India Bitumen Market Size, Share, Trends and Forecast by Product Type, Viscosity Grade, Application, and Region, 2025-2033

India Bitumen Market Overview:

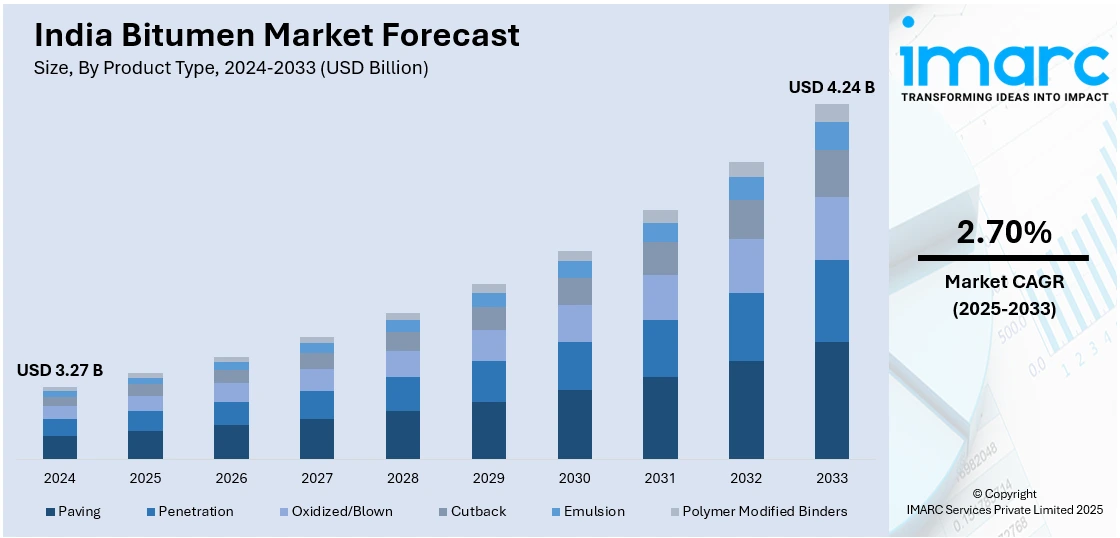

The India bitumen market size reached USD 3.27 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.24 Billion by 2033, exhibiting a growth rate (CAGR) of 2.70% during 2025-2033. Key factors driving the India bitumen market include rapid infrastructure development, rising vehicle ownership, expanding bitumen imports, advancements in modified bitumen, and rising investments in domestic bitumen production capacity to reduce import dependency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.27 Billion |

| Market Forecast in 2033 | USD 4.24 Billion |

| Market Growth Rate 2025-2033 | 2.70% |

India Bitumen Market Trends:

Infrastructure Development and Road Expansion

India's bitumen industry is heavily influenced by the fast development of infrastructure, especially in road construction. The government has been actively promoting projects under schemes, such as the Bharatmala Pariyojana, to construct more than 34,800 km of highways to enhance connectivity. In the same manner, rural roads under Pradhan Mantri Gram Sadak Yojana (PMGSY) have boosted demand for bitumen-based products. With India moving further toward being urbanized and industrialized, highways, expressways, and urban roads that connect all regions have become imperative. Vehicle ownership is increasing and so is the number of smart cities, leading to growing logistical needs, all of which exert pressure on authorities to improve road networks. Being cheaper and durable, the primary paving material is generally bitumen. Additionally, maintenance and repair of roads already in use also support the consistent demand for bitumen. As Indian roads are exposed to harsh weather conditions, they need to be resurfaced and repaired periodically, further supporting the market.

To get more information on this market, Request Sample

Rising Investments In Domestic Bitumen Production Capacity To Reduce Import Dependency

India's concerted efforts to bolster domestic bitumen production are significantly reshaping its bitumen market by reducing import dependency and fostering economic benefits. In the fiscal year 2023-24, India's bitumen consumption reached approximately 8.8 million metric tons, with projections indicating an increase to 10 million metric tons in 2024-25. Notably, about 50% of this demand has been met through imports, incurring an annual expenditure of INR 25,000–30,000 crore. To address this, the government has initiated the integration of bio-bitumen into traditional petroleum-based bitumen. Developed from agricultural residues like paddy straw, bio-bitumen allows for a substitution of up to 35% in conventional bitumen mixtures. This strategy is anticipated to save approximately INR 10,000 crore in foreign exchange outflows. Additionally, the government’s focus on bio-bitumen not only reduces import reliance but also addresses environmental concerns by converting agricultural waste into valuable resources, supporting both sustainability and rural incomes.

India Bitumen Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, viscosity grade, and application.

Product Type Insights:

- Paving

- Penetration

- Oxidized/Blown

- Cutback

- Emulsion

- Polymer Modified Binders

The report has provided a detailed breakup and analysis of the market based on the product type. This includes paving, penetration, oxidized/blown, cutback, emulsion, and polymer modified binders.

Viscosity Grade Insights:

- VG10

- VG30

- VG40

- Others

A detailed breakup and analysis of the market based on the viscosity grade have also been provided in the report. This includes VG10, VG30, VG40, and others.

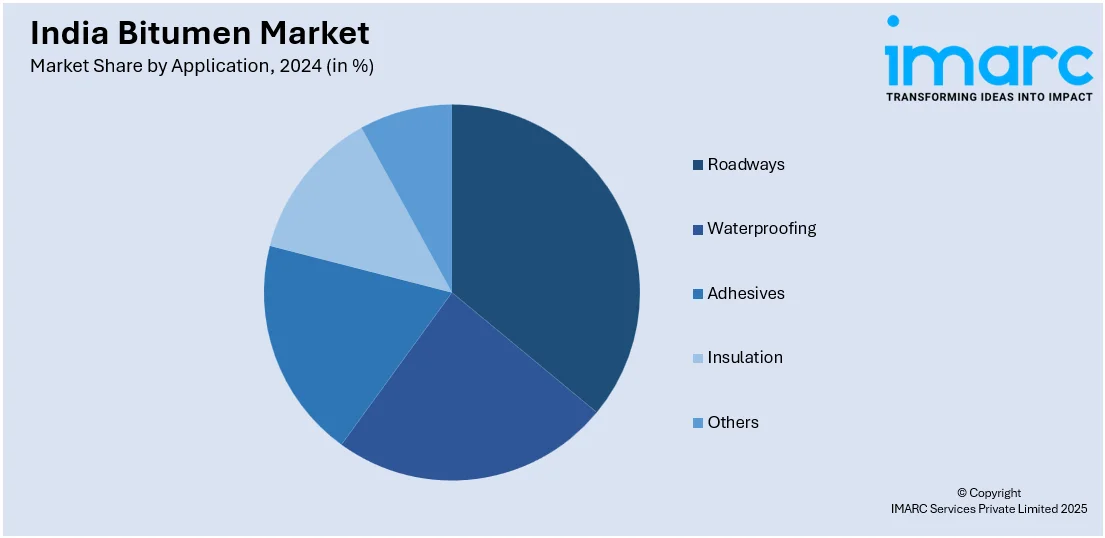

Application Insights:

- Roadways

- Waterproofing

- Adhesives

- Insulation

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes roadways, waterproofing, adhesives, insulation, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Bitumen Market News:

- December 2024: Mangalore Refinery and Petrochemicals Limited (MRPL) commissioned a new bitumen production unit in Mangaluru, utilizing advanced 'Biturox' technology from Austria. This facility, engineered by Engineers India Limited, doubles MRPL's bitumen production capacity to 150,000 metric tons annually. The unit is designed to consistently produce premium VG40 bitumen, with the flexibility to manufacture VG30 and other grades to meet diverse industry needs.

- December 2024: Praj Industries inaugurated India's first national highway constructed with lignin-based bio-bitumen at the Nagpur-Mansar Bypass Project on NH44. This eco-friendly technology allows for up to 15% blending with conventional bitumen, reducing greenhouse gas emissions by 70% compared to traditional methods.

- October 2024: Platts, part of S&P Global Commodity Insights, will begin publishing daily assessments for bitumen delivered on a Cost and Freight (CFR) basis to West and East Coast India. These assessments will reflect bulk Viscosity Grade 30 and VG40 bitumen for delivery 10-25 days forward for West Coast India and 15-30 days forward for East Coast India. Specific ports include Kandla, Mundra, and Pipavav for the West Coast, and Haldia, Kolkata, Chennai, Vishakhapatnam, and Paradip for the East Coast.

India Bitumen Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Paving, Penetration, Oxidized/Blown, Cutback, Emulsion, Polymer Modified Binders |

| Viscosity Grades Covered | VG10, VG30, VG40, Others |

| Applications Covered | Roadways, Waterproofing, Adhesives, Insulation, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India bitumen market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India bitumen market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India bitumen industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bitumen market in India was valued at USD 3.27 Billion in 2024.

The India bitumen market is projected to exhibit a CAGR of 2.70% during 2025-2033, reaching a value of USD 4.24 Billion by 2033.

The India bitumen market is expanding due to rising infrastructure development, especially in road construction and maintenance. Government-backed projects, growing urbanization, and increased demand in roofing and waterproofing drive usage. Additionally, innovations in bitumen formulations and a push for self-reliant production support further market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)