India C4 Raffinate Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Market Overview:

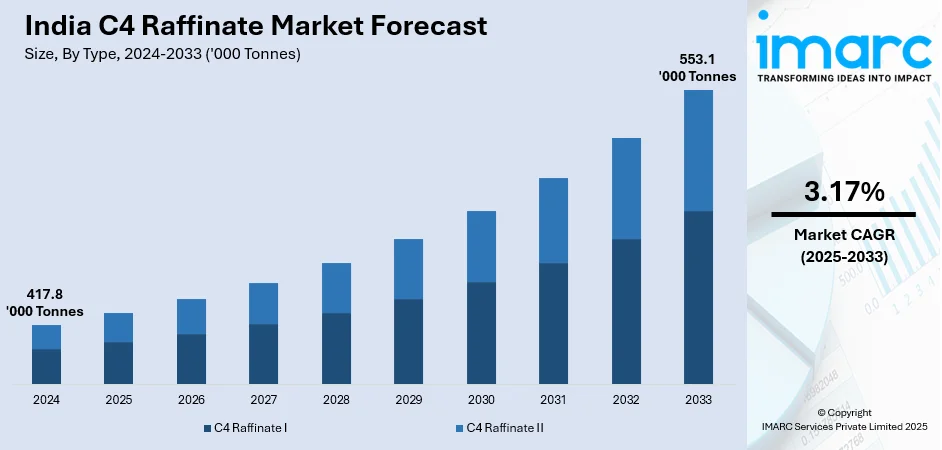

India C4 raffinate market size reached 417.8 Thousand Metric Tonnes in 2024. Looking forward, IMARC Group expects the market to reach 553.1 Thousand Metric Tonnes by 2033, exhibiting a growth rate (CAGR) of 3.17% during 2025-2033. The market is experiencing robust growth due to increasing demand for petrochemicals, driven by industrialization, urbanization, automotive industry expansion, advancements in manufacturing technology, and stringent environmental regulations promoting eco-friendly materials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

417.8 Thousand Metric Tonnes |

|

Market Forecast in 2033

|

553.1 Thousand Metric Tonnes |

| Market Growth Rate 2025-2033 | 3.17% |

C4 raffinate refers to a byproduct obtained during the production of ethylene in the petrochemical industry. The term "C4" denotes a mixture of hydrocarbons containing four carbon atoms. Ethylene production involves the cracking of hydrocarbons, and C4 raffinate is a stream that contains various C4 hydrocarbons, such as butanes and butenes. This byproduct has economic significance as it can be further processed to extract valuable chemicals like butadiene, a key raw material for synthetic rubber. The separation and utilization of C4 raffinate contribute to the overall efficiency and profitability of petrochemical operations. Additionally, environmental considerations play a role in managing C4 raffinate to minimize its impact, making it a relevant aspect in the broader context of sustainable and responsible industrial practices.

To get more information on this market, Request Sample

India C4 Raffinate Market Trends:

The C4 raffinate market in India is witnessing robust growth, driven by several key factors. Firstly, the increasing demand for petrochemicals, particularly in the production of various polymers and resins, serves as a prominent driver. This surge in demand is fueled by the growing industrialization and urbanization in various regions. Additionally, the automotive industry's continuous expansion and the rising popularity of electric vehicles contribute significantly to the escalating need for C4 raffinate in the manufacturing of tires, adhesives, and sealants. Moreover, the ongoing advancements in technology and the adoption of innovative manufacturing processes further propel the C4 raffinate market forward. The development of more efficient and cost-effective production methods enhances the overall supply chain and stimulates market growth. Furthermore, stringent environmental regulations promoting the use of eco-friendly materials boost the demand for C4 raffinate, known for its versatility and compatibility with sustainability objectives. In conclusion, the C4 raffinate market in India is thriving due to the confluence of factors such as heightened industrial activities, technological advancements, and the regional shift towards environmentally responsible practices, all of which collectively foster a positive outlook for the market's future trajectory.

India C4 Raffinate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- C4 Raffinate I

- C4 Raffinate II

The report has provided a detailed breakup and analysis of the market based on the type. This includes C4 raffinate I and C4 raffinate II.

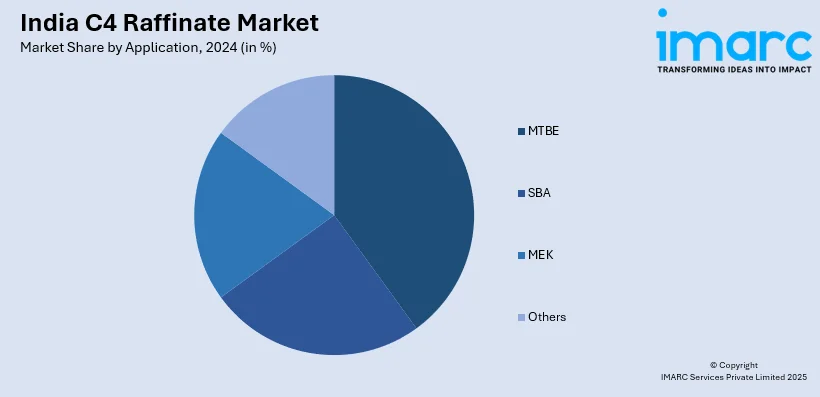

Application Insights:

- MTBE

- SBA

- MEK

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes MTBE, SBA, MEK, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India C4 Raffinate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Metric Tonnes |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | C4 Raffinate I, C4 Raffinate II |

| Applications Covered | MTBE, SBA, MEK, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India C4 raffinate market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India C4 raffinate market?

- What is the breakup of the India C4 raffinate market on the basis of type?

- What is the breakup of the India C4 raffinate market on the basis of application?

- What are the various stages in the value chain of the India C4 raffinate market?

- What are the key driving factors and challenges in the India C4 raffinate?

- What is the structure of the India C4 raffinate market and who are the key players?

- What is the degree of competition in the India C4 raffinate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India C4 raffinate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India C4 raffinate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India C4 raffinate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)