India Built-In Kitchen Appliances Market Size, Share, Trends and Forecast by Product Type, Distribution Channel and Region, 2025-2033

India Built-In Kitchen Appliances Market Overview:

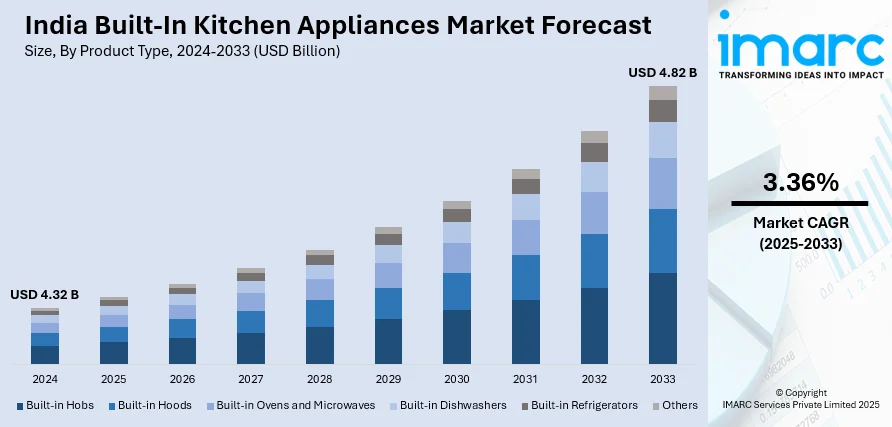

The India built-in kitchen appliances market size reached USD 4.32 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.82 Billion by 2033, exhibiting a growth rate (CAGR) of 3.36% during 2025-2033. The increasing urbanization, growing demand for sophisticated, space-efficient home solutions, growing consumer demand for high-end, energy-efficient, and smart appliances and increasing e-commerce channels are propelling the India built-in kitchen appliances market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.32 Billion |

| Market Forecast in 2033 | USD 4.82 Billion |

| Market Growth Rate 2025-2033 | 3.36% |

India Built-In Kitchen Appliances Market Trends:

Rising Popularity of Smart and Connected Kitchen Appliances

The integration of smart technology is boosting the India built-in kitchen appliances market growth. With the increasing prevalence of IoT at homes, consumers are looking at kitchen appliances that make things easier and save energy and could offer smooth connectivity. Smart appliances for the kitchen such as smart ovens, refrigerators, dish washers, and cooktops are fast becoming voice-controlled, with remote monitoring and app-based control. Hence, users can adjust and observe them for their cook experiences using their smartphones. Besides, smart appliances will tend to reduce energy consumption and hence encourage homeowners to save utility costs while not compromising on being eco-friendly. As per industry reports, several major brands project, that by 2025-2026, AI products would contribute over 50 % revenue to their overall sales. The Indian home appliance market is expected to grow at a rate of 6-8% and largely driven by the smart space, within which a significant chunk is expected from the AI-fueled smart appliance, projected to grow by 14-18 % in the next 4-5 years. This phenomenon can particularly be illustrated in urban India where consumers of the new age are willing to invest a good amount of money for fast technology. With modern, minimalist kitchens being new age and installed with the latest technology to enhance the user experience, consumer need is further increasing the demand for such appliances.

To get more information on this market, Request Sample

Increasing Preference for Energy-Efficient and Sustainable Appliances

With growing awareness among individuals towards energy conservation and environmental sustainability, Indian consumers are increasingly looking toward energy-saving in-built kitchen appliances. In January 2025, India also achieved a milestone in its renewable energy sector, as solar power accounted for nearly 59.99% of the country's total renewable energy production, excluding large hydropower. The country generated 12,285.74 million units of solar energy, highlighting its commitment to clean and renewable sources of energy. Therefore, skyrocketing electricity bills and the increasing focus on living green lives are encouraging people to look for those appliances which are more power saving but not compromising on their performance. Induction cooking ranges, washing machines, and refrigerators, among other in-built kitchen appliances, now pride themselves on energy ratings that emphasize the efficiency of such equipment. There is the addition of eco-friendly features by most brands, such as the use of low water content in dish washers and fridges that emit fewer refrigerants. And efficient appliances help reduce the carbon footprint of the home, which also finds common ground with India's shift towards sustainability. As consumers move towards greener lifestyles, individuals are ready to pay a premium for appliances that not only are green but also cost-effective for long-term usage. According to 2023 industry data, energy-efficient solutions such as inverter compressors on air-conditioners and refrigerators currently contribute over 85% of AC category sales and 40% of refrigerator sales, an unequivocal jump from 60% and 20% respectively three years ago. This phenomenon is particularly prevalent among high-income consumers as well as those that reside in urban areas, where the demand for new, green living solutions is highest.

Surge in Customization and Premium Kitchen Designs

One of the predominant trends influencing the India built-in kitchen appliances market outlook is the increasing demand for innovative and premium products. With the rise in the standard of living and consumer awareness towards beauty and function, there is a noticeable trend toward higher-end products and designer kitchen appliances. The high-end real estate business in India is on a growing trend with significant considerations, forecasting a CAGR of 21.81% from 2024 to 2029 onwards. Another thing from the context of raising demand for housing and urban development in India is an expected increase in the urbanization rate from 36.50% to 42.50% over a span of 10 years. Ovens, cooktops, dishwashers, and refrigerators are all integrated appliances which have become increasingly preferred as they fit into modern kitchen designs, creating a more contemporary and elegant look. This is an exceptional case considered in urban communities where space-saving advantages become essential. Energy-efficient and intelligent kitchen appliances which furnish convenience through connectivity and sophistication are also in very high demand. Environmentally sustainable products with durability are also gaining demand among consumers, which in turn is motivating the manufacturers to take the step toward sustainable materials and energy-efficient technologies. There is a marked shift toward premium technological and green kitchen solutions in the global market.

India Built-In Kitchen Appliances Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, and distribution channel.

Product Type Insights:

- Built-in Hobs

- Built-in Hoods

- Built-in Ovens and Microwaves

- Built-in Dishwashers

- Built-in Refrigerators

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes built-in hobs, built-in hoods, built-in ovens and microwaves, built-in dishwashers, built-in refrigerators, and others.

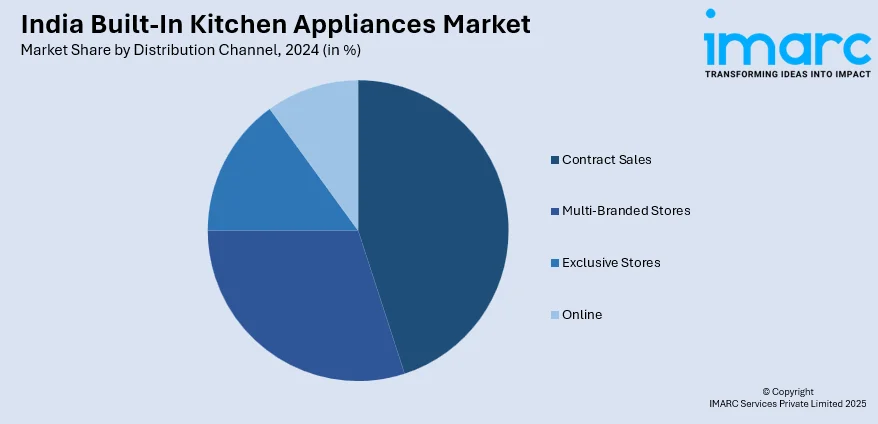

Distribution Channel Insights:

- Contract Sales

- Multi-Branded Stores

- Exclusive Stores

- Online

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes contract sales, multi-branded stores, exclusive stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Built-In Kitchen Appliances Market News:

- In November 2024, Hafele introduced a series of cutting-edge premium appliances, reinforcing its status as a top supplier of all-inclusive kitchen solutions. The company’s dedication to implementing innovative technologies has allowed it to meet the changing needs of its audience since 2014.

India Built-In Kitchen Appliances Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Built-in Hobs, Built-in Hoods, Built-in Ovens and Microwaves, Built-in Dishwashers, Built-in Refrigerators, Others |

| Distribution Channels Covered | Contract Sales, Multi-Branded Stores, Exclusive Stores, Online |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India built-in kitchen appliances market performed so far and how will it perform in the coming years?

- What is the breakup of the India built-in kitchen appliances market on the basis of product type?

- What is the breakup of the India built-in kitchen appliances market on the basis of distribution channel?

- What is the breakup of the India built-in kitchen appliances market on the basis of region?

- What are the various stages in the value chain of the India built-in kitchen appliances market?

- What are the key driving factors and challenges in the India built-in kitchen appliances market?

- What is the structure of the India built-in kitchen appliances market and who are the key players?

- What is the degree of competition in the India built-in kitchen appliances market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India built-in kitchen appliances market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India built-in kitchen appliances market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India built-in kitchen appliances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)