India Catering Services Market Size, Share, Trends and Forecast by Service Type, End-User, and Region, 2026-2034

India Catering Services Market Overview:

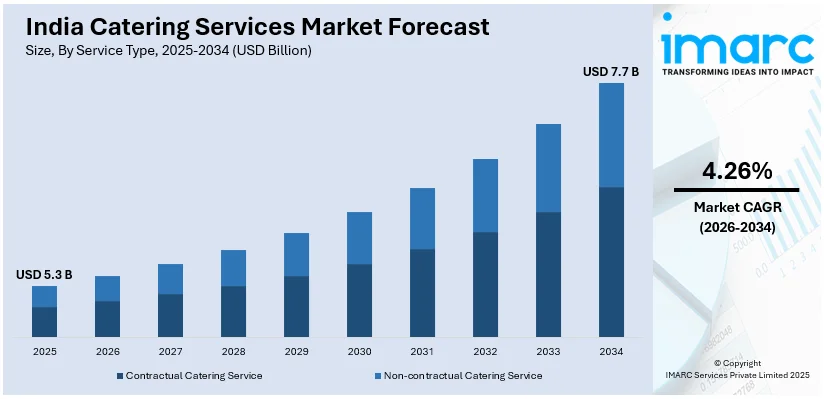

The India catering services market size reached USD 5.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 7.7 Billion by 2034, exhibiting a growth rate (CAGR) of 4.26% during 2026-2034. The market is driven by rising health consciousness, increasing demand for customized and dietary-specific meals, and the growing preference for convenience in urban areas. Additionally, technological advancements, such as online booking platforms and AI-driven solutions, are enhancing operational efficiency and customer engagement, further propelling the India catering services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.3 Billion |

| Market Forecast in 2034 | USD 7.7 Billion |

| Market Growth Rate (2026-2034) | 4.26% |

India Catering Services Market Trends:

Rising Demand for Health-Conscious Catering Options

The escalating shift towards health-conscious food choices, driven by increasing awareness of wellness and nutrition, is favoring India catering services market growth. Consumers are prioritizing meals that are organic, low-calorie, and free from artificial additives. This trend is particularly prominent in urban areas, where busy professionals and families seek convenient yet healthy catering solutions. Caterers are responding by incorporating superfoods, whole grains, and plant-based ingredients into their menus. Additionally, there is a growing demand for customizable meal plans that cater to specific dietary requirements, such as gluten-free, keto, or vegan diets. A meta-analysis of 13 studies showed that vegan diets had both the highest proportion of plant protein (77% to 98%) and the most diverse sources of plant protein. In contrast, semivegetarian-type diets had the smallest percentage (37%–83%) and were composed mostly of grains. Overall, in all dietary patterns, grains had the largest relative contribution to plant protein intake (60%–78%). For vegan diets, the dominant sources of plant protein were found to be soy, beans, peas and lentils. This assessment highlights the need for clearer policies on the intake of plant protein to be encouraged as part of balanced plant-based diets. Besides this, the COVID-19 pandemic has further accelerated this trend, as individuals are more focused on enhancing immunity through nutritious food. As a result, catering companies are partnering with nutritionists and dieticians to design menus that align with these changing consumer preferences, ensuring they remain competitive in a rapidly changing market.

To get more information on this market Request Sample

Adoption of Technology for Enhanced Customer Experience

The market is increasingly leveraging technology to streamline operations and improve customer engagement. Therefore, this is creating a positive India catering services market outlook. Online platforms and mobile apps are becoming essential tools for booking catering services, customizing menus, and tracking orders in real-time. This digital transformation is particularly appealing to tech-savvy millennials and Gen Z consumers who value convenience and transparency. Caterers are also using data analytics to understand customer preferences and predict demand, enabling them to optimize inventory and reduce food waste. Furthermore, the integration of AI-powered chatbots and virtual assistants is enhancing customer support, providing instant responses to queries and personalized recommendations. According to a new report by IMARC Group, the Indian chatbot market has jumped to a value of USD 243.3 Million in 2024 while also reaching a value of USD 1,465.2 Million by 2033, growing at a CAGR of 20.43% between the years 2025 and 2033. Social media platforms are also playing a crucial role in marketing, with caterers showcasing their offerings through visually appealing content and influencer collaborations. As technology continues to transform, it is expected to drive innovation and efficiency in the catering industry, creating a seamless experience for both businesses and customers.

India Catering Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on service type and end-user.

Service Type Insights:

- Contractual Catering Service

- Non-contractual Catering Service

The report has provided a detailed breakup and analysis of the market based on the service type. This includes contractual catering service and non-contractual catering service.

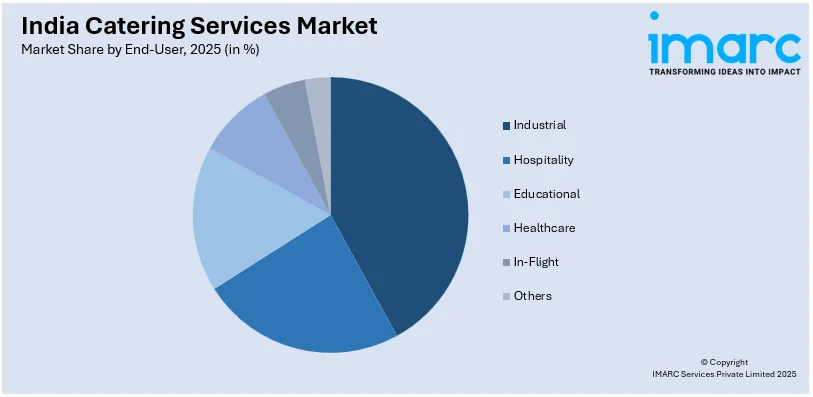

End-User Insights:

Access the comprehensive market breakdown Request Sample

- Industrial

- Hospitality

- Educational

- Healthcare

- In-Flight

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes industrial, hospitality, educational, healthcare, in-flight, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Catering Services Market News:

- July 01, 2024: Elior India inaugurated its state-of-the-art 20,000 sq. ft. kitchen in Hyderabad. The additional 25,000 meals from this facility can be scaled up to 30,000 to make the Indian catering business more than a good meal. The kitchen is designed with the help of the Elior Group, a global leader in the food services industry, to showcase a focus on hygiene, energy-efficient and sustainable solutions, including sewage treatment plants and a planned rainwater harvesting system. Besides corporate catering, Elior India has also added services for educational institutions, healthcare facilities, and banqueting services.

India Catering Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Contractual Catering Service, Non-contractual Catering Service |

| End-Users Covered | Industrial, Hospitality, Educational, Healthcare, In-Flight, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India catering services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India catering services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India catering services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India catering services market was valued at USD 5.3 Billion in 2025.

The India catering services market is projected to exhibit a CAGR of 4.26% during 2026-2034, reaching a value of USD 7.7 Billion by 2034.

The India catering services market is driven by the need for scheduled meal services at weddings, business events, and social gatherings, as well as by increased urbanization and disposable incomes. The expansion of the hospitality sector, changing food preferences, and convenience-focused lifestyles further contribute to the growth of catering services across regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)