India Catheters Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

Market Overview:

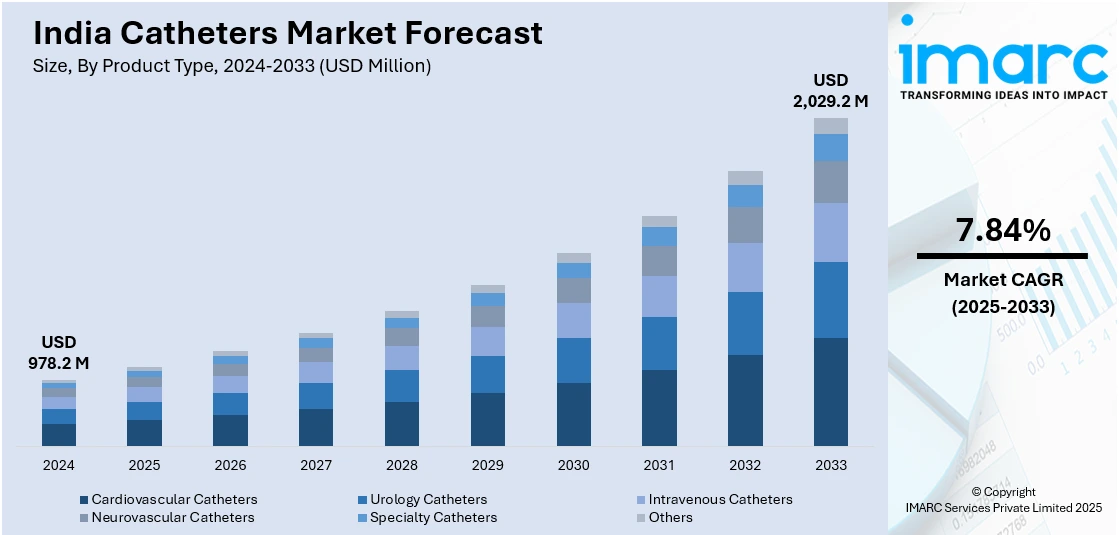

India catheters market size reached USD 978.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,029.2 Million by 2033, exhibiting a growth rate (CAGR) of 7.84% during 2025-2033. The rising incidence of chronic diseases, including cardiovascular diseases, diabetes, and urinary tract disorders, which has contributed to an increased need for catheterization procedures, is driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 978.2 Million |

|

Market Forecast in 2033

|

USD 2,029.2 Million |

| Market Growth Rate 2025-2033 | 7.84% |

A catheter is a medical device used to access and manage the urinary or vascular systems within the human body. It is a thin, flexible tube typically made of rubber, plastic, or silicone. In urology, urinary catheters are inserted into the bladder through the urethra to drain urine when natural voiding is impaired, such as in cases of surgery, injury, or certain medical conditions. Vascular catheters are designed for access to blood vessels, facilitating various medical procedures like intravenous therapy, angiography, or measuring blood pressure. Catheters may have different shapes and sizes, ranging from Foley catheters with inflatable balloons to secure them in place, to central venous catheters for prolonged vascular access. While catheters serve crucial medical purposes, their usage requires careful attention to hygiene and maintenance to prevent complications such as infections.

To get more information on this market, Request Sample

India Catheters Market Trends:

The catheters market in India is experiencing robust growth, primarily fueled by an aging regional population and the increasing prevalence of chronic diseases. As the elderly population expands, the demand for medical interventions rises, contributing to the escalating adoption of catheters. Moreover, advancements in medical technology have led to the development of innovative catheter designs, enhancing their efficacy and patient comfort. Additionally, the growing incidence of cardiovascular diseases, urinary disorders, and neurovascular conditions necessitates the use of catheters for diagnostic and therapeutic purposes. Furthermore, the expanding awareness regarding minimally invasive procedures has driven the demand for catheters, as they play a pivotal role in reducing the invasiveness of medical interventions. The escalating emphasis on home healthcare and the rising trend of outpatient procedures further bolster the catheters market, facilitating patient convenience and healthcare cost containment. Additionally, strategic collaborations between healthcare providers and manufacturers contribute to market expansion, fostering R&D activities. In conclusion, the catheters market in India is propelled by a confluence of demographic shifts, technological innovations, increased disease prevalence, and a growing preference for minimally invasive procedures, signaling a dynamic and flourishing landscape in the healthcare industry.

India Catheters Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Cardiovascular Catheters

- Urology Catheters

- Intravenous Catheters

- Neurovascular Catheters

- Specialty Catheters

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cardiovascular catheters, urology catheters, intravenous catheters, neurovascular catheters, specialty catheters, and others.

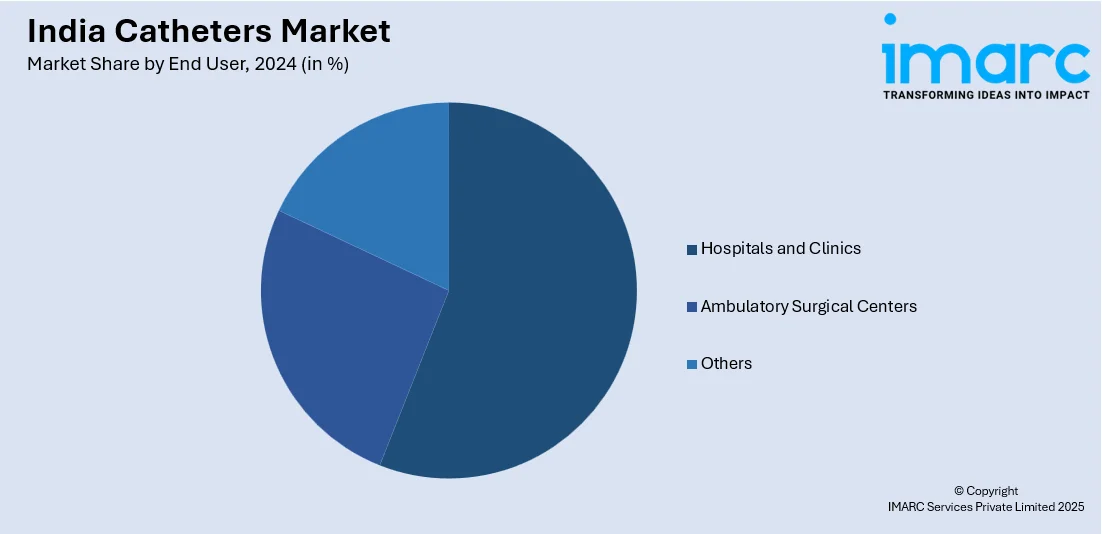

End User Insights:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, ambulatory surgical centers, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Catheters Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cardiovascular Catheters, Urology Catheters, Intravenous Catheters, Neurovascular Catheters, Specialty Catheters, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgical Centers, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India catheters market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India catheters market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India catheters industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India catheters market was valued at USD 978.2 Million in 2024.

The India catheters market is projected to exhibit a CAGR of 7.84% during 2025-2033, reaching a value of USD 2,029.2 Million by 2033.

India's catheter market is driven by rising health issues, greater awareness of medical care, and growing demand for minimally invasive treatments. Improvements in hospital facilities, home care usage, and advanced catheter designs support growth. Supportive healthcare policies and increased private sector involvement also encourage wider adoption across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)