India Carbon Capture and Storage Market Size, Share, Trends and Forecast by Service, Technology, End Use Industry, and Region, 2025-2033

India Carbon Capture and Storage Market Overview:

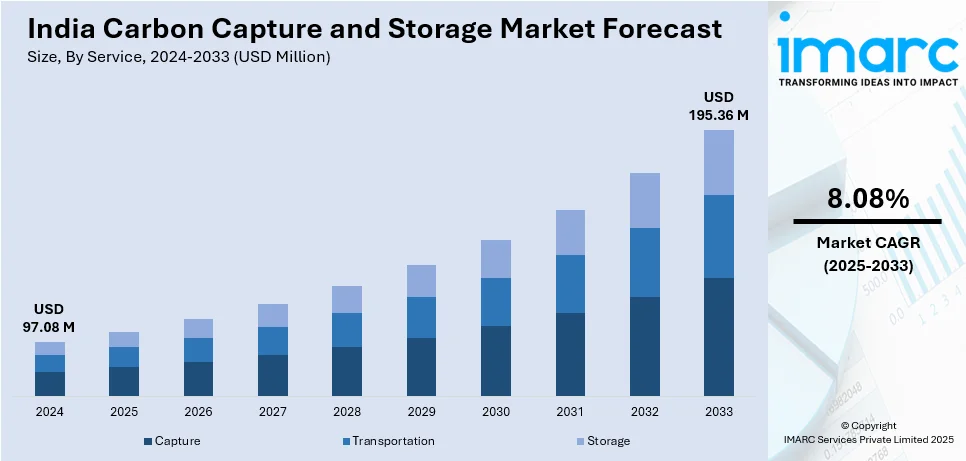

The India carbon capture and storage market size reached USD 97.08 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 195.36 Million by 2033, exhibiting a growth rate (CAGR) of 8.08% during 2025-2033. The strict emission regulations, net-zero commitments, industrial decarbonization needs, and advancements in capture technologies are the factors propelling the growth of the market. Foreign investments, carbon credit incentives, and energy security concerns contribute to CCS adoption in high-emission industries such as electricity, steel, and cement.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 97.08 Million |

| Market Forecast in 2033 | USD 195.36 Million |

| Market Growth Rate 2025-2033 | 8.08% |

India Carbon Capture and Storage Market Trends:

Advancing Carbon Capture for Industrial Decarbonization

Carbon capture and utilization (CCU) is increasingly being used in industrial operations to minimize emissions and meet environmental goals. Adoption of CCU technology leads to efficient CO₂ capture and promotes low-carbon energy options. Government incentives and regulatory assistance are pushing firms to employ carbon capture in high-emission areas, therefore balancing economic development with environmental responsibility. Expanding carbon capture infrastructure is critical for meeting long-term decarbonization targets, reducing reliance on traditional fossil fuels, and improving energy security. Investments in carbon utilization and storage technologies are bolstering emission reduction efforts, establishing CCU as a critical facilitator of climate goals. As companies implement advanced technologies, scalable carbon capture programs are becoming increasingly important for reaching net-zero objectives and contributing to a cleaner ecosystem. For example, in December 2024, New Era Cleantech Solutions received a financial incentive from India's Ministry of Coal for the country's first large-scale coal gasification and carbon capture initiative. This effort aims to achieve 100% CO₂ collection, harmonizing with India's Financial Incentive Scheme to expedite coal gasification and Carbon Capture Utilization (CCU), and supporting net-zero emission goals by 2030.

To get more information on this market, Request Sample

Strengthening Carbon Capture for Emission Reduction

Carbon capture, utilization, and storage (CCUS) is gaining popularity as a key method for industrial decarbonization. Scaling CCUS technology in high-emission industries requires the establishment of a comprehensive regulatory framework as well as the advancement of R&D. Strategic investments in carbon markets and legislative incentives are pushing companies to include carbon capture technology, therefore advancing long-term emission reduction targets. The push for CCUS adoption aligns with sustainability promises, seeking to reduce industrial CO₂ emissions while sustaining economic development. Governments and companies are working together to adopt carbon management systems, guaranteeing a systematic approach to meeting climate objectives. Scalable CCUS technologies are projected to play a critical role in allowing low-carbon industrial processes, encouraging environmental resilience, and speeding up the transition toward net-zero emissions. For instance, in July 2024, the 25th meeting of India's Science, Technology, and Innovation Advisory Council (PM-STIAC) underlined carbon capture, utilization, and storage (CCUS) as a key to decarbonization. It advocated for a CCUS regulatory framework, R&D activities, and carbon market development to reduce emissions in hard-to-abate industries, hence helping India's objective of 45% emission reduction by 2030 and net zero by 2070.

India Carbon Capture and Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on service, technology, and end use industry.

Service Insights:

- Capture

- Transportation

- Storage

The report has provided a detailed breakup and analysis of the market based on the service. This includes capture, transportation, and storage.

Technology Insights:

- Post-combustion Capture

- Pre-combustion Capture

- Oxy-fuel Combustion Capture

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes post-combustion capture, pre-combustion capture, and oxy-fuel combustion capture.

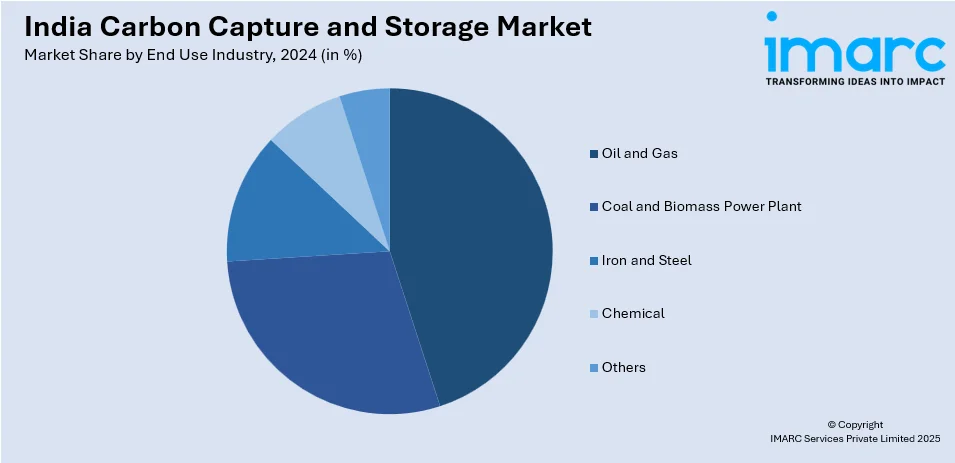

End Use Industry Insights:

- Oil and Gas

- Coal and Biomass Power Plant

- Iron and Steel

- Chemical

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes oil and gas, coal and biomass power plant, iron and steel, chemical, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Carbon Capture and Storage Market News:

- In February 2025, Honeywell and AM Green signed a memorandum of understanding (MoU) during India Energy Week 2025 to evaluate the techno-economic feasibility of manufacturing sustainable aviation fuel (SAF) from ethanol, green methanol from CO₂ emission sources, and green hydrogen. This partnership emphasizes Honeywell's portfolio's association with three compelling megatrends, one of which is the energy transition.

- In December 2024, Larsen & Toubro (L&T) partnered with climate tech firm n0c tech to deliver low-cost and compact carbon capture and storage (CCS) technology across multiple industries. The collaboration intends to deliver cost-effective decarbonization solutions for sectors like steel, cement, oil and gas, chemicals, marine, and energy-from-waste facilities, therefore expanding India's carbon capture and storage industry.

India Carbon Capture and Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Capture, Transportation, Storage |

| Technologies Covered | Post-combustion Capture, Pre-combustion Capture, Oxy-fuel Combustion Capture |

| End Use Industries Covered | Oil and Gas, Coal, Biomass Power Plant, Iron, Steel, Chemical, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India carbon capture and storage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India carbon capture and storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India carbon capture and storage market industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The carbon capture and storage market in India was valued at USD 97.08 Million in 2024.

The India carbon capture and storage market is projected to exhibit a CAGR of 8.08% during 2025-2033, reaching a value of USD 195.36 Million by 2033.

The India carbon capture and storage market is driven by increasing government focus on reducing carbon emissions, particularly in industries like cement, power generation, and oil and gas. Growing awareness about climate change and sustainability, alongside technological advancements in carbon capture solutions, also contributes to market expansion. Furthermore, corporate commitments to achieving net-zero emissions and international collaborations further accelerate market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)