India Breakfast Foods Market Size, Share, Trends and Forecast by Source, Packaging Type, Distribution Channel and Region, 2025-2033

India Breakfast Foods Market Overview:

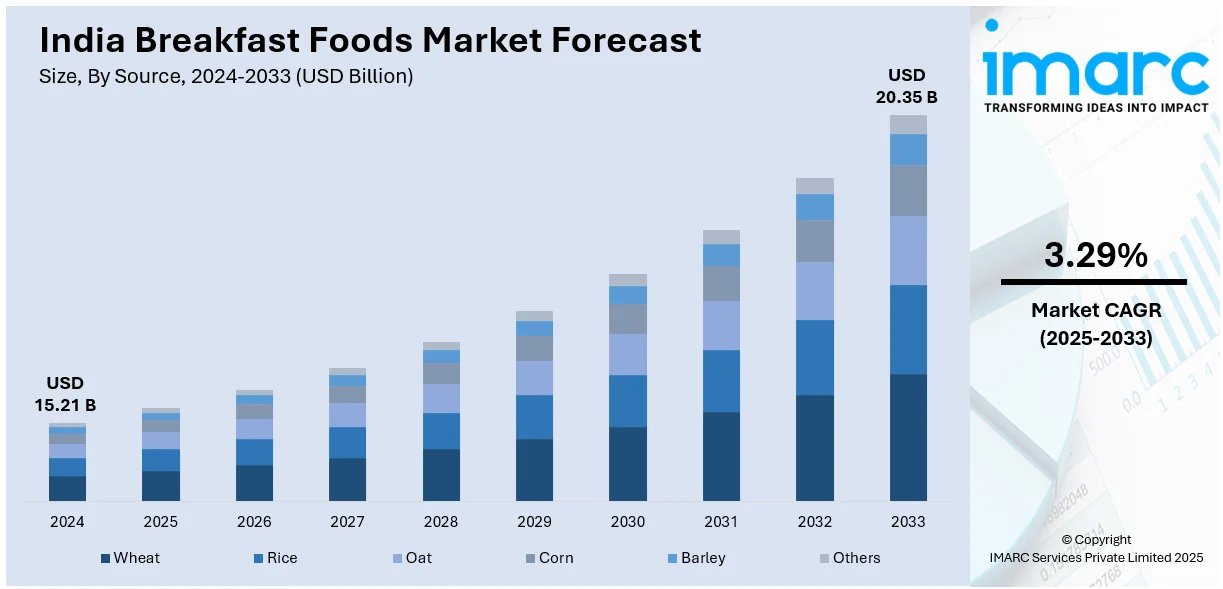

The India breakfast foods market size reached USD 15.21 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 20.35 Billion by 2033, exhibiting a growth rate (CAGR) of 3.29% during 2025-2033. The market is fueled by increasing urbanization, lifestyle changes, and health consciousness. Moreover, growing demand for convenient, ready-to-consume foods, coupled with a shift toward healthier, nutrient-rich products and the impact of Western food trends is also increasing the India breakfast foods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15.21 Billion |

| Market Forecast in 2033 | USD 20.35 Billion |

| Market Growth Rate 2025-2033 | 3.29% |

India Breakfast Foods Market Trends:

Rising Demand for Healthy and Nutrient-Dense Breakfast Options

In India, there is an emerging trend toward breakfast food that is healthier and more nutrient-dense. Increasing health awareness among consumers has led many away from traditional high-refined sugar and fat food items to products with more nutritional value. Recent studies also indicate that approximately 63% of consumers are looking for innovative and healthy snack choices. This trend is being driven by influences like increasing awareness of the need for a balanced diet, growing fitness culture, and the emphasis on weight control and general well-being. Consumers are now seeking breakfast foods that are high in protein, fiber, and vitamins, like oatmeal, muesli, smoothies, and fortified cereals. Apart from this, more and more gluten-free and plant-based products are becoming popular since consumers are on the lookout for alternatives to common wheat-based items. With growing demand for healthier alternatives, players are developing such products that satisfy the changing preferences of health-orientated buyers, fueling the Indian breakfast foods market growth.

To get more information on this market, Request Sample

Growth of Ready-to-Eat and Convenient Breakfast Options

Increased urbanization and hectic lifestyles are fueling the need for convenient and ready-to-eat breakfast in India. As per the industry reports, the frozen ready-to-cook snacks segment is projected to be a Rs 3,500-crore market, with merely 6-7 percent penetration in urban regions. More working professionals, students, and double-income households are resulting in time constraints that are driving people to quick, easy-to-prepare breakfasts. Breakfast packaged foods such as instant cereals, instant oats, breakfast bars, and packaged bread are gaining traction, as they provide a quick and convenient option without sacrificing taste or nutritional content. The trend towards convenience is also being aided by the growth of e-commerce websites, where consumers can easily buy a range of breakfast items from the comfort of their own homes. Brands are responding to this trend by launching healthier, easy-to-consume alternatives that coincide with the rising demand for wholesome and convenient meal options. The trend is redefining the India breakfast food market outlook, while convenience and speed are emerging as major drivers of consumer behavior.

India Breakfast Foods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on source, packaging type, distribution channel and region.

Source Insights:

- Wheat

- Rice

- Oat

- Corn

- Barley

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes wheat, rice, oat, corn, barley, and others.

Packaging Type Insights:

- Boxes

- Pouches

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes boxes, pouches, and others.

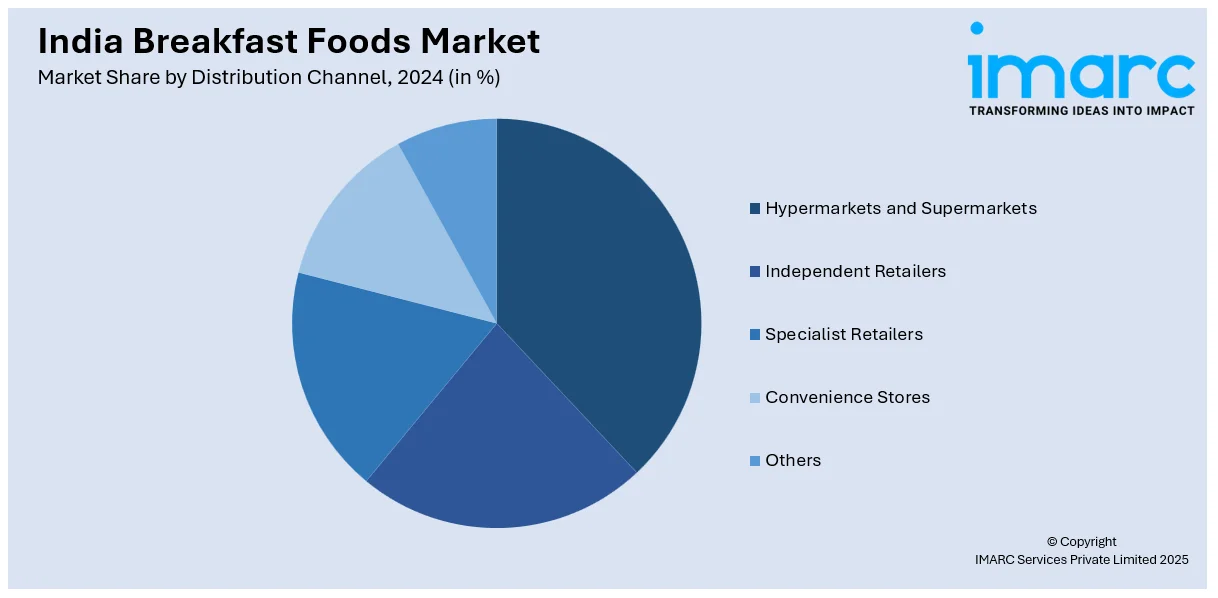

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Independent Retailers

- Specialist Retailers

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, independent retailers, specialist retailers, convenience stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Breakfast Foods Market News:

- In February 2025, Nestlé India broadened its breakfast cereal lineup with the introduction of Munch Choco Fills. Munch Choco Fills, now launched throughout India, aims to make breakfast thrilling with its mix of a crispy exterior and a chocolatey center, ideal for anyone looking for a delightful morning meal.

- In July 2024, Kellanova India opted to reintroduce its top breakfast cereal brand, Kellogg’s Chocos, under the new name Multigrain Chocos. This aligns with the packaged food giant's plan to increase the household reach of its breakfast cereals range in the nation. The organization was previously referred to as Kellogg India.

- In March 2023, Bagrry’s India Private Limited, a prominent health food and breakfast cereals brand in India, revealed the expansion of its breakfast offerings with the introduction of organic honey.

India Breakfast Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Wheat, Rice, Oat, Corn, Barley, Others |

| Packaging Types Covered | Boxes, Pouches, Others |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Independent Retailers, Specialist Retailers, Convenience Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India breakfast foods market performed so far and how will it perform in the coming years?

- What is the breakup of the India breakfast foods market on the basis of source?

- What is the breakup of the India breakfast foods market on the basis of packaging type?

- What is the breakup of the India breakfast foods market on the basis of distribution channel?

- What is the breakup of the India breakfast foods market on the basis of region?

- What are the various stages in the value chain of the India breakfast foods market?

- What are the key driving factors and challenges in the India breakfast foods market?

- What is the structure of the India breakfast foods market and who are the key players?

- What is the degree of competition in the India breakfast foods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India breakfast foods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India breakfast foods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India breakfast foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)