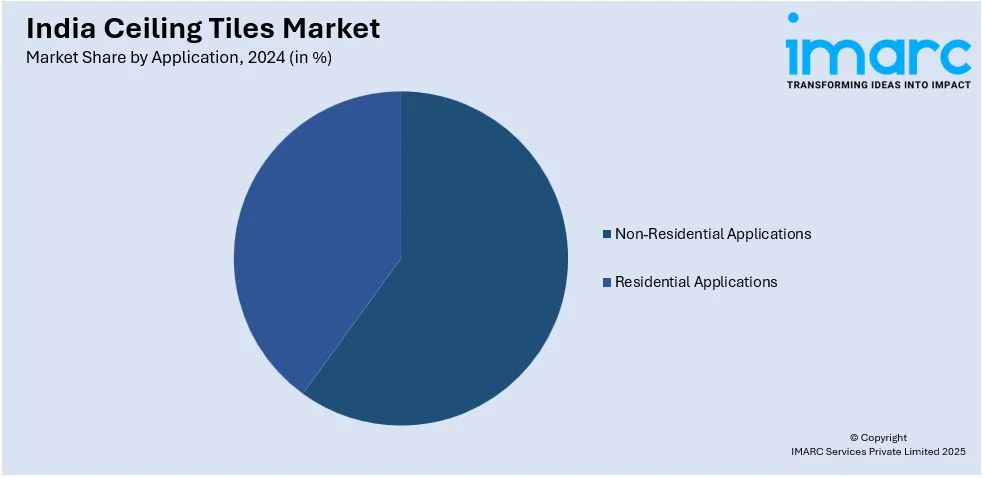

Non-residential applications holds the largest India ceiling tiles market share primarily due to the rapid growth of commercial and industrial spaces. Demand for ceiling tiles in offices, retail stores, shopping malls, hotels, hospitals and educational institutions has contributed greatly to the market's dominance. Non-residential buildings require ceiling tiles that are more durable and possess better acoustic properties and are fire-resistant all of which are covered by materials such as gypsum and mineral fiber. As urbanization increases and infrastructure projects flourish under government initiatives the non-residential sector continues to drive the adoption of ceiling tiles making it the largest application segment in the market.

Regional Analysis:

- South India

- West and Central India

- North India

- East India

South India dominates the India ceiling tiles market which is fueled by rapid urbanization, infrastructure development and the growth of construction activities in the region. Chennai, Bengaluru, Hyderabad, and Kochi are seeing an increase in commercial and residential projects such as IT parks, office buildings, shopping malls and housing developments. The demand for ceiling tiles in these areas is fueled by the preference for modern, aesthetic, and sustainable building materials. The hospitality, education and healthcare sectors in the region are also thriving thus further boosting the India ceiling tiles market demand. The favorable climatic conditions and economic growth in South India continue to make it a key market for ceiling tile manufacturers.

Competitive Landscape:

The India ceiling tiles market is highly competitive with a mix of established players and emerging manufacturers striving to capture market share. Companies in the market focus on offering innovative cost-effective and high-quality products to meet the growing demand across residential and non-residential applications. Key strategies include product diversification such as the development of acoustically efficient, fire-resistant and environmentally friendly ceiling tiles to cater to diverse consumer preferences. Manufacturers are investing in advanced production technologies and expanding their distribution networks to reach new markets. Price competitiveness remains a crucial factor especially with the increasing demand for affordable and sustainable solutions in the affordable housing and commercial sectors. The market is also witnessing collaborations and partnerships to leverage technological advancements and improve market reach.

The report provides a comprehensive analysis of the competitive landscape in the India ceiling tiles market with detailed profiles of all major companies, including:

- Aerolite Industries Pvt. Ltd.

- AWI Licensing LLC

- Diamond International Inex Private Limited

- Everest Industries Limited

- Hunter Douglas India Pvt Ltd. (Hunter Douglas N.V.)

- India Gypsum Pvt. Ltd.

- Knauf AMF GmbH & Co. KG

- Ramco Industries Limited

- Saint-Gobain Gyproc India Ltd (Compagnie de Saint-Gobain S.A.)

- Techno Ceiling Products

- USG Boral Building Products India Pvt. Ltd.

- VANS Gypsum Pvt. Ltd.

- Visaka Industries Limited

Latest News and Developments:

- In November 2024, VOX India announced the launch of a sustainable collection of wall and ceiling panels: Infratop Four Lamella SV26, Fronto SV24 and Welo SV22. These innovative solutions blend aesthetic appeal with durability catering to both residential and commercial spaces and signify a significant advancement in architectural design and material longevity.

- In September 2024, India’s largest tile manufacturer, Kajaria Ceramics announced the acquisition of seven stores in the UK for £400,000 from the administrators of CTD Tiles. The endeavor aims to strengthen relationships with contractors and architects.

- In August 2024, PARÉ Innovations Pvt. Ltd. announced the launch of its new 'Baffle Ceiling System' designed to revolutionize ceiling design with customizable panels available in various shades. The company emphasized ease of installation and aesthetic sophistication reflecting the company's commitment to innovation and growth in both domestic and international markets.

- In December 2023, Saint-Gobain Gyproc India launched a new range of innovative building products, including 'Habito Standard' gypsum board for heavy loading, 'Rigiroc' moisture-resistant board with enhanced features, 'Glasroc X' for superior exterior performance, and 'Metlance' architectural metal ceiling tiles. These products are designed to redefine architectural aesthetics, functionality, and durability, offering comprehensive solutions for both interior and exterior applications, ensuring high performance and long-lasting results.

- In December 2023, Fashion and home decor influencer Hetaa Ramani endorsed Decoraids Decorating Solutions' innovative ceiling panels, lauding their versatility and design options, which include antique, art deco, modern, and wooden styles. The panels, known for their strength, durability, and easy installation, offer a complete makeover for homes, offices, and hospitality spaces. Ramani praised Decoraids as a home-grown brand, highlighting its impact on India's interior decor industry with its holistic wall and ceiling solutions.

India Ceiling Tiles Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Crores, Million Square Meters |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Gypsum, Mineral Fiber, Metallic, Calcium Silicate, PVC, Wood, Others |

| Applications Covered |

Non-Residential Applications (Private Sector, Public Sector), Residential Applications |

| Regions Covered | South India, West and Central India, North India, East India |

| Companies Covered | Aerolite Industries Pvt. Ltd., AWI Licensing LLC, Diamond International Inex Private Limited, Everest Industries Limited, Hunter Douglas India Pvt Ltd. (Hunter Douglas N.V.), India Gypsum Pvt. Ltd., Knauf AMF GmbH & Co. KG, Ramco Industries Limited, Saint-Gobain Gyproc India Ltd (Compagnie de Saint-Gobain S.A.), Techno Ceiling Products, USG Boral Building Products India Pvt. Ltd, VANS Gypsum Pvt. Ltd, Visaka Industries Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ceiling tiles market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India ceiling tiles market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ceiling tiles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ceiling tiles market in india is valued at INR 2,767.19 Crore in 2024.

The key drivers include rapid urbanization, government initiatives like smart city projects and affordable housing schemes, increasing demand for energy-efficient and sustainable materials, and growing infrastructure development in commercial and residential spaces.

IMARC estimates the ceiling tiles market to reach INR 4,782.63 Crore by 2033.

The India ceiling tile market is exhibiting a CAGR of 5.95% during 2025-2033.

Non-residential applications dominate the market due to the rapid expansion of commercial and industrial spaces, particularly in offices, retail outlets, and healthcare facilities.

Some of the major key players in the market include, Aerolite Industries Pvt. Ltd., AWI Licensing LLC, Diamond International Inex Private Limited, Everest Industries Limited, Hunter Douglas India Pvt Ltd. (Hunter Douglas N.V.), India Gypsum Pvt. Ltd., Knauf AMF GmbH & Co. KG, Ramco Industries Limited, Saint-Gobain Gyproc India Ltd (Compagnie de Saint-Gobain S.A.), Techno Ceiling Products, USG Boral Building Products India Pvt. Ltd, VANS Gypsum Pvt. Ltd, Visaka Industries Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)