India Bone Graft and Substitutes Market Size, Share, Trends, and Forecast by Material Type, Application, End User, and Region, 2025-2033

India Bone Graft and Substitutes Market Overview:

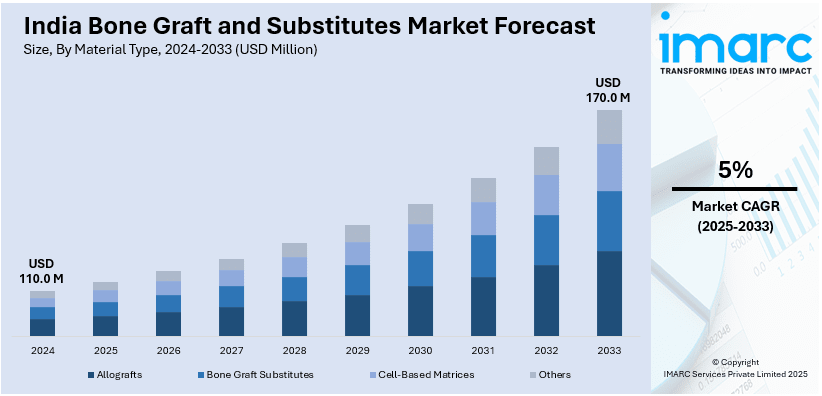

The India bone graft and substitutes market size reached USD 110.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 170.0 Million by 2033, exhibiting a growth rate (CAGR) of 5% during 2025-2033. The market is growing with rising orthopedic and dental procedures, heightened cases of trauma, and technological developments in synthetic graft materials. Additionally, the increased usage of allografts and biomaterials, combined with enhanced healthcare infrastructure, is propelling the market growth. Increasing uses in spinal fusion and regenerative medicine also contribute to industry growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 110.0 Million |

| Market Forecast in 2033 | USD 170.0 Million |

| Market Growth Rate 2025-2033 | 5% |

India Bone Graft and Substitutes Market Trends:

Rising Incidence of Bone-Related Disorders and Trauma Cases

The rising incidence of osteoporosis, arthritis, and traumatic bone injuries in India is fueling the demand for bone substitutes and bone grafts. With the increase in the number of elderly populations, the rates of degenerative bone diseases have also increased, resulting in the need for increased orthopedic procedures. For instance, as per industry reports, by 2050, the percentage of people aged 60 years and above is expected to surpass 20% of the total population. Additionally, increasing numbers of road accidents and sports injuries are leading to a higher number of bone fractures that need grafting. Government efforts to enhance the accessibility of healthcare, along with increasing insurance coverage, are making advanced bone grafting more affordable for a wider patient population. The transition to minimally invasive orthopedic procedures is also impacting product development, with a bias toward synthetic and allograft-based substitutes providing improved integration and recovery. As India's healthcare infrastructure continues to grow, additional hospitals and specialized orthopedic units are capable of undertaking sophisticated bone grafting procedures, thereby further boosting the market. With growing awareness of bone health, especially among the elderly, demand for sophisticated grafting solutions is likely to increase, further justifying the need for high-quality, biocompatible bone graft substitutes.

To get more information on this market, Request Sample

Growing Adoption of Synthetic and Allograft Bone Substitutes

The Indian bone grafts and substitutes market is experiencing a transition towards allograft- and synthetic-based products because they have several advantages over conventional autografts. Synthetic bone grafts, which are developed from bioactive ceramics, calcium phosphates, and polymer-based materials, are becoming increasingly popular because they are biocompatible, less susceptible to infection, and can enhance natural bone healing. Allografts, obtained from donor tissue, provide an alternative option with good viability, especially when autografts are not indicated. The allograft substitutes obviate the requirement of secondary surgical locations, shortening patient recovery periods and decreasing post-operative complications. Advances in biomaterials such as 3D-printed grafts and bioresorbable scaffolds are further boosting the efficacy of bone regeneration treatment. For instance, in July 2024, innovators Adersh G.A. and Shivadhath R.P. announced the launch of OsseoCraft, the world's first clinical 3D bone graft printer. This technology aims to revolutionize bone reconstructive surgery by providing precise and customizable grafts, enhancing surgical outcomes. The availability of these advanced grafts is improving with increased investment in domestic manufacturing and partnerships with international medical device companies. As the adoption of synthetic and allograft solutions grows, the market is expected to see greater demand for cost-effective, high-performance alternatives that address the limitations of traditional bone grafting techniques.

India Bone Graft and Substitutes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on material type, application, and end user.

Material Type Insights:

- Allografts

- Machined Allografts

- Demineralized Bone Matrix (DBMs)

- Bone Graft Substitutes

- Bone Morphogenic Proteins (BMPs)

- Synthetic Bone Grafts

- Cell-Based Matrices

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes allografts (machined allografts and demineralized bone matrix (DBMs)), bone graft substitutes (bone morphogenic proteins (BMPs) and synthetic bone grafts) cell-based matrices, and others.

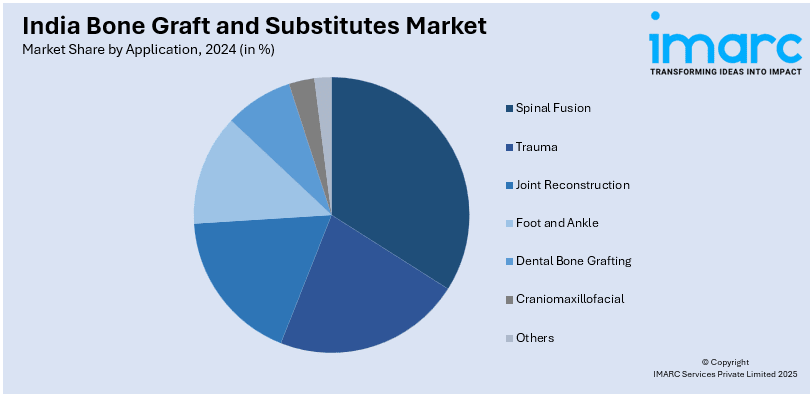

Application Insights:

- Spinal Fusion

- Trauma

- Joint Reconstruction

- Foot and Ankle

- Dental Bone Grafting

- Craniomaxillofacial

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes spinal fusion, trauma, joint reconstruction, foot and ankle, dental bone grafting, craniomaxillofacial, and others.

End User Insights:

- Hospitals

- Surgical Centres

- Clinics

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, surgical centres, clinics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Bone Graft and Substitutes Market News:

- In February 2025, Sree Chitra Tirunal Institute for Medical Sciences and Technology (SCTIMST) announced the launch of two innovative drug-eluting bone graft products, CASPRO and BONYX. The products, developed by SCTIMST’s Biomedical Technology Wing and commercialized by Onyx Medicals Pvt Ltd, offer controlled drug delivery for bone infections and defects, providing long-term healing support.

India Bone Graft and Substitutes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered |

|

| Applications Covered | Spinal Fusion, Trauma, Joint Reconstruction, Foot and Ankle, Dental Bone Grafting, Craniomaxillofacial, Others |

| End Users Covered | Hospitals, Surgical Centres, Clinics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India bone graft and substitutes market performed so far and how will it perform in the coming years?

- What is the breakup of the India bone graft and substitutes market on the basis of material type?

- What is the breakup of the India bone graft and substitutes market on the basis of application?

- What is the breakup of the India bone graft and substitutes market on the basis of end user?

- What is the breakup of the India bone graft and substitutes market on the basis of region?

- What are the various stages in the value chain of the India bone graft and substitutes market?

- What are the key driving factors and challenges in the India bone graft and substitutes?

- What is the structure of the India bone graft and substitutes market and who are the key players?

- What is the degree of competition in the India bone graft and substitutes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bone graft and substitutes market from 2025-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bone graft and substitutes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bone graft and substitutes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)