India Blood Warmer Devices Market Size, Share, Trends and Forecast by Product, Type, End Use, and Region, 2025-2033

India Blood Warmer Devices Market Overview:

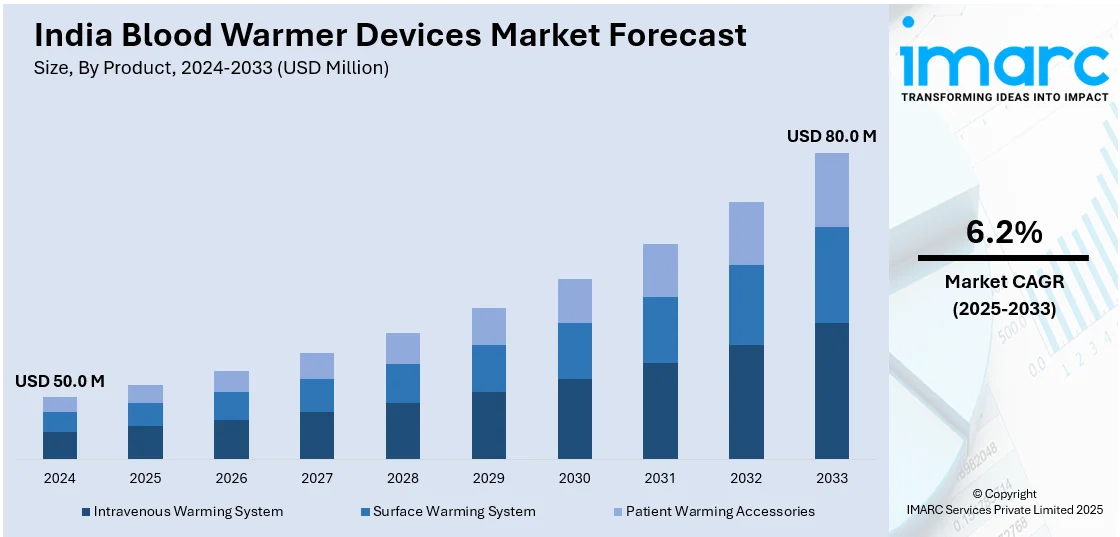

The India blood warmer devices market size reached USD 50.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 80.0 Million by 2033, exhibiting a growth rate (CAGR) of 6.2% during 2025-2033. The India blood warmer market is driven by expanding healthcare infrastructure, government initiatives supporting medical device manufacturing, increasing surgical procedures, rising demand for neonatal and emergency care, advancements in medical technology, and the emphasis on patient safety in hospitals and ambulatory settings, ensuring optimal blood and fluid temperature management during critical treatments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 50.0 Million |

| Market Forecast in 2033 | USD 80.0 Million |

| Market Growth Rate 2025-2033 | 6.2% |

India Blood Warmer Devices Market Trends:

Rising Incidence of Hypothermia and Trauma Cases

India has one of the highest rates of road traffic accidents and trauma cases in the world. Moreover, a substantial majority of patients end up being operated on extensively or being afflicted with hemorrhagic conditions, such as postpartum bleeding, internal bleeding, or serious infections, that result in massive blood loss. In such instances, blood transfusions are instrumental in stabilizing the patient. Yet, when vast amounts of cold-stored blood or IV fluids are infused without adequate warming, they will lower the patient's core body temperature dramatically and induce hypothermia. Hypothermia is especially risky in trauma patients because it may induce coagulopathy (blood-clotting disorder), raise the risk of infection, extend hospital stays, and even result in multi-organ failure. According to research, even a decrease of 1°C in core body temperature would raise mortality rates in trauma patients. This has influenced the growing demand for blood warmer devices in emergencies and critical care environments. These machines ensure the optimal transfusion temperature (37°C) to reduce hypothermia-related complications and improve patient outcomes.

To get more information on this market, Request Sample

New Product Launches and Technological Advancements

India blood warmer devices market is witnessing growth as a result of ongoing technology development and launch of new products designed to further augment patient care. Companies are bringing innovative blood warmers with the latest features of accurate temperature adjustment, high-speed warming, and portability for enhanced efficiency in critical conditions. The combination of microprocessor-based controls and smart sensors has greatly improved the safety and precision of blood warming, minimizing the risks of transfusing cold fluids or blood. The growing trend of compact, battery-powered blood warmers is also influencing adoption in emergency and military uses where mobility is paramount. Key players are also introducing disposable warming sets to guarantee sterility and reduce the risk of contamination. Advancements in infrared heating and dry heat-based blood warmers are enhancing efficiency and diminishing the reliance on conventional water bath-dependent systems. Increased use of AI-based monitoring systems in healthcare also affected the evolution of smart blood warmer devices that offer real-time temperature monitoring and notifications.

India Blood Warmer Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, type, and end use.

Product Insights:

- Intravenous Warming System

- Surface Warming System

- Patient Warming Accessories

The report has provided a detailed breakup and analysis of the market based on the product. This includes intravenous warming system, surface warming system, and patient warming accessories.

Type Insights:

- Portable

- Non-Portable

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes portable and non-portable.

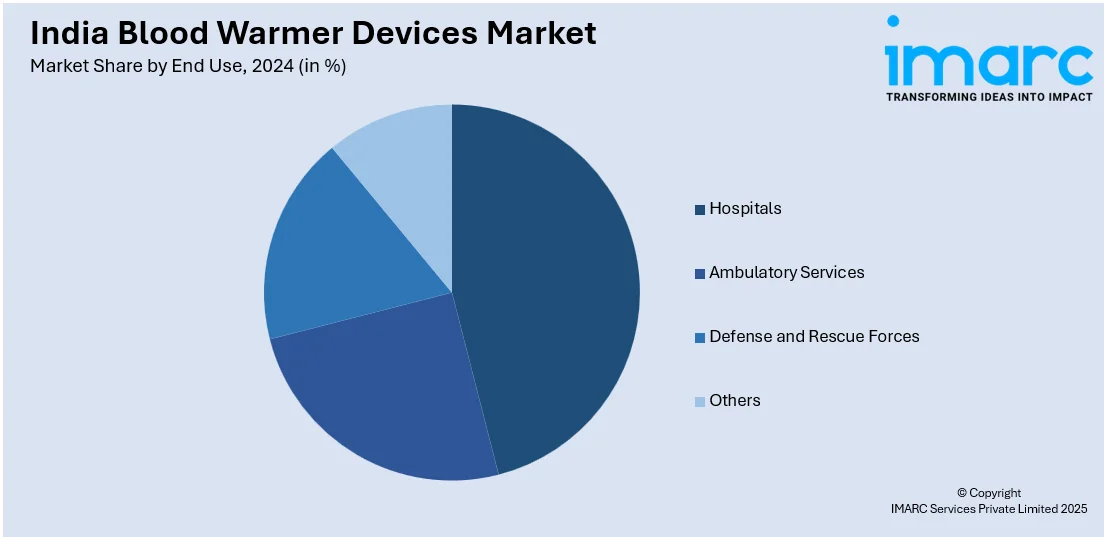

End Use Insights:

- Hospitals

- Ambulatory Services

- Defense and Rescue Forces

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes hospitals, ambulatory services, defense and rescue forces, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Blood Warmer Devices Market News:

- October 2024: AKAS Medical Equipment launched the WARMJET IV and WARMJET II, India's first indigenously developed and produced blood and fluid warmers. These machines improve patient care by avoiding hypothermia during crucial medical procedures. The launch fortifies India's blood warmer market by encouraging local innovation and decreasing dependence on foreign equipment.

India Blood Warmer Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Intravenous Warming System, Surface Warming System, Patient Warming Accessories |

| Types Covered | Portable, Non-Portable |

| End Uses Covered | Hospitals, Ambulatory Services, Defense and Rescue Forces, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India blood warmer devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India blood warmer devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India blood warmer devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The blood warmer devices market in India was valued at USD 50.0 Million in 2024.

The India blood warmer devices market is projected to exhibit a CAGR of 6.2% during 2025-2033, reaching a value of USD 80.0 Million by 2033.

The India blood warmer devices market is driven by rising surgical procedures, increasing trauma cases, and growing awareness about safe transfusion practices. Hospitals and clinics seek reliable solutions to prevent hypothermia during transfusions. Demand grows as healthcare infrastructure expands, patient safety standards improve, and advanced medical technologies gain acceptance, supporting the growth for blood warmer device adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)