India Carpet Market Size, Share, Trends and Forecast by Material, Price Point, Sales Channel, End User, and Region, 2026-2034

India Carpet Market 2025, Size and Trends:

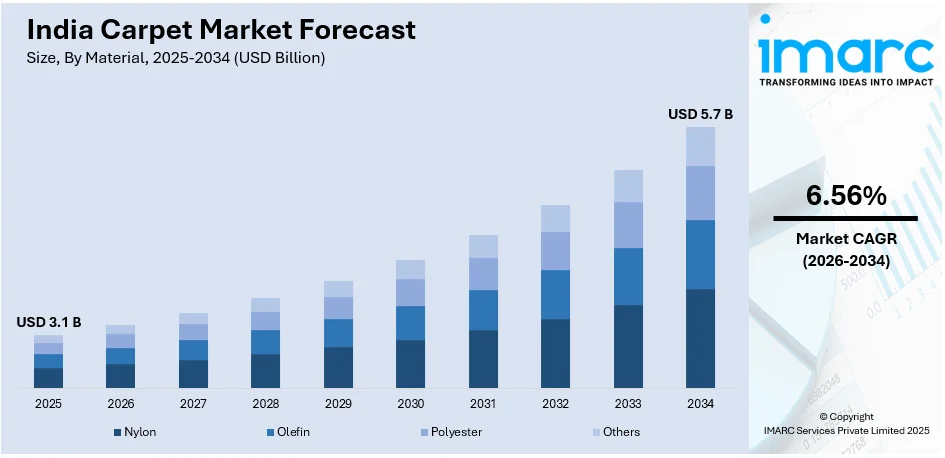

The India carpet market size was valued at USD 3.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 5.7 Billion by 2034, exhibiting a CAGR of 6.56% from 2026-2034. The Indian market is primarily driven by rapid digitalization through e-commerce and social media, rising demand for customized designs using advanced production methods, and a growing focus on sustainability with eco-friendly materials, upcycling initiatives, and certifications for export markets, enhancing its global reputation are boosting the India Carpet market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.1 Billion |

| Market Forecast in 2034 | USD 5.7 Billion |

| Market Growth Rate (2026-2034) | 6.56% |

The market is primarily driven by the rising popularity of intricate designs and craftsmanship among global and domestic buyers. Similarly, the rise in traditional weaving techniques blended with modern patterns, is impelling the market. Furthermore, favorable government initiatives such as the 'India Handloom' Brand and Export Promotion Schemes is playing a pivotal role in supporting artisans and exporters, thereby positively influencing the India carpet market outlook. As of August 20, 2024, the 'India Handloom' Brand has issued nearly 2,000 registrations for 184 product categories, emphasizing high-quality, eco-friendly products. Projects, including the National Handloom Development Programme, support handloom workers through upgraded looms, marketing, and design enhancements, benefiting 151 producer companies. Additionally, rising disposable incomes and growing interest in carpets as interior design elements drive demand, especially in urban regions, positioning India as a leading carpet supplier in global markets.

To get more information on this market Request Sample

Besides this, the increasing demand for sustainable and eco-friendly home furnishings is significantly expanding the market for handwoven carpets made from natural fibers. Indian manufacturers are meeting this demand by producing carpets aligned with environmentally responsible practices, catering to conscious consumers worldwide. As of October 2024, India dominates global handmade carpet exports, accounting for 40% of worldwide handmade carpets. FY23 exports reached USD 1.36 Billion, achieving a CAGR of 7% since 2017-18. Major export markets include the USA (USD 214.84 Million in April-June 2024), Germany, and the UK. Initiatives by the Carpet Export Promotion Council (CEPC) and government programs support artisans, improve marketing capabilities, and enhance global competitiveness. Moreover, e-commerce platforms, trade agreements, and international trade fairs further expand access, combining traditional craftsmanship with modern distribution channels for sustained India carpet market growth.

India Carpet Market Trends:

Shift Towards Digitalization in Sales and Marketing

The market is embracing digital transformation, with e-commerce platforms and online marketplaces becoming vital for connecting with domestic and international consumers. These platforms enable exporters and manufacturers to showcase diverse product ranges, offering virtual experiences with detailed visuals to attract buyers. This shift helps small and medium-sized enterprises (SMEs) bypass traditional distribution challenges and directly engage with global customers. Digital marketing tools, including social media and targeted campaigns, are enhancing the visibility, augmenting sales, and expanding the India carpet market share. Jaipur Rugs exemplifies this trend with its ‘Court of Carpets’ campaign launched on October 8, 2024, featuring tennis icon Rohan Bopanna. The campaign celebrates Indian craftsmanship, highlighting the artistry of over 40,000 rural artisans through its Manchaha Rugs initiative, blending heritage and innovation.

Rising Demand for Customization and Personalization

The carpet market in India is experiencing a rise in demand for customized carpets, driven by consumer preferences for personalized designs, patterns, and sizes that complement unique interior themes. Luxurify, a luxury brand by RKS Carpets, reflects this trend with its hand-knotted carpet collection launched on January 3, 2025, featuring collaborations with supermodels Carol Gracias, Rickee Chatterjee, and Deepti Gujral. The collection seamlessly blends contemporary, modern, and traditional styles, showcasing the craftsmanship of over 10,000 artisans and redefining luxury living for Indian homes and curated office spaces. This growing focus on customization is leading manufacturers to adopt flexible production methods and advanced tools like computer-aided design (CAD), combining traditional techniques with innovative designs to strengthen India's position as a global leader in the manufacturing of high-quality, bespoke carpets.

Increasing Focus on Sustainability

Sustainability is one of the major areas of focus in the industry as buyers are demanding more eco-friendly products. Manufacturers are adopting sustainable practices by using natural fibers such as wool, jute, and organic cotton and implementing processes that reduce environmental impact. Certifications adhering to green standards have become essential, particularly for export markets in Europe and North America. According to IBEF, in FY24, India exported USD 1.34 Billion worth of wool carpets, which accounts for 80% of total wool exports. Woollen yarn and fabrics exports stood at USD 192 Million, while ready-made garments reached USD 202 Million. Total exports of these items from April-January 2023-24 were USD 1.45 Billion, with a CAGR of 3.7% from 2017-2022. Upcycling and recycling efforts, like upcycling the leftovers for a new design, also add an environmental-friendly aspect to Indian carpets and thus bolsters the India carpet market size.

India Carpet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India carpet market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on material, price point, sales channel, and end user.

Analysis by Material:

- Nylon

- Olefin

- Polyester

- Others

Nylon plays a pivotal role in the growth of the India carpet market, primarily due to its superior durability and resilience. As one of the most robust synthetic fibers, nylon is resistant to wear and tear, making it the go-to option for high-traffic areas such as commercial spaces, offices, and hotels. The increasing demand for long-lasting, low-maintenance carpets accelerated its adoption. Additionally, advancements in manufacturing techniques have allowed nylon carpets to retain their appearance and performance for extended periods. These characteristics render nylon an attractive choice for both the domestic and export markets, driving its significant share in the carpet sector’s growth.

Olefin, or polypropylene, is rapidly gaining traction in the market due to its exceptional stain resistance, moisture-wicking properties, and low cost. These attributes enable olefin carpets highly suitable for residential use, especially in regions with humid climates or where easy maintenance is essential. The fiber's resistance to fading and mildew further adds to its appeal, particularly for outdoor or rug applications. Moreover, with a growing preference for sustainable and eco-friendly products, olefin’s affordability and recyclability have positioned it as a competitive option in the market. This, combined with expanding demand for affordable yet high-quality carpeting, fueled olefin’s growth in India.

Polyester is an increasingly important fiber in the market, particularly with the growing demand for eco-friendly alternatives. Known for its softness, vibrant color retention, and affordability, polyester carpets are gaining popularity in both residential and commercial sectors. The rise in consumer awareness regarding environmental sustainability led to increased preference for carpets made from recycled polyester, which are perceived as more eco-conscious. Furthermore, the advancements in polyester fiber technology have improved the durability and stain resistance of these carpets, enhancing their appeal. As polyester aligns with consumer trends toward affordability and sustainability, its market share continues to expand, contributing significantly to the overall growth of India’s carpet industry.

Analysis by Price Point:

- Economy

- Luxury

The economy segment of the carpet market in India is significant attributed to the increasing demand for affordable yet functional flooring solutions in both residential and commercial sectors. As India's middle-class population continues to expand, there is an increasing preference for cost-effective carpets that provide value for money. The growth of the real estate sector, particularly in urban areas, further strengthened the demand for economical carpets. The affordability aspect, coupled with better design and quality, thus makes economy carpets an attractive solution for budget-sensitive consumers, fueling this sector's growth in India.

The luxury segment of the carpet market is experiencing robust growth, driven by the rising disposable income of the affluent class and an increasing penchant for high-end, premium products. Luxury carpets, often made from materials such as silk, wool, and high-quality synthetic fibers, offer superior aesthetics, comfort, and durability. As India’s luxury housing market expands, particularly in metropolitan cities, demand for opulent interiors increased, with luxury carpets being a key component of home décor. Additionally, growing awareness about global design trends and the increasing preference for bespoke, custom-made carpets is fueling the expansion of this segment, allowing luxury carpet brands to capture a larger share of the market.

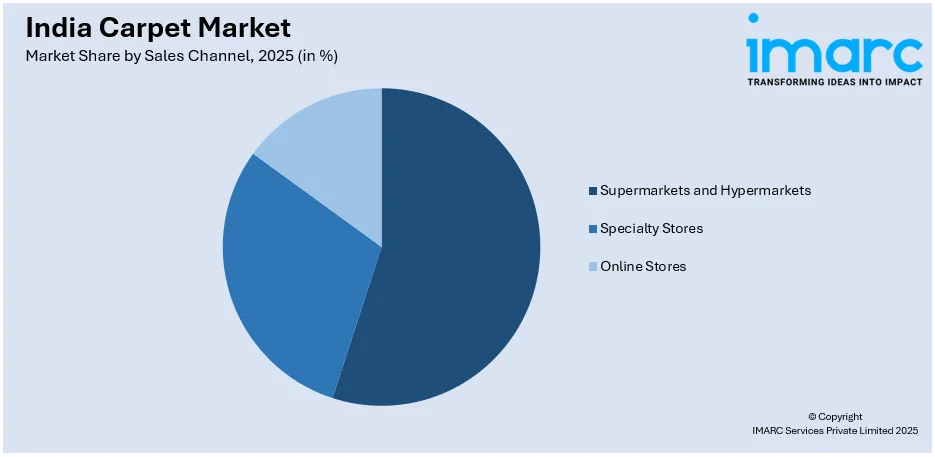

Analysis by Sales Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

Supermarkets and hypermarkets are important players in the India carpet market, providing a diverse selection of economical and practical carpet choices for cost-aware shoppers. The rise of organized retail chains and greater urbanization resulted in the growth of supermarkets and hypermarkets in India, offering a comprehensive shopping hub for carpets. These shops meet the increasing need for affordable carpets, along with convenience for customers seeking fast and easily available choices. The presence of different carpet styles and dimensions in these stores, along with offers and price reductions, fuels the expansion of this sector. Furthermore, the growing preference among consumers for large retail chains instead of traditional stores is driving the expansion of supermarkets and hypermarkets within the carpet market.

Specialty stores, focusing on premium products and exclusive designs, are another vital segment in the market. These stores cater to a niche market that seeks high-quality, luxurious, and customized carpets. The growth of the urban middle class with increasing disposable incomes has driven demand for carpets that not only meet functional needs but also serve as an essential element of home décor. Specialty stores offer personalized shopping experiences, often providing expert guidance and high-end products that attract discerning customers. As consumer preference for unique, designer carpets grow, specialty stores have become integral in fulfilling this demand, thus fueling the growth of the premium carpet market in India.

Online stores have changed the carpet market in India by providing the comfort of home shopping and ample carpet options to consumers. The increasing penetration of internet access and smartphone usage has made e-commerce a primary channel for carpet purchase. In addition, this online platform would offer attractive offers, home deliveries, and back-end return services, which appealed to many for the purchase on the online website. The development of trust of digital payments through a larger size of tech-savvy younger consumption continues to stimulate the growth in the number of online stores through the India carpeting industry.

Analysis by End User:

- Residential

- Commercial

The residential segment is a major driver of growth in the India carpet industry, driven by the growing demand for stylish and functional home décor. As urbanization increases and disposable incomes rise, consumers are more inclined to invest in quality carpets that enhance the aesthetics of their living spaces. The trend of personalization and customization further augmented the demand for carpets, with consumers opting for unique designs that match their home interiors. Additionally, the rising popularity of home renovation and interior design services is contributing to the expansion of the residential carpet market. The growing middle-class population and the increasing demand for affordable yet stylish carpets are key factors fueling growth in this segment.

The commercial sector is witnessing substantial demand, fueled by the rising development of office buildings, hotels, and retail shops. With companies prioritizing the design of visually attractive and cozy spaces for both staff and clients, the need for commercial carpets is increasing. The hospitality industry, specifically, plays a crucial role in this area, as hotels and resorts need long-lasting and aesthetically pleasing carpets to improve guest satisfaction. Moreover, businesses are progressively putting money into sustainable and low-maintenance carpet choices. The growth of corporate offices, retail stores, and the rising demand for high-quality carpets in public areas are key factors fueling the commercial carpet market in India.

Regional Analysis:

- South India

- North India

- West and Central India

- East India

South India plays a significant role in the growth of the India carpet market, with cities like Bengaluru, Chennai, and Hyderabad acting as key hubs for the carpet trade. The region's rising disposable incomes, growing urbanization, and preference for traditional and modern carpet designs have strengthened demand. Additionally, the strong presence of the textile and handloom industries in South India contributes to the availability of high-quality, locally made carpets. The increasing demand for carpets in both residential and commercial sectors is being driven by the expansion of the hospitality industry and the growing number of offices and retail establishments in this region.

North India, with its rich cultural heritage and vibrant handicraft traditions, is a significant contributor to the market. The region is home to traditional carpet-making centers like Kashmir, which is renowned for its hand-knotted carpets. Demand for luxury and artisanal carpets is driven by the region’s growing middle class and increasing awareness about quality home décor. Additionally, the growing urban population and rapid construction of residential and commercial spaces in cities such as Delhi NCR have impelled the market for carpets. The region's affinity for traditional designs combined with modern preferences for synthetic carpets is propelling growth in this segment.

West and Central India are essential regions for the carpet market in India, with Maharashtra, Gujarat, and Madhya Pradesh being major contributors. Mumbai, as a commercial hub, drives the demand for both residential and commercial carpets. The booming real estate sector in cities like Pune and Ahmedabad, coupled with the increasing demand from the hospitality industry, supports the market growth. The region is also seeing a rise in the demand for synthetic carpets, particularly in urban areas. The availability of diverse carpet designs, driven by both domestic manufacturers and imports, ensures that the market can meet the varied needs of consumers in this region.

East India, with its growing textile industry and cultural focus on traditional art forms, is becoming an increasingly important market for carpets. The regions of West Bengal and Odisha are known for their handcrafted carpets, which are in high demand both domestically and internationally. The rising disposable income of consumers and the growing trend of home renovations have stimulated demand for residential carpets. Additionally, the increasing construction of commercial spaces such as offices, shopping malls, and hotels in Kolkata and other urban centers in the region is fostering growth in the carpet market. The focus on sustainability and eco-friendly carpets is also gaining traction in this region.

Competitive Landscape:

The competitive landscape of the India carpet market is diverse and fragmented, with both domestic and international players competing for market share. Domestic manufacturers, particularly from regions like Kashmir and Rajasthan, focus on traditional craftsmanship, producing highly valued hand-knotted and handmade carpets. For instance, on October 8, 2024, Hands unveiled the "KNOTION by Nika Zupanc" collection at ID India Design Mumbai, featuring ten hand-knotted carpets crafted from botanical silk. These contemporary pieces, inspired by knots and life’s journey, showcase intricate geometry and vibrant designs. International brands also play a significant role, offering innovative designs, including synthetic and luxury carpets. E-commerce platforms have intensified competition, giving consumers greater access to diverse carpet collections. Strategic partnerships, manufacturing technologies, and quality customization are essential growth drivers for these players.

The report provides a comprehensive analysis of the competitive landscape in the India carpet market with detailed profiles of all major companies.

Latest News and Developments:

- April 16, 2024: Jaipur Rugs, will showcase its expertise during Milan Design Week 2024 (April 15-21). The brand will present three new collections: Couture, Facade, and Zig Zag. Collaborating with Vimar1991, Michele De Lucchi's ADML, and DAAA Haus, the collections blend traditional Indian craftsmanship with modern design, highlighting India's rich carpet-making heritage on a global stage.

- March 5, 2024: Shalini Misra launched the Stepwells rug collection, inspired by India's ancient stepwells. Collaborating with cc-tapis, the collection features three abstract designs based on iconic stepwells, celebrating their aesthetic, spiritual, and social significance. Hand-knotted by Nepalese artisans, the sustainable, high-craft rugs are available exclusively online at Curio, reflecting Misra’s holistic design values.

- March 24, 2024: Nodana, a bespoke carpet brand founded by Haresh Adnani, debuted in India, offering hand-knotted, custom-designed rugs. Made in Bhadohi, Uttar Pradesh, each carpet is crafted with up to 300 knots per square inch for durability. The brand uses eco-friendly materials and creates unique pieces like Haiku and Nirvana, reflecting global inspirations.

- November 18, 2024: Aquafil Group launched the ECONYL® Bespoke Collection, offering sustainable yarns inspired by natural materials. The collection includes ECONYL® ReLana, ReSeta, and Terra, suitable for handmade, machine-made, tufted, and woven rugs. With a focus on sustainability and performance, Aquafil strengthened its presence in India by locally stocking these eco-friendly finishes for carpet makers.

India Carpet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Nylon, Olefin, Polyester, Others |

| Price Points Covered | Economy, Luxury |

| Sales Channels Covered | Supermarkets And Hypermarkets, Specialty Stores, Online Stores |

| End Users Covered | Residential, Commercial |

| Regions Covered | South India, North India, West and Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India carpet market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India carpet market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India carpet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India carpet market was valued at USD 3.1 Billion in 2025.

Key factors driving the market include ongoing digitalization through e-commerce and social media, increasing demand for customized designs using advanced production methods, heightened focus on sustainability with eco-friendly practices and materials, favorable government initiatives, and rising disposable incomes driving demand for luxury and economy carpets.

IMARC estimates the India carpet market to exhibit a CAGR of 6.56% during 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)