India Calibration Services Market Size, Share, Trends and Forecast by Service Type, Calibration Type, End Use Industry, and Region, 2025-2033

India Calibration Services Market Overview:

The India calibration services market size reached USD 0.60 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.80 Billion by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033. The market is progressing with growing demand for precise measurement in healthcare, manufacturing, and energy. Additionally, mobile calibration units, digital compliance platforms, regulatory reform, and a growing emphasis on quality assurance in the public and private sectors are the market drivers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.60 Billion |

| Market Forecast in 2033 | USD 0.80 Billion |

| Market Growth Rate 2025-2033 | 3.90% |

India Calibration Services Market Trends:

Improving Access to Calibration Services in Remote Healthcare

Increased demand for reliable diagnostic equipment in urban and rural healthcare environments is driving India's calibration services market. With the hospital and clinic sector increasingly dependent on sophisticated medical equipment, maintaining routine calibration is essential in order to prevent misdiagnosis and delays in treatment. Mobile solutions are already starting to emerge as a means to reach geographically challenged areas and deliver quality assurance to the point of care. This has generated interest in calibration units that are portable and can work under changing field conditions, without loss of accuracy. This is directly applicable to primary health centers and minor clinics that are not equipped with high-quality testing facilities. For instance, in April 2024, IIT Madras launched India’s first mobile calibration facility for medical devices. The unit is designed to travel across the country and offer on-site testing, calibration, and safety verification of essential medical instruments. It follows international testing standards and reduces both operational and logistical costs associated with equipment servicing. By eliminating the need to transport devices to centralized labs, this facility brought a new level of accessibility and affordability to medical device calibration. The initiative aligned with national health goals and added momentum to the calibration services market by expanding service coverage and improving quality assurance in healthcare delivery.

.webp)

To get more information on this market, Request Sample

Digitalization of Compliance and Metrology Processes

Rising regulatory demands and the need for a uniform compliance structure are pushing the Indian market toward digital integration. Businesses working with weighing and measuring instruments face complexity in navigating state-specific legal metrology systems, which can delay operations and create inconsistencies. With growing trade volumes and increased scrutiny on measurement accuracy, the push for a single-window platform to streamline documentation and verification has become a strong driver. This shift is enabling faster license renewals, reducing human error, and bringing transparency to inspection and stamping processes. In December 2024, the Indian government introduced the eMaap portal to consolidate and digitize legal metrology functions across states. The portal enabled centralized management of licenses, verification records, and enforcement data, simplifying compliance for both manufacturers and users of calibrated instruments. By allowing real-time access to regulatory information and reducing manual intervention, eMaap improved the ease of doing business in the calibration ecosystem. The system also generated structured datasets that can help in future policy development. This digital infrastructure marked a key turning point in the modernization of India’s calibration services market, improving operational efficiency and encouraging broader industry participation.

India Calibration Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on service type, calibration type, and end use industry.

Service Type Insights:

- In-House

- OEMs

- Third-Party Service

The report has provided a detailed breakup and analysis of the market based on the service type. This includes in-house, OEMs, and third-party service.

Calibration Type Insights:

- Electrical

- Mechanical

- Thermodynamic

- Physical/Dimensional

- Others

A detailed breakup and analysis of the market based on the calibration type have also been provided in the report. This includes electrical, mechanical, thermodynamic, physical/dimensional, others.

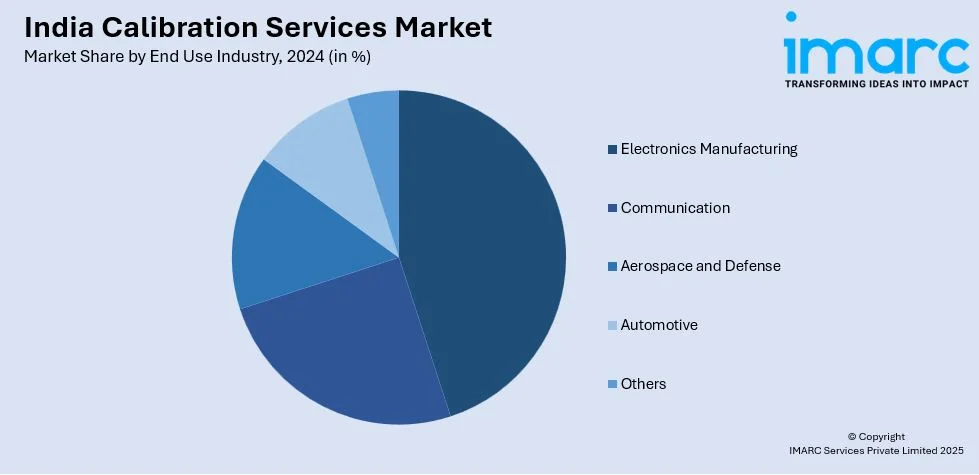

End Use Industry Insights:

- Electronics Manufacturing

- Communication

- Aerospace and Defense

- Automotive

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes electronics manufacturing, communication, aerospace and defense, automotive, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Calibration Services Market News:

- December 2024: Waaree Energies received NABL accreditation for its PV Module Test Lab in Gujarat. This advanced facility enhanced domestic calibration capacity, reduced reliance on foreign labs, and strengthened India’s solar testing ecosystem driving self-reliance and boosting the calibration services segment’s credibility and global competitiveness.

- November 2024: Israel Aerospace Industries inaugurated the HELA Systems facility in Hyderabad, specializing in radar system calibration and testing. This boosted India's defense calibration capacity, reduced foreign dependency, and strengthened local expertise advancing the calibration services industry in aerospace and defense sectors.

India Calibration Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | In-House, OEMs, Third-Party Service |

| Calibration Types Covered | Electrical, Mechanical, Thermodynamic, Physical/Dimensional, Others |

| End Use Industries Covered | Electronics Manufacturing, Communication, Aerospace and Defense, Automotive, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India calibration services market performed so far and how will it perform in the coming years?

- What is the breakup of the India calibration services market on the basis of service type?

- What is the breakup of the India calibration services market on the basis of calibration type?

- What is the breakup of the India calibration services market on the basis of end use industry?

- What are the various stages in the value chain of the India calibration services market?

- What are the key driving factors and challenges in the India calibration services?

- What is the structure of the India calibration services market and who are the key players?

- What is the degree of competition in the India calibration services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India calibration services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India calibration services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India calibration services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)