India Broom and Mop Market Size, Share, Trends and Forecast by Product Type, Distribution Channel and Region, 2025-2033

India Broom and Mop Market Size and Share:

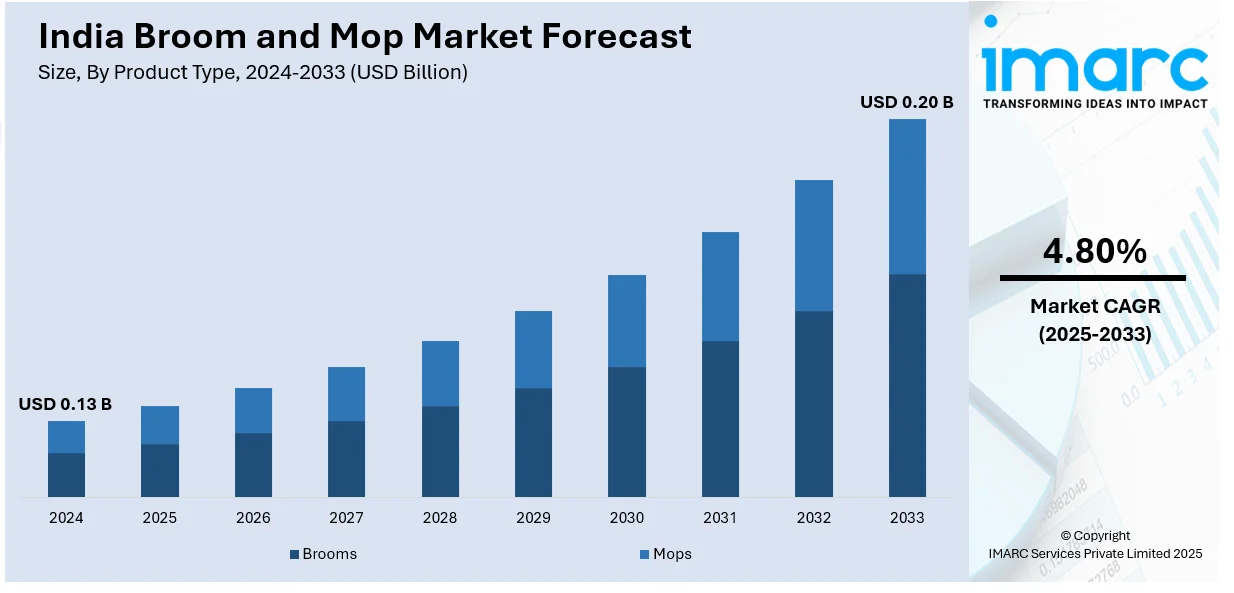

The India broom and mop market size reached USD 0.13 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.20 Billion by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. The rising consciousness regarding hygiene, growing demand for chemical-free and eco-friendly cleaning products, increasing trend toward convenient, time-efficient cleaning products, and expansion of e-commerce sites are further impelling the India broom and mop market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.13 Billion |

| Market Forecast in 2033 | USD 0.20 Billion |

| Market Growth Rate (2025-2033) | 4.80% |

India Broom and Mop Market Trends:

Increasing Demand for Hygienic and Chemical-Free Cleaning Solutions

One of the major trends in the India broom and mop market outlook is that consumers are increasingly opting for hygienic and chemical-free cleaning products. According to the Centre for Science and Environment, 60-70% of cleaning products sold in India do not disclose their chemical compositions, which may result in health and environmental risks. Additionally, an Indian home generates approximately 500 grams of plastic trash every month just from cleaning materials. With consumers becoming increasingly health and environment conscious, there is a visible trend towards using brooms and mops with natural fibers like bamboo, cotton, and jute. These are viewed as green options to synthetic products, which could be laced with chemicals that are not good for health. Moreover, increased awareness regarding indoor air quality and the ill effects of chemical cleaners on health has resulted in consumers opting for healthier, greener alternatives. Companies are countering with the manufacture of brooms and mops not only efficient in cleaning but also enhancing hygiene without the application of harmful chemicals. The trend exists in both rural and urban locations, where shoppers are increasingly moving towards green and eco-friendly cleaning products to keep their living environments healthy.

To get more information on this market, Request Sample

Technological Advancements and Product Innovation

The India broom and mop market share is experiencing growth in technological innovation and product development focused on enhancing efficiency and user-friendliness. Conventional brooms and mops are undergoing change, with producers adding features that improve cleaning performance and convenience. Microfiber mops, for example, have become popular because of their higher dirt-pickup capacity, dust-trapping ability, and ease of maintenance. Further, the availability of spray mops, through which users can dispense cleaning products directly onto flooring, has taken hold in household and business areas. Ergonomic design innovations have also become popular, with both brooms and mops coming in a manner that is designed to be easier to use for longer periods with less strain for the user. As the consumer searches for efficient cleaning agents saving time and energy, these advancements in technology are pushing demand for higher technology-based and easier-to-use broom and mop products in India.

Growth of E-commerce and Online Retailing

The growth of e-commerce and online retailing is another key trend driving the India broom and mop market. As internet penetration increases and more consumers shift toward online shopping, there is a growing preference for purchasing cleaning products, including brooms and mops, through digital platforms. E-commerce websites offer a wide variety of products with detailed descriptions, customer reviews, and competitive prices, which make online shopping an attractive option for consumers. Additionally, the convenience of home delivery and the ability to compare products and prices with ease have further fueled the growth of online sales. The rise of e-commerce giants like Amazon and Flipkart, along with niche cleaning product platforms, has expanded access to a broader range of broom and mop options across urban and rural regions. According to reports, the percentage of online buyers in Tier II and III cities has increased from 46 percent in the financial year 2019-20 (FY20) to 56 percent in FY24, with expectations to hit 64 percent by FY30. This trend is expected to continue, as more consumers embrace the ease and convenience of online shopping for cleaning solutions.

India Broom and Mop Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, distribution channel and region.

Product Type Insights:

- Brooms

- Mops

The report has provided a detailed breakup and analysis of the market based on the product type. This includes brooms and mops.

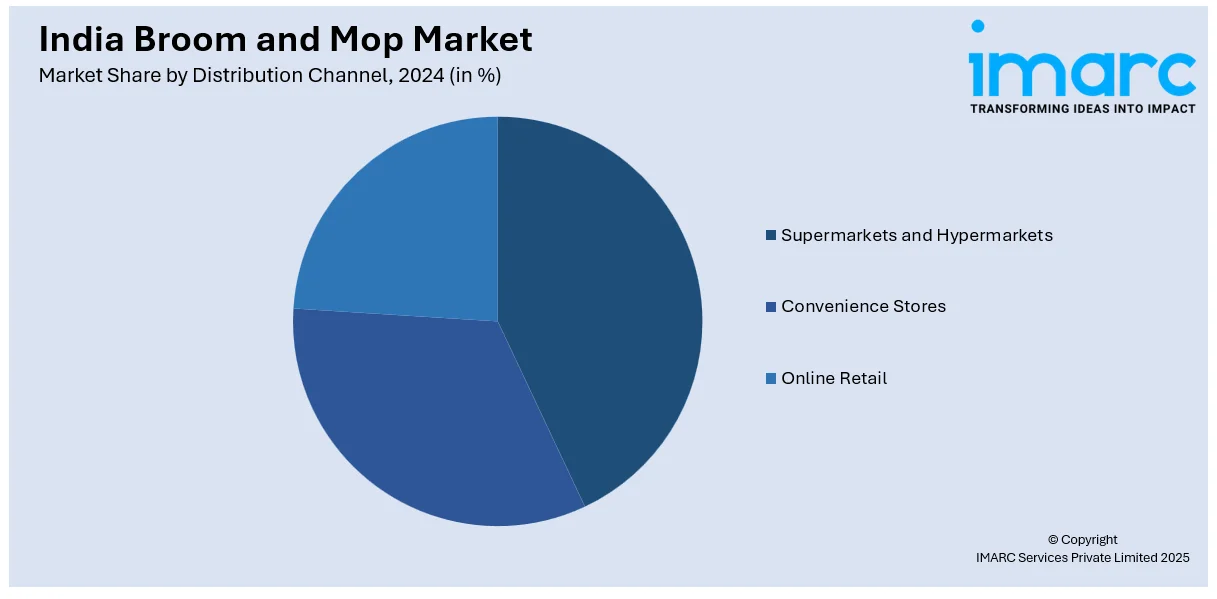

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, and online retail.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Broom and Mop Market News:

- In February 2025, Freudenberg Gala Household Products (FGHP) increased its manufacturing and office spaces in Adas, Gujarat. The inauguration signifies a key moment in increasing the site's ability to satisfy the rising need for innovative household product solutions in India and globally.

India Broom and Mop Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Brooms, Mops |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, and Online Retail |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India broom and mop market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India broom and mop market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India broom and mop industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The broom and mop market in India was valued at USD 0.13 Billion in 2024.

The India broom and mop market is projected to exhibit a CAGR of 4.80% during 2025-2033, reaching a value of USD 0.20 Billion by 2033.

Urbanization, rising awareness towards household cleaning, and commercial cleaning service growth fuel demand. Creative product designs, sustainable material usage, and ergonomic solutions increase market attractiveness. Growth of e-commerce, convenient availability, and disposability hygiene issues also spur adoption. Growing disposable income and sanitation standards awareness in residential as well as institutional segments support market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)