India Biscuits Market Size, Share, Trends and Forecast by Product Type, Ingredient, Packaging Type, Distribution Channel, and Region, 2025-2033

India Biscuits Market Overview:

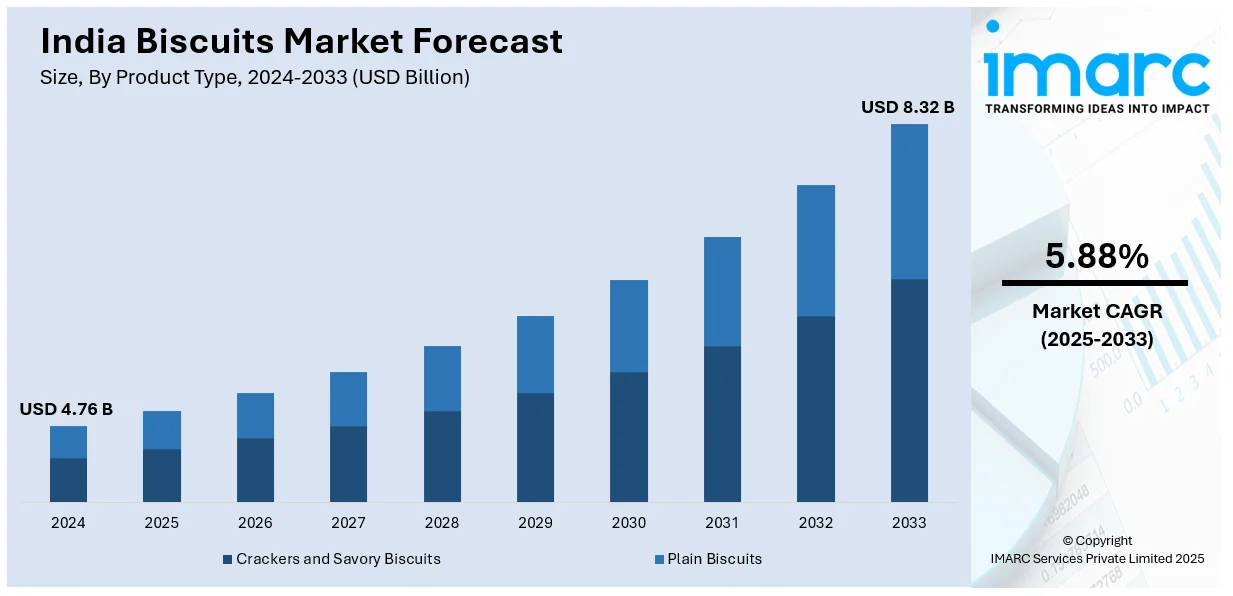

The India biscuits market size reached USD 4.76 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.32 Billion by 2033, exhibiting a growth rate (CAGR) of 5.88% during 2025-2033. The market is growing as a result of rising consumer demand for varied, health-oriented, and convenient snack foods, aided by advances in packaging, ingredients, and distribution channels, to meet changing tastes and busy lifestyles in urban and rural regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.76 Billion |

| Market Forecast in 2033 | USD 8.32 Billion |

| Market Growth Rate 2025-2033 | 5.88% |

India Biscuits Market Trends:

Health-Conscious Biscuits

In the last few years, there has been a definitive change towards healthy biscuits in India. People are searching more and more for products that fit their heightening awareness of a healthy diet. Biscuits are now being produced using whole grains, including oats, millet, and barley, providing more fiber and nutrients. Gluten-free, sugar-free, and low-calorie biscuits are gaining popularity as people search for something different from the usual options. There is a growing demand for fortified biscuits with vitamins, minerals, and other wholesome ingredients as well. With India's wellness and health movement, there is an increase in biscuits as functional foods being positioned to enhance one's dietary intake. The urban population especially is focusing more on products which have a good effect on one's digestive health, immunity, and overall wellbeing. This change has caused manufacturers to create and offer healthier, more nutritious alternatives without compromising on taste and convenience. For instance, in June 2024, Bisk Farm enhanced its 'Eat Fit' lineup with the additions of 'Eat Fit Digestive' and 'Eat Fit Atta Marie' biscuits for those health-focused buyers who would have whole-wheat, no extra sugar, high-fiber possibilities.

To get more information on this market, Request Sample

Premium and Indulgence Biscuits

There has been an increase in demand for premium and indulgent biscuits in the Indian biscuit industry. This is fueled by shifting consumer preference for superior-quality snacks and willingness to pay extra for indulgent treats. Premium biscuits, produced with imported ingredients, unusual flavors, and upmarket packaging, are meeting the boosting demand for luxury foods. For example, in June 2024, Mondelēz International joined forces with Lotus Bakeries to produce, promote, and distribute Biscoff cookies in India, tapping Mondelēz's distribution platform to drive the brand's growth in the premium cookie category with high potential. Moreover, not only have these biscuits been made to deliver exceptional taste and texture but they are also specifically crafted to impart a novel sense experience. With rising disposable incomes and evolving lifestyles, consumers are seeking biscuits that go beyond simple snacking, turning them into indulgent treats. This trend is especially strong in cities, where shoppers enjoy better availability of specialty foods and are more likely to try new flavors. Companies are trying out ingredients such as dark chocolate, nuts, and dried fruits to upgrade the whole experience.

Convenience and On-the-Go Packaging

The rise in convenience and portability has heavily influenced the India biscuit industry with the rising desire for biscuits packed in compact, convenient-to-carry portions. With hectic lifestyles, particularly in cities, people are opting for snacks that are easy, fast, and on-the-go. Biscuits now come in single-pouch packs, resealable packets, and travel-packing forms to address this necessity for portability. This trend is especially favored by working professionals, students, and individuals who are always on the move. Also, the popularity of e-commerce websites has made it easy to access a range of packaged biscuits, further supporting this trend. Manufacturers are emphasizing providing biscuits that not only fulfill convenience needs but also retain freshness and flavor in these small packaging sizes. This increasing demand for convenience is the defining trend in India's biscuit market, and it is a key force for driving change.

India Biscuits Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, ingredient, packaging type, and distribution channel.

Product Type Insights:

- Crackers and Savory Biscuits

- Plain Crackers

- Flavored Crackers

- Sweet Biscuits

- Plain Biscuits

- Cookies

- Sandwich Biscuits

- Chocolate-Coated Biscuits

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes crackers and savory biscuits (plain crackers, and flavored crackers) sweet biscuits (plain biscuits, cookies, sandwich biscuits, chocolate-coated biscuits, and others).

Ingredient Insights:

- Wheat

- Oats

- Millets

- Others

A detailed breakup and analysis of the market based on the ingredient have also been provided in the report. This includes wheat, oats, millets, and others.

Packaging Type Insights:

- Pouches/Packets

- Jars

- Boxes

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes pouches/packets, jars, boxes, and others.

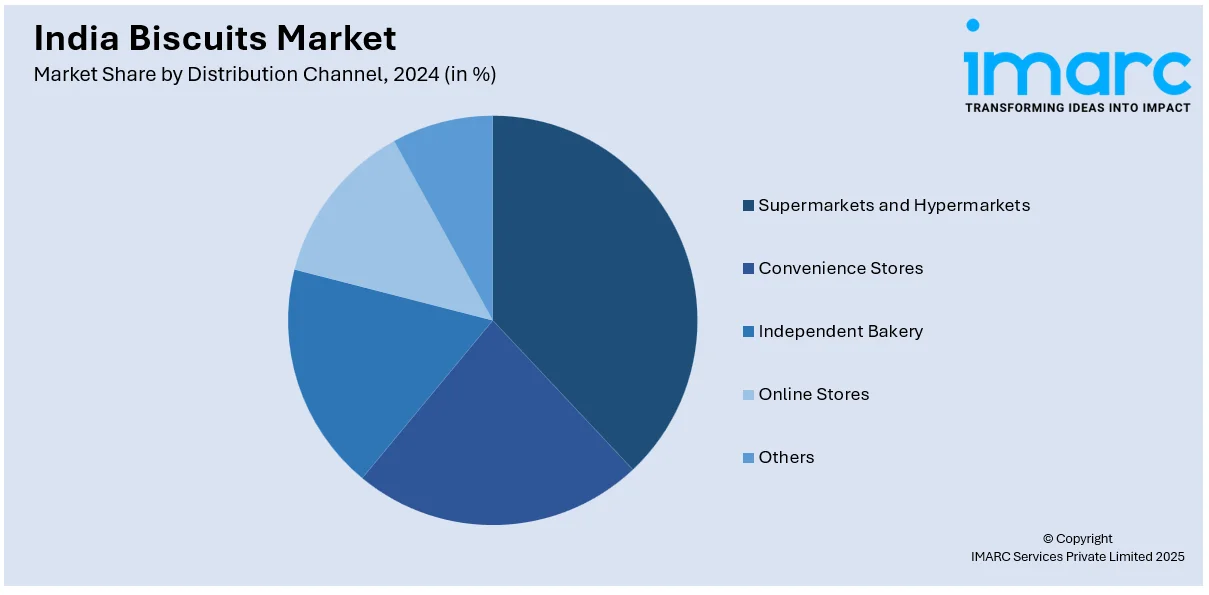

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Independent Bakery

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, independent bakery, online stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Biscuits Market News:

- In August 2024, ITC Sunfeast launched 'Super Egg & Milk Biscuit' throughout South and East India, focusing on children nutrition with a protein-enriched combination of egg and milk. The biscuits will offer a nutritious, tasty, and convenient snacking solution, bolstering ITC's biscuit portfolio.

- In July 2024, Lifespan Pvt Ltd introduced India's first 11-variant protein biscuit range, addressing health-conscious consumers with nutrition-dense products. The assortment provides varied formulations, promoting active lifestyles and balanced nutrition, upholding the increasing demand for healthier snacking options in the Indian market.

India Biscuits Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Ingredients Covered | Wheat, Oats, Millets, Others |

| Packaging Types Covered | Pouches/Packets, Jars, Boxes, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Independent Bakery, Online Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India biscuits market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India biscuits market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India biscuits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biscuits market in India was valued at USD 4.76 Billion in 2024.

The India biscuits market is projected to exhibit a CAGR of 5.88% during 2025-2033, reaching a value of USD 8.32 Billion by 2033.

The Indian biscuits market is driven by rapid urbanization, rising disposable incomes, growing preference for convenient, on-the-go snacks, and changing lifestyles. Increased health consciousness also fuels demand for healthier options like multi-grain and sugar-free varieties, alongside continuous product innovation and expanding distribution channels.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)