India Car Loan Market Size, Share, Trends and Forecast by Type, Car Type, Provider Type, Tenure, and Region, 2025-2033

India Car Loan Market Overview:

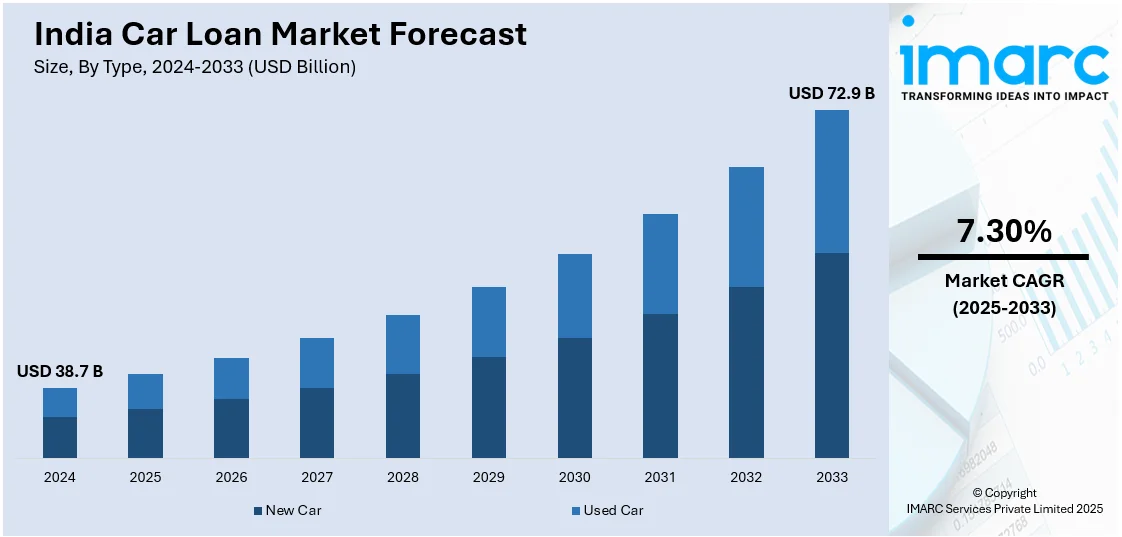

The India car loan market size reached USD 38.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 72.9 Billion by 2033, exhibiting a growth rate (CAGR) of 7.30% during 2025-2033. Rising disposable incomes, growing middle-class aspirations, urbanization, and increased vehicle ownership are driving the market demand. Additionally, favorable interest rates, digital loan processing, attractive financing schemes, government initiatives, and the growing demand for electric vehicles further boost market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 38.7 Billion |

| Market Forecast in 2033 | USD 72.9 Billion |

| Market Growth Rate (2025-2033) | 7.30% |

India Car Loan Market Trends:

Digital Transformation in Loan Processing

India's car loan market is undergoing a rapid digital transformation, driven by growing internet penetration and mobile adoption. The surge in Unified Payments Interface (UPI) transactions, from 5.4 billion in FY 2018-19 to 83.8 billion in FY 2022-23, highlights widespread digital financial acceptance. Banks and NBFCs are leveraging artificial intelligence (AI), machine learning (ML), and digital know your customer (KYC) for auto-underwriting, streamlining loan approvals, and reducing turnaround times. Paper-based processes are being substituted with web platforms and mobile apps, providing speedier disbursals and more convenience. Real-time tracking of loans and equated monthly installment (EMI) calculators add to customer confidence. As digital-savvy millennials opt for digital transactions, digital car loans are the new choice. This change comes in line with India's thrust towards a cashless economy and higher financial inclusion, upholding transparency and ease of vehicle finance.

To get more information on this market, Request Sample

Surge in Used Car Financing

The rising demand for used vehicles is driving a noticeable trend in used car financing across India. Affordability concerns, economic uncertainties, and improved reliability of pre-owned cars are pushing more consumers toward this segment. Financial institutions are increasingly offering tailored loan products for used cars with flexible repayment options and competitive interest rates. Further, the rise of used car organized dealerships and internet-based auto marketplaces has increased access to car evaluation as well as financing. Enhanced vehicle verification technologies and risk assessment methodologies have allowed lenders to lower default risks. With middle-class populations opting for affordable mobility solutions, used car loan portfolios are experiencing strong growth, playing an important role in the overall growth of the Indian car loan market.

Customized Loan Products and Flexible Repayment Options

The other upcoming trend in the Indian automobile loan space is the provisioning of differentiated loan products for a variety of customer segments. Lenders are offering customized solutions in terms of credit rating, income levels, and car choices. Flexible loan tenures, step-up EMI plans, zero down payment plans, and balloon payment schemes are gaining traction with customers, particularly first-time buyers and salaried customers. These innovations drive affordability and extend access to funding. Lenders are also moving toward partnering more closely with vehicle manufacturers and dealerships to sell bundled packages, promotional rates, and loyalty rewards. These individualized financial instruments not only borrow more customers, but they create long-term ties between lenders and customers, all of which propel the market competitiveness.

India Car Loan Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, car type, provider type, and tenure.

Type Insights:

- New Car

- Used Car

The report has provided a detailed breakup and analysis of the market based on the type. This includes new car and used car.

Car Type Insights:

- SUV

- Hatchback

- Sedan

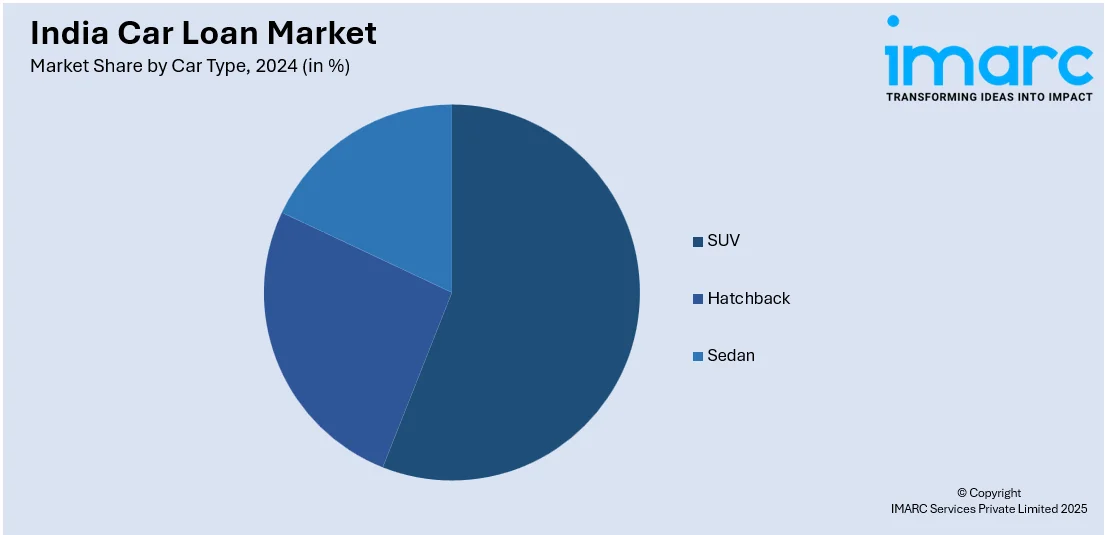

A detailed breakup and analysis of the market based on the car type have also been provided in the report. This includes SUV, hatchback, and sedan.

Provider Type Insights:

- OEM (Original Equipment Manufacturers)

- Banks

- NBFCs (Non Banking Financials Companies)

The report has provided a detailed breakup and analysis of the market based on the provider type. This includes OEM (original equipment manufacturers), banks, and NBFCS (non banking financials companies).

Tenure Insights:

- Less Than 3 Years

- 3-5 Years

- More Than 5 Years

A detailed breakup and analysis of the market based on the tenure have also been provided in the report. This includes less than 3 years, 3-5 years, and more than 5 years.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Car Loan Market News:

- In March 2025, Poonawalla Fincorp Ltd launched secured loans for both new and used commercial vehicles, targeting small, light, and heavy vehicle operators. Initially covering 68 locations across 12 states, the company plans to expand to 400 locations in 20 states using a hub-and-spoke model. Focused on Tier 2 and Tier 3 cities, the loans offer simplified documentation and flexible payments to support transportation and logistics sector growth across India.

- In February 2025, CARS24 expanded its loan offerings through its platform LOANS24, which initially focused on used car financing. The platform will now provide new car financing, purchase financing, loans against cars, and top-up loans. The initiative, active through a pilot phase in recent weeks, aims to enhance CARS24’s financial services. CARS24 Financial Services Private Limited, a wholly-owned subsidiary established in 2019, is driving this broader financial services expansion.

India Car Loan Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | New Car, Used Car |

| Car Types Covered | SUV, Hatchback, Sedan |

| Provider Types Covered | OEM (Original Equipment Manufacturers), Banks, NBFCs (Non Banking Financials Companies) |

| Tenures Covered | Less Than 3 Years, 3-5 Years, More Than 5 Years |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India car loan market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India car loan market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India car loan industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The car loan market in India was valued at USD 38.7 Billion in 2024.

With an increase in the urban population and a desire for convenient transportation, the demand for car loans is consistently rising. In addition, financial institutions and non-banking finance companies are offering appealing loan choices with competitive rates of interest and limited documentation, enhancing the accessibility of car ownership. Moreover, the availability of online loan application services and quicker approval timelines is fueling the market growth.

The India car loan market is projected to exhibit a CAGR of 7.30% during 2025-2033, reaching a value of USD 72.9 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)