India Calcium Chloride Market Size, Share, Trends and Forecast by Application, Product Type, Raw Material, Grade, and Region, 2025-2033

India Calcium Chloride Market Size and Share:

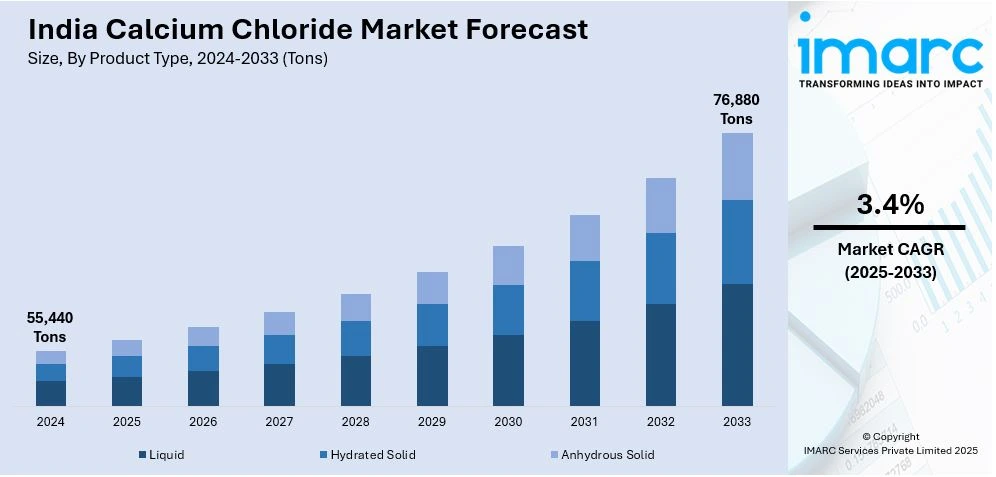

The India calcium chloride market size was valued at 55,440 Tons in 2024. Looking forward, IMARC Group estimates the market to reach 76,880 Tons by 2033, exhibiting a CAGR of 3.4% from 2025-2033. The market is driven by robust demand from infrastructure development, including road construction and smart city projects, where it is used for de-icing, dust control, and concrete acceleration. Government initiatives and industrial growth further propel India calcium chloride market share, making calcium chloride a critical component across diverse sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

55,440 Tons |

|

Market Forecast in 2033

|

76,880 Tons |

| Market Growth Rate (2025-2033) | 3.4% |

The India calcium chloride market is primarily driven by the growing demand from the industrial and infrastructure sectors. Calcium chloride is extensively used as a de-icing agent, dust suppressant, and in concrete acceleration, making it essential for road construction and maintenance, particularly in regions with extreme weather conditions. The Indian government’s focus on improving infrastructure, including highways, airports, and smart cities, is positively influencing the India calcium chloride market demand. On 10th February 2025, The Indian government unveiled a Public-Private Partnership (PPP) fund amounting to Rs 10,000 crore aimed at enhancing infrastructure development. This initiative includes an interest-free loan of Rs 1.5 lakh crore allocated to states. Significant projects encompass the Maritime Development Fund and the UDAN Scheme, which are designed to enhance connectivity. Additionally, India Post is set to be transformed into a logistics organization, which could provide advantages to various industries. Additionally, the expansion of the construction industry, coupled with increasing urbanization, is further propelling its usage in stabilizing soil and enhancing the durability of concrete structures.

To get more information on this market, Request Sample

In addition, the extensive application in the oil and gas industry is also significantly supporting the market. Calcium chloride is used in drilling fluids to stabilize shale formations and control well pressure, which is critical for efficient oil extraction. With India’s growing energy demands and increasing exploration activities, the demand for calcium chloride in this sector is on the rise. India's electricity demand is anticipated to increase at a compound annual growth rate (CAGR) exceeding 7% from fiscal year 2024 to fiscal year 2027 as per industry reports. This growth is attributed to economic expansion, increased electrification, and the rising needs of sectors such as data centers, electric vehicle charging, and green hydrogen production. By fiscal year 2025, renewable energy sources, predominantly solar and wind, are projected to account for 35% of the country's electricity supply, thereby aiding India in achieving its target of 500 gigawatts of renewable capacity by the year 2030. Furthermore, its use in food processing, pharmaceuticals, and water treatment industries is also contributing to India calcium chloride market growth. Furthermore, the rising awareness about water purification and the need for effective waste management systems is amplifying its demand, making it a vital chemical across multiple industries.

India Calcium Chloride Market Trends:

Rising Adoption in Agriculture as a Soil Conditioner

A significant trend in the India calcium chloride market is its increasing use in agriculture to improve soil health and crop yield. Calcium chloride is being widely adopted as a soil conditioner to address calcium deficiencies, which can hinder plant growth and reduce agricultural productivity. With India’s focus on enhancing farm output and sustainable farming practices, the demand for calcium chloride in agriculture is growing. On 27th August 2024, India announced its commitment to promoting sustainable agriculture through various initiatives, including the National Mission for Sustainable Agriculture, the Paramparagat Krishi Vikas Yojana, and the Clean Plant Programme, with an investment exceeding Rs 4,000 crore. These initiatives are designed to foster organic farming, develop climate-resilient crops, and improve soil health, benefiting more than 189,000 farmers across 172,000 hectares. Additionally, the government is advocating for the use of bio-fertilizers, with the goal of encouraging one crore farmers to adopt natural farming practices within the next two years. Additionally, its role in reducing soil erosion and improving water retention is gaining attention, particularly in regions with arid or degraded soils, further creating a positive India calcium chloride market outlook.

Expansion in Food Preservation and Processing

The food industry in India is witnessing a rise in the use of calcium chloride as a preservative and firming agent. It is increasingly utilized in canned vegetables, dairy products, and beverages to maintain texture, extend shelf life, and enhance quality. As consumer preferences shift toward processed and packaged foods, manufacturers are incorporating calcium chloride to meet quality standards and regulatory requirements. On 18th November 2024, a research investigation revealed that the application of 6% calcium chloride (CaCl2) after harvesting markedly enhanced the shelf life of strawberries. This treatment effectively minimized weight loss, decay, and respiration rates over 15 days. Additionally, it helped to retain essential bioactive compounds, such as organic acids and vitamin C, indicating its potential as an effective method for prolonging the quality of processed and packaged strawberry products. The use of 6% CaCl2 proved to be particularly beneficial in preserving the quality of the fruit during storage. This trend is further supported by the growing food processing industry, driven by urbanization, changing lifestyles, and the rise of organized retail, creating new opportunities for calcium chloride applications.

Growing Demand for Eco-Friendly De-Icing Solutions

With increasing environmental concerns, there is a rising demand for eco-friendly de-icing agents, and calcium chloride is emerging as a preferred choice. Unlike traditional salt-based de-icers, calcium chloride is effective at lower temperatures and has a lower environmental impact, making it suitable for use in colder regions of India. This trend is particularly relevant as infrastructure development expands to hilly and northern areas, where icy roads are a challenge. On 7th June 2024, a research initiative focused on de-icing solutions employed machine learning techniques to enhance deicers, discovering a more effective blend of propylene glycol and sodium formate that surpassed conventional calcium chloride-based alternatives. This novel mixture exhibited greater ice penetration capacity (IPC) and a diminished environmental footprint relative to current products. This groundbreaking method holds the potential for developing more efficient and sustainable de-icing solutions for both roadways and runways. Moreover, government and private sector initiatives to adopt sustainable solutions for winter maintenance are further acting as one of the significant India calcium chloride market trends.

India Calcium Chloride Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India calcium chloride market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on application, product type, raw material, and grade.

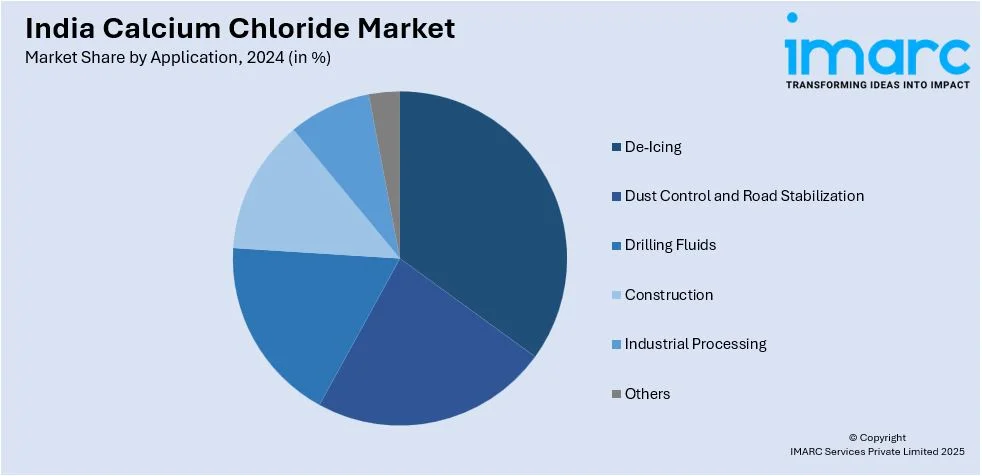

Analysis by Application:

- De-Icing

- Dust Control and Road Stabilization

- Drilling Fluids

- Construction

- Industrial Processing

- Others

De-icing is the largest application segment in the market, driven by its widespread use in maintaining safe and accessible roadways during winter, particularly in northern and hilly regions. Calcium chloride is highly effective as a de-icing agent due to its ability to lower the freezing point of water and melt ice at extremely low temperatures. Its rapid action and efficiency make it a preferred choice for government agencies and private contractors responsible for road maintenance. Additionally, the growing focus on improving transportation infrastructure and ensuring year-round connectivity in challenging terrains has further enhanced its demand. The segment’s dominance is also supported by the chemical’s eco-friendly properties compared to traditional alternatives, aligning with sustainability goals.

Analysis by Product Type:

- Liquid

- Hydrated Solid

- Anhydrous Solid

Hydrated solid calcium chloride is the largest product type segment in the market, primarily due to its versatility and widespread application across various industries. This form of calcium chloride is highly preferred for its ease of handling, storage, and transportation, making it a practical choice for end-users. It finds extensive use in de-icing, dust control, and construction activities, where its moisture-absorbing properties and ability to accelerate concrete setting are highly valued. Additionally, hydrated solid calcium chloride is widely utilized in agriculture as a soil conditioner and in industrial processes for its stability and effectiveness. The segment’s dominance is further reinforced by its cost-efficiency and availability, catering to the growing demand from infrastructure, agriculture, and industrial sectors.

Analysis by Raw Material:

- Natural Brine

- Solvay Process (by-Product)

- Limestone and HCL

- Others

Natural brine is the largest raw material segment in the market, due to its cost-effectiveness and abundant availability. Sourced from natural salt lakes or underground deposits, natural brine is a preferred choice for producing calcium chloride due to its lower extraction and processing costs compared to synthetic alternatives. This raw material is highly efficient in meeting the growing demand for calcium chloride across key applications such as de-icing, construction, and industrial processes. Additionally, the use of natural brine aligns with sustainability trends, as it minimizes environmental impact and reduces reliance on chemical-intensive production methods. Its widespread availability and economic advantages make it the dominant raw material, supporting the expansion of the calcium chloride market in India.

Analysis by Grade:

- Food Grade

- Industrial Grade

Industrial grade calcium chloride is the largest grade segment in the market, driven by its extensive use across various industrial applications. This grade is highly valued for its effectiveness in processes such as dust control, de-icing, and concrete acceleration, making it indispensable in construction and infrastructure development. Moreover, it occupies an indispensable role in the oil and gas industry, namely the purposes of stabilizing the drilling fluid and water treatment for reasons of purification. Its cost-effectiveness and adaptability, and thus addressing the needs of large industrial operations, are further contributing to its dominance over the segment. With the country’s industrial growth and infrastructure projects, the requirement for industrial-grade calcium chloride continues to climb, reinforcing its position as the primary product in the market.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

The de-icing sector, mainly used in the snow-prone hilly regions of North India, accounts for the major part of the market for calcium chloride. The regions such as Jammu & Kashmir and Himachal Pradesh are the ones where it mostly occurs. The region’s harsh winters necessitate effective ice-melting solutions, driving demand. Additionally, ongoing infrastructure projects and road construction activities further enhance the market, making North India a key consumer of calcium chloride for both industrial and transportation purposes.

West and Central India are significant markets for calcium chloride, driven by rapid industrialization and infrastructure development. States including Maharashtra and Gujarat, with their thriving chemical, oil, and gas industries, contribute heavily to demand. The region’s focus on water treatment and dust control in arid areas also supports market growth, making it a hub for industrial-grade calcium chloride applications.

South India’s calcium chloride market is fueled by its growing construction and agricultural sectors. States such as Tamil Nadu and Karnataka utilize calcium chloride for concrete acceleration and soil conditioning. The region’s expanding food processing industry also drives demand, as calcium chloride is widely used as a preservative and firming agent, contributing to steady market growth.

East India is emerging as a promising market for calcium chloride, supported by increasing infrastructure projects and agricultural activities. States including Odisha and West Bengal are witnessing rising demand for soil stabilization and water treatment applications. The region’s focus on improving road connectivity and industrial growth further propels the adoption of calcium chloride, positioning it as a growing market segment.

Competitive Landscape:

The market is competitive amongst the leading participants who are continuously trying to gain their source presence through strategy collaborations. Production capability expansion, big tech upgrades, and product innovation have all become major focus areas for organizations trying to cater to a plethora of industrial demands. Many are therefore also channeling funds towards research and development that helps grow product excellence and develop eco-friendly substitutes while recognizing sustainability goals. In addition, strategic alliances, partnerships, and mergers are the trends in companies' distribution pathways to expand their market reach. Furthermore, competitive pricing strategies and custom solutions are among the current offerings used to satisfy the construction, agriculture, and food processing sectors' unique requirements, ultimately increasing the competition level in the market.

The report provides a comprehensive analysis of the competitive landscape in the India calcium chloride market with detailed profiles of all major companies.

Latest News and Developments:

- April 10, 2024: Nuberg EPC secured the largest Chlor-Alkali project in India, a 2200 TPD facility for Mundra Petrochemical Ltd. (part of the Adani Group) located in Gujarat, aimed at the production of Caustic Soda and other vital chemicals. This project is expected to generate by-products such as HCl, NaOH, and Sodium Hypochlorite, which will contribute to MPL’s Green PVC initiative. With a commitment to deliver within 15 months, Nuberg EPC leverages its global expertise for this important industrial undertaking.

- February 27, 2024: DCM Shriram Ltd. announced a significant investment of Rs 1000 crore to set up a cutting-edge epoxy manufacturing facility in India, thereby entering the Advanced Materials sector. This new plant will enhance its current Epichlorohydrin (ECH) facility located in Gujarat and is designed to meet the increasing demand from sectors such as wind turbine blades, electric vehicles, and electronics. DCM Shriram is committed to bolstering its chemicals division, which features essential products including caustic soda and calcium chloride.

India Calcium Chloride Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | ‘000 Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | De-Icing, Dust Control and Road Stabilization, Drilling Fluids, Construction, Industrial Processing, Others |

| Product Types Covered | Liquid, Hydrated Solid, Anhydrous Solid |

| Raw Materials Covered | Natural Brine, Solvay Process (by-Product), Limestone and HCL, Others |

| Grades Covered | Food Grade, Industrial Grade |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India calcium chloride market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India calcium chloride market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India calcium chloride industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India calcium chloride market was valued at 55,440 Tons in 2024.

The growth of the India calcium chloride market is driven by robust demand from infrastructure development, including road construction and smart city projects, where it is used for de-icing, dust control, and concrete acceleration. Government initiatives, industrial growth, and expanding applications in agriculture, food processing, and oil & gas further contribute to its increasing demand.

The India calcium chloride market is projected to exhibit a CAGR of 3.4% during 2025-2033, reaching a value of 76,880 Tons by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)