India Carton Packaging Market Size, Share, Trends and Forecast by Material Type, Product Type, End User, and Region, 2025-2033

India Carton Packaging Market Overview:

The India carton packaging market size reached USD 6.58 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.98 Billion by 2033, exhibiting a growth rate (CAGR) of 5.85% during 2025-2033. The market is expanding due to rising demand in food and beverage (F&B), healthcare, and personal care industries. The market is boosted by growing consumer inclination towards packaged products, better supply chains, and changing packaging innovations that increase product safety and convenience.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.58 Billion |

| Market Forecast in 2033 | USD 10.98 Billion |

| Market Growth Rate 2025-2033 | 5.85% |

India Carton Packaging Market Trends:

Sustainable Packaging Takes Center Stage

The increasing need for environmentally friendly packaging solutions is fueling innovation in India's carton packaging sector. As consumers become more environmentally conscious, businesses are shifting towards recyclable, biodegradable, and compostable carton materials. For instance, In February 2025, Tetra Pak launched India's first carton pack with 5% certified recycled polymers, aligning with the Plastic Waste Management (Amendment) Rules 2022. Produced at its ISCC PLUS-certified Pune plant. Moreover, eco-friendly packaging solutions like paper-based cartons with water-based coatings or biopolymer linings are becoming popular. Government policies encouraging plastic waste minimization and extended producer responsibility (EPR) norms are also compelling brands to switch to greener options. Moreover, the incorporation of recycled materials and cutting-edge lightweight carton design diminishes carbon traces while preserving the integrity of products. As more consumers become keen on sustainable packaging, companies are concentrating on enhancing manufacturing processes, embracing circular economies, and providing end-of-life solutions to end-users. In general, sustainability is not just a regulatory necessity but also a brand differentiator for companies that want to resonate with green consumers in India's rapidly changing packaging market.

.webp)

To get more information on this market, Request Sample

Rise of Smart and Interactive Carton Packaging

Intelligent and interactive carton packaging is growing as a large trend in India, fueled by technological advancements and shifting consumer demand. Brands are now more regularly adding QR codes, NFC tags, and augmented reality (AR) features into carton packages to improve customer experience. All these technologies deliver consumers instant product information, interactive content, and personalized offers to their smartphones. Furthermore, smart packaging solutions ensure product safety and authenticity through traceability and tamper-proof capabilities. Monitoring freshness and product quality is also made possible with the use of smart sensors in packaging, especially in the food and pharmaceutical industries. With increasing digital engagement, smart carton packaging provides brands with a creative means of reaching tech-conscious consumers, enhancing brand loyalty, and differentiating themselves in a saturated market. This trend manifests the combination of functionality, convenience, and consumer interaction in contemporary packaging solutions.

Growth of Premium and Customizable Packaging

As disposable incomes rise and premiumization is on the way, demand for premium-quality and visually attractive carton packaging in India is gaining momentum. Not only does premium packaging add perceived value to a product, but it also significantly contributes to brand differentiation, particularly in categories such as personal care, cosmetics, and luxury goods. Recreatable packaging options, such as specialty shapes, embossing, metallic colors, and bright graphics, are becoming more popular with brands that want to design unforgettable unboxing experiences. Seasonal and limited-time packaging themes are also being applied to drive sales and build loyalty. The trend is carried through to small businesses and online shopping brands, which are starting to implement custom packaging to suit their brand personality and build emotional connections with customers. As the competition gets tougher, the place of premium and bespoke carton packaging in swaying buying choices is more paramount than ever before.

India Carton Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on material type, product type, and end user.

Material Type Insights:

- Paper and Paperboard

- Plastic

- Biopolymers

The report has provided a detailed breakup and analysis of the market based on the material type. This includes paper and paperboard, plastic, and biopolymers.

Product Type Insights:

- Folding Cartons

- Rigid Cartons

- Liquid Cartons

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes folding, rigid, and liquid cartons.

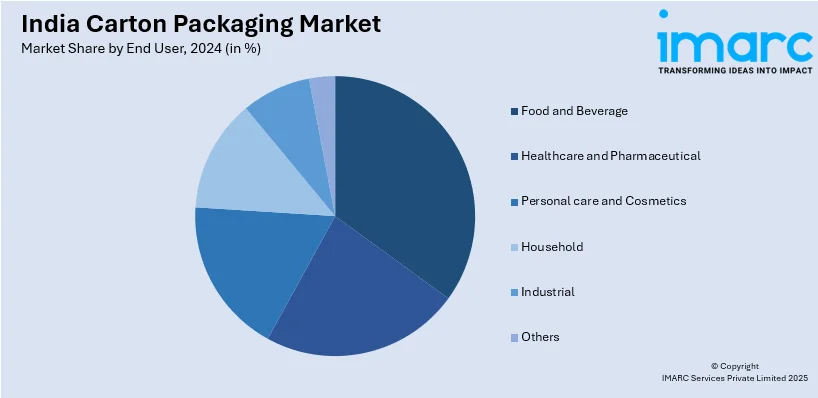

End User Insights:

- Food and Beverage

- Healthcare and Pharmaceutical

- Personal care and Cosmetics

- Household

- Industrial

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes food and beverage, healthcare and pharmaceutical, personal care and cosmetics, household, industrial, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Carton Packaging Market News:

- In February 2024, Engage Cologne made the switch to 100% paper-based recyclable cartons, cutting out metallized plastic layers from its packaging. The environmentally friendly transition is in line with ITC Limited's sustainability objectives, increasing recyclability in the perfumery business and aiding India's drive towards more environmentally friendly consumer product packaging solutions.

- In December 2023, SIG announced development plans for its first aseptic carton factory in Ahmedabad, Gujarat, India. The cutting-edge plant will reinforce SIG's growing filler network, supporting top-tier dairy and non-carbonated soft drink businesses. Construction kicked off in Q1 2023, and commercial production was due by end-2024, boosting in-market packaging strength.

India Carton Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Paper and Paperboard, Plastic, Biopolymers |

| Product Types Covered | Folding Cartons, Rigid Cartons, Liquid Cartons |

| End Users Covered | Food and Beverage, Healthcare and Pharmaceutical, Personal Care and Cosmetics, Household, Industrial, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India carton packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the India carton packaging market on the basis of material type?

- What is the breakup of the India carton packaging market on the basis of product type?

- What is the breakup of the India carton packaging market on the basis of end user?

- What is the breakup of the India carton packaging market on the basis of region?

- What are the various stages in the value chain of the India carton packaging market?

- What are the key driving factors and challenges in the India carton packaging?

- What is the structure of the India carton packaging market and who are the key players?

- What is the degree of competition in the India carton packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India carton packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India carton packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India carton packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)