India Cargo Insurance Market Size, Share, Trends and Forecast by Insurance Type, Distribution Channel, End User, and Region, 2025-2033

India Cargo Insurance Market Overview:

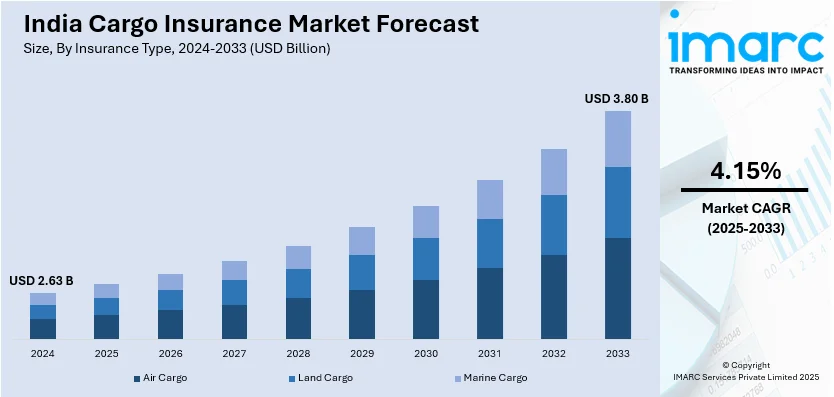

The India cargo insurance market size reached USD 2.63 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.80 Billion by 2033, exhibiting a growth rate (CAGR) of 4.15% during 2025-2033. The market for cargo insurance in India is growing as a result of international partnerships, government initiatives, and technology breakthroughs. Moreover, the need for dependable and effective cargo insurance solutions is further increased by growing trade volumes and risk management requirements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.63 Billion |

| Market Forecast in 2033 | USD 3.80 Billion |

| Market Growth Rate 2025-2033 | 4.15% |

India Cargo Insurance Market Trends:

Government Initiatives for Domestic Insurance

As government efforts are increasing to create a robust domestic insurance system, the Indian cargo insurance market is transforming. The government is working to create a specialized Protection and Indemnity (P&I) insurance company to maintain stability in marine commerce and lessen reliance on international insurers. Shipping companies will benefit from improved coverage, risk management, and financial certainty for cargo movement if domestic insurance capabilities are strengthened. This shift is crucial for India’s growing trade sector, which requires efficient insurance solutions to safeguard against potential losses. In October 2024, the Indian government considered seed funding for a P&I insurance entity, encouraging private insurers and shippers to participate at a later stage. This move is expected to enhance the country’s ability to provide marine coverage, ensuring comprehensive risk protection for vessels. Additionally, proposed amendments to the Insurance Act would enable mutual insurance associations, further strengthening India’s marine insurance sector. By establishing a domestic insurance framework, the market will benefit from reduced costs, improved policy accessibility, and faster claim settlements. It will also boost confidence among global traders and shipping companies operating in India. Strengthening India’s cargo insurance industry through government support will provide long-term stability, improving overall trade security and financial resilience in the logistics sector.

To get more information on this market, Request Sample

Technology-Driven Cargo Insurance Accessibility

The growing demand for cargo insurance in India is driving the adoption of digital solutions that streamline access to coverage. Many transporters, fleet owners, and MSMEs lack awareness or access to reliable insurance options, leading to financial risks in case of accidents or damages. With technological advancements, digital platforms are making cargo insurance more accessible, ensuring higher compliance and efficient risk management for logistics operations. In March 2023, Vahak partnered with SecureNow to offer digital cargo insurance solutions for India’s trucking community. This collaboration enables transporters and businesses to purchase transit insurance at the time of booking, improving coverage rates and reducing administrative overheads. SecureNow’s tech-enabled platform provides comprehensive policies with limited exclusions and an easy claims process, ensuring seamless integration into logistics operations. The rise of digital platforms in cargo insurance is simplifying policy management and increasing adoption among small businesses. With automated processes, transporters can access affordable insurance plans instantly, ensuring better financial security. As more logistics players embrace technology-driven solutions, the cargo insurance market in India is becoming more efficient and inclusive. This trend is set to continue, improving the overall stability and reliability of India’s logistics sector.

India Cargo Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on insurance type, distribution channel, and end user.

Insurance Type Insights:

- Air Cargo

- Land Cargo

- Marine Cargo

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes air cargo, land cargo, and marine cargo.

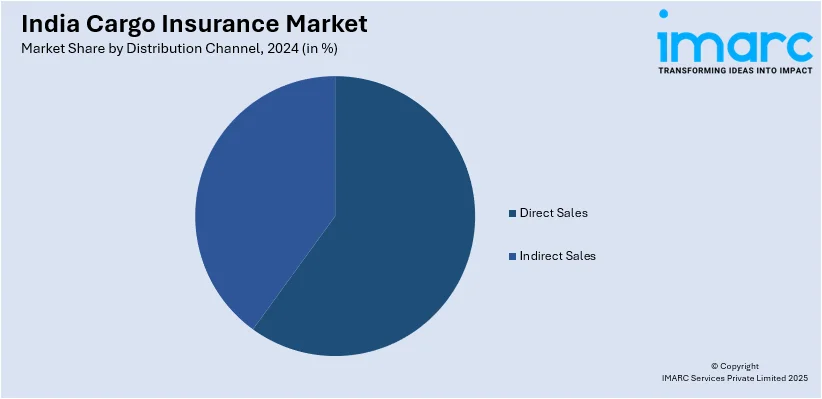

Distribution Channel Insights:

- Direct Sales

- Indirect Sales

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales and indirect sales.

End User Insights:

- Traders

- Cargo Owners

- Ship Owners

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes traders, cargo owners, ship owners, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cargo Insurance Market News:

- January 2025: Soglasie Insurance announced the approval of India for providing marine cover, with extended authorizations for Sogaz, Alfastrakhovanie, and VSK until 2030. This move strengthens India’s cargo insurance industry by ensuring uninterrupted maritime trade, securing oil shipments, and mitigating risks amid evolving global sanctions and regulatory concerns.

India Cargo Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Type Covered | Air Cargo, Land Cargo, Marine Cargo |

| Distribution Channel Covered | Direct Sales, Indirect Sales |

| End User Covered | Traders, Cargo Owners, Ship Owners, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cargo insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cargo insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cargo insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cargo insurance market in India was valued at USD 2.63 Billion in 2024.

The India cargo insurance market is projected to exhibit a CAGR of 4.15% during 2025-2033, reaching a value of USD 3.80 Billion by 2033.

The India cargo insurance market is driven by rising international trade, growing e-commerce logistics, and the need to mitigate risks from theft, accidents, and natural disasters. Increasing regulatory emphasis on risk management and expanding transportation networks further boost demand for comprehensive cargo insurance coverage across sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)