India Building Management Systems Market Size, Share, Trends and Forecast by Service Type, Software, Application, and Region, 2026-2034

India Building Management Systems Market Size and Share:

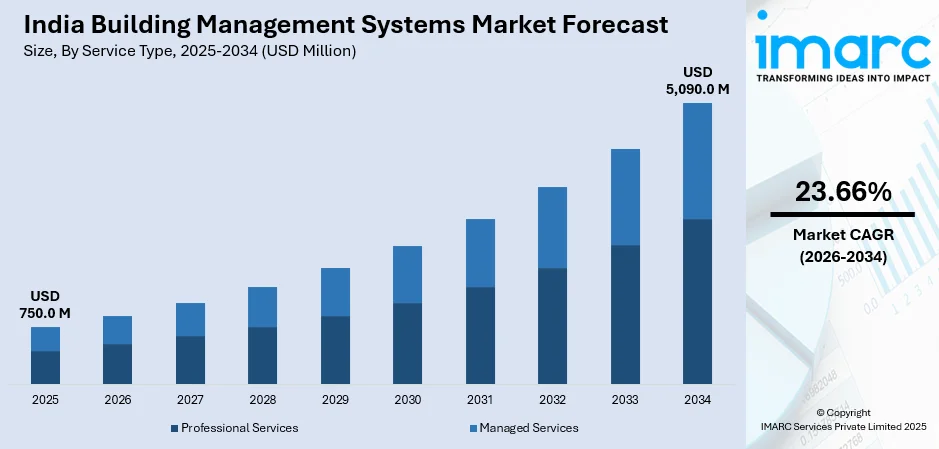

The India building management systems market size reached USD 750.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 5,090.0 Million by 2034, exhibiting a growth rate (CAGR) of 23.66% during 2026-2034. The market is witnessing significant growth, driven by increasing integration of IoT and AI in building management systems and enhanced security and surveillance systems in building management.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 750.0 Million |

| Market Forecast in 2034 | USD 5,090.0 Million |

| Market Growth Rate (2026-2034) | 23.66% |

India Building Management Systems Market Trends:

Increasing Integration of IoT and AI in Building Management Systems

Building management systems in India rapidly take on the integration of the Internet of Things (IoT) and the applications of Artificial Intelligence to enable and become a part of the value chains of features such as energy efficiency, optimization of operational performance, and real-time data analytics. Internet of Things devices allow for efficient and effective integration between HVAC (heating, ventilation, and air conditioning), lighting, security, and all systems in the building. For example, in February 2025, ACREX India announced its plans to bring together HVAC manufacturers, government officials, and industry leaders to showcase the latest in HVAC technologies to facilitate the sector's eventual development into a $30 billion market by 2030. These latest equipment devices collect large volumes of data related to HVAC systems, the processing of which through AI algorithms may trigger predictions for energy consumption, capture maintenance issues potentially, and perform routine automation. AI is enabling predictive analytics in BMS, enhancing resource management, and lessening operational costs. Whereas this was attracting a major focus with the industries, it would support the green building initiative concerning optimization of energy usage and carbon footprint reduction. This would further provide for the integration of smart meters and sensors with cloud-based management solutions that would provide a remote monitoring and control environment for various building systems, allowing managers to achieve data-driven decision-making and, eventually, superior building performance. In this context, with the growing demand for such energy-efficient buildings, the HMA trend in India would similarly also evolve rapidly as a push from smart cities and infrastructure projects drives the adoption of such advanced types of BMS technology to support urbanization goals and environmental commitments of the Indian government.

To get more information on this market, Request Sample

Enhanced Security and Surveillance Systems in Building Management

As urbanization in India accelerates, the need for robust security and surveillance systems within building management systems has risen significantly. In response, there has been a major trend toward incorporating advanced security technologies, such as facial recognition, biometric access control, and AI-powered video surveillance, into BMS. For instance, IFSEC India 2025 highlighted security tech advancements with over 300 brands showcasing 5,000+ products. It featured innovations in CCTV, biometrics, RFID, and integrated systems, addressing the rising demand for secure solutions. These technologies not only provide real-time monitoring of building perimeters and entry points but also ensure the safety of residents, employees, and assets through automated threat detection. The use of AI in surveillance systems allows for more accurate anomaly detection, minimizing the risk of false alarms and ensuring quicker response times to security breaches. Additionally, integrating these advanced security features with other building systems, such as lighting and HVAC, creates a unified management platform that streamlines operations and enhances safety protocols. For example, in the event of an emergency, BMS can automatically trigger lighting changes, adjust HVAC settings for smoke ventilation, and direct security teams to affected areas. As security concerns continue to grow in India's metropolitan areas, the demand for sophisticated, integrated security solutions in building management is expected to increase, making this an essential component of modern BMS designs in India.

India Building Management Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on service type, software, and application.

Service Type Insights:

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes professional services and managed services.

Software Insights:

- Facility Management

- Security Management

- Energy Management

- Infrastructure Management

- Emergency Management

A detailed breakup and analysis of the market based on the software have also been provided in the report. This includes Facility Management, Security Management, Energy Management, Infrastructure Management, and Emergency Management.

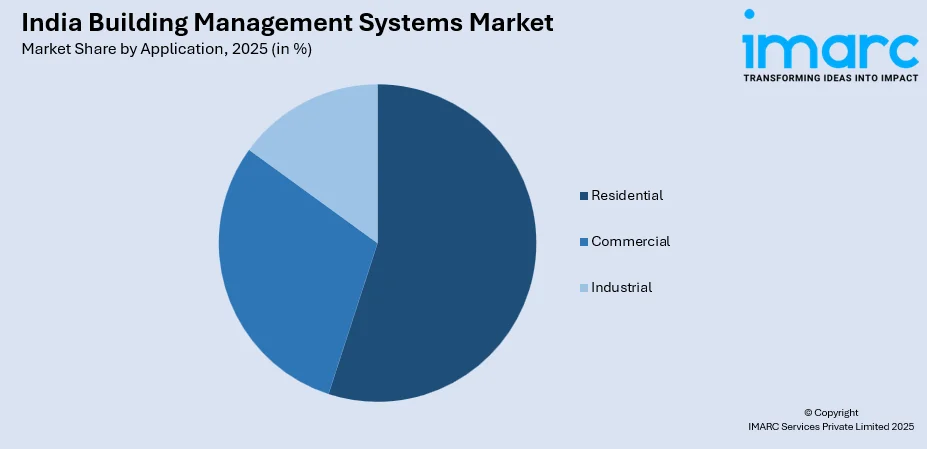

Application Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Building Management Systems Market News:

- In December 2025, Honeywell Automation India announced securing a contract from Reliance Life Sciences for building management and safety technology at its Nashik plants. Honeywell will supply, install, test, and commission integrated command, control, and environmental monitoring systems, along with integrating fire detection and evacuation systems, offering seven years of maintenance support for operational excellence.

India Building Management Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Professional Services, Managed Services |

| Softwares Covered | Facility Management, Security Management, Energy Management, Infrastructure Management, Emergency Management |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India building management systems market performed so far and how will it perform in the coming years?

- What is the breakup of the India building management systems market on the basis of service type?

- What is the breakup of the India building management systems market on the basis of software?

- What is the breakup of the India building management systems market on the basis of application?

- What is the breakup of the India building management systems market on the basis of region?

- What are the various stages in the value chain of the India building management systems market?

- What are the key driving factors and challenges in the India building management systems?

- What is the structure of the India building management systems market and who are the key players?

- What is the degree of competition in the India building management systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India building management systems market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India building management systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India building management systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)