India Bottled Water Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

India Bottled Water Market Summary:

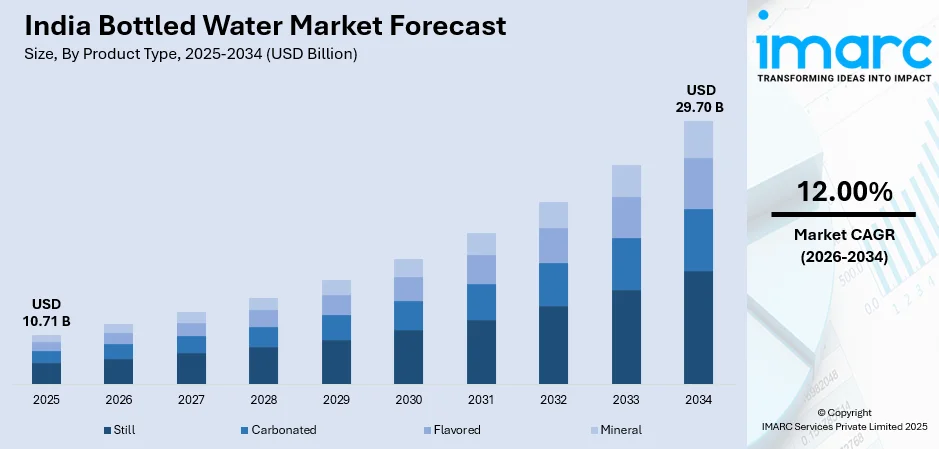

The India bottled water market size was valued at USD 10.71 Billion in 2025 and is projected to reach USD 29.70 Billion by 2034, growing at a compound annual growth rate of 12.00% from 2026-2034.

The India bottled water market is experiencing robust expansion driven by increasing health consciousness among consumers, growing concerns over municipal water quality, and rising urbanization across the country. The expanding middle-class population with heightened awareness of waterborne diseases and preference for safe hydration alternatives is significantly contributing to the India bottled water market share and driving sustained demand across diverse consumer segments.

Key Takeaways and Insights:

-

By Product Type: Still water dominates the market with a share of 50.25% in 2025, driven by widespread consumer preference for pure, non-carbonated hydration and its suitability for everyday consumption needs.

-

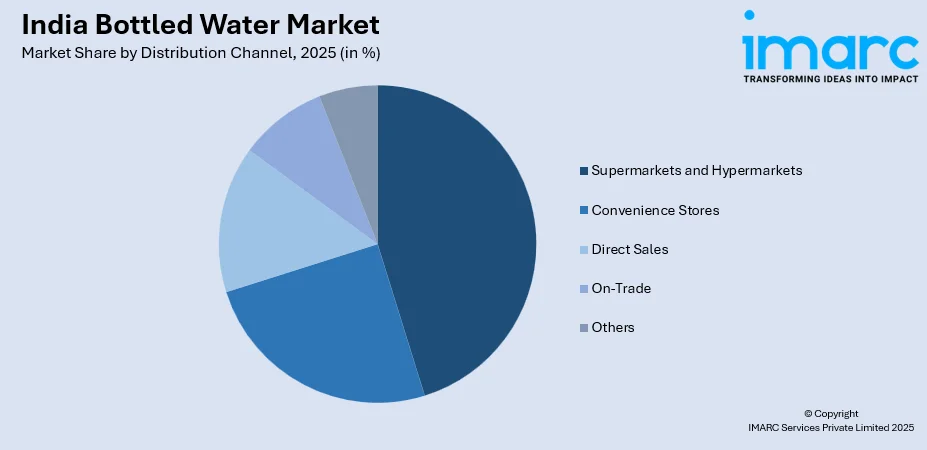

By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 45.37% in 2025, attributed to organized retail expansion, product visibility, one-stop shopping convenience, and assured product authenticity.

-

By Region: North India dominates with a market share of 32% in 2025, driven by high population density, urbanization in the National Capital Region, and significant groundwater quality challenges.

-

Key Players: The India bottled water market features a competitive landscape with established domestic brands commanding significant market presence alongside multinational beverage corporations. Key players differentiate through brand trust, distribution network strength, product quality certifications, and pricing strategies across value and premium segments.

To get more information on this market Request Sample

The India bottled water market has evolved from a niche segment to a mainstream consumer essential, driven by ongoing challenges in accessing safe drinking water across urban and rural areas. The market includes still, carbonated, flavored, and mineral water, catering to diverse consumer preferences and usage occasions. Alongside packaged water, the India water purifier market is witnessing significant growth, valued at USD 3,350.1 Million in 2024 and projected to reach USD 7,119.1 Million by 2033, growing at a CAGR of 8.7% from 2025 to 2033. Rising awareness of waterborne diseases, increasing disposable incomes, and adoption of advanced purification technologies are boosting demand for home and commercial solutions. Gaps in drinking water infrastructure continue to support strong demand for safe, convenient hydration, while premiumization and the HoReCa sector further expand consumption opportunities nationwide.

India Bottled Water Market Trends:

Premiumization and Growing Demand for Natural Mineral Water

The India bottled water market is increasingly shifting toward premium and natural mineral water as health-conscious consumers seek superior hydration solutions. Urban demand for glacier-sourced, spring, and mineral-rich water is rising, supported by perceptions of enhanced health benefits. In May 2024, Marvelle Healthcare launched Rhythm Water, a premium natural mineral water brand sourced from the Himalayas, reflecting growing interest in high-quality bottled water offerings in key urban centres. Alkaline and pH-balanced variants are gaining popularity for digestion and wellness benefits. Luxury hotels, fine-dining restaurants, and corporate offices are further boosting institutional demand for premium bottled water offerings.

Sustainability Focus and Eco-Friendly Packaging Innovations

Sustainability has become a key differentiator in the India bottled water market, driven by environmentally conscious millennials and Gen Z consumers. Companies are adopting recyclable plastics, biodegradable materials, paper cartons, plant-based bioplastics, aluminum bottles, and glass packaging to reduce plastic waste. For instance, Coca-Cola India and ALPLA launched India’s first 100% recycled PET (rPET) bottle for packaged drinking water under the Kinley brand, marking a major step toward circular, recyclable packaging in the bottled water segment. Eco-friendly mineral water packaging is gaining traction as consumers seek plastic-free alternatives.

Expansion of Direct-to-Consumer and E-Commerce Channels

Digitalization is transforming bottled water distribution in India, with brands expanding direct-to-consumer models and online sales channels. Quick commerce platforms and online grocery apps are enabling fast, convenient home delivery, particularly in urban areas. App-based ordering allows consumers to choose from multiple brands and subscription options. In June 2025, CLEAR Premium Water entered e-commerce and quick-commerce platforms including Amazon, Swiggy Instamart, Blinkit, Zepto, BigBasket, and Flipkart Minutes, expanding instant digital access to bottled water. Pandemic-driven shifts toward online purchasing of essentials have created long-term changes in consumer buying behavior and channel preferences.

Market Outlook 2026-2034:

The India bottled water market outlook remains positive, supported by municipal water supply gaps, rising health awareness, and urbanization. Growth will be driven by premiumization, including natural mineral water, functional hydration, and sustainable packaging. Expansion into tier-II and tier-III cities, HoReCa sector recovery, and rising institutional demand from transport hubs and corporates will add momentum. Technological advances in purification, packaging, and supply chains will further improve efficiency and offerings. The market generated a revenue of USD 10.71 Billion in 2025 and is projected to reach a revenue of USD 29.70 Billion by 2034, growing at a compound annual growth rate of 12.00% from 2026-2034.

India Bottled Water Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Still | 50.25% |

| Distribution Channel | Supermarkets and Hypermarkets | 45.37% |

| Region | North India | 32% |

Product Type Insights:

- Still

- Carbonated

- Flavored

- Mineral

The still dominates with a market share of 50.25% of the total India bottled water market in 2025.

Still bottled water dominates the India market due to its universal acceptance as the primary hydration choice for everyday consumption across all demographic segments. The segment benefits from widespread consumer preference for pure, non-carbonated water that serves basic hydration needs without added flavors or carbonation. In 2025, Usha Shriram, a well-known electrical appliances firm, entered the bottled water market with its brand “Aquaero,” marking its strategic foray into FMCG and intensifying competition beyond traditional beverage players. Still water is suitable for all consumption occasions including meals, outdoor activities, travel, and workplace hydration, making it the default choice for most consumers.

The still water segment's leadership reflects the fundamental role of bottled water as a safe drinking water alternative in India where municipal water quality remains a persistent concern. Manufacturers offer still water across diverse packaging formats including small bottles for on-the-go consumption, medium bottles for household use, and large containers for bulk consumption. The segment benefits from extensive distribution networks ensuring availability across urban and rural markets through multiple retail channels. Brand recognition and consumer trust play critical roles in purchase decisions within this segment as consumers prioritize established brands with quality certifications.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

The supermarkets and hypermarkets lead with a share of 45.37% of the total India bottled water market in 2025.

Supermarkets and hypermarkets have established dominance in bottled water distribution through their ability to offer wide product assortment, competitive pricing, and assured product authenticity. These modern retail formats provide consumers with the convenience of comparing multiple brands, pack sizes, and price points within a single shopping trip. In 2025, organised retail chains like Reliance Retail expanded across urban and semi‑urban India, adding around 2,000 stores annually to strengthen distribution and improve accessibility of everyday essentials, including bottled water. The organized retail channel benefits from better visibility through dedicated shelf space and promotional displays that enhance brand presence and drive impulse purchases.

The channel's leadership is reinforced by the rapid expansion of organized retail across Indian cities, bringing modern shopping experiences to increasingly wider consumer segments. Supermarkets and hypermarkets offer advantages including air-conditioned environments, product quality assurance, billing transparency, and return policies that build consumer confidence. The channel also enables bulk purchasing with attractive multi-buy offers that appeal to household buyers seeking value. Strategic partnerships between bottled water brands and major retail chains ensure consistent availability and promotional support that drives category growth.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

North India exhibits a clear dominance with a 32% share of the total India bottled water market in 2025.

North India's market leadership reflects the region's high population density, extensive urbanization particularly in the National Capital Region, and significant groundwater quality challenges that drive demand for safe packaged drinking water. The region encompasses major consumption centers including Delhi, Uttar Pradesh, Punjab, Haryana, and Rajasthan where concerns over water contamination and unreliable municipal supply sustain strong bottled water demand. Hot climatic conditions during summer months significantly elevate consumption patterns, with travelers, outdoor workers, and households increasing bottled water purchases during peak temperature periods.

The region benefits from well-developed distribution infrastructure connecting urban centers with semi-urban and rural areas, ensuring bottled water availability across diverse market segments. Major national brands have established strong presence in North India through manufacturing facilities, distribution networks, and marketing investments targeting the region's large consumer base. The presence of numerous religious pilgrimage sites, tourist destinations, and transportation hubs including railway stations and bus terminals creates substantial on-the-go consumption demand. Corporate and institutional segments including offices, educational institutions, and healthcare facilities contribute additional volume demand in the region.

Market Dynamics:

Growth Drivers:

Why is the India Bottled Water Market Growing?

Inadequate Municipal Water Infrastructure and Quality Concerns

Persistent challenges in municipal water supply infrastructure and quality concerns represent the primary demand driver for bottled water in India. Despite government initiatives to expand tap water coverage to rural and urban households, issues including inconsistent service reliability, last-mile contamination, pipeline leakages, and groundwater depletion continue to elevate perceived health risks associated with tap water consumption. Over 15.7 crore rural households gained tap water access under the Jal Jeevan Mission, covering more than 80% of rural homes, though reliability and consistent quality gaps persist in many regions. Consumers across income segments increasingly prioritize packaged water from trusted brands adhering to Bureau of Indian Standards certifications as a safer alternative to uncertain tap water quality. This fundamental infrastructure gap ensures sustained baseline demand for bottled water as a quasi-utility product.

Rising Health Consciousness and Awareness of Waterborne Diseases

Growing health consciousness among Indian consumers is driving increased preference for safe, quality-assured hydration options over traditional water sources. Heightened awareness of waterborne diseases, contamination risks, and the importance of consuming clean drinking water motivates consumers to invest in bottled water despite availability of alternatives. The post-pandemic period has further amplified consumer focus on health and hygiene, with households increasingly sourcing drinking water directly from trusted bottled water brands. This health-driven consumer behavior transcends income segments, with awareness spreading through digital media, healthcare advisories, and word-of-mouth recommendations.

Urbanization and Expanding HoReCa Sector Demand

Rapid urbanization and the expansion of the hotels, restaurants, and catering sector are driving significant volume growth in the India bottled water market. Urban consumers with busy lifestyles increasingly rely on bottled water for on-the-go hydration during commutes, work hours, and outdoor activities. Demand from hotels and restaurants has risen due to safety concerns and customer preferences. In Bengaluru, over 70% of fine‑dining patrons choose bottled water, reflecting perceptions of safer, higher-quality drinking water and boosting consumption in food service settings. The flourishing food service industry including restaurants, cafes, quick service restaurants, and catering services requires consistent bottled water supply to serve customers expecting quality beverage options. Premium hospitality establishments particularly drive demand for branded and premium bottled water variants as part of enhanced guest experience offerings.

Market Restraints:

What Challenges the India Bottled Water Market is Facing?

Environmental Concerns and Plastic Packaging Regulations

Growing environmental concerns regarding single-use plastic packaging and tightening regulatory frameworks present significant challenges for the bottled water industry. Government initiatives targeting plastic waste reduction and Extended Producer Responsibility requirements are compelling manufacturers to invest in alternative packaging solutions and recycling infrastructure. Consumer sentiment particularly among younger demographics is shifting toward environmentally responsible brands, creating pressure on traditional plastic bottle packaging that dominates the market.

Prevalence of Counterfeit and Spurious Products

The presence of counterfeit and spurious bottled water products, particularly in tier-II and tier-III cities and unorganized retail channels, undermines consumer confidence and poses health risks. Unscrupulous operators refilling branded bottles with untreated water damage brand reputation and erode consumer trust in the category. This challenge particularly affects legitimate manufacturers who invest in quality processes and certifications while competing against low-cost counterfeit products in price-sensitive market segments.

Competition from Water Purification Systems

The growing adoption of household and commercial water purification systems including reverse osmosis units presents competition to bottled water consumption. Consumers increasingly view water purifiers as cost-effective long-term alternatives to recurring bottled water purchases, particularly for household consumption. The expanding availability of affordable water purification solutions across price points enables consumers to access safe drinking water without dependence on packaged products.

Competitive Landscape:

The India bottled water market is highly competitive, shaped by the presence of long-established domestic players and large international beverage companies. Market leadership is driven by strong brand recognition and extensive distribution networks developed over time. Multinational participants leverage wide retail access and aggressive marketing to maintain visibility across urban and semi-urban areas. Premium natural mineral water offerings are gaining traction among health-conscious consumers, particularly in metropolitan regions. Value-focused brands continue to strengthen their position in regional markets through affordable pricing. Institutional demand is supported through dedicated supply channels. Overall, competition is intensifying as brands focus on premiumization, sustainable packaging, and expanding direct consumer engagement.

Recent Developments:

-

In October 2025, Reliance enters India’s bottled water market with Campa Sure, a new value-priced mineral water brand aiming to challenge Bisleri, Kinley and Aquafina with bottles starting as low as ₹5. RCPL plans wide distribution through its retail network to capture share in the ₹30,000 crore packaged water industry.

India Bottled Water Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still, Carbonated, Flavored, Mineral |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Direct Sales, On-Trade, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India bottled water market size was valued at USD 10.71 Billion in 2025.

The India bottled water market is expected to grow at a compound annual growth rate of 12.00% from 2026-2034 to reach USD 29.70 Billion by 2034.

Still water dominates the India bottled water market with a 50.25% share, driven by widespread consumer preference for pure, non-carbonated hydration suitable for everyday consumption needs.

Key factors driving the India bottled water market include inadequate municipal water infrastructure and quality concerns, rising health consciousness and awareness of waterborne diseases, and expanding urbanization with growing HoReCa sector demand.

Major challenges include environmental concerns and tightening plastic packaging regulations, prevalence of counterfeit and spurious products in unorganized channels, and competition from household and commercial water purification systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)