India Buy Now Pay Later Market Size, Share, Trends and Forecast by Channel, Enterprise Size, End Use, and Region, 2025-2033

India Buy Now Pay Later Market Size and Share:

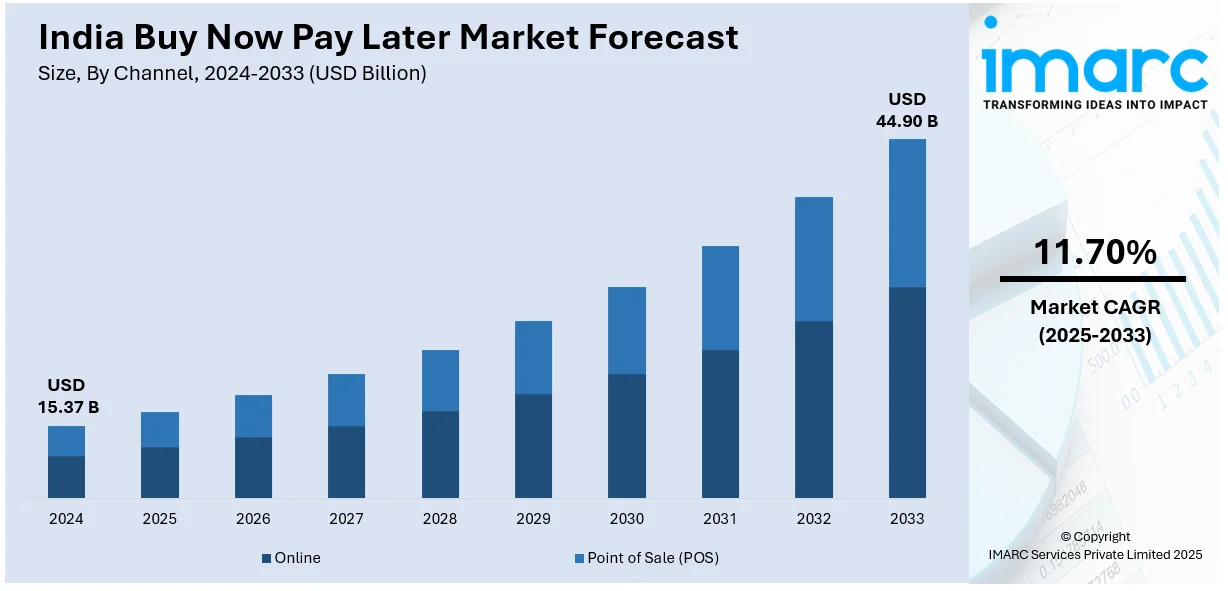

The India buy now pay later (BNPL) market size was valued USD 15.37 Billion in 2024 and is projected to reach USD 44.90 Billion by 2033, exhibiting a growth rate (CAGR) of 11.70% from 2025-2033. The market is experiencing rapid growth, driven by increased e-commerce adoption, a shift towards digital payments, and strategic partnerships with retailers. These factors are expanding the consumer base, enhancing flexibility, and boosting the India buy now pay later market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15.37 Billion |

| Market Forecast in 2033 | USD 44.90 Billion |

| Market Growth Rate 2025-2033 | 11.70% |

There is a discernible trend towards greater flexibility in payments in India with changing consumer behavior, especially among millennials and Gen Z. These two generations, being highly technology-savvy, are more likely to choose solutions that provide convenience, like Buy Now Pay Later (BNPL) solutions. This increasing need for payment flexibility is one of the key drivers for the BNPL segment in India. As disposable incomes increase and consumers prefer smoother shopping experiences, most consumers are turning to BNPL to control their spending. BNPL products enable them to shop both offline and online without paying full amounts upfront, which makes it a highly desirable option during festivals and special promotional offers.

To get more information on this market, Request Sample

Strategic partnerships between BNPL players and large retailers are driving the market's penetration throughout India. These collaborations are designed to make BNPL services easily accessible to consumers, something that is especially useful in a nation where access to traditional credit is still out of reach for so many. Retailers are now incorporating BNPL solutions into their payment portals as a means of broadening their customer base. Both parties stand to benefit with a win-win through these collaborations by increasing consumer expenditure and providing consumers with an option to pay in installments without the interest component.

India Buy Now Pay Later Market Trends:

Government Support Driving BNPL Adoption

The BNPL market in India continues to grow, largely driven by supportive regulations and government policies aimed at expanding financial inclusion. With a vast, untapped consumer base and increasing digital penetration, there is a noticeable shift towards alternative credit models like BNPL. These models provide consumers with the ability to make purchases on flexible payment terms, making them especially attractive to younger individuals and those with limited access to conventional credit. In May 2025, PayU was granted final approval by the Reserve Bank of India (RBI) to function as an Online Payment Aggregator, allowing the company to expand its BNPL services. This move is expected to play a significant role in making BNPL offerings more accessible to consumers, driving greater market penetration. The RBI’s move signals increased regulatory clarity, encouraging more companies to enter the space. This has positioned BNPL as a reliable and convenient payment option in India, especially in the e-commerce sector. Furthermore, the regulatory backing boosts consumer confidence, resulting in higher adoption rates. As businesses recognize the need for flexible credit solutions, the regulatory environment remains a key enabler of BNPL's success in India.

Strategic Partnerships Expanding BNPL Reach

Another key driver in the growth of India’s BNPL market is the strategic partnerships being formed between fintech companies and major retailers. These collaborations aim to bridge the credit gap by providing easy access to instant digital credit, catering to a vast segment of underbanked consumers. In August 2024, PayU teamed up with Amazon Pay Later to offer instant credit to Millions of shoppers in India. This partnership brought together PayU’s advanced payment infrastructure and Amazon’s established consumer base, enabling seamless BNPL options for shoppers. By offering customers the ability to pay in installments, this collaboration provided greater financial flexibility, which in turn is expected to drive consumer purchasing power. Such partnerships help create a win-win situation for both merchants and consumers, with merchants benefiting from increased sales and consumers enjoying the ease of deferred payments. This model of collaboration is expected to push BNPL services into the mainstream market, particularly among shoppers who previously lacked access to credit. As more fintech companies and retail giants join forces, the BNPL ecosystem is set to expand further, reshaping how consumers approach online and offline shopping in India.

Expansion of E-Commerce and Digital Payments

The BNPL market size in India is experiencing robust growth, driven by several key factors. The rapid expansion of e-commerce in India has played a key role in widening the reach of Buy Now, Pay Later (BNPL) services. According to the India Brand Equity Foundation (IBEF), the country's e-commerce sector is projected to grow at a CAGR of 27% and touch USD 163 billion by 2026. As digital shopping gains traction, more consumers are looking for flexible and easy-to-use payment options, making BNPL an attractive choice. This trend is particularly prominent among millennials and Gen Z users, who value speed, convenience, and real-time service. The increasing use of mobile wallets and digital payment tools has further boosted the BNPL segment. Findings from a joint survey by Kearney India and Amazon Pay India, titled "How Urban India Pays," indicate that 90% of respondents prefer digital payment methods for their online purchases. Integrating BNPL into these platforms enhances the checkout experience and aligns well with the habits of digitally inclined users. With the number of online shoppers in India expected to hit 350 Million by FY26, demand for BNPL offerings is likely to keep rising. Collaborations between BNPL providers and retail partners are also making these services more accessible, fueling the segment’s ongoing growth.

India Buy Now Pay Later Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India buy now pay later market, along with forecasts at the regional levels from 2025-2033. The market has been categorized based on channel, enterprise size, and end use.

Analysis by Channel:

- Online

- Point of Sale (POS)

The increasing shift towards online shopping has become a key driver for the growth of BNPL in India. With e-commerce platforms gaining widespread popularity, consumers are seeking flexible payment solutions to enhance their shopping experience. BNPL services provide consumers the option to make payments in installments, offering a convenient and accessible alternative to traditional credit. This trend has gained momentum in various sectors, including fashion, electronics, and groceries, driving the adoption of BNPL options. The growing number of online merchants integrating BNPL as a payment option further accelerates the market's expansion in India.

In-store shopping is also increasingly integrating buy now pay later options, especially at the point of sale (POS). Retailers are adopting BNPL services to meet the rising demand for flexible payment methods among customers. The ability to choose installment-based payments at the POS provides consumers with greater financial flexibility, making it easier to purchase products without immediate full payment. This convenience encourages higher transaction volumes and drives customer loyalty. As POS financing solutions become more mainstream, the India BNPL market is likely to witness an uptick in adoption across various retail sectors, including electronics and fashion.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises

As per India buy now pay later market outlook, large enterprises are increasingly adopting these services to cater to the growing consumer demand for flexible payment options. These companies, with their extensive customer bases, have significant resources to integrate BNPL services into their platforms, driving large-scale adoption. As large enterprises partner with BNPL providers, they can offer a seamless, installment-based payment system that attracts customers and boosts sales. The widespread reach of these enterprises across multiple industries, including consumer goods, fashion, and electronics, plays a critical role in expanding the India BNPL market, making it more accessible to diverse consumer segments.

Small and medium-sized enterprises (SMEs) in India are increasingly adopting BNPL services to stay competitive in the evolving market. By integrating BNPL into their payment systems, SMEs can offer flexible payment options, attract more customers, and increase conversion rates. The affordability and ease of implementation of BNPL solutions make them particularly appealing to smaller businesses. As SMEs look to expand their reach, they recognize the potential of BNPL to boost sales and customer loyalty, particularly in sectors such as fashion, home goods, and consumer electronics, thereby driving the market growth.

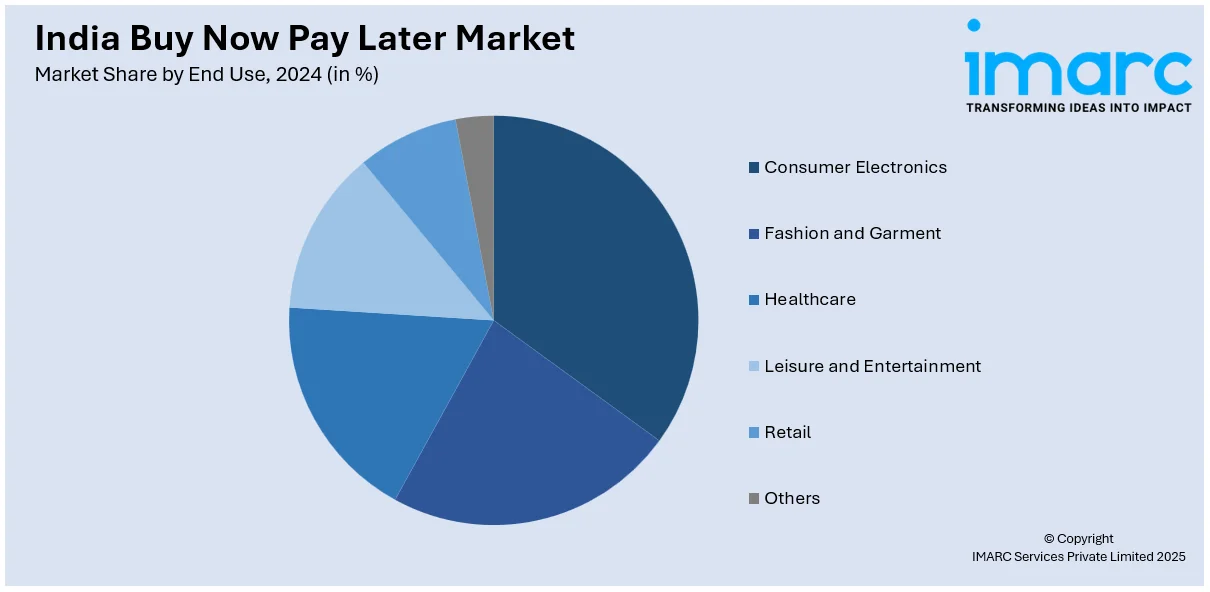

Analysis by End Use:

- Consumer Electronics

- Fashion and Garment

- Healthcare

- Leisure and Entertainment

- Retail

- Others

The consumer electronics sector is a significant driver for the BNPL market, as high-value electronics often require flexible payment options. Consumers are increasingly turning to BNPL services to purchase products like smartphones, laptops, and home appliances, which may otherwise require larger upfront payments. With the rising middle class and increasing internet penetration, more consumers are opting for BNPL to manage these higher-ticket purchases. E-commerce platforms and retail stores in the electronics space are integrating BNPL options to attract more buyers, further propelling the growth of BNPL services in India’s consumer electronics market.

The fashion and garment industry in India is increasingly leveraging buy now pay later services to cater to the growing demand for flexible payment solutions. As fashion trends evolve quickly, consumers often make frequent purchases, and BNPL allows them to manage expenses over time without immediate financial strain. The convenience of splitting payments over several months encourages higher spending, particularly among younger, digitally savvy consumers. Fashion brands and retailers are integrating BNPL into their e-commerce platforms and physical stores, helping drive sales and enhancing customer retention. This has become a key trend in India’s BNPL market.

Healthcare is an emerging sector driving the adoption of BNPL services in India. Rising healthcare costs, particularly for medical procedures and treatments, have made flexible payment options a necessity. BNPL enables patients to access essential healthcare services without facing immediate financial burden. As healthcare providers increasingly offer BNPL services for elective procedures, surgeries, and treatments, patients are more likely to seek care and follow through with appointments. This shift is particularly relevant in private healthcare and wellness services, where BNPL can help expand access to healthcare, making the India BNPL market more inclusive.

The leisure and entertainment industry in India is adopting BNPL options to offer consumers flexible ways to pay for experiences. With growing interest in movies, concerts, travel, and other forms of entertainment, BNPL allows consumers to enjoy these experiences now and pay later, making them more accessible. As disposable incomes rise and consumers prioritize leisure spending, BNPL offers a way to manage expenses while enjoying entertainment. E-commerce platforms and event organizers are integrating BNPL into their offerings, making it a key driver of growth in the leisure and entertainment segments of India’s BNPL market.

The retail sector in India is one of the primary drivers of the buy now pay later market, as it provides a flexible payment option for consumers across a wide range of products. Retailers, both online and offline, are increasingly adopting BNPL services to attract customers who prefer paying in installments. The rise of e-commerce and the growing trend of online shopping have made BNPL a popular option for purchasing fashion, home goods, and electronics. Retailers benefit from higher conversion rates, while customers enjoy financial flexibility, making BNPL an essential tool for expanding India’s retail sector and boosting the overall BNPL market.

Several other sectors are contributing to the expansion of the BNPL market, including sectors such as education, travel, and home services. As consumers seek more ways to manage expenses, BNPL is increasingly being integrated into a variety of industries. In education, BNPL services enable students to pay tuition fees and course expenses in installments, making education more affordable. Similarly, in the travel and home services sectors, BNPL offers consumers a way to manage large expenditures, encouraging more spending. This diverse adoption across industries helps accelerate the overall growth of the BNPL market in India.

Regional Analysis:

- North India

- West and Central India

- South India

- East and Northeast India

North India is one of the key regions driving the buy now pay later market in India. The region, which includes major cities like Delhi, Chandigarh, and Jaipur, has seen rapid growth in e-commerce and digital payment adoption. As disposable incomes rise and urbanization increases, more consumers are opting for flexible payment options like BNPL to manage their expenses. The growing preference for online shopping in North India, combined with the rise of digital wallets and mobile payment platforms, is creating an ideal environment for BNPL services to flourish. This trend is expected to drive significant growth in the North Indian BNPL market.

West and Central India, including states like Maharashtra, Gujarat, Madhya Pradesh, and Rajasthan, are witnessing a surge in the adoption of BNPL services. With cities like Mumbai, Pune, and Ahmedabad serving as economic hubs, the region has become a hotspot for e-commerce and digital payment adoption. As consumers in these areas increasingly turn to BNPL for flexible payment solutions, retailers and e-commerce platforms are integrating BNPL options into their offerings. This is driving growth in sectors like fashion, electronics, and home goods, making West and Central India a key driver of the BNPL market in India.

South India, encompassing states such as Tamil Nadu, Karnataka, Andhra Pradesh, and Kerala, is experiencing strong demand for BNPL services. With cities like Bengaluru, Chennai, and Hyderabad leading the way in digital transformation, consumers in South India are increasingly adopting BNPL solutions to manage their purchases. The region’s rapidly growing tech-savvy population, combined with a rise in e-commerce and mobile payments, is contributing to the expansion of BNPL services. The convenience of paying in installments, particularly for fashion, electronics, and home goods, is driving the growth of the BNPL market in South India.

East and Northeast India, including states like West Bengal, Odisha, Assam, and the Northeastern region, are gradually adopting BNPL services as e-commerce and digital payment adoption increase. Though historically slower to adopt digital payment methods, these regions are seeing rapid improvements in internet connectivity and smartphone penetration. The growing interest in online shopping, along with the availability of flexible payment options, is driving the BNPL market forward. As more retailers integrate BNPL services into their offerings, the market in East and Northeast India is set to experience significant growth in the coming years.

Competitive Landscape:

The market research report includes a thorough analysis of the competitive landscape, covering aspects such as market structure, positioning of key players, leading strategies, a competitive dashboard, and company evaluation quadrant. Additionally, the report provides in-depth profiles of all major companies.

Latest News and Developments:

- March 2025: Klarna became Walmart's exclusive Buy Now Pay Later (BNPL) provider through a partnership with One Pay. This collaboration allowed Walmart customers to access flexible installment loan options, enhancing shopping convenience and accelerating BNPL adoption, thereby boosting market growth and consumer engagement.

- January 2025: MakeMyTrip launched a part payment option for international flights, allowing travelers to pay only 10–40% upfront and the rest within 45 days at no extra cost. The feature eased booking for families and groups, aligning with rising interest in flexible payment solutions across sectors like travel, e-commerce, and fintech.

- January 2025: Amazon is planning to acquire Indian BNPL startup Axio for over USD 150 Million, deepening its financial services presence. Axio, serving over 10 Million customers, offered credit at checkout on platforms like Amazon and MakeMyTrip. The deal followed Amazon’s earlier investment and awaited central bank approval to close.

- January 2025: Samsung Wallet announced two new features Tap to Transfer and Instant Installments which are set to launch later in 2025. Tap to Transfer enabled peer-to-peer payments via NFC. At the same time, Instant Installments allowed users to convert purchases into installments at checkout, leveraging Visa and Mastercard, without offering direct credit, enhancing offline and online transaction flexibility.

India Buy Now Pay Later Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | Online, Point of Sale (POS) |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| End Uses Covered | Consumer Electronics, Fashion and Garment, Healthcare, Leisure and Entertainment, Retail, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India buy now pay later market from 2019-2033.

- The India buy now pay later market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India buy now pay later industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The buy now pay later market in India was valued at USD 15.37 Billion in 2024.

The India buy now pay later market is projected to exhibit a CAGR of 11.70% during 2025-2033, reaching a value of USD 44.90 Billion by 2033.

The India buy now pay later market is driven by increasing smartphone adoption, rising e-commerce, flexible payment options, and growing consumer demand for convenient credit solutions. Additionally, supportive regulations and partnerships between fintech firms and retailers further propel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)