India Biosurfactants Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Biosurfactants Market Overview:

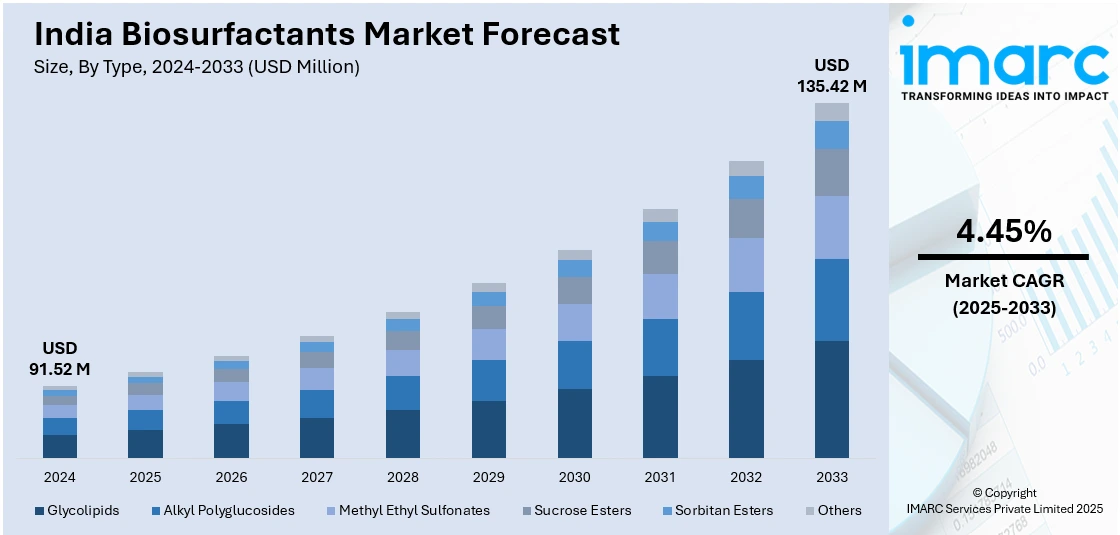

The India biosurfactants market size reached USD 91.52 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 135.42 Million by 2033, exhibiting a growth rate (CAGR) of 4.45% during 2025-2033. The rising demand for eco-friendly and biodegradable surfactants, increasing industrial applications in detergents, cosmetics, and agriculture, and stringent environmental regulations are strengthening the market growth. Besides this, advancements in microbial fermentation, expanding research and development (R&D) investments, and a shift toward sustainable alternatives to synthetic surfactants in various industries are further contributing to the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 91.52 Million |

| Market Forecast in 2033 | USD 135.42 Million |

| Market Growth Rate 2025-2033 | 4.45% |

India Biosurfactants Market Trends:

Rising Demand for Eco-Friendly and Biodegradable Surfactants

Growing environmental awareness and stringent regulations on synthetic surfactants are fueling the adoption of biosurfactants in India. Derived from microbial fermentation and plant-based sources, biosurfactants offer superior biodegradability and lower toxicity compared to conventional petroleum-based alternatives. Their rising demand is driven by the expanding personal care, detergent, and industrial cleaning sectors, with the market for biodegradable detergents alone projected to grow by 20% by 2025, spurred by the Bureau of Indian Standards (BIS) guidelines promoting eco-friendly formulations. Multinational corporations like Unilever and Procter & Gamble are incorporating biosurfactants such as rhamnolipids and sophorolipids into their Indian product lines, particularly in cosmetics and household cleaners, to cater to the increasing consumer preference for natural and sustainable ingredients. Additionally, the Indian government’s push for green chemistry and circular economy initiatives is encouraging domestic manufacturers to scale up biosurfactant production. By 2025, local production capacity is expected to rise by 30%, reducing reliance on imports and lowering costs, further boosting the shift toward sustainable surfactants in the Indian market.

To get more information on this market, Request Sample

Growing Application in Agriculture and Bioremediation

The adoption of biosurfactants in India's agriculture and environmental cleanup sectors is surging as a sustainable alternative to synthetic agrochemicals. With nearly 70% of surface and groundwater contaminated, growing concerns over soil and water pollution are driving their use in pesticide formulations, soil remediation, and plant growth enhancement. Government initiatives like the National Mission on Sustainable Agriculture (NMSA) are actively promoting bio-based inputs such as biosurfactants to improve soil health and reduce chemical runoff. Additionally, biosurfactants are proving vital in bioremediation efforts, aiding in the degradation of oil spills, heavy metals, and industrial pollutants. The Indian oil and gas sector is increasingly leveraging biosurfactants for enhanced oil recovery (EOR) and wastewater treatment, with demand projected to grow by 15% by 2025. Companies like ONGC and Indian Oil Corporation are investing in biosurfactant-based solutions to comply with stricter pollution control regulations. As awareness of climate change and sustainable agriculture rises, biosurfactants are set to play a key role in India’s transition to greener industrial and agricultural practices, reducing environmental impact while enhancing productivity and resource efficiency.

India Biosurfactants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Glycolipids

- Alkyl Polyglucosides

- Methyl Ethyl Sulfonates

- Sucrose Esters

- Sorbitan Esters

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes glycolipids, alkyl polyglucosides, methyl ethyl sulfonates, sucrose esters, sorbitan esters, and others.

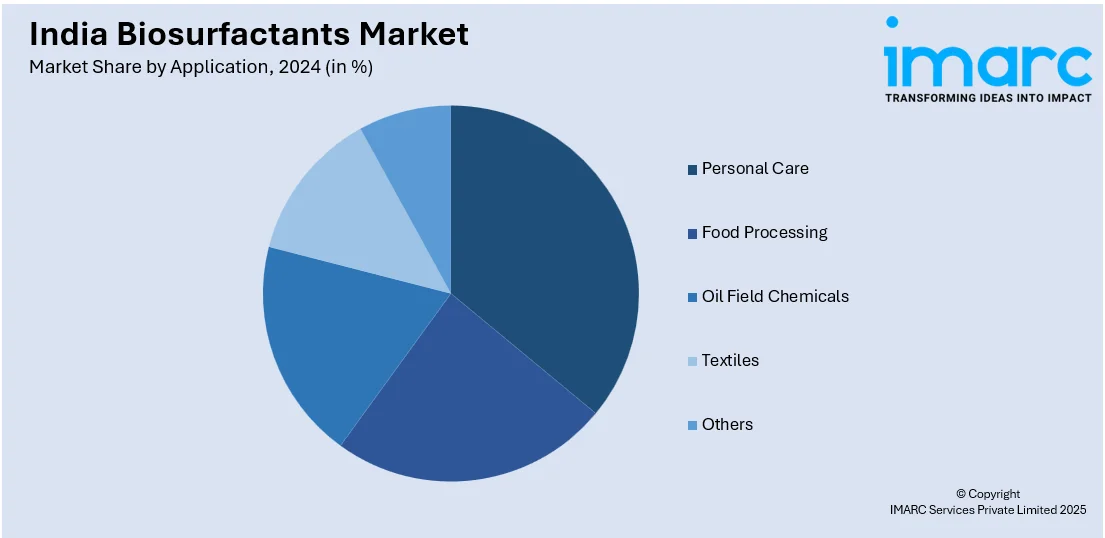

Application Insights:

- Personal Care

- Food Processing

- Oil Field Chemicals

- Textiles

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes personal care, food processing, oil field chemicals, textiles, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Biosurfactants Market News:

- August 2024: Researchers at the Indian Institute of Science (IISc) launched CNSL-1000-M, a bio-based surfactant derived from agricultural waste, to catalyze industrially important processes in water rather than organic solvents via a mechanism known as micellar catalysis. The surfactant, generated from cashew nut shell liquid (CNSL), is a bio-based alternative to organic solvents since many substrates and catalysts are sensitive to water and experience side reactions, resulting in undesirable compounds.

- April 2024: Evonik opened its new office and R&D premises, Evonik India Research Hub (EIRH), in Thane, India. The 100,000 square-foot office serves as a hub for Evonik's operations in India, providing an inspiring environment for employees to collaborate, innovate, and drive growth. The EIRH will also serve as a global support center for formulation development in specialty chemicals, including biosurfactants.

India Biosurfactants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Glycolipids, Alkyl Polyglucosides, Methyl Ethyl Sulfonates, Sucrose Esters, Sorbitan Esters, Others |

| Applications Covered | Personal Care, Food Processing, Oil Field Chemicals, Textiles, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India biosurfactants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India biosurfactants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India biosurfactants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biosurfactants market in India was valued at USD 91.52 Million in 2024.

The India biosurfactants market is projected to exhibit a CAGR of 4.45% during 2025-2033, reaching a value of USD 135.42 Million by 2033.

Growing demand for eco-friendly and biodegradable ingredients in personal care, agriculture, and household cleaning products is driving the biosurfactants market. Increasing environmental regulations, rising awareness about sustainable alternatives, and the shift away from petrochemical-based surfactants are further supporting market expansion in India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)