India Casein Market Size, Share, Trends and Forecast by Product Type, End Use, and Region, 2025-2033

Market Overview:

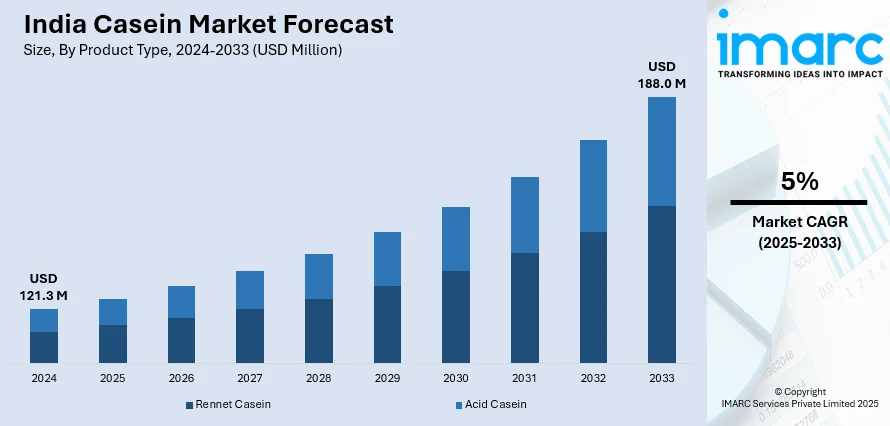

The India casein market size reached USD 121.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 188.0 Million by 2033, exhibiting a growth rate (CAGR) of 5% during 2025-2033. The increasing inclination towards protein rich food products, rising health consciousness, and the growing product adoption in the production of cosmetics and skincare products represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 121.3 Million |

|

Market Forecast in 2033

|

USD 188.0 Million |

| Market Growth Rate 2025-2033 | 5% |

The burgeoning F&B Industry in India Augmenting Market Growth

The India casein market has been experiencing moderate growth. The increasing consumption of ready to eat (RTE) food products on account of rapid urbanization, expanding purchasing power of consumers, growing global population, and changing lifestyle represents one of the major factors driving the demand for casein in India. It can also be attributed to the benefits associated, such as repairing muscle tissues and bones, boosting energy levels, and promoting weight management.

To get more information of this market, Request Sample

Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The market structure is moderately consolidated with the presence of several established players and local players. The competitive environment in this market is likely to increase on account of expanding food products portfolio, product differentiation, and pricing. The volume of new entrants is moderate in the India casein industry due to price sensitive buyers and abundance of raw material in the market. Leading players are also competing in the market on basis of quality of products, pricing offered to their customers, companies brand and reputation.

What is Casein?

Casein is a protein found in the milk of mammals, including cows, buffalo, sheep, yak, and goats. It is a tasteless, odorless, and amorphous white solid that forms a thick paste in the stomach and slows down the rate of protein absorption and digestion in the body. It is generally naturally obtained from casein curdles after the fermentation of milk sugar or through the precipitation of acid casein by adding dilute hydrochloric or sulfuric acid. It is rich in carbohydrates, minerals, amino acids, calcium, phosphorous, and other essential nutrients, which aid in ensuring muscle recovery, enhancing digestion, fueling metabolic rate, lowering blood pressure, and improving body strength.

COVID-19 Impact:

The COVID-19 pandemic outbreak has caused a severe impact on the Indian casein industry and imposed unprecedented challenges in the country. Due to the lockdown, the demand for milk products, such as casein, decreased drastically as restaurants, cafes, hotels, and other food service providers were forced to shut down. This resulted in a sharp decline in the price of casein which caused financial distress for many farmers and producers. Moreover, the disruption in the supply chain due to the lockdown and transportation restrictions contributed to the difficulties faced by the casein industry. As India is a leading exporter of casein and other dairy products, many dairy processing companies had to scale back their operations or shut down entirely, which led to job losses and a decline in the overall economic activity in the sector. The pandemic also resulted in supply chain disruptions and transportation restrictions and reduced employment opportunities in the industry as various processing plants and dairy farms had to scale back their operations. However, the industry also witnessed some positive developments during the pandemic. With the people spending more time at home, the demand for packaged milk and milk products like casein increased. This shift in consumer behavior led to a rise in the production of casein and other milk products by several small scale and large scale producers. Apart from this, the Government of India (GoI) offered various support measures, such as financial assistance and exemptions, to help the casein industry cope with the economic impact of the pandemic. These measures provided some relief to the industry, which allowed it to recover gradually from the adverse effects of the pandemic.

India Casein Market Trends:

Casein is used as an emulsifier in the preparation of various food products and beverages, such as cheese, yogurt, protein bars, bread, muffins, coffee, shakes, and smoothies, which are served across restaurants and other commercial food outlets. This, coupled with significant growth in the food and beverage (F&B) industry, represents one of the major factors strengthening the growth of the market in India. Moreover, the increasing health consciousness and rising awareness among the masses about the health benefits of casein-based food products are favoring the growth of the market. In addition, the growing inclination of individuals towards a healthy and nutritious diet due to the surging prevalence of obesity and other lifestyle diseases and the rising global population with poor metabolic health is influencing the market positively in the country. Apart from this, there is an increase in the use of casein in the manufacturing of baby food and infant formula to improve digestion. This, along with the growing concerns of parents about the balanced nutrition of their children, is creating a positive outlook for the market in the country. Furthermore, the increasing usage of casein in the production of dietary supplements, such as pills, gummies, powders, liquids, and bars, due to the rising consumption of dietary supplements in daily routines for maintaining overall health is bolstering the growth of the market in the country. Besides this, the growing preferences for cosmetics and skincare products, such as hair conditioners, moisturizers, anti-aging, and acne products are driving the use of casein in these products across the country.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India casein market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product type and end use.

Product Type Insights:

- Rennet Casein

- Acid Casein

The report has provided a detailed breakup and analysis of the India casein market based on the product type. This includes rennet and acid casein. According to the report, rennet casein represented the largest segment as it is a milk protein obtained by coagulation of skimmed milk by the action of enzymes (chymosin and pepsin). It is commonly used in the production of processed, spreadable, and sliced cheese across India due to its firmness and elasticity properties. Moreover, the increasing demand for cheese and cheese products and rising consumption of protein health drinks on account of rapid urbanization, quick adoption of western culture, and expanding purchasing power of consumers is influencing the market positively in the country.

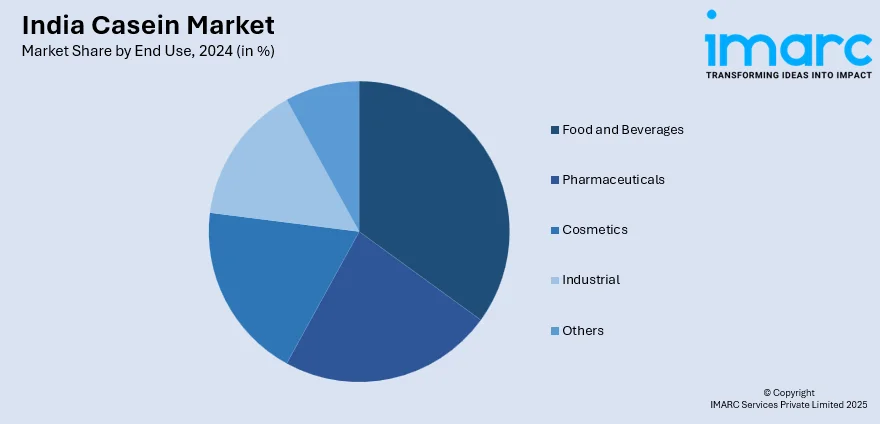

End Use Insights:

- Food and Beverages

- Pharmaceuticals

- Cosmetics

- Industrial

- Others

A detailed breakup and analysis of the India casein market based on the end use has also been provided in the report. This includes food and beverages, pharmaceuticals, cosmetics, industrial and others. According to the report, food and beverages accounted for the largest market share in India as it is used in extruded snack foods to produce the required texture and for nutritional fortification. It is also utilized in fried food as coatings or to reduce oil absorption during the cooking and frying stage of the food. Moreover, changing dietary patterns, increasing health consciousness among the masses, and rising awareness about the associated health benefits are favoring the growth of the market in the country.

Regional Insights:

- North India

- West and Central India

- South India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East India.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India casein market.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Product Type, End Use, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India casein market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the India casein market?

- What is the impact of each driver, restraint, and opportunity on the India casein market?

- What are the key regional markets?

- What is the breakup of the market based on the product type?

- Which is the most attractive product type in the India casein market?

- What is the breakup of the market based on the end use?

- Which is the most attractive end use in the casein market?

- What is the competitive structure of the India casein market?

- Who are the key players/companies in the India casein market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India casein market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India casein market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India casein industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)