India Ceiling Light Market Size, Share, Trends and Forecast by Light Source, Mounting Type, Application, Smart Features, Style, and Region, 2025-2033

India Ceiling Light Market Overview:

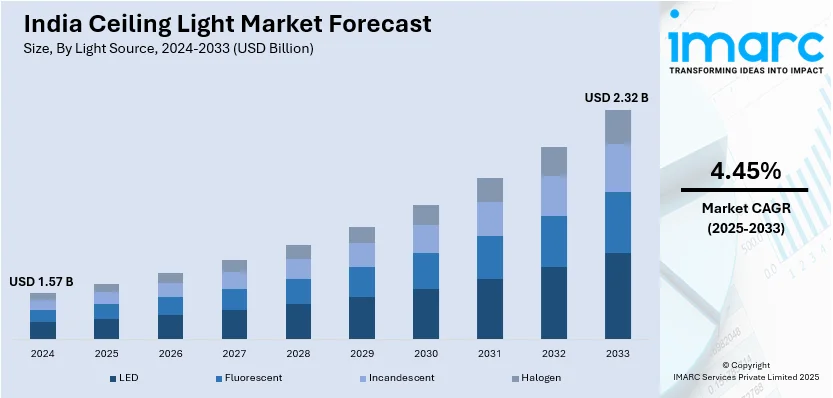

The India ceiling light market size reached USD 1.57 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.32 Billion by 2033, exhibiting a growth rate (CAGR) of 4.45% during 2025-2033. Rising urbanization, increasing disposable income, expanding real estate development, growing adoption of energy-efficient LED lighting, government initiatives promoting smart cities, and advancements in lighting technology are some of the key factors positively impacting the India ceiling light market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.57 Billion |

| Market Forecast in 2033 | USD 2.32 Billion |

| Market Growth Rate (2025-2033) | 4.45% |

India Ceiling Light Market Trends:

Expansion of Energy-Efficient LED Ceiling Lights

The transition from conventional lighting to LED-based lights is a significant factor propelling the India ceiling light market growth. According to an industry report, the Indian LED lighting market size reached USD 5.0 Billion in 2024 and is expected the market to reach USD 26.7 Billion by 2033, exhibiting a growth rate (CAGR) of 19.35% during 2025-2033. Energy efficiency mandates, cost savings, and sustainability concerns further drive this growth. LED ceiling lights use less power than incandescent and CFL and provide high-lumen output and a longer lifespan. Government initiatives such as UJALA (Unnat Jyoti by Affordable LEDs for All) and incentives for LED adoption are facilitating India ceilings light market growth. The fall in the price of LEDs due to bulk production and improved technology is also driving people to switch and replace existing lighting systems. Commercial and industrial sectors are replacing LED panel lights and downlights to reduce electricity bills and meet the green building norm. Additionally, greater awareness of the environment and corporate sustainability initiatives are encouraging households and companies to invest in LED ceiling lights with recyclable material and low carbon footprints.

To get more information on this market, Request Sample

Increasing Demand for Decorative and Customizable Ceiling Lighting

Aesthetic preferences and interior design trends are influencing the demand for decorative and customizable ceiling lights, which is positively influencing the India ceiling light market outlook. Consumers are opting for modern chandeliers, pendant lights, and flush-mounted fixtures that complement architectural styles and enhance ambiance. According to IBEF, the real estate industry in India is anticipated to expand between 2023 and 2028 at a CAGR of 9.2%. The growth of premium residential and commercial real estate, along with rising disposable income, is encouraging investment in designer lighting solutions. Manufacturers are offering a variety of materials, finishes, and modular designs to cater to diverse consumer preferences. Tunable color temperature and remotely controlled brightness are the most popular customization options among urban consumers. Retailers and hospitality businesses in commercial buildings are installing statement ceiling lights to create engaging spaces. The growing popularity of international design trends, as well as growing access to high-end lighting brands in India, is also fueling demand for the decorative ceiling light segment.

India Ceiling Light Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on light source, mounting type, application, smart features and style.

Light Source Insights:

- LED

- Fluorescent

- Incandescent

- Halogen

The report has provided a detailed breakup and analysis of the market based on the light source. This includes LED, fluorescent, incandescent, and halogen.

Mounting Type Insights:

- Recessed

- Surface-Mounted

- Pendant

- Chandelier

A detailed breakup and analysis of the market based on the mounting type have also been provided in the report. This includes recessed, surface-mounted, pendant, and chandelier.

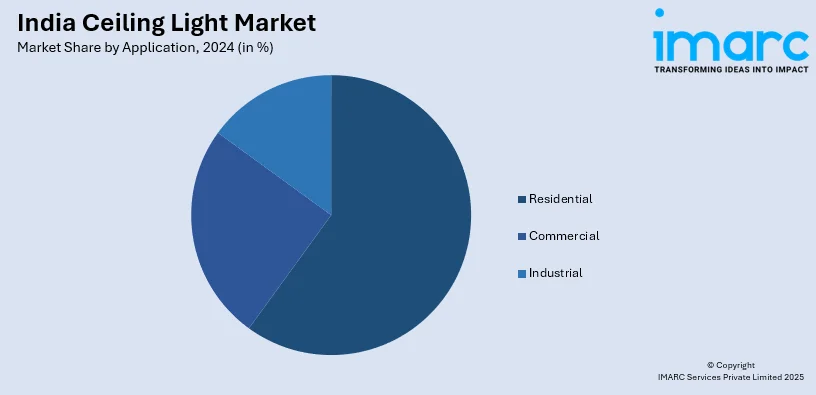

Application Insights:

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, and industrial.

Smart Features Insights:

- Dimmable

- Color-Changing

- Voice-Controlled

- Smart Home Integration

A detailed breakup and analysis of the market based on the smart feature have also been provided in the report. This includes dimmable, color-changing, voice-controlled, and smart home integration.

Style Insights:

- Modern

- Traditional

- Contemporary

- Industrial

- Coastal

The report has provided a detailed breakup and analysis of the market based on the style. This includes modern, traditional, contemporary, industrial, and coastal.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ceiling Light Market News

- On March 7, 2024, Crompton Greaves Consumer Electricals Ltd. introduced the TRIO range of lighting solutions, encompassing ceiling lights, battens, and lamps. Available in authorized retail outlets across India and on leading e-commerce platforms, this collection is designed to enhance home lighting experiences by offering versatile and energy-efficient options. The TRIO range aims to provide consumers with innovative lighting choices that combine functionality with modern aesthetics.

- On June 1, 2024, FIG Living introduced a new collection of pendant lighting designs in the Indian market, featuring handcrafted pieces that have received global media recognition. Notably, their marble paper pendant lamps were awarded Best Designed Home Decor Product at the Ambiente Trends Show 2024 in Messe Frankfurt. The collection also includes viral cloud lights constructed from High-Density Polyethylene Fibers that have been recycled Fibers and raffia pendant lamps, blending modern, minimal, Scandinavian, and Japanese aesthetics.

India Ceiling Light Market Report Coverage

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Light Sources Covered | LED, Fluorescent, Incandescent, Halogen |

| Mounting Types Covered | Recessed, Surface-Mounted, Pendant, Chandelier |

| Applications Covered | Residential, Commercial, Industrial |

| Smart Features Covered | Dimmable, Color-Changing, Voice-Controlled, Smart Home Integration |

| Styles Covered | Modern, Traditional, Contemporary, Industrial, Coastal |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ceiling light market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ceiling light market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ceiling light industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ceiling light market in India was valued at USD 1.57 Billion in 2024.

The India ceiling light market is projected to exhibit a CAGR of 4.45% during 2025-2033, reaching a value of USD 2.32 Billion by 2033.

The India ceiling light market is driven by an increasing urbanization, the growing demand for home and commercial interior decor, and advancements in energy-efficient lighting solutions. Rising disposable incomes, changing user preferences for aesthetic designs, and the expansion of the real estate and construction sectors also contribute to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)