India Cargo Containers Market Size, Share, Trends and Forecast by Type, Size, End User, and Region, 2026-2034

India Cargo Containers Market Overview:

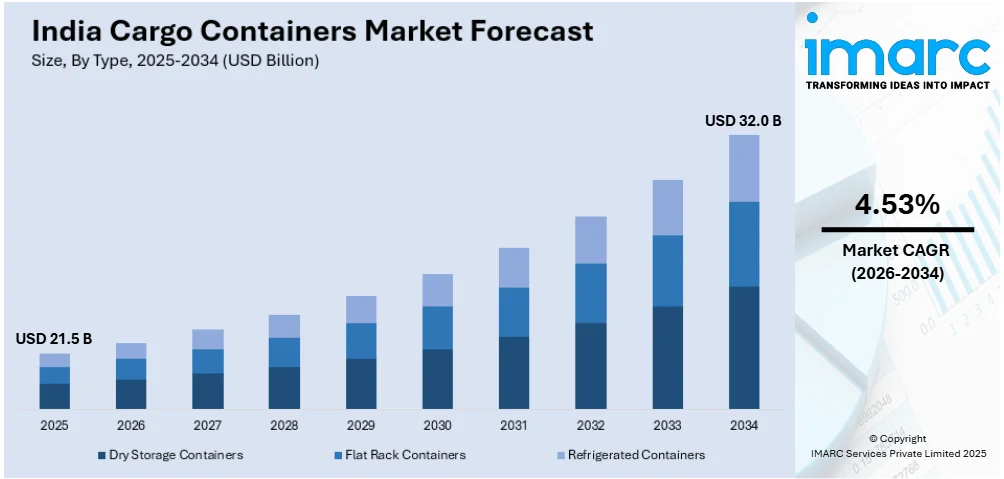

The India cargo containers market size reached USD 21.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 32.0 Billion by 2034, exhibiting a growth rate (CAGR) of 4.53% during 2026-2034. The market for cargo containers in India is expanding due to the rising trade demand, developing infrastructure, and improvements in logistics effectiveness. Moreover, growing investments in container transportation, better connectivity, and less reliance on foreign carriers are boosting cargo movement, expanding the market, and fortifying the nation's position in international trade.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 21.5 Billion |

| Market Forecast in 2034 | USD 32.0 Billion |

| Market Growth Rate (2026-2034) | 4.53% |

India Cargo Containers Market Trends:

Expansion of Domestic Container Shipping Fleet

India is fortifying its cargo container industry by developing its domestic shipping fleet to meet rising trade demands. To increase export and import efficiency and lessen reliance on foreign carriers, a strong container transportation network is necessary. Having a specialized fleet offers stability, cost management, and increased operational flexibility when patterns of international trade change. Also, companies that depend on smooth freight transportation benefit from increased shipping capacity, which aids in supply chain optimization. In February 2025, India announced the launch of Bharat Container Line, a new public-private container shipping venture set to operate a fleet of 100 ships. This initiative enhances India's trade capacity and positions the country as a competitive player in the global maritime sector. By investing in its fleet, India reduces reliance on international carriers, ensuring greater control over freight costs and transit times. As trade volumes continue to grow, a well-developed domestic container shipping network strengthens the country's logistics sector. Businesses benefit from more predictable shipping routes and reduced delays, supporting economic expansion. The move also aligns with India's long-term vision of becoming a global manufacturing and export hub. The expansion of domestic container shipping is set to drive efficiency and resilience in India's cargo container industry.

To get more information on this market Request Sample

Infrastructure Development for Cargo Efficiency

The growth of India's cargo container market is driven by large-scale infrastructure development aimed at improving logistics efficiency. Modernized container terminals play a crucial role in facilitating faster cargo movement, reducing bottlenecks, and enhancing trade competitiveness. As demand for containerized transport rises, investment in logistics infrastructure is essential for handling increasing freight volumes efficiently. In November 2024, Indian Railways announced the development of 23 new container terminals across key states, improving connectivity for cargo movement. These terminals are designed to streamline logistics, attract private investment, and support the projected growth of containerized trade to 91 Million Tons by 2025. By integrating better rail infrastructure, the initiative enhances intermodal transport, reducing transit times and costs for businesses. Upgraded logistics infrastructure strengthens India's trade ecosystem by improving cargo handling efficiency. Increased terminal capacity supports smoother freight movement, leading to reduced congestion at existing ports and rail networks. Private sector participation further accelerates the development of modern logistics solutions. As India continues expanding its container terminal network, the cargo container market will experience sustained growth, driving the country's economic and trade competitiveness.

India Cargo Containers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, size, and end user.

Type Insights:

- Dry Storage Containers

- Flat Rack Containers

- Refrigerated Containers

The report has provided a detailed breakup and analysis of the market based on the type. This includes dry storage containers, flat rack containers, and refrigerated containers.

Size Insights:

- Small Containers (20 ft)

- Medium Containers (40 ft)

- Large Containers (Above 40 ft)

The report has provided a detailed breakup and analysis of the market based on the size. This includes small containers (20 ft), medium containers (40 ft), and large containers (above 40 ft).

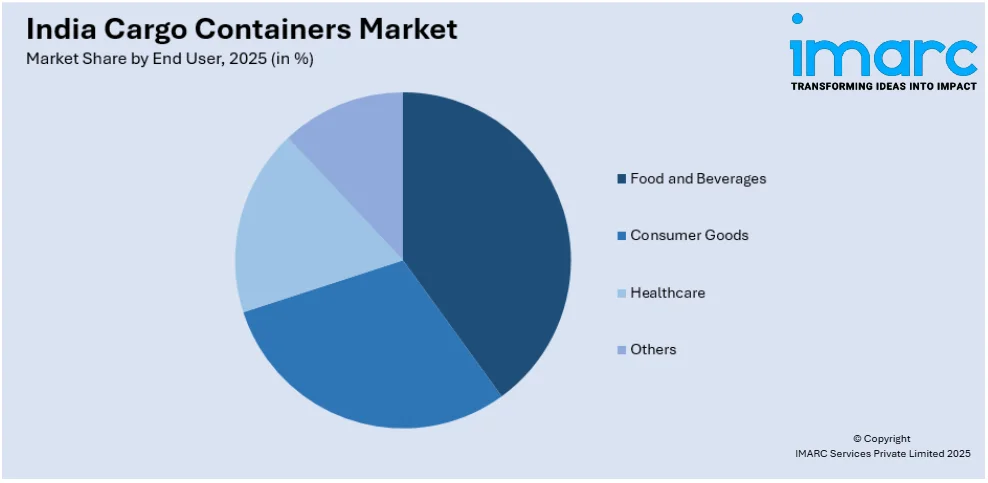

End User Insights:

Access the Comprehensive Market Breakdown Request Sample

- Food and Beverages

- Consumer Goods

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes food and beverages, consumer goods, healthcare and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cargo Containers Market News:

- December 2024: Ocean Network Express (ONE) launched the Indian Ocean Express (IOX) service, linking India, Sri Lanka, and Pakistan with North Europe. This boosts India’s cargo container market by improving trade connectivity, enhancing transshipment via Colombo, and strengthening export-import logistics despite Red Sea security concerns.

- March 2024: MSC launched a feeder shuttle service connecting Paradip, Odisha, to Colombo, Sri Lanka, enhancing trade from India’s eastern region. This strengthens India’s cargo container market by improving port accessibility, boosting export potential, and expanding containerized trade from previously underutilized industrial hubs.

India Cargo Containers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dry Storage Containers, Flat Rack Containers, Refrigerated Containers |

| Sizes Covered | Small Containers (20 ft), Medium Containers (40 ft), Large Containers (Above 40 ft) |

| End Users Covered | Food and Beverages, Consumer Goods, Healthcare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cargo containers market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cargo containers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cargo containers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cargo containers market in India was valued at USD 21.5 Billion in 2025.

The cargo containers market in India is projected to exhibit a CAGR of 4.53% during 2026-2034, reaching a value of USD 32.0 Billion by 2034.

The expansion of domestic container shipping fleets, significant infrastructure development, and increased investments in container transportation are the key drivers of the cargo containers market in India. Additionally, better connectivity, reduced reliance on foreign carriers, and improvements in logistics efficiency are contributing to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)