India Blockchain Identity Management Market Size, Share, Trends and Forecast by Component, Organization Size, Application, Vertical, and Region, 2025-2033

India Blockchain Identity Management Market Overview:

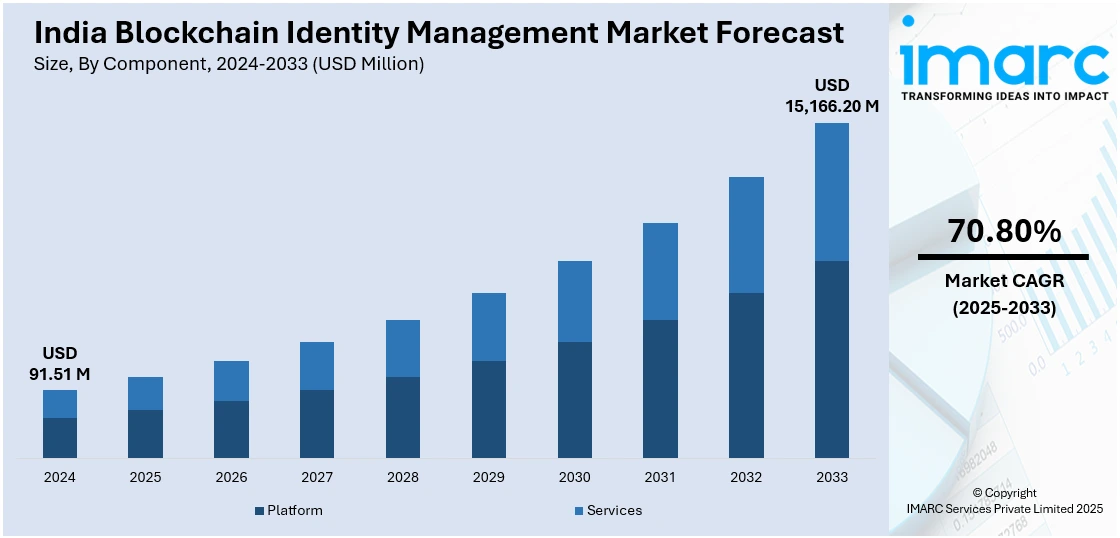

The India blockchain identity management market size reached USD 91.51 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 15,166.20 Million by 2033, exhibiting a growth rate (CAGR) of 70.80% during 2025-2033. The market is driven by rising concerns over data security, favorable government initiatives, such as Aadhaar-linked blockchain systems, and the increasing adoption of decentralized identity solutions. Moreover, the expanding digital banking applications, regulatory compliance needs, and enterprise blockchain adoption are also bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 91.51 Million |

| Market Forecast in 2033 | USD 15,166.20 Million |

| Market Growth Rate 2025-2033 | 70.80% |

India Blockchain Identity Management Market Trends:

Government Adoption of Blockchain for Digital Identity

The government is increasingly leveraging blockchain technology to enhance security, transparency, and efficiency in national digital identity systems. One key initiative is the exploration of blockchain-based Aadhaar verification, aimed at preventing identity fraud and strengthening privacy protections. With over 1.3 billion Aadhaar-linked accounts, blockchain can provide a tamper-proof digital identity framework. Furthermore, the Ministry of Electronics and Information Technology (MeitY) is leading the creation of a national blockchain strategy to increase usage in public services, digital voting, and identity verification. Blockchain is also being used in India's 100 Smart Cities program to secure citizen identification verification, streamline authentication procedures, and improve service delivery. With the growth of digital public infrastructure, blockchain technology is expected to play an important role in enabling safe, decentralized, and transparent identity management across a wide range of government and private sector applications.

To get more information on this market, Request Sample

Rising Enterprise Adoption and Decentralized Identity Solutions

Enterprises are rapidly embracing self-sovereign identity (SSI) and decentralized identity (DID) models to minimize dependence on centralized databases, which are increasingly vulnerable to cyberattacks. In the financial sector, banks and fintech firms are integrating blockchain-based Know Your Customer (KYC) solutions, cutting verification costs by up to 30% and accelerating digital onboarding processes. The rising emphasis on cybersecurity and regulatory compliance has encouraged blockchain adoption, notably in India, which had a 25% year-on-year increase in data breaches in 2023. To improve security, organizations are turning to blockchain for robust identity management systems that fulfill demanding regulatory requirements. Furthermore, the popularity of Web3 and metaverse applications is increasing the need for blockchain-based authentication in decentralized apps (dApps), NFT transactions, and digital wallets. As digital economies grow, blockchain technology is emerging as a major facilitator of secure, decentralized, and tamper-proof identity verification across a wide range of businesses.

India Blockchain Identity Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, organization size, application, and vertical.

Component Insights:

- Platform

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes platform and services.

Organization Size Insights:

- Large Organization

- Small and Medium Organization

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes large organization and small and medium organization.

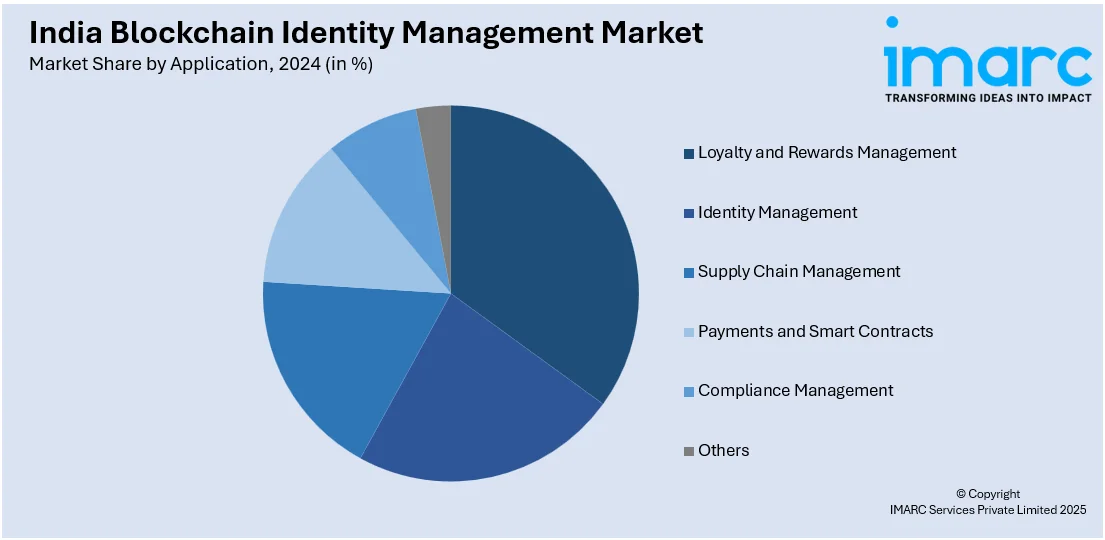

Application Insights:

- Loyalty and Rewards Management

- Identity Management

- Supply Chain Management

- Payments and Smart Contracts

- Compliance Management

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes loyalty and rewards management, identity management, supply chain management, payments and smart contracts, compliance management, and others.

Vertical Insights:

- BFSI

- Government

- Healthcare & Life Sciences

- Telecom and IT

- Retail and E-Commerce

- Transport and Logistics

- Real Estate

- Media and Entertainment

- Travel and Hospitality

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes BFSI, government, healthcare and life sciences, telecom and IT, retail and e-commerce, transport and logistics, real estate, media and entertainment, travel and hospitality, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Blockchain Identity Management Market News:

- March 2025: Mintoak, a merchant payment services provider backed by PayPal and HDFC Bank, acquired Digiledge for approximately USD 3.5 million. This acquisition is expected to be significant for India's central bank digital currency (CBDC) sector and aligns with the Reserve Bank of India's expansion of its CBDC pilot to include payment firms beyond banks.

- January 2025: Soulverse partnered with the India Blockchain Alliance to implement blockchain-based identity infrastructure across 50+ colleges, targeting 20,000 students. Through its SoulWallet platform, the initiative aims to streamline credential verification and identity management, enhancing data security and transparency.

- March 2024: IDfy, a digital identity verification startup, secured USD 27 million through a combination of primary and secondary fundraising rounds. This capital infusion is intended to support the company's expansion plans and further development of its identity verification technologies.

India Blockchain Identity Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Platform, Services |

| Organization Sizes Covered | Large Organization, Small and Medium Organization |

| Applications Covered | Loyalty and Rewards Management, Identity Management, Supply Chain Management, Payments and Smart Contracts, Compliance Management, Others |

| Verticals Covered | BFSI, Government, Healthcare and Life Sciences, Telecom and IT, Retail and E-Commerce, Transport and Logistics, Real Estate, Media and Entertainment, Travel and Hospitality, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India blockchain identity management market performed so far and how will it perform in the coming years?

- What is the breakup of the India blockchain identity management market on the basis of component?

- What is the breakup of the India blockchain identity management market on the basis of organization size?

- What is the breakup of the India blockchain identity management market on the basis of application?

- What is the breakup of the India blockchain identity management market on the basis of vertical?

- What are the various stages in the value chain of the India blockchain identity management market?

- What are the key driving factors and challenges in the India blockchain identity management market?

- What is the structure of the India blockchain identity management market and who are the key players?

- What is the degree of competition in the India blockchain identity management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India blockchain identity management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India blockchain identity management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India blockchain identity management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)