India Car Insurance Market Size, Share, Trends and Forecast by Coverage, Application, Distribution Channel, and Region, 2025-2033

India Car Insurance Market Size and Share:

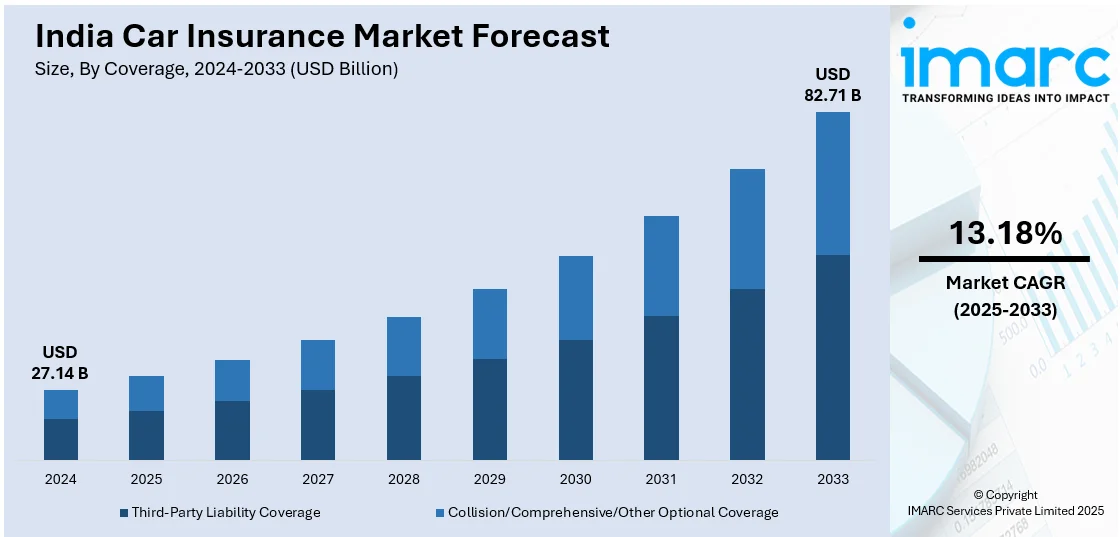

The India car insurance market size reached USD 27.14 Billion in 2024. The market is expected to reach USD 82.71 Billion by 2033, exhibiting a growth rate (CAGR) of 13.18% during 2025-2033. The market growth is attributed to digitalization, customized pricing schemes, and environment-friendly policies, led by AI-driven solutions, usage-based insurance, and rising electric vehicle (EV) adoption.

Market Insights:

- On the basis of region, the market has been divided into North, South, East, and West India.

- On the basis of coverage, the market has been divided into third-party liability coverage, and collision/comprehensive/other optional coverage.

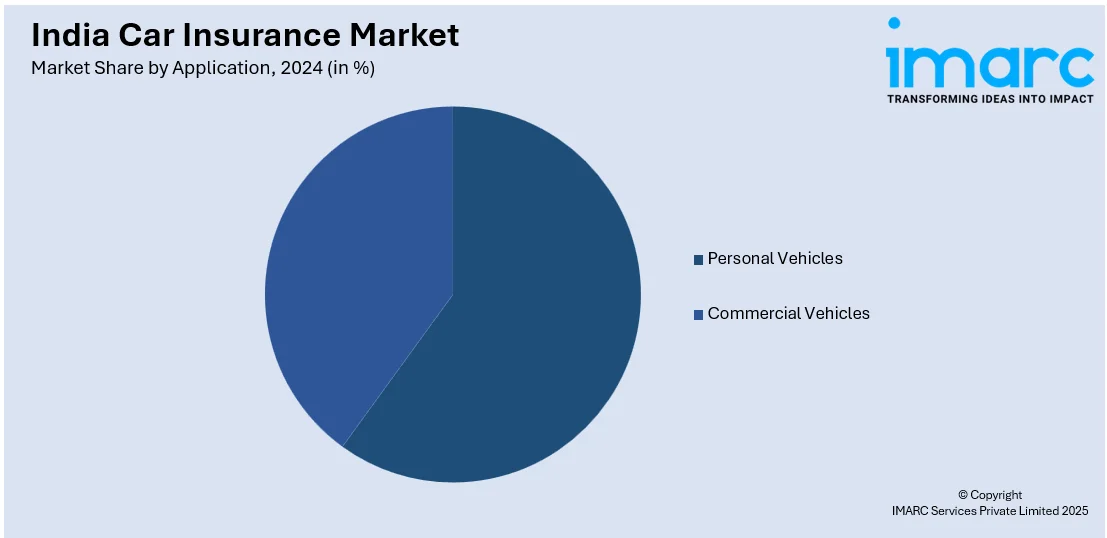

- On the basis of application, the market has been divided into personal vehicles and commercial vehicles.

- On the basis of distribution channel, the market has been divided into direct sales, individual agents, brokers, banks, online, and others.

Market Size and Forecast:

- 2024 Market Size: USD 27.14 Billion

- 2033 Projected Market Size: USD 82.71 Billion

- CAGR (2025-2033): 13.18%

India Car Insurance Market Trends:

Increased Adoption of Digital and AI-Powered Solutions

The India car insurance market is moving towards digital platforms and AI-based solutions, offering an overall improved customer experience. Insurers are using artificial intelligence (AI), machine learning (ML), and big data analytics more and more to simplify policy issuance, claims processing, and risk evaluation. Chatbots and virtual assistants based on AI are enhancing customer interaction through real-time policy suggestions and claim status notifications. Also, digital-first strategies like paperless policy issuance and online verification processes are accelerating policy issuance and streamlining it. Telematics and usage-based insurance models are increasingly integrated, enabling insurers to provide customized premiums depending on driver behavior. For example, in August 2024, Zuno General Insurance launched the "Pay How You Drive" car insurance add-on, making use of mobile telematics to deliver dynamic premiums and renewal discounts that reward good driving behavior. Furthermore, more consumers making purchases and renewals via mobile apps and online channels are causing businesses to prioritize smooth digital experiences, making them more accessible and convenient. This shift towards tech-infused insurance offerings is poised to reshape the way policies are purchased, administered, and claimed in India.

To get more information on this market, Request Sample

Personalization and Usage-Based Insurance Models

Customized motor insurance policies are gaining traction in India as insurance companies embrace innovative pricing strategies that tailor to personal driving behavior and risk profiles. Pay-as-you-drive and pay-how-you-drive UBI models are picking up momentum as policyholders can pay premiums on actual car usage and driving habits. Telematics technology, used to gather immediate feedback on mileage, braking habit, and speeding, is facilitating the provision of customized policies for insurers that compensate good drivers through reduced premiums. It benefits clients through encouraging sensible driving and merit-based pricing while better risk exposure ability is in the interest of insurers. Customizable policies granting short-term duration coverage or set add-ons reflecting personalized requirements are gaining traction too, which is impacting the car insurance industry size in India. For instance, in March 2025, Policybazaar launched a 'monthly mode' car insurance policy, which provides flexible short-term Own Damage protection. This innovation is in line with changing consumer behavior and digital-first payment patterns, ensuring convenience and affordability. Moreover, as consumers want more control over their insurance policies, usage-based and customized policies are likely to emerge as a major differentiator in the India car insurance sector, making insurance more affordable and transparent.

Growing Emphasis on Sustainability and Green Insurance

With growing environmental consciousness, the India car insurance industry is slowly embracing sustainability-based initiatives. Insurers are launching green insurance policies that provide incentives for electric vehicles (EVs) and hybrid cars in the form of reduced premiums and specialized coverage for battery protection. With the government encouraging EV adoption through subsidies and regulatory incentives, insurance companies are modifying their products to address this emerging segment. Also, eco-friendly measures that incentivize low-emission driving or the use of environmentally friendly vehicle parts are also getting into the spotlight, contributing to the India car insurance market growth. Electronic issuance of policy and paperless claim settlement are also adding to the sustainability cause by minimizing the carbon footprint of insurance activities. Insurers are also looking at collaborations with EV makers and charging point providers to provide bundled solutions. As the Indian automotive ecosystem shifts towards greener mobility solutions, automobile insurance companies are framing their strategies along sustainability objectives, bringing environmentally sound policies within the reach of more customers.

Enhanced Digital Distribution Channels and Fintech Integration

Digital innovation in of distribution channels is augmenting the car insurance market share in India. Traditional insurance distribution models are being disrupted by fintech partnerships, aggregator platforms, and direct-to-consumer digital channels that offer seamless customer experiences. Mobile applications, comparison websites, and integrated financial platforms are becoming primary touchpoints for policy purchases and renewals. The emergence of embedded insurance within automotive ecosystems, ride-sharing platforms, and e-commerce marketplaces is creating new revenue streams and customer acquisition channels. Insurance companies are leveraging partnerships with banks, NBFCs, and digital payment platforms to reach the underserved segments and expand the car insurance market size in India. Advanced analytics and customer journey mapping are enabling personalized product recommendations and dynamic pricing models. The integration of blockchain technology for transparent claim processing and smart contracts for automated policy management is further enhancing operational efficiency. Digital wallets and UPI-based payment systems are simplifying premium payments and creating frictionless customer experiences. This digital transformation is not only improving accessibility but also reducing distribution costs, enabling insurers to offer competitive premiums while maintaining profitability in the market, creating a positive India car insurance market outlook.

Regulatory Reforms and Compliance Technology Advancements

The evolving regulatory landscape and technological compliance frameworks are significantly impacting the India Car Insurance Market growth trajectory. The Insurance Regulatory and Development Authority of India (IRDAI) has introduced progressive reforms including sandbox regulations for insurtech innovations, liberalized pricing guidelines, and simplified product approval processes. These regulatory changes are fostering innovation while ensuring consumer protection and market stability. Compliance technology solutions including automated regulatory reporting, risk monitoring systems, and fraud detection algorithms are becoming essential infrastructure investments for insurance providers, augmenting the India car insurance market share. The implementation of Insurance Information Bureau (IIB) databases and centralized motor insurance verification systems is enhancing transparency and reducing fraudulent claims. Data localization requirements and privacy regulations are driving investments in secure data infrastructure and cybersecurity measures. The introduction of standardized APIs for inter-company data sharing and claim settlement processes is streamlining industry operations. RegTech solutions are enabling real-time compliance monitoring and automated regulatory filings, reducing operational overhead. Additionally, the focus on financial inclusion through microinsurance products and rural penetration initiatives is expanding the addressable market. These regulatory and technological advancements are creating a more robust, transparent, and customer-centric car Insurance industry in India.

Growth, Opportunities, and Challenges in the India Car Insurance Market:

- Growth Drivers of the India Car Insurance Market: The rapid digitization of insurance processes and increasing vehicle ownership rates across urban and semi-urban areas are propelling substantial market expansion. Government initiatives promoting mandatory insurance compliance and rising awareness about financial protection are strengthening the Car Insurance industry in India foundation. The growing adoption of usage-based insurance models and telematics technology is creating innovative value propositions for consumers.

- Opportunities in the India Car Insurance Market: The untapped rural market presents significant penetration opportunities with increasing vehicle ownership and infrastructure development in tier-2 and tier-3 cities. Strategic partnerships with automotive manufacturers and fintech platforms can enhance distribution reach and customer acquisition capabilities. The emerging electric vehicle segment offers specialized insurance product development opportunities for sustainable mobility solutions.

- Challenges in the India Car Insurance Market: Intense price competition and regulatory pressure on premium rates are constraining profitability margins across the Car Insurance industry size in India landscape. High claim ratios due to increasing road accidents and vehicle repair costs pose operational challenges for insurers. Consumer preference for lowest-cost policies over comprehensive coverage limits revenue growth potential despite expanding market volumes.

India Car Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on coverage, application, and distribution channel.

Coverage Insights:

- Third-Party Liability Coverage

- Collision/Comprehensive/Other Optional Coverage

The report has provided a detailed breakup and analysis of the market based on the coverage. This includes third-party liability coverage, and collision/comprehensive/other optional coverage.

Application Insights:

- Personal Vehicles

- Commercial Vehicles

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes personal vehicles and commercial vehicles.

Distribution Channel Insights:

- Direct Sales

- Individual Agents

- Brokers

- Banks

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales, individual agents, brokers, banks, online, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Car Insurance Market News:

- In May 2025, InsuranceDekho, the CarDekho-backed insurance platform, finalized a share-swap merger with insurtech startup Renew Buy. This merger, pending regulatory approval, positions the combined entity among India’s top three physical insurance distributors, substantially increasing premium volume and digital insurance reach.

- In May 2025, Magma General Insurance expanded its motor insurance reach by partnering with Toyota Tsusho Insurance Broker India Pvt. Ltd. (TTIBI). Through this collaboration, TTIBI will distribute Magma’s motor insurance products via its network of 150 dealers, targeting both private and commercial passenger vehicles. This partnership aims to improve accessibility and operational efficiency in India’s car insurance market.

- In May 2025, Park+ entered the motor insurance space through a partnership with ICICI Lombard, aiming to revolutionize the way car owners buy and claim insurance. This expansion follows its growth in the FASTag business and plans to diversify into the used car market with Cars24, targeting a revenue of Rs 500–700 crore before considering an IPO.

- In June 2024, Kotak General Insurance entered into a strategic partnership with Zurich, with the latter acquiring a 70% stake in the company. This partnership positions Kotak General Insurance as a leading player in India’s general insurance market, aiming to drive growth in commercial, motor, and retail insurance sectors.

- In March 2024, ACKO released the second installment of its car insurance campaign with Saif and Sara Ali Khan. The campaign debunks myths regarding dealer-forced insurance and promotes ACKO's hassle-free renewal process and value-added services for greater customer convenience.

India Car Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Coverages Covered | Third-Party Liability Coverage, Collision/Comprehensive/Other Optional Coverage |

| Applications Covered | Personal Vehicles, Commercial Vehicles |

| Distribution Channels Covered | Direct Sales, Individual Agents, Brokers, Banks, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India car insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India car insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India car insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The car insurance market in India was valued at USD 27.14 Billion in 2024.

The India car insurance market is projected to exhibit a CAGR of 13.18% during 2025-2033, reaching a value of USD 82.71 Billion by 2033.

Key factors driving the India car insurance market include rising vehicle ownership, stricter regulatory mandates (such as third-party insurance), and growing consumer awareness about coverage benefits. Additionally, digital distribution channels, simplified claim processes, and the introduction of tailored usage-based and add-on policies are enhancing accessibility and market penetration.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)