India Car Rental Market Size, Share, Trends and Forecast by Booking Type, Rental Length, Vehicle Type, Application, End-User, and Region, 2026-2034

India Car Rental Market Size and Share:

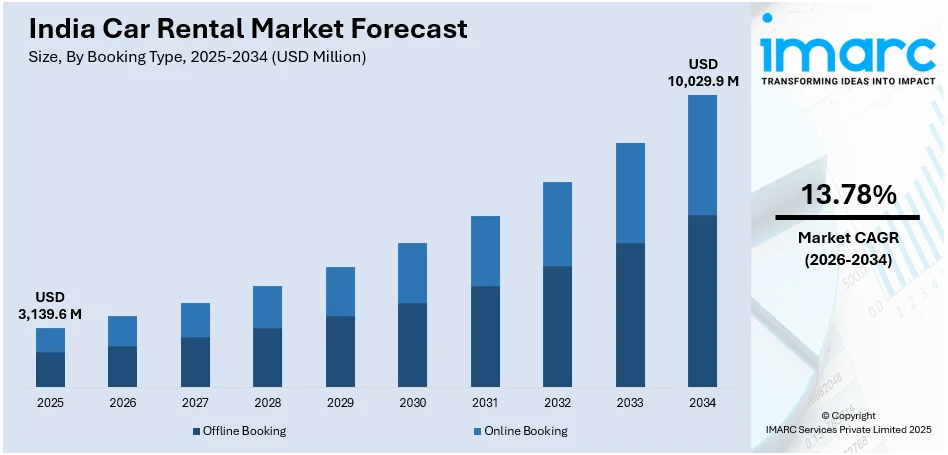

The India car rental market size was valued at USD 3,139.6 Million in 2025. The market is expected to reach USD 10,029.9 Million by 2034, exhibiting a CAGR of 13.78% from 2026-2034. The market growth is attributed to increased tourism, increased disposable incomes, preference for convenience and flexibility in transportation, expansion of the tourism and hospitality sectors, and online platforms that offer competitive pricing and accessibility.

Market Insights:

- Based on region, the market is divided into South India, North India, West and Central India, South India, and East India.

- On the basis of booking type, the market is categorized as offline booking and online booking.

- Based on rental length, the market is segmented into short term and long term.

- On the basis of vehicle type, the market is categorized as luxury, executive, economy, SUVs, and others.

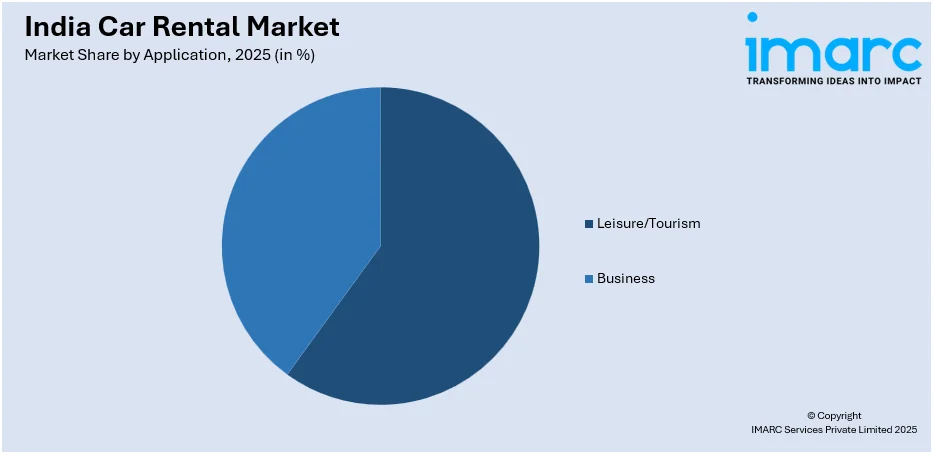

- Based on application, the market is segmented into leisure/tourism and business.

- On the basis of end-user, the market is categorized as delf-driven and chauffeur-driven.

Market Size and Forecast:

- 2025 Market Size: USD 3,139.6 Million

- 2034 Projected Market Size: USD 10,029.9 Million

- CAGR (2026-2034): 13.78%

The India car rental market growth is driven by the rapid expansion of the tourism and hospitality sectors. As per the India Brand Equity Foundation, India's tourism and hospitality sector is expected to generate revenue exceeding US $59 Billion by 2028. This is fueling demand for convenient, short, flexible travel options. As disposable incomes increase across urban and semi-urban areas, travelers, both domestic and international, are opting for car rentals to enhance their experiences. This preference is fueled by a growing middle class seeking comfortable travel solutions without the inconvenience of public transportation. The booming tourism industry, especially in metro cities and tourist destinations, has significantly boosted the demand for rental services, which are ideal alternatives to taxis and other forms of transport. The expansion of hotels, resorts, and travel agencies offering car rental services further expands India car rental industry size.

To get more information on this market Request Sample

With the advantage of door-to-door services and customized packages, car rentals have emerged as a preferred choice for large segments of travelers. Online and mobile-based platforms offering a seamless booking experience have been another factor for growth. To cater to all customers and offer easy accessibility, these websites provide a variety of types of vehicles from economy options to luxury and SUVs-at very competitive prices. Advanced technologies include GPS tracking, real-time vehicle availability, and contactless payment systems, which enhance the convenience and efficiency of car rentals. Increased business travel also contributes to the growing demand for short-term car rentals, as corporate professionals are often traveling and prefer renting cars for their comfort and flexibility. According to the India car rental market analysis, rising urbanization and increasing demand for personalized, on-demand mobility services are projected to significantly drive market growth. This surge is further supported by evolving consumer preferences and rapid advancements in technology, collectively accelerating the demand for car rentals across the country.

India Car Rental Market Trends:

Increasing number of self-drive rentals

Growth in self-drive rentals segment is prominently visible in India the most prominent segment of the car rental market for the Indian business is self-drive rental services. The traditional chauffeur-driven rentals are being gradually substituted by self-drive options, mainly catering to millennials and young working professionals who prefer privacy, independence, and flexible travel schedules. The shift has greatly been driven by urbanization and lifestyle modifications where consumers want vehicles for personal usage as against the long-term responsibilities associated with car ownership. Self-drive rentals have become easily accessible and affordable with the emergence of platforms like Zoomcar, Revv, and Myles, which offer hatchbacks to SUVs for an hour, a day, or a week. The convenience of app-based bookings, real-time tracking of vehicles, and contactless payments have further added to the comfort of customers. Adding to this momentum, EV Story highlights that Zoomcar, in collaboration with SPARKCARS, is set to introduce over 1,000 electric vehicles to its platform across India within the next two years from 2024. This move aligns with the growing emphasis on sustainable and hassle-free mobility solutions, particularly in metro cities and tourist hubs where self-drive rentals and on-demand electric vehicles are becoming increasingly sought after.

Technological integration in car rentals

Technological advancements are driving significant transformation in the India car rental market trend, making it more efficient, user-friendly, and adaptable to evolving consumer demands. The integration of AI, machine learning, and data analytics enables rental companies to offer highly personalized experiences by analyzing customer behavior, preferences, and travel patterns. These tools also optimize fleet management, enabling better vehicle utilization and cost reduction. Features like GPS navigation, automated keyless entry, and real-time vehicle diagnostics enhance user convenience and safety, providing a seamless driving experience. Easy booking and payment for tech-savvy customers are possible due to mobile applications, which allow integration with digital wallets, UPI systems, and contactless payments. Rental companies monitor the vehicle performance in real-time, undertake maintenance at appropriate times, and adhere to stringent safety standards, again with technology as a backbone. Another significant shift for the sector is the acceptance of electric vehicles. With EV charging infrastructure coming up all over India, more customers are buying into this model. Several rental companies are adding EVs to their fleets, appealing to eco-conscious consumers while aligning with sustainability goals. This shift reduces carbon footprints and positions the industry as a critical player in India’s green mobility drive, further boosting its growth and evolution.

Rise in subscription-based car rentals

Subscription-based car rentals are emerging as a key trend in car rental industry in India, offering a middle ground between renting and owning a vehicle. This model provides consumers with the flexibility to use cars on a monthly or yearly subscription basis without the financial burden of ownership. Services typically include insurance, maintenance, and roadside assistance, ensuring a hassle-free experience. Companies like Ola Drive and Zoomcar are now offering subscription plans wherein vehicles may be availed of without heavy upfront costs. These offerings appeal to individuals and corporate clients alike, especially expatriates, business professionals, and urban dwellers who need vehicles for limited periods. As congestion in urban areas rises and consumer preferences shift toward personalized, commitment-free options, subscription-based models are poised to gain significant traction.

Recent Developments in the India Car Rental Market:

The market is witnessing a wave of innovative hybrid models that are reshaping mobility solutions. An industry report highlights a significant surge in car rental-related searches during Summer 2025, marking a 21% rise compared to the same period in 2024. This notable year-on-year increase reflects the growing demand and heightened consumer interest in car rental services. As a response, several startups have introduced peer-to-peer car sharing platforms, enabling private vehicle owners to rent out their cars directly. This approach enhances fleet availability while creating additional income streams. Concurrently, regional operators are trialing dynamic pricing mechanisms based on real-time traffic conditions and demand fluctuations, adapting surge pricing strategies from ride-hailing services to suit daily rental scenarios. As per the India car rental industry report, another emerging trend is the adoption of micro-subscription plans, which allow users to pay fixed daily or weekly rates for unlimited mileage, appealing especially to freelancers, students, and remote workers. Apart from this, firms in tourist-centric areas are launching digital adventure kits, offering virtual previews, personalized local itineraries, and in-app concierge services—positioning car rentals as comprehensive travel lifestyle solutions.

India Car Rental Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India car rental market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on booking type, rental length, vehicle type, application, and end-user.

Analysis by Booking Type:

- Offline Booking

- Online Booking

The report has provided a detailed breakup and analysis of the market based on the booking type. This includes offline booking and online booking. Offline booking, which involves traditional methods such as reservations through physical offices, travel agents, or phone calls, continues to hold relevance in tier-2 and tier-3 cities, and among older demographics. This segment appeals to customers seeking personal interaction and tailored advice, offering a sense of trust and familiarity. It also remains an essential option in regions where digital literacy or smartphone penetration is relatively low, ensuring accessibility for all. Online booking is driven by the growing adoption of technology and the unparalleled convenience it offers. Digital platforms, including mobile apps and websites, allow customers to compare prices, check vehicle availability, and make instant bookings from the comfort of their homes. Online booking has specifically become attractive and appealing to such urban, technically savvy consumers that mostly belong to the generation of millennials or Gen Z, targeting ease and freedom. Internet growth has played the most crucial part in this journey. The Internet in India 2024 stated the active Internet users' number in the country to be about 886 Million users in 2024, meaning an 8% year-on-year growth. This digital boom, along with the popularity of digital wallets and UPI-based payments is augmenting the car rental industry share in India. This shift has firmly established online booking as the dominant mode in the country’s car rental market.

Analysis by Rental Length:

- Short Term

- Long Term

Short-term rentals usually vary from a few hours to a few days and are the most popular among tourists and occasional users. This segment is driven by the demand for flexible, on-demand transportation for a specific duration, such as travel, business trips, or weekend getaways. Short-term rentals are highly in demand in tourist hotspots, cities with heavy tourist traffic, and for last-minute travel plans. Long-term rentals, typically spanning weeks and months, are more in demand, especially among business travelers, expatriates, and those who will need a car for a longer period, however, don't want to be burdened with buying or leasing a car. Long-term rental often offers extras such as the cost of maintaining the car and its insurance altogether, allowing the user of the car, who requires a vehicle for an extended period, to enjoy services at a considerably cheaper rate compared to car ownership. Increased preference is even witnessed in cities categorized as tier-2 or tier-3, where buying and owning cars is not easy or desirable to people.

Analysis by Vehicle Type:

- Luxury

- Executive

- Economy

- SUVs

- Others

The luxury car market targets the high-income population, corporate travelers, and international visitors seeking comfort and status in an international automobile for themselves. It covers brands like Mercedes-Benz, BMW, and Audi. Executive vehicles find a perfect middle ground of comfort and price as they appeal to corporate customers and working professionals seeking comfort with business-class service at a lesser cost than a luxury car. The economy vehicle segment is the most affordable, featuring budget-friendly cars like hatchbacks and sedans. It appeals to budget-conscious travelers and those seeking cost-effective transportation options. SUVs, with their larger capacity and rugged capabilities, are preferred for long-distance travel, off-road trips, or family vacations. This segment caters to those looking for more space, comfort, and versatility.

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Leisure/Tourism

- Business

Leisure and tourism are key drivers of the Indian car rental market since domestic travel continues to grow. People are increasingly using car rentals as they are more comfortable, flexible, and convenient for visiting cities, historical sites, and natural destinations at one's own pace without having to rely on public transportation. Rental services catering to this segment provide both short-term and long-term options, tailored to diverse travel itineraries. The tourism sector has been promising in terms of its contribution to the car rental market. As per the India Brand Equity Foundation, international tourist arrivals in India are going to reach 30.5 Million by 2028, thus increasing its share in supporting leisure travel through car rentals. An adaptable and hassle-free mobility solution is offered to tourists. Thus, with an increase in tourism, car rental services demand will be raised, and most of it comes from the business segment. Corporate travelers often require transportation for meetings, conferences, and professional engagements, with a preference for executive cars or chauffeur-driven services to ensure punctuality, professionalism, and comfort. Companies also rely on rental cars for employee travel or to accommodate consultants who frequently move between locations. Moreover, the rise in remote working and business expansion has fueled demand for corporate mobility solutions, making the car rental market a key enabler for business operations.

Analysis by End-User:

- Self-Driven

- Chauffeur-Driven

Self-driven car rentals are gaining popularity among consumers who seek independence and flexibility during their travel. This segment attracts younger generations, including millennials and tech-savvy users, who prefer the freedom of driving themselves without any time restrictions or additional costs associated with hiring a driver. Self-driven rentals allow consumers to experience complete autonomy in choosing travel routes, stops, and schedules. The market for self-drive rentals is primarily driven by mobile applications and digital platforms that provide convenience, transparency, and a wide range of vehicle choices. Chauffeur-driven rentals, however, remain the popular choice for business travelers, senior citizens, and those who prefer a more premium, hassle-free experience. This service provides added comfort, especially for long-distance travel or trips to unfamiliar cities. Chauffeurs also ensure a higher level of safety, convenience, and local expertise, making it an appealing option for foreign tourists and business executives.

Regional Analysis:

- South India

- North India

- West & Central India

- East India

South India is among the most driving forces since it has so many tourist hotspots in places like Tamil Nadu, Karnataka, and Kerala. Big cities, such as Bengaluru, Chennai, and Hyderabad, are leading markets for hiring due to burgeoning IT hubs and increased disposable income. Executives as well as chauffeur-driven cars are in huge demand among these cities in catering to corporate executives and professionals who travel by hiring cars on a rental basis. India is rapidly urbanizing, with the World Bank estimating that by 2036, 600 million people, which is 40% of the population, will be living in urban areas. Urbanization is driving the demand for car rentals as it is influencing the metro cities and business centers. North India, comprising cities like Delhi, Jaipur, and Chandigarh, is another important contributor expanding the car rental industry size in India. This region boasts rich cultural heritage and historic icons that have placed it among the biggest tourism centers, whereas the increase in business travel and infrastructural developments increases demand for car rentals. The western and central Indian regions of Maharashtra, Gujarat, and Madhya Pradesh also contribute significantly to the car rental market. Cities like Mumbai and tourist destinations such as Goa will drive demand. The East India region is developed yet is in a growth cycle. The states of West Bengal and Odisha, which have infrastructural development happening and an increasing focus on tourism and urbanization, are experiencing high demand for rentals.

Competitive Landscape:

Market players in the Indian car rental industry are adopting innovative strategies to enhance their offerings and maintain a competitive edge in this evolving market. A key trend is the integration of technology, as companies leverage AI, machine learning, and data analytics to optimize fleet management, personalize customer experiences, and improve operational efficiency. These advancements enable companies to meet the dynamic demands of a tech-savvy customer base while streamlining operations. Many companies are expanding their vehicle portfolios to include electric vehicles (EVs) in response to the growing demand for sustainable mobility solutions. This is in line with the increasing environmental consciousness among consumers and the push for eco-friendly transportation options. According to the India car rental market forecast, subscription-based rental models are poised to gain more popularity as they offer flexibility to customers who prefer commitment-free, on-demand mobility solutions. Market players are making alliances with hotels, airlines, and travel agencies to enhance the value proposition by ensuring hassle-free travel for the consumer. Tier-2 and tier-3 cities have tremendous potential, and hence, the companies are penetrating these markets and are now growing hubs due to increased urbanization and tourism. The India Brand Equity Foundation states that India's travel market is in a great deal of growth as it is set to reach US$ 125 Billion by FY27. This growth would require innovative strategies to capture the rising demand for mobility solutions. Aggressive promotional campaigns, loyalty programs, and discounts are being offered to attract new customers and retain existing ones to maintain growth in the competitive landscape. These efforts together create a positive India car rental market outlook.

The report provides a comprehensive analysis of the competitive landscape in the India car rental market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: Zoomcar Holdings announced a strategic partnership with CARS24 aimed at elevating vehicle quality and safety standards across its self‑drive rental fleet. Under the collaboration, CARS24 will conduct comprehensive Pre‑Delivery Inspections covering mechanical, electrical, and safety systems, tagging compliant vehicles as “verified” on Zoomcar’s platform to boost renter trust and host earnings. Additionally, Zoomcar will install advanced GPS trackers to enable real‑time vehicle monitoring and driver‑behaviour tracking.

- April 2025: GoWheelo, a leading two-wheeler rental aggregation platform in India, announced the launch of its car rental vertical as part of a strategic expansion and brand repositioning initiative. The move aims to reinforce GoWheelo’s vision of becoming a holistic urban mobility partner, supported by a refreshed brand identity. With operations across more than 55 cities, the company enters the car rental segment.

- April 2025: Cityflo revealed its plans to venture into the four-wheeler rental market with the launch of a new service named “Luxe”. The move responds to urban India’s unmet demand for reliable, high-quality car rentals, addressing customer pain points including poorly maintained vehicles, erratic cancellations, untrained drivers, and inconsistent fares. Backed by marquee investors, Cityflo plans to scale Luxe across major metropolitan markets.

- December 2024: ZEVO launched its innovative EV rental app to revolutionize electric mobility in India, targeting consumers and gig workers with seamless bookings and detailed EV specifications. CEO Aditya Singh Ratnu said that it aimed to make sustainable mobility accessible, focusing on eco-conscious solutions in metros and urban centers, driving EV adoption nationwide.

- December 2024: Zoomcar Holdings Inc. Launched "Zoomcar Cabs" as a pilot in Bengaluru, priced affordably. It was designed to be driven by chauffeurs and allowed users to select from specific car models using AI for transparency and adaptability. In the future, it would work toward improving the experience for customers by expanding in 2025, subject to the result of the pilot.

- March 2024. Eco Mobility began to service tier-II and tier-III cities. The company added EVs and luxury cars to its fleet, aimed to grow its corporate client base, and operated in 100 cities with over 9,000 cars. It followed an asset-light model and advanced technology systems.

- February 2024: Rego partnered with Reliance Jio-BP to power its pan-India corporate car rental services with EV charging solutions. Jio-BP's Pulse Fleet Program offers Rego exclusive discounts and preferential charging. Rego plans to achieve a 100% green fleet by 2030 and recently launched corporate EV lounges in major Indian cities.

- February 2024: MakeMyTrip acquires a majority stake in Savaari Car Rentals to expand its network from 2,000 to 4,000 cities in six months. This will use MakeMyTrip's technology and consumer insights to transform the USD 6-USD8 Billion intercity car rental market, with an emphasis on online penetration, standardization, and customer-centric innovation.

India Car Rental Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Booking Types Covered | Offline Booking, Online Booking |

| Rental Lengths Covered | Short Term, Long Term |

| Vehicle Types Covered | Luxury, Executive, Economy, SUVs, Others |

| Applications Covered | Leisure/Tourism, Business |

| End-Users Covered | Self-Driven, Chauffeur-Driven |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India car rental market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India car rental market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India car rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India car rental market was valued at USD 3,139.6 Million in 2025.

The India car rental market is driven by the increased tourism, increased disposable incomes, preference for convenience and flexibility in transportation, expansion of the tourism and hospitality sectors, and online platforms that offer competitive pricing and accessibility.

The India car rental market is estimated to exhibit a CAGR of 13.78% during 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)